Travis Texas Approval of employee stock purchase plan for The American Annuity Group, Inc.

Description

How to fill out Approval Of Employee Stock Purchase Plan For The American Annuity Group, Inc.?

Whether you plan to start your enterprise, engage in a contract, request an update for your identification, or address family-centric legal matters, it’s essential to prepare specific documents that comply with your local laws and regulations.

Finding the appropriate forms can be time-consuming and laborious unless you take advantage of the US Legal Forms library.

The platform offers users over 85,000 expertly crafted and verified legal templates for any personal or commercial situation. All documents are categorized by state and applicable use, so selecting a document like Travis Approval of employee stock purchase plan for The American Annuity Group, Inc. is straightforward and efficient.

Documents provided by our site are reusable. With an active subscription, you can access all your previously acquired paperwork at any time through the My documents section of your profile. Stop wasting time on an endless quest for current formal documents. Register for the US Legal Forms platform and organize your paperwork with the largest online form library!

- Ensure the template meets your individual needs and state legal requirements.

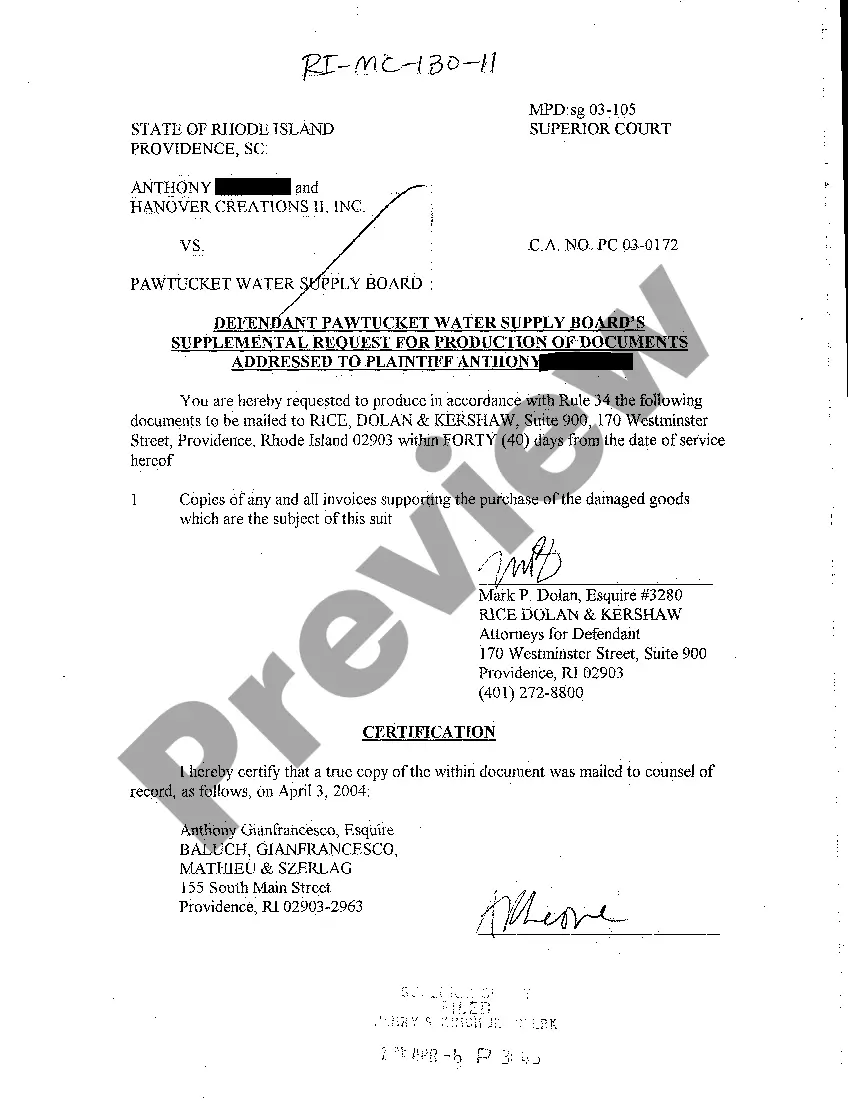

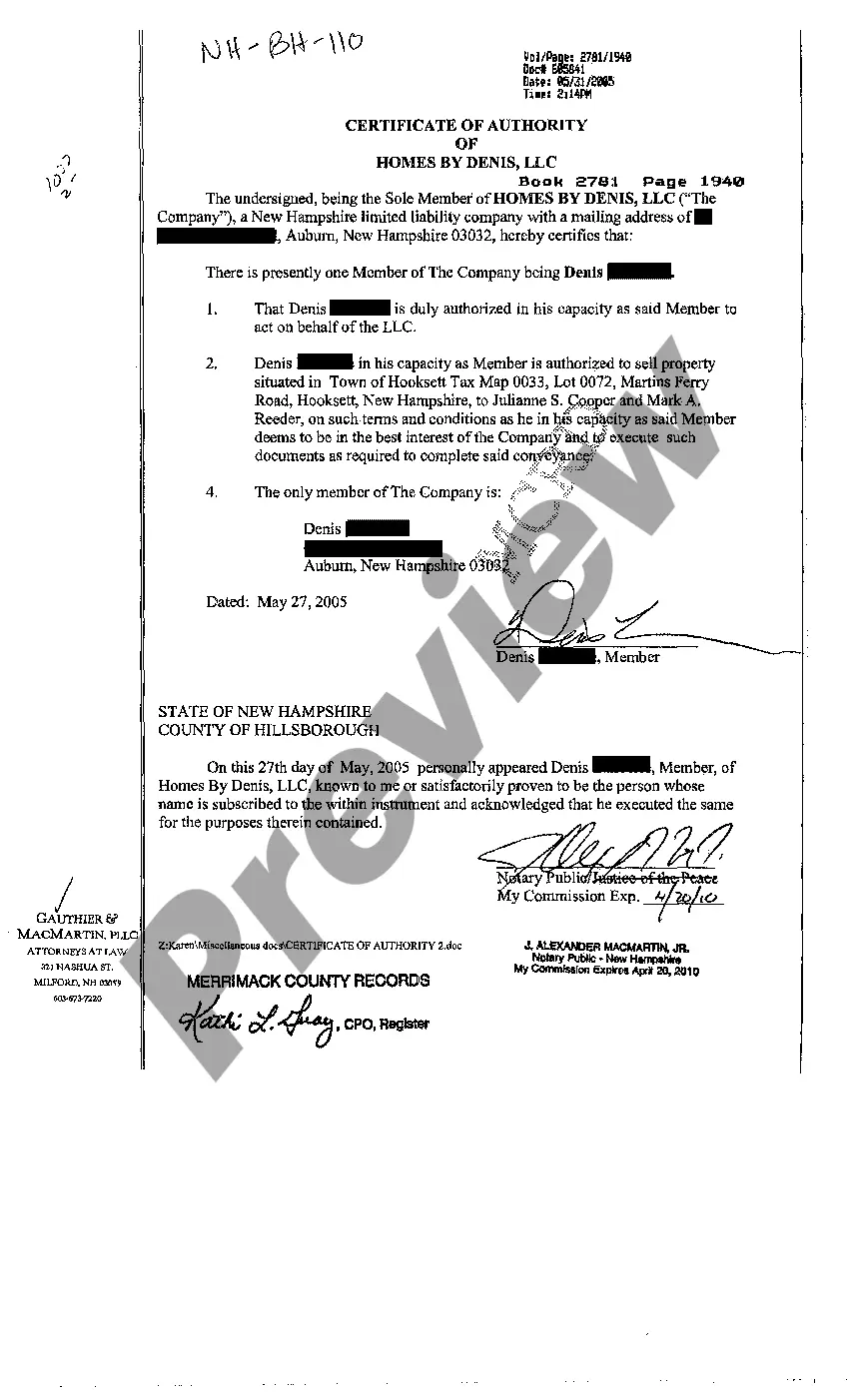

- Examine the form description and review the Preview if available on the webpage.

- Use the search feature designating your state above to locate another template.

- Select Buy Now to acquire the document once you identify the correct one.

- Choose the subscription plan that best fits your needs to move forward.

- Log in to your account and settle the payment with a credit card or PayPal.

- Download the Travis Approval of employee stock purchase plan for The American Annuity Group, Inc. in the file format you need.

- Print the document or complete it and sign it electronically using an online editor to save time.

