Travis Texas Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees

Description

How to fill out Nonqualified Stock Option Plan Of Medicore, Inc., For Officers, Directors, Consultants, Key Employees?

Drafting legal documents can be tedious. Furthermore, if you choose to engage a legal expert to create a business contract, ownership transfer documents, pre-nuptial agreements, divorce forms, or the Travis Nonqualified Stock Option Plan for Medicore, Inc., regarding officers, directors, consultants, and essential personnel, it could be quite costly.

So, what is the most efficient way to conserve both time and financial resources while ensuring that you create valid documents in strict adherence to your state and local legislation and regulations.

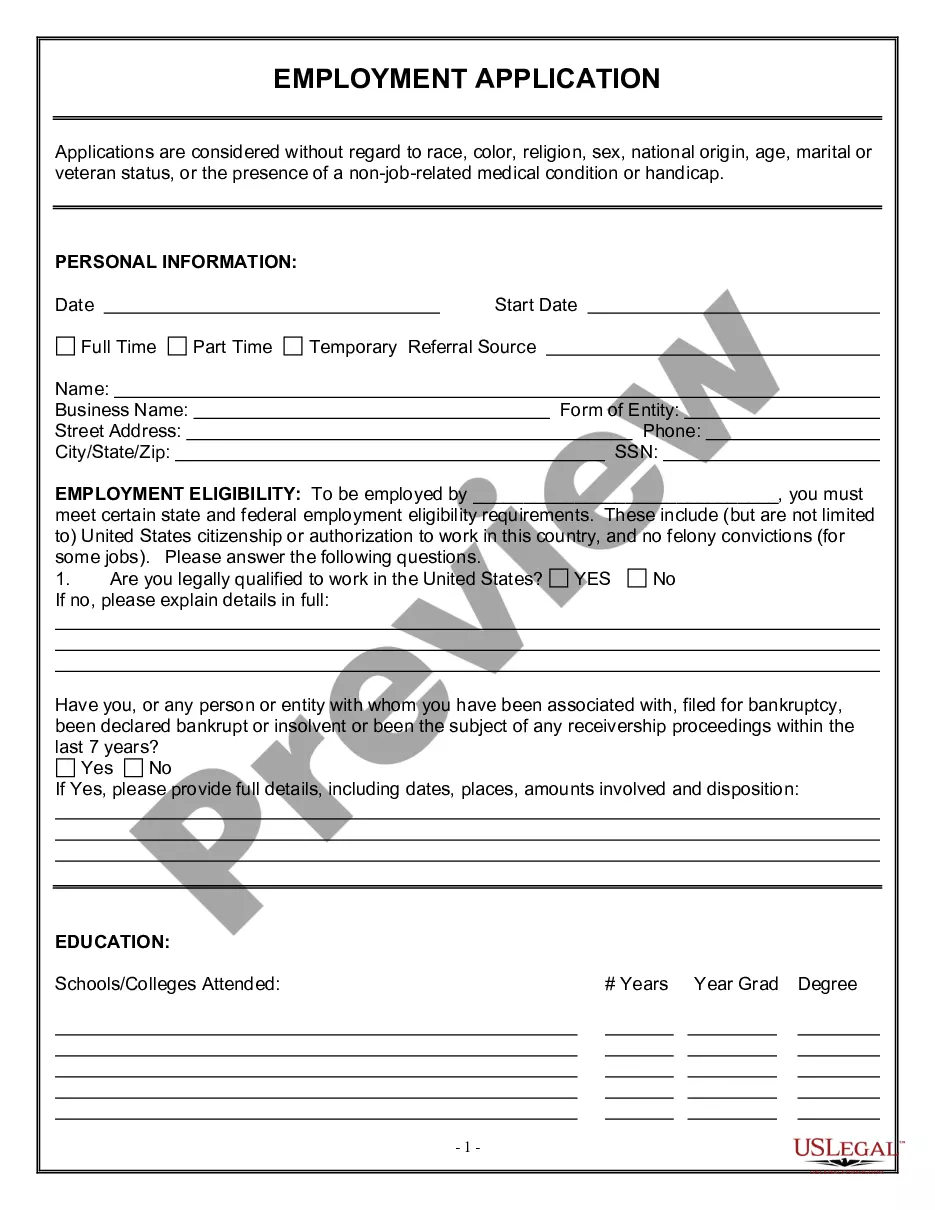

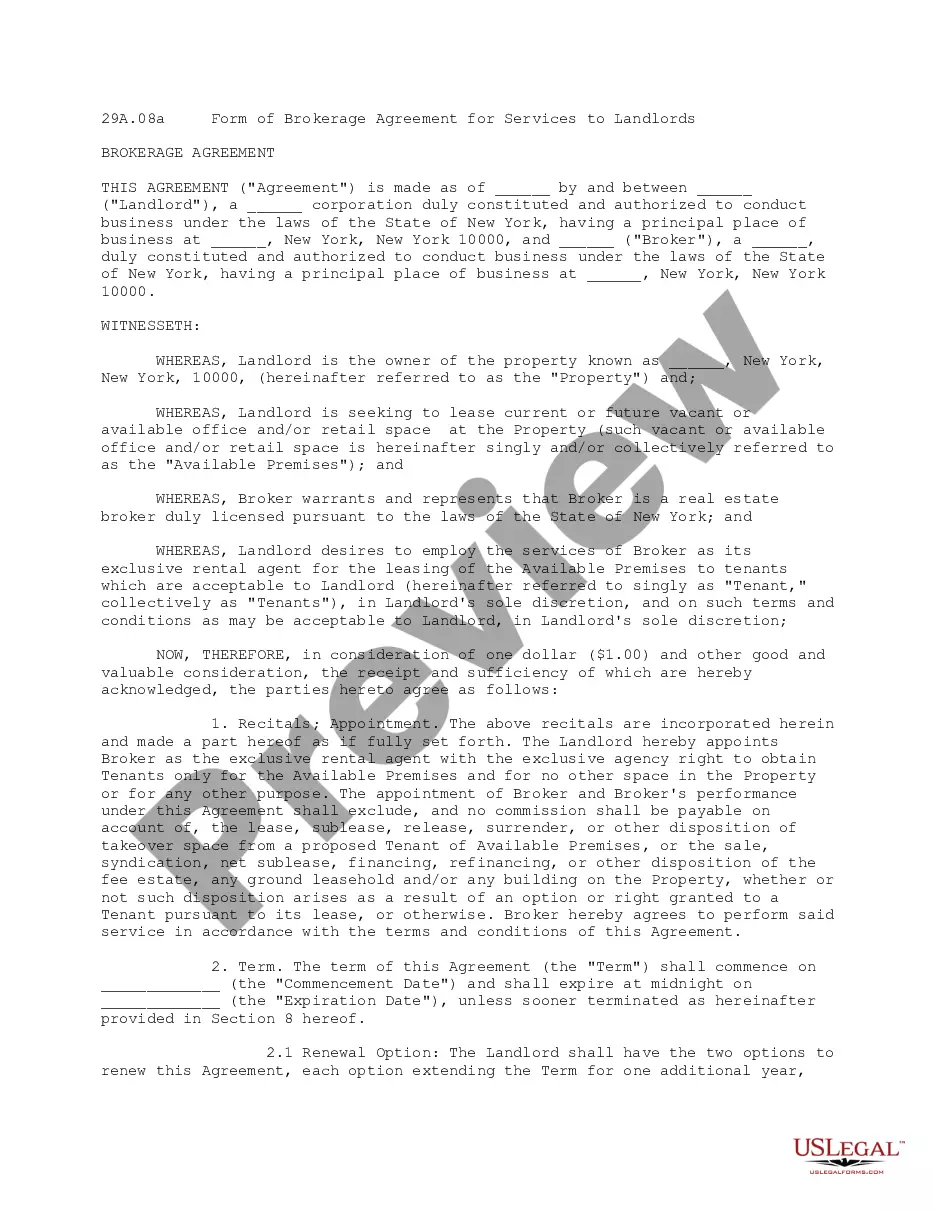

Review the form description and utilize the Preview option, if available, to confirm it is the document you require. Don't be concerned if the form doesn't match your needs - search for the appropriate one in the header. Click Buy Now once you find the necessary template and select the most suitable subscription. Log In or create an account to process your subscription payment. Make a payment using a credit card or through PayPal. Choose the file format for your Travis Nonqualified Stock Option Plan for Medicore, Inc., regarding officers, directors, consultants, and key personnel, and store it. When completed, you can print it for manual completion or upload the templates to an online editor for quicker and more convenient filling. US Legal Forms allows you to utilize all the documents you have acquired multiple times - you can access your templates in the My documents tab of your profile. Give it a try today!

- US Legal Forms is an excellent answer, regardless of whether you seek templates for personal or commercial requirements.

- US Legal Forms boasts the largest online repository of state-specific legal documents, offering users access to the most current and professionally verified forms for any situation, all conveniently gathered in one location.

- Thus, if you require the most updated version of the Travis Nonqualified Stock Option Plan for Medicore, Inc., pertaining to officers, directors, consultants, key personnel, you can effortlessly locate it on our site.

- Acquiring the documents demands minimal time.

- Individuals with an existing account should confirm their subscription is active, Log In, and select the template by clicking on the Download button.

- For those who have not yet subscribed, here is how to obtain the Travis Nonqualified Stock Option Plan for Medicore, Inc., for officers, directors, consultants, and key personnel.

