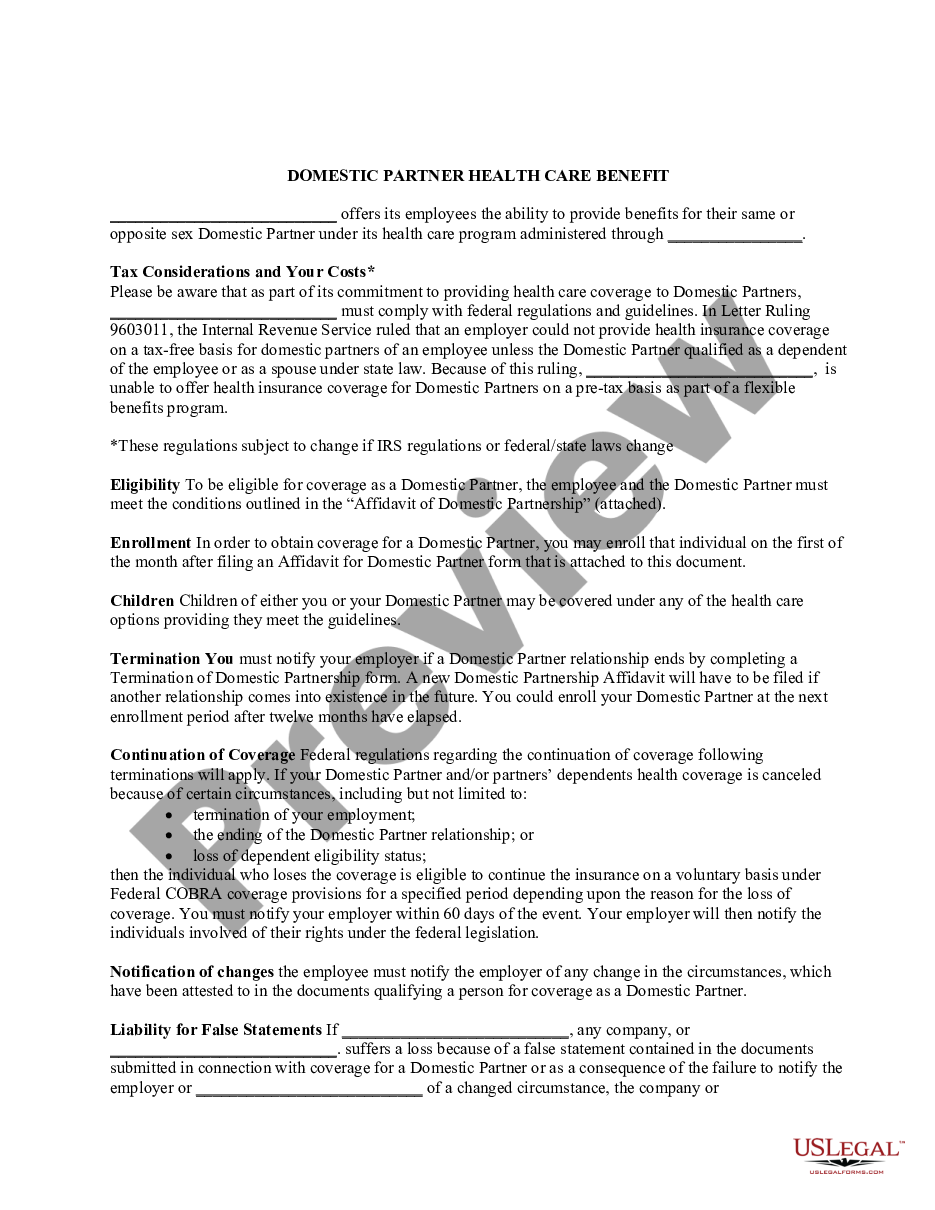

Kings New York Domestic Partnership Dependent Certification Form

Description

How to fill out Domestic Partnership Dependent Certification Form?

How long does it typically require you to draft a legal document.

Considering that each state has its own laws and regulations for every life circumstance, locating a Kings Domestic Partnership Dependent Certification Form that satisfies all local requirements can be daunting, and procuring it from a professional lawyer is frequently costly. Numerous online services provide the most widely used state-specific templates for download, but utilizing the US Legal Forms library is the most advantageous.

US Legal Forms is the most extensive online repository of templates, compiled by states and areas of application. In addition to the Kings Domestic Partnership Dependent Certification Form, you can discover any particular document needed for managing your business or personal affairs, adhering to your county standards. Professionals authenticate all samples for their validity, ensuring you can prepare your documentation accurately.

Print the document or utilize any chosen online editor to finish it electronically. Regardless of how many times you need to employ the purchased template, you can locate all the samples you’ve ever saved in your profile by accessing the My documents tab. Give it a try!

- The process is quite straightforward.

- If you possess an existing account on the platform and your subscription remains active, you simply need to Log In, select the required form, and download it.

- You can access the document in your profile at any point later.

- On the other hand, if you are a newcomer to the platform, there will be additional steps to follow before you receive your Kings Domestic Partnership Dependent Certification Form.

- Review the content of the page you’re on.

- Examine the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you are confident about the chosen document.

- Select the subscription plan that best fits your needs.

- Establish an account on the platform or Log In to move on to payment options.

- Complete your payment via PayPal or your credit card.

- Change the file format if necessary.

- Click Download to save the Kings Domestic Partnership Dependent Certification Form.

Form popularity

FAQ

