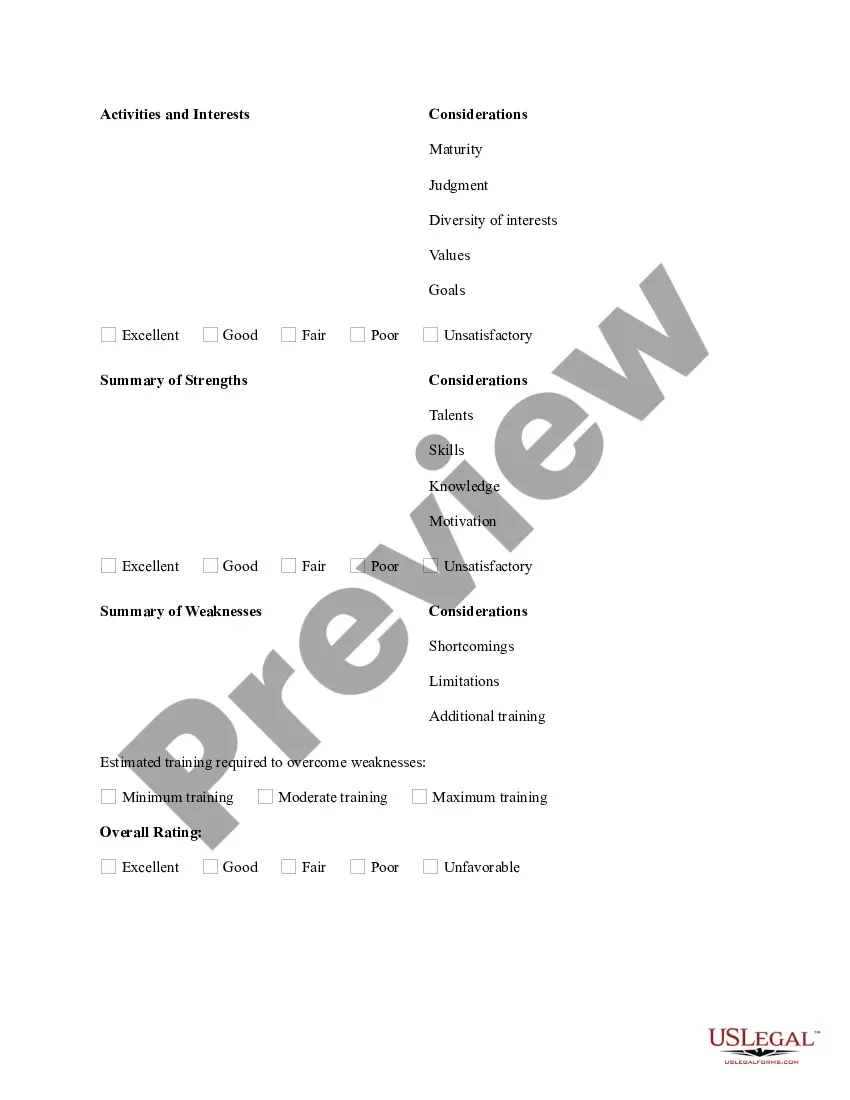

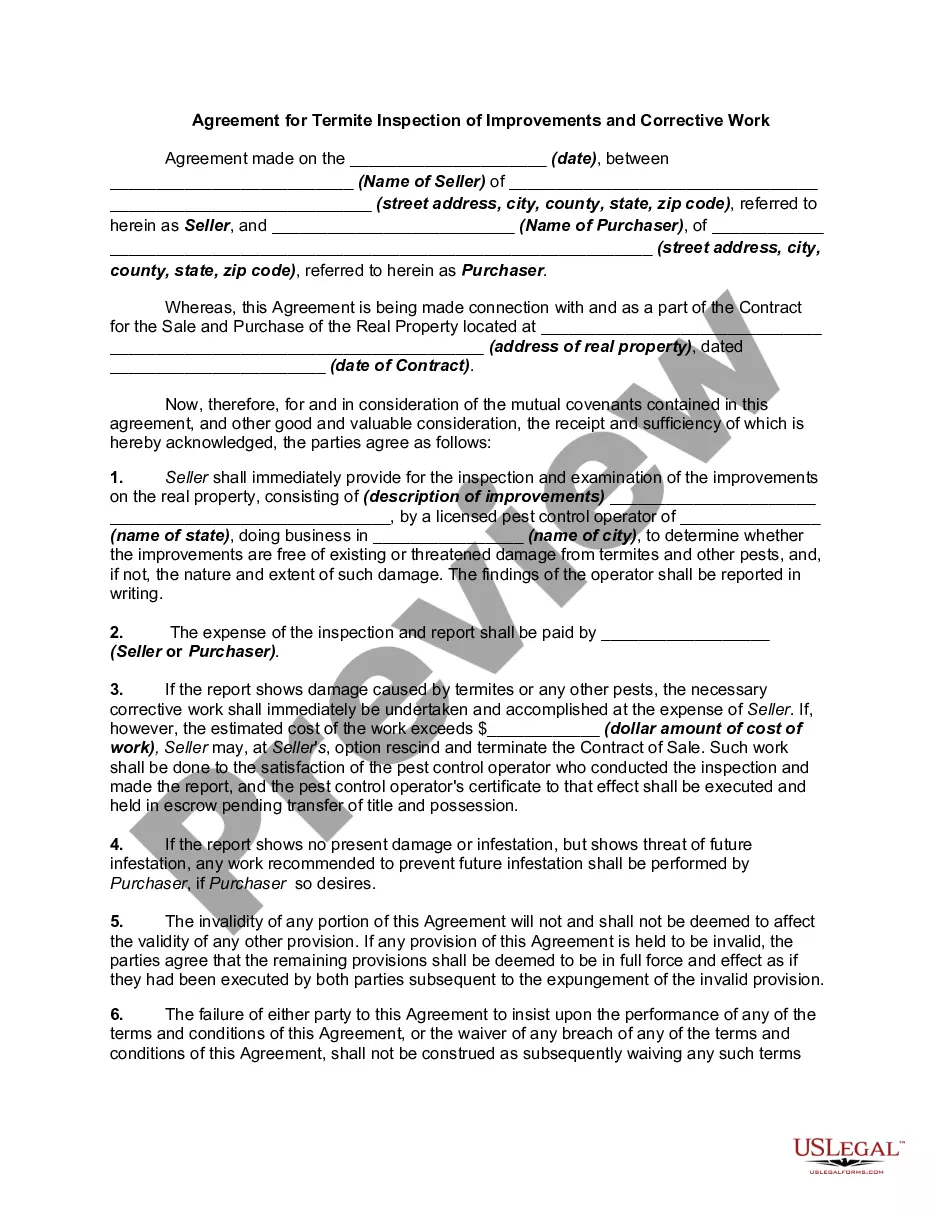

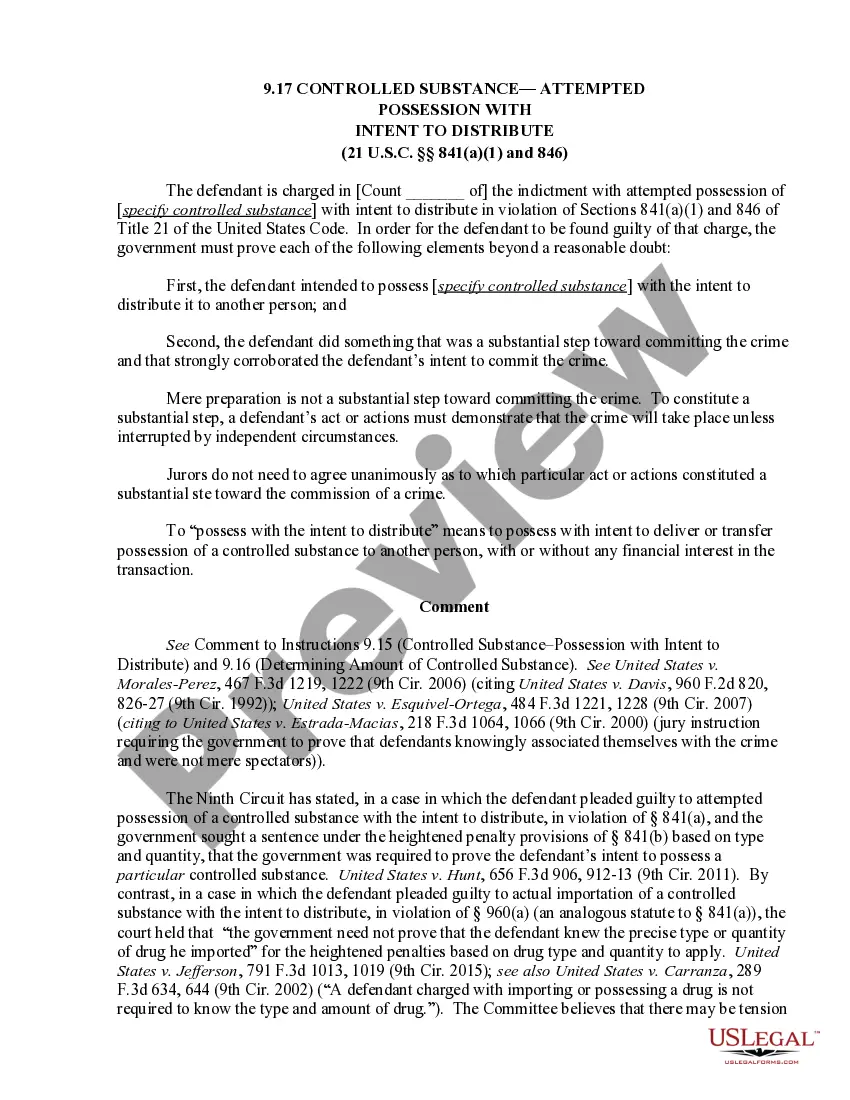

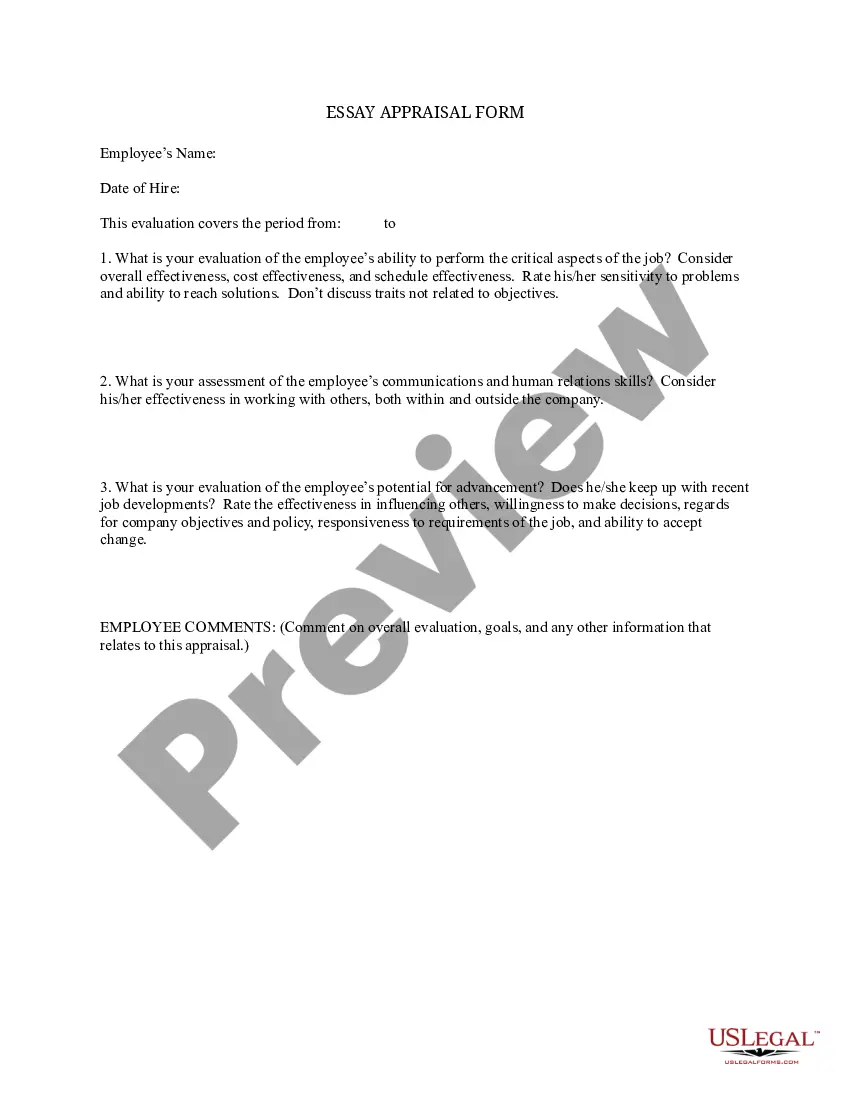

Philadelphia Pennsylvania Interviewer's Report

Description

How to fill out Interviewer's Report?

Developing legal documents is essential in the contemporary environment.

However, you don’t always have to seek professional help to construct some of them from the ground up, including the Philadelphia Interviewer's Report, using a service such as US Legal Forms.

US Legal Forms offers over 85,000 templates to choose from across various categories ranging from living wills to real estate documents to divorce paperwork. All forms are categorized by their corresponding state, simplifying the search process.

If you are already subscribed to US Legal Forms, you can locate the necessary Philadelphia Interviewer's Report, Log In to your account, and download it. Naturally, our platform cannot entirely replace