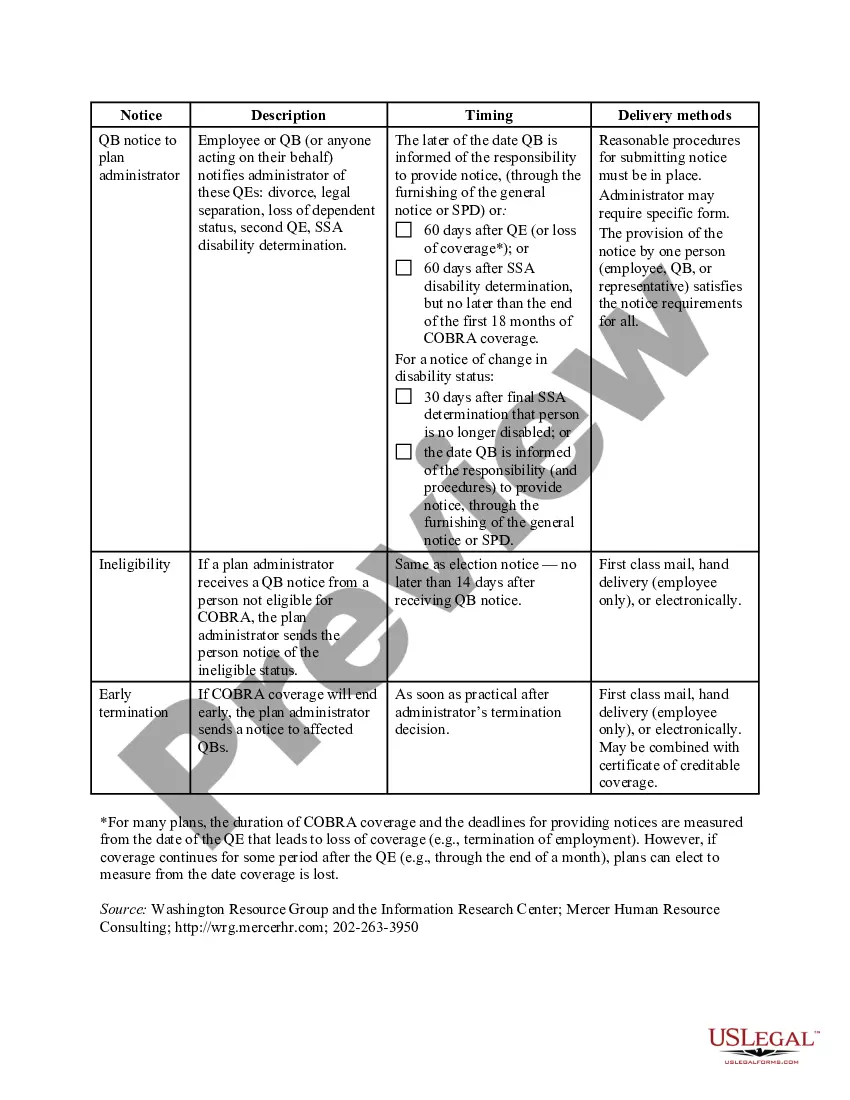

Travis Texas COBRA Notice Timing Delivery Chart

Description

How to fill out COBRA Notice Timing Delivery Chart?

Drafting legal documents can be tedious.

Furthermore, if you opt to hire a legal expert to create a business contract, documents for asset transfer, prenuptial agreement, divorce forms, or the Travis COBRA Notice Timing Delivery Chart, it could be quite expensive.

Browse the webpage and confirm there’s a template for your area. Review the form details and utilize the Preview option, if accessible, to ensure it's the right template for your needs. Don't be concerned if the form is not suitable - search for the appropriate one in the header. Click Buy Now once you locate the desired template and choose the most appropriate subscription. Log In or register for an account to purchase your subscription. Process payment with a credit card or through PayPal. Select the file format for your Travis COBRA Notice Timing Delivery Chart and download it. Upon completion, you can print it and fill it out on paper or import the templates into an online editor for quicker and more efficient completion. US Legal Forms permits you to reuse any documentation acquired multiple times - you can find your templates under the My documents tab in your account. Give it a try today!

- What is the most effective way to conserve time and finances while preparing valid forms in full alignment with your state and local laws.

- US Legal Forms is a great option, whether you seek templates for personal or corporate purposes.

- US Legal Forms boasts the largest online repository of state-specific legal documents, offering users the latest and professionally verified templates for any situation all in one location.

- If you need the latest version of the Travis COBRA Notice Timing Delivery Chart, you can readily locate it on our site.

- Acquiring the documents requires minimal time.

- Users with an existing account should verify their subscription status, Log In, and select the template using the Download button.

- If you haven't subscribed yet, here’s how you can access the Travis COBRA Notice Timing Delivery Chart.

Form popularity

FAQ

In California, employers must send the COBRA notice within 44 days from the date of an employee's qualifying event. This period ensures that individuals are informed about their health insurance continuation rights promptly. To navigate this process effectively, you can refer to the Travis Texas COBRA Notice Timing Delivery Chart, which provides clarity on timing and requirements. Using resources like the US Legal Forms platform can help employers stay compliant and manage these notifications efficiently.

COBRA continuation coverage notices are documents that explain employees' rights under the Consolidated Omnibus Budget Reconciliation Act of 1985. These documents generally contain a variety of information, including the following: The name of the health insurance plan.

COBRA continuation coverage notices are documents that explain employees' rights under the Consolidated Omnibus Budget Reconciliation Act of 1985. These documents generally contain a variety of information, including the following: The name of the health insurance plan.

The election notice should include the following information: The name of the plan and the name, address and telephone number of the plan's COBRA administrator. Identification of the qualifying event. Identification of the qualified beneficiaries (by name or by status).

Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event. You are responsible for making sure your COBRA coverage goes into and stays in effect - if you do not ask for COBRA coverage before the deadline, you may lose your right to COBRA coverage.

In addition, employers can provide COBRA notices electronically (via email, text message, or through a website) during the Outbreak Period, if they reasonably believe that plan participants and beneficiaries have access to these electronic mediums.

The employer penalties for not complying with the COBRA: The IRS can charge you $100 tax per day of noncompliance per person or $200 tax per day per family.

Under the Employment Retirement Income Security Act of 1974 (ERISA), a penalty of up to $110 per day may be imposed for failing to provide a COBRA notice.

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss,

The COBRA election notice should describe all of the necessary information about COBRA premiums, when they are due, and the consequences of payment and nonpayment. Plans cannot require qualified beneficiaries to pay a premium when they make the COBRA election.