- Browse through the page to ascertain that a sample exists for your jurisdiction.

Form popularity

FAQ

qualified stock option plan allows companies to offer stock options to employees and certain nonemployees without adhering to the complex regulations of qualified plans. The Travis Texas Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees provides flexibility in tailoring the plan to meet specific business needs and individual circumstances.

Yes, companies can grant stock options to non-employees, including consultants, advisors, and independent contractors. However, the Travis Texas Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees outlines specific eligibility criteria. It's essential to follow federal and state regulations to ensure compliance.

Typically, non-statutory stock options are not taxable upon grant or receipt under the Travis Texas Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, and key employees. Instead, taxation occurs when you exercise the options. This allows you to plan your finances better, as you won't incur tax liabilities until you take action with the options.

NQSO's are a form of employee compensation benefit that are subject to their own unique rules. Generally, NQSO's are taxable to employees and deductible as compensation by the company at the same time.

Stock options are only for people While it's usually fine to grant stock options to an individual consultant under the option plan, grants generally can't be made to an entity. If you want to grant options to non-individuals, consult your attorney.

There are two types of stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs). A company may grant ISOs and NSOs to its employees, but ISOs cannot be granted to non-employees. Options that are granted to non-employee directors, contractors, consultants and advisors can only be NSOs.

Tax Treatment of Non-Qualified Stock Options Stock acquired from exercising a non-qualified stock option is treated as any other investment property when sold. The employee's basis is the amount paid for the stock, plus any amount included in income upon exercising the option.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

Non-qualified stock options are stock options that do not receive favorable tax treatment when exercised but do provide additional flexibility for the issuing company. Gains from non-qualified stock options are taxed as normal income.

Incentive stock options (ISOs), are a type of employee stock option that can be granted only to employees and confer a U.S. tax benefit. ISOs are also sometimes referred to as statutory stock options by the IRS. ISOs have a strike price, which is the price a holder must pay to purchase one share of the stock.