a lawyer. If you need assistance with a particularly intricate situation, we recommend consulting an attorney to review your form before signing and submitting it.

With more than 25 years in the industry, US Legal Forms has become a preferred resource for various legal documents for millions of clients. Join them today and easily procure your state-compliant forms!

- Review the preview and description of the document (if available) to gain a fundamental understanding of what you’ll receive upon obtaining the form.

- Ensure that the template you select corresponds to your state/county/region as state laws may influence the validity of certain records.

- Look at related forms or restart the search to locate the right document.

- Click Purchase now and create your account. If you already possess an account, opt to Log In.

- Select the pricing {plan, followed by a suitable payment option, and acquire the Philadelphia Interviewer's Report.

- Choose to save the form template in any available format.

- Navigate to the My documents section to download the file again.

Form popularity

FAQ

How to file City taxes Filing returns online. All Philadelphia taxes can be filed online.Filing returns through Modernized e-Filing (MeF) You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes.Filing paper returns.

The tax applies to payments that a person receives from an employer in return for work or services. All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

1. What is Annual Reconciliation? In addition to filing wage withholding returns and making payments throughout the year, employers or entities that issue income payments to individuals must also submit an annual withholding reconciliation with the Department of Revenue.

How to file City taxes Filing returns online. All Philadelphia taxes can be filed online.Filing returns through Modernized e-Filing (MeF) You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes.Filing paper returns.

Sign the return, enclose W-2 forms, PA Schedule SP (if applicable) and mail to: Philadelphia Department of Revenue, P.O. Box 1648, Philadelphia, PA 19105-1648.

How to pay Mail the application form to: Philadelphia Dept. of Revenue. 1401 John F. Kennedy Blvd.File returns and send quarterly payments to: Philadelphia Dept. of Revenue. P.O. Box 1648. Philadelphia, PA 1910520101648.File and pay the annual reconciliation by mailing it to: Philadelphia Dept. of Revenue. P.O. Box 1648.

Connect AddressMunicipal Services Building 1401 JFK Boulevard Philadelphia, PA 19102Emailrevenue@phila.govSocialFacebook Twitter Youtube channel

To file and pay the Earnings Tax by mail: 1401 John F. Kennedy Blvd.

You can file BIRT returns and make payments through the Philadelphia Tax Center. Starting with payments due in April 2018 for Tax Year 2017, taxpayers who owe $5,000 or more for the Business Income and Receipts Tax are required to pay those taxes electronically.