Form popularity

FAQ

You may be able to withdraw your contributions for cash Under most ESPPs, employees can withdraw from the plan at any time before the purchase date (when their contributions are used to purchase shares). Your company will generally return your accumulated contri- butions back to you through payroll.

An ESPP allows you to purchase company stock at a discounted price, often between 5-15% off the fair market value. For example, if the fair market value on the applicable date is $10 per share, and your plan offers a 15% discount, you can purchase those shares for $8.50 per share.

More than 80% of tech companies offer an employee stock purchase plan (ESPP). Of the plans we've seen (and we've seen a lot of them), Adobe's ESPP is top-notch and may even be the best in the industry.

Six companies have ESOPs, and four of these are majority employee-owned (Publix, Burns & McDonnell, West Monroe Partners, and W.L. Gore & Associates). A table with the employee ownership companies only is below. For the complete list and details on each company, see the Fortune or Great Place to Work sites.

More than 80% of tech companies offer an employee stock purchase plan (ESPP). Of the plans we've seen (and we've seen a lot of them), Adobe's ESPP is top-notch and may even be the best in the industry.

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

You can usually purchase ESPP plan stock worth 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. If you participate, your employer will deduct your contribution directly from your paycheck. Your employer will then purchase the company stock for you, typically at the end of a 6-month period.

An ESPP is the easiest and often the most cost-effective way for employees to purchase shares in the company. When employees are also owners, they have a greater stake in the success of the company, which can be a powerful motivator and reduce turnover.

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.