Collin Texas FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule

Description

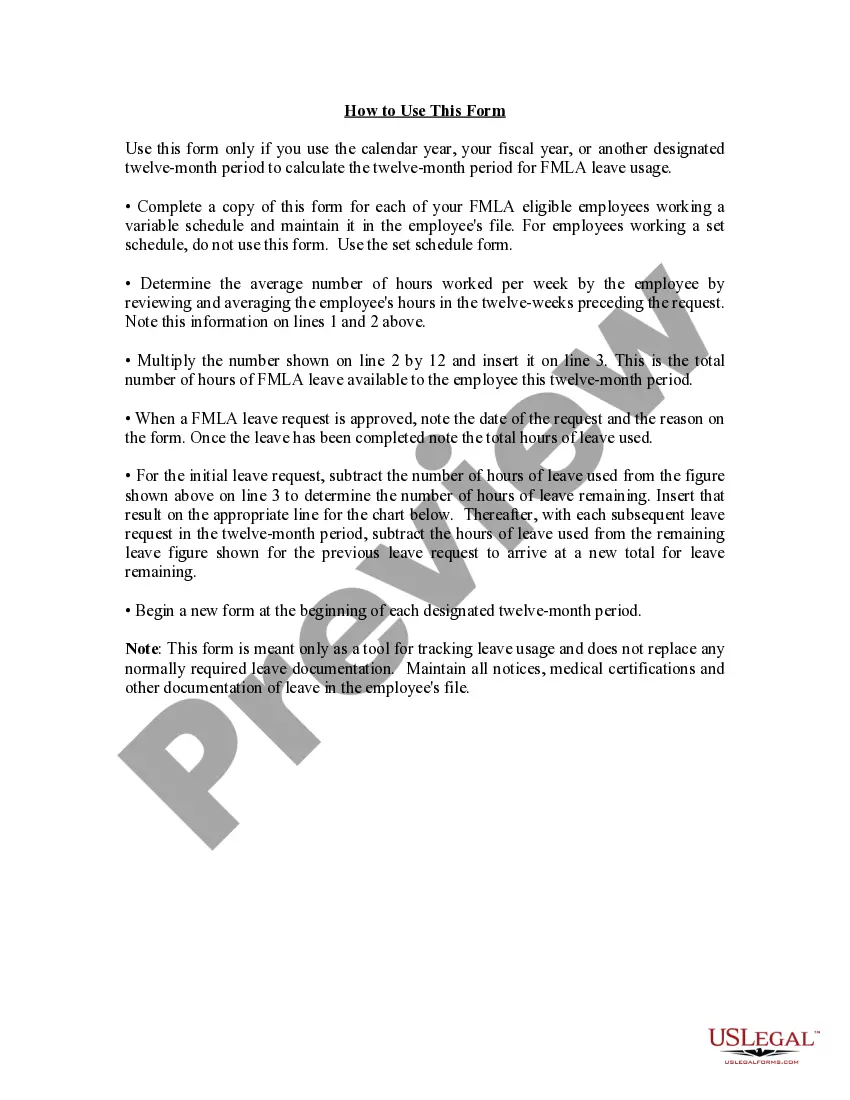

How to fill out FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Variable Schedule?

Developing paperwork, such as the Collin FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule, for managing your legal affairs can be a challenging and time-intensive endeavor.

Numerous situations necessitate the involvement of a lawyer, which further adds to the expense of this undertaking.

However, you can take charge of your legal issues independently and manage them on your own.

- US Legal Forms is available to assist you.

- Our platform offers over 85,000 legal templates designed for various circumstances and life events.

- We ensure that each document complies with state laws, relieving you of concerns regarding legal compliance issues.

- If you are already acquainted with our services and have an ongoing subscription, you understand how straightforward it is to access the Collin FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule template.

- Just Log In to your account, retrieve the template, and adapt it to your specifications.

- Have you misplaced your document? No problem. You can find it in the My documents section of your account - accessible via desktop or mobile.

Form popularity

FAQ

A rolling calendar basis means that each FMLA leave request is evaluated based on the 12 months prior to the leave start date. This can make tracking benefits complex but manageable with the right resources. Utilizing the Collin Texas FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule streamlines this assessment, making it easier to navigate and comply with FMLA regulations. Your records will remain accurate, and employees can rely on clear guidelines.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

For example, an employer considers Thanksgiving a holiday and is closed on that day, and none of its employees work. One of its employees is taking 12 weeks of unpaid FMLA leave the last 12 weeks of the calendar year. The employer would count Thanksgiving Day as FMLA leave for that employee.

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.

One of the easiest methods by which an employer can track FMLA leave is to place all employees on a calendar year track. This means that each employee can take 12 weeks of FMLA leave anytime between January and December, and the calculations reset on January 1 of each year.

The 12-month period measured forward from the date any employee's first FMLA leave begins; or. A "rolling" 12-month period measured backward from the date an employee uses any FMLA leave.

Records pertaining to FMLA leave Intermittent leave can be tracked by recording the employee's work schedule and subtracting from it the number of hours they took for FMLA leave. If the employee was scheduled to work 7 hours and only worked 3 hours, then 4 hours of FMLA leave can be counted.

(4) a rolling 12-month period measured backward 12-month period measured backward from the date an employee uses any FMLA leave.

An employee is allowed for a 12-week FMLA leave. For computing intermittent leave, the period is mostly divided into hours. Like if an employee works for 40 hours every week, then his/her intermittent leave period shall be 40×12=480 hours. Therefore, the employee is eligible for 480 hours of intermittent leave.

The calendar year; Any fixed 12-month "leave year" The 12-month period measured forward from the date any employee's first FMLA leave begins; or. A "rolling" 12-month period measured backward from the date an employee uses any FMLA leave.