Travis Texas Appraisal System Evaluation Form

Description

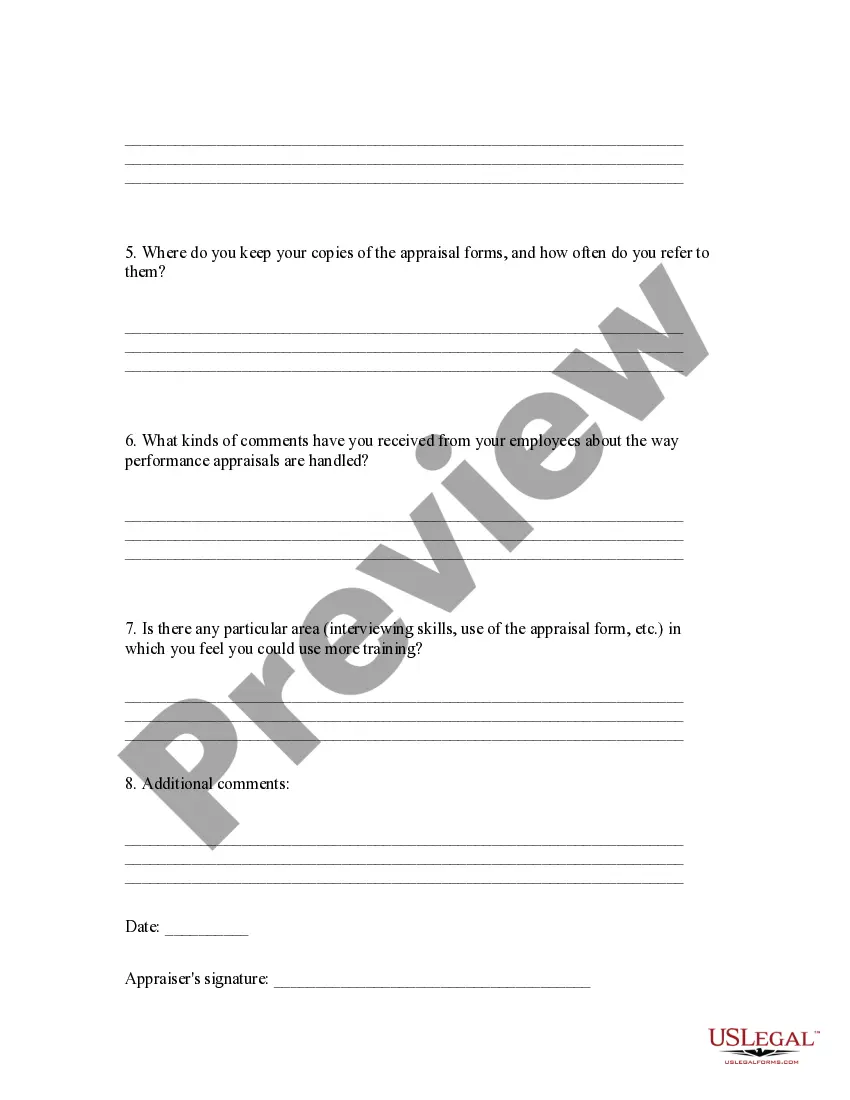

How to fill out Appraisal System Evaluation Form?

Drafting documents for business or personal requirements is always a significant obligation.

When creating a contract, a public service petition, or a power of attorney, it’s vital to take into account all federal and state laws relevant to the specific location.

However, smaller counties and even towns have legislative rules that must also be considered.

The remarkable aspect of the US Legal Forms library is that all the documents you've previously purchased are permanently accessible - you can retrieve them in your profile under the My documents tab at any time. Join the platform and easily acquire validated legal forms for any circumstance with just a few clicks!

- All these factors make it tedious and labor-intensive to produce the Travis Appraisal System Evaluation Form without professional assistance.

- It is feasible to save money on attorneys by preparing your documents and creating a legally acceptable Travis Appraisal System Evaluation Form independently, using the US Legal Forms online library.

- This is the largest online collection of state-specific legal documents that are professionally vetted, ensuring their legitimacy when choosing a sample for your county.

- Previously subscribed users just need to Log In to their accounts to download the required document.

- If you don't have a subscription yet, follow the step-by-step guide below to obtain the Travis Appraisal System Evaluation Form.

- Browse the page you’ve accessed and verify if it contains the document you need.

- To do this, use the form description and preview if these features are available.

Form popularity

FAQ

These values are determined by the appraisal district: Market Value: What the property would sell for. Assessed Value: The limited property value after exemptions are applied. Taxable Value: The property value you pay taxes on.

To calculate property taxes in Travis County, property value must first be assessed by the county. The tax is based on the taxable value of the property, which is the assessed value minus any deductions or exemptions. Each county has a central authority that is responsible for appraising the value of property.

To arrive at the assessed value, an assessor first estimates the market value of your property by using one or a combination of three methods: performing a sales evaluation, the cost method, the income method. The market value is then multiplied by an assessment rate to arrive at the assessed value.

You may apply to the appraisal district the year you become age 65 or qualify for disability. If your application is approved, you will receive the exemption for the entire year in which you become age 65 or disabled and for subsequent years as long as you own a qualified residence homestead.

Seniors qualify for an added $10,000 in reduced property value. Additionally, all taxing districts can offer optional percentage exemptions of up to 20% of the home's value or at least $5,000. Optional percentage exemptions for seniors may also be available from taxing districts. These exemptions start at $3,000.

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

The Texas Constitution sets out five basic rules for property taxes in our state: Taxation must be equal and uniform. No single property or type of property should pay more than its fair share. The property taxes you pay are based on the value of property you own.

In Texas, the taxable value of a residential property is 100% of its "market value"basically, what it would sell for on the open market. The 100% figure is also known as the assessment ratio. The taxing authorities multiply the taxable value of your property by the tax rate to arrive at the tax you'll owe.

Each year, Texas property owners see the values of their homes creeping up. The state caps property value increases at 10% each year, but this cap does not protect new homeowners or commercial properties. Even a 10% increase in appraised value is significant.

The city also has to be careful not to exceed a state cap on how much new property tax revenue it can collect. State lawmakers in 2019 passed a bill lowering that cap from 8 percent to 3.5 percent. If the city wants to exceed this number, it has to hold an election. But a lower tax rate doesn't always mean lower taxes.