Wayne Michigan Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

How long does it generally take for you to draft a legal document? Given that each state has its own laws and regulations for various life situations, finding a Wayne Bill of Sale of Personal Property - Reservation of Life Estate in Seller that fulfills all local criteria can be laborious, and acquiring it from a qualified attorney is frequently costly. Several online platforms provide the most prevalent state-specific templates for download, but utilizing the US Legal Forms repository is the most beneficial.

US Legal Forms is the largest online compilation of templates, organized by states and areas of usage. Besides the Wayne Bill of Sale of Personal Property - Reservation of Life Estate in Seller, here you can acquire any particular form necessary to conduct your business or personal transactions, adhering to your county's requirements. Experts review all samples for their current relevance, ensuring that you can prepare your documents accurately.

Using the service is quite straightforward. If you already possess an account on the platform and your subscription is active, you simply need to Log In, select the desired sample, and download it. You can store the document in your profile at any time later. Conversely, if you are new to the platform, there will be a few additional steps to complete before obtaining your Wayne Bill of Sale of Personal Property - Reservation of Life Estate in Seller.

Regardless of how often you need to use the acquired template, you can find all the files you’ve previously downloaded in your profile by accessing the My documents section. Give it a shot!

- Review the content of the page you’re visiting.

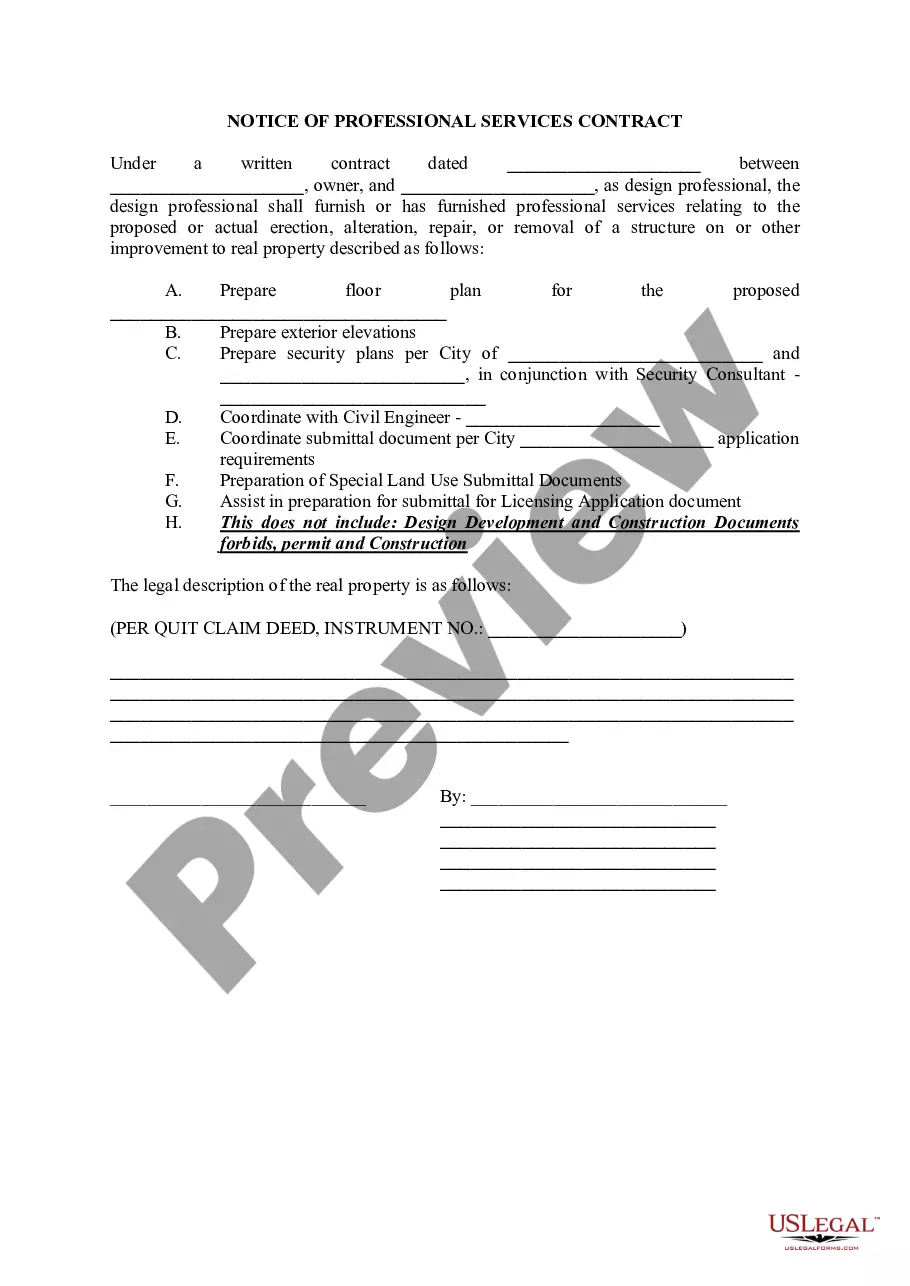

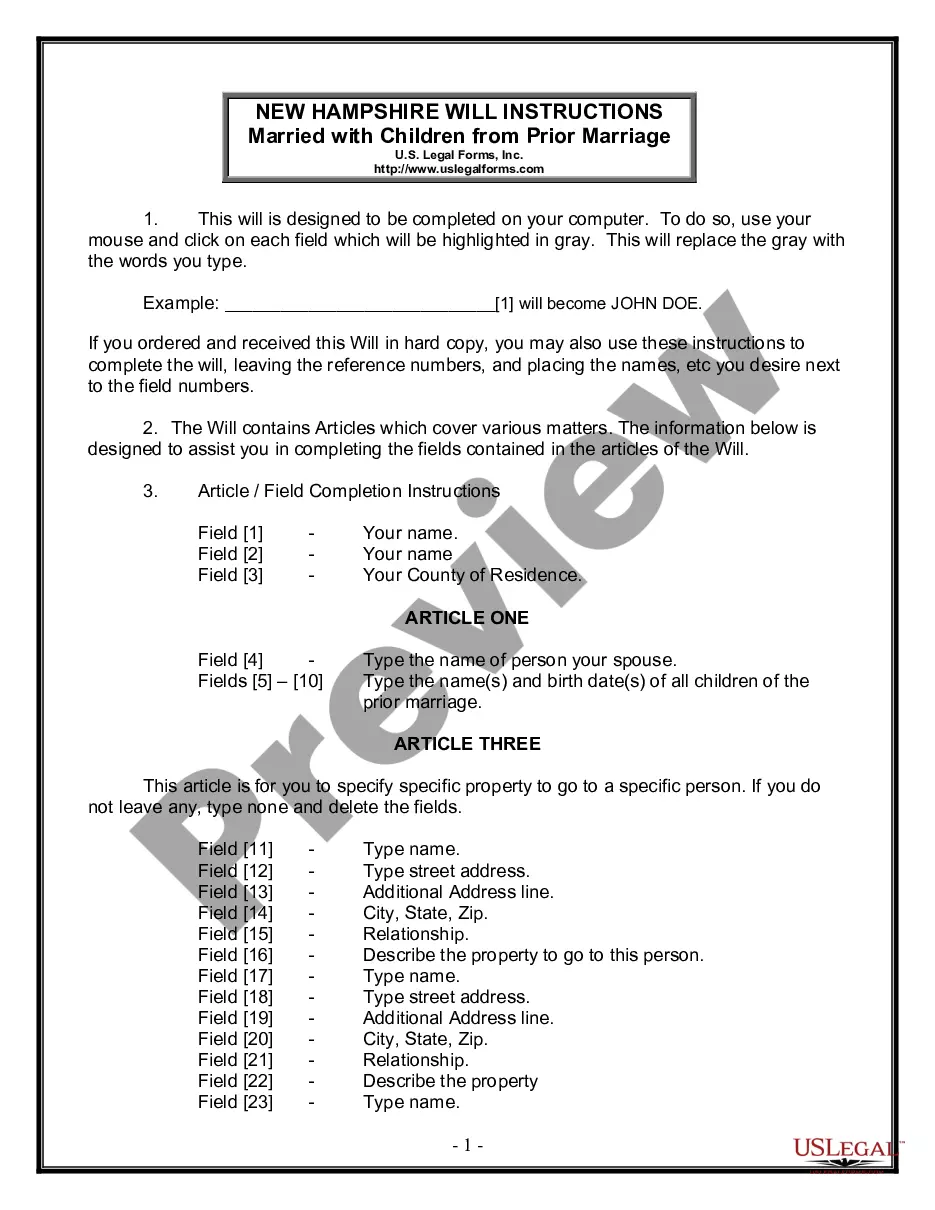

- Examine the description of the template or Preview it (if accessible).

- Look for another form using the corresponding option in the header.

- Press Buy Now once you are confident in the selected document.

- Select the subscription plan that best fits your needs.

- Register for an account on the platform or Log In to move forward to payment options.

- Complete your payment through PayPal or using your credit card.

- Change the file format if necessary.

- Hit Download to save the Wayne Bill of Sale of Personal Property - Reservation of Life Estate in Seller.

- Print the sample or utilize any chosen online editor to finish it electronically.

Form popularity

FAQ

For Medicaid eligibility purposes, the Social Security Life Expectancy table is used to value the life estate and remainder interest. Pursuant to IRC ' 2702 if the homestead is transferred to a non-family member, the use of a traditional life estate will result in a completed gift of the remainder interest.

When you create a life estate, a gift is automatically made to your children. The gift is known as the remainder interest. This gift disqualifies you for medical assistance (help with nursing home bills) for the then applicable "look back" period.

The basis would be the fair market value on the date of death of the last life tenant.

Also known as an estate for life. In a real estate context, an interest in real property that terminates once a person expressly identified in a life estate agreement dies. Life estates are measured either by the life of the property recipient or by the life of some other person.

Life Estate: Voluntary Life Estates or "Conventional Life Estates." o Estate in Reversion 2022 A life estate that is deeded to a life tenant - incomplete bundle of rights during lifetime. A reversion estate that is retained by the grantor.

A life estate is property, usually a residence, that an individual owns and may use for the duration of their lifetime. This person, called the life tenant, shares ownership of the property with another person or persons, who will automatically receive the title to the property upon the death of the life tenant.

The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree. The life tenant usually receives a smaller portion based on the value of the life estate, calculated using actuarial tables.

The major forms of legal life estate are the homestead, dower and curtesy, and elective share.

Life estate pros Using a life estate helps avoid probate so your beneficiary can receive the property faster. The life estate cannot be used to satisfy the tenant's creditors once they're dead. The life tenant may be able to qualify for Medicaid benefits and protect the property from estate recovery.

Fee Simple Estates are the most common and grant a complete interest in land (its yours to be used without conditions or limitations).