Wake North Carolina Issuance of Common Stock in Connection with Acquisition

Description

How to fill out Issuance Of Common Stock In Connection With Acquisition?

How long does it usually take for you to draft a legal document.

Considering that each state has its own laws and regulations for various life situations, locating a Wake Issuance of Common Stock in Connection with Acquisition that fulfills all regional criteria can be exhausting, and hiring a professional attorney can often be costly.

Numerous online platforms provide the most sought-after state-specific documents for download, but utilizing the US Legal Forms repository is the most beneficial.

Click Buy Now when you are confident in the chosen document.

- US Legal Forms is the largest online collection of templates, categorized by states and areas of application.

- Apart from the Wake Issuance of Common Stock in Connection with Acquisition, you can obtain any specific document necessary to manage your business or personal matters, adhering to your local guidelines.

- Professionals verify all samples for their relevance, so you can be assured of preparing your documents accurately.

- The usage of the service is quite simple.

- If you already possess an account on the site and your subscription is active, you only need to Log In, select the desired form, and download it.

- You can access the document in your profile at any time in the future.

- However, if you are a newcomer to the site, there will be a few additional steps to execute before obtaining your Wake Issuance of Common Stock in Connection with Acquisition.

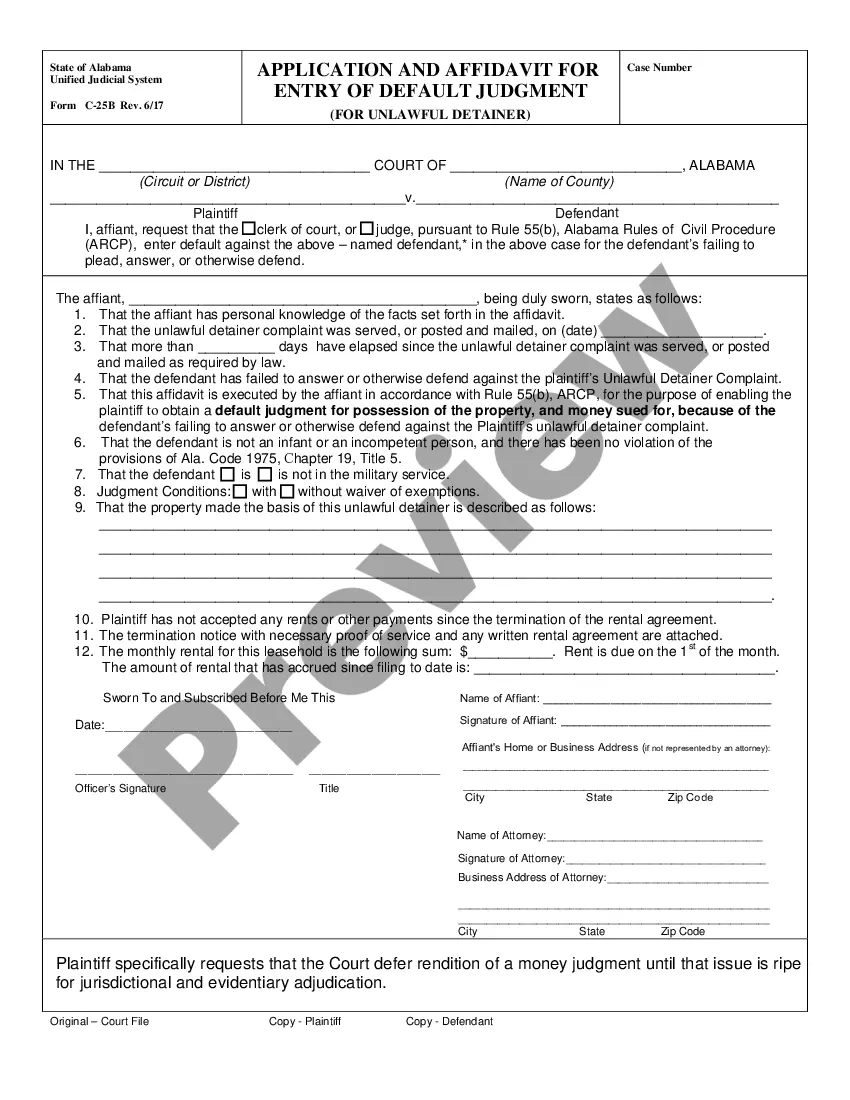

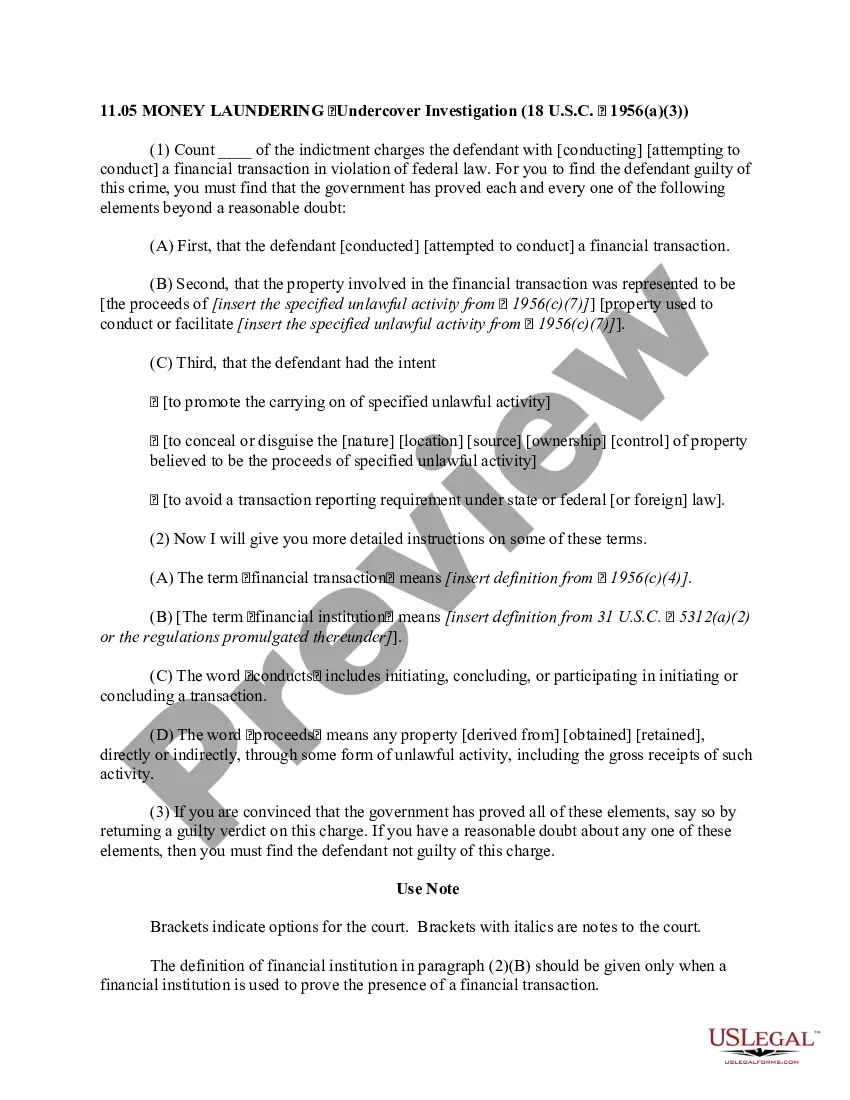

- Review the content of the page you’re currently on.

- Examine the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

Form popularity

FAQ

The new company formed as a result of the M&A will issue new shares after both the companies surrender their existing shares. In the case of an acquisition, the acquiring company's shares are not affected. The company that gets acquired stops trading its stocks in the market.

Common stocks are ordinary shares that companies issue as an alternative to selling debt or issuing a different class of shares known as preferred stock. The first time that a company issues a public offering of common stock, it does so via an initial public offering.

When one company acquires another, the stock price of the acquiring company tends to dip temporarily, while the stock price of the target company tends to spike. The acquiring company's share price drops because it often pays a premium for the target company, or incurs debt to finance the acquisition.

Common stocks are ordinary shares that companies issue as an alternative to selling debt or issuing a different class of shares known as preferred stock. The first time that a company issues a public offering of common stock, it does so via an initial public offering.

forstock merger occurs when shares of one company are traded for another during an acquisition. When, and if, the transaction is approved, shareholders can trade the shares of the target company for shares in the acquiring firm's company.

Issuing common stock generates cash for a business, and this inflow is recorded as a debit in the cash account and a credit in the common stock account. The proceeds from the stock sale become part of the total shareholders' equity for the corporation but do not affect retained earnings.

What Is a Dilutive Acquisition? A dilutive acquisition is a takeover transaction that decreases the acquirer's earnings per share (EPS) through lower (or negative) earnings contribution or if additional shares are needed to be issued by the acquiring company to pay for the acquisition.

Small firm shareholders earn systematically more when acquisitions are announced. This size effect is typically more important than how an acquisition is financed and than the organizational form of the assets acquired. The only acquisitions that have positive aggregate gains are acquisitions of subsidiaries.

Issuing common stock enables the company to grow and achieve specific goals such as expanding the business offerings, acquiring another company, paying off debt, or raising more capital for general business reasons.

Exercised shares: Most of the time in an acquisition, your exercised shares get paid out, either in cash or converted into common shares of the acquiring company. You may also get the chance to exercise shares during or shortly after the deal closes.