Nassau New York Co-Employee Applicant Appraisal Form

Description

How to fill out Co-Employee Applicant Appraisal Form?

Managing legal documents is essential in the contemporary world. Nevertheless, you don't always have to seek professional assistance to develop some of them from scratch, such as the Nassau Co-Employee Applicant Appraisal Form, utilizing a service like US Legal Forms.

US Legal Forms boasts over 85,000 documents to choose from across various categories ranging from living wills to property agreements to divorce papers. All documents are categorized according to their corresponding state, simplifying the search process.

You can also access informational resources and guides on the site to make any tasks related to document processing uncomplicated.

If you're already a subscriber to US Legal Forms, you can find the necessary Nassau Co-Employee Applicant Appraisal Form, Log In to your account, and download it. It's important to note that our platform cannot entirely replace a legal expert. If you encounter a particularly complex situation, we recommend consulting a lawyer to review your form prior to signing and submitting it.

With over 25 years in the industry, US Legal Forms has become a preferred platform for various legal documents for millions of users. Join them today and obtain your state-specific forms seamlessly!

- Review the document's preview and outline (if available) to gain a general understanding of what you will receive after downloading the document.

- Confirm that the document you select is tailored to your state/county/locality since state regulations may affect the validity of certain records.

- Examine related documents or restart the search to identify the right file.

- Click Buy now and create your account. If you already possess an account, opt to Log In.

- Choose the option, select the required payment method, and purchase Nassau Co-Employee Applicant Appraisal Form.

- Decide to save the form template in any provided format.

- Navigate to the My documents section to re-download the document.

Form popularity

FAQ

The easiest way to lower your assessment is to apply for a STAR exemption. STAR is New York State's School Tax Relief Program that includes a school property tax rebate program and a partial property tax exemption from school taxes.

Ways to Apply for Tax Grievance in Nassau County: Submitting an online application is the easiest and fastest way. Click Here to Apply for Nassau Tax Grievance. Click this link if you prefer to print out the application in PDF form and fax it to 631-782-3174. Or you can call us at 516-342-4849.

A certificate of occupancy shall be issued, where appropriate, within 30 days after application therefor is made.

Nassau County uses a simple formula to calculate your property taxes: Assessed Value (AV) x Tax Rate = Dollar Amount of Taxes. Examine the Data. Claim the Exemptions to Which You're Entitled. Do Your Due Diligence (Or Let Us Do it For You)

In Long Island, permits are typically required for the following types of work: Decks and patios. Dormers. Central A/C and generators.

Bottom Line: Since your property tax bill is calculated by multiplying your property assessment by your local tax rate by not filing you are paying, in some cases, double what your neighbor is. Nassau Counties' property tax grievance deadline is March 1, 2023.

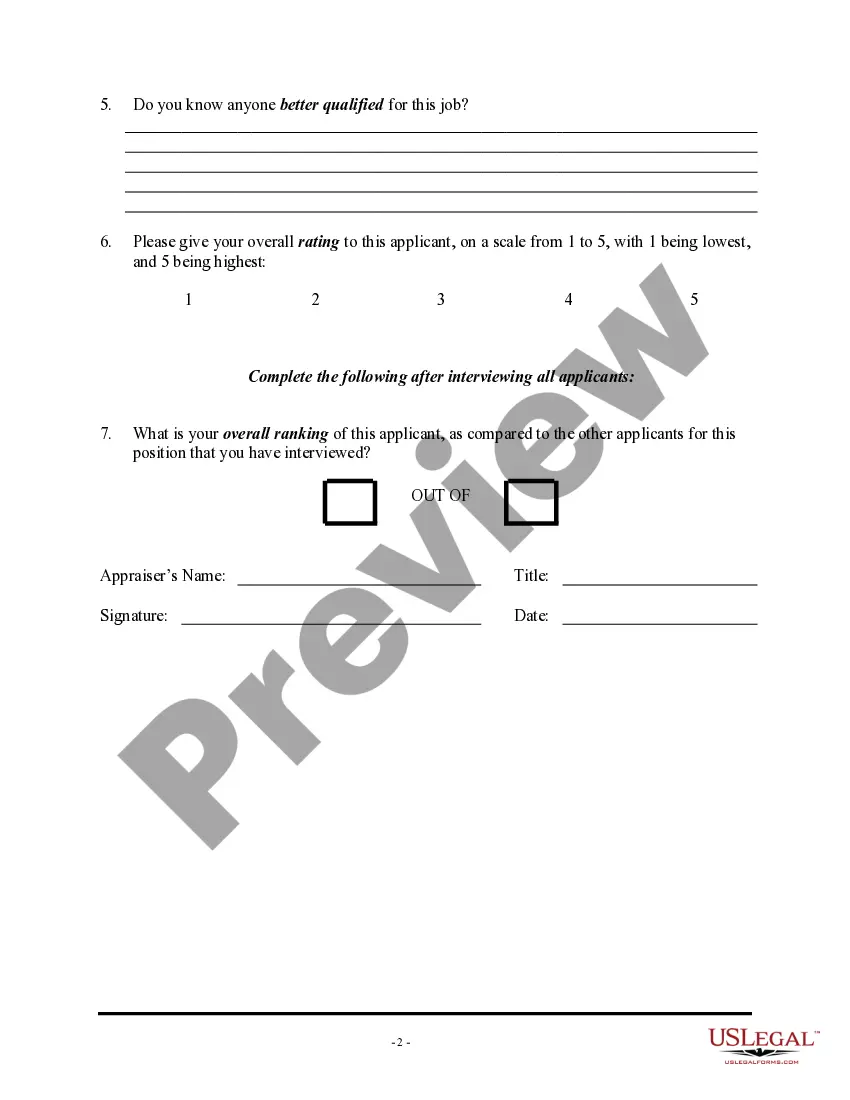

An applicant appraisal form is the foundation for objectively comparing candidates for your company's job opening.

The property tax grievance process is a long one. It could take more than a year from beginning to end. However, regardless of when your case is settled, the results will always be retroactive to the beginning of the tax year for which you filed your property tax grievance.

Nassau County uses a simple formula to calculate your property taxes: Assessed Value (AV) x Tax Rate = Dollar Amount of Taxes. Examine the Data. Claim the Exemptions to Which You're Entitled. Do Your Due Diligence (Or Let Us Do it For You)

The fastest way to obtain this information is to come to the Nassau County Clerk's office here at 240 Old Country Rd, Mineola, NY 11501 with the section, block, and lot of the property. If you want to mail your request download the instructions (PDF). Read the instructions on the form and send in the appropriate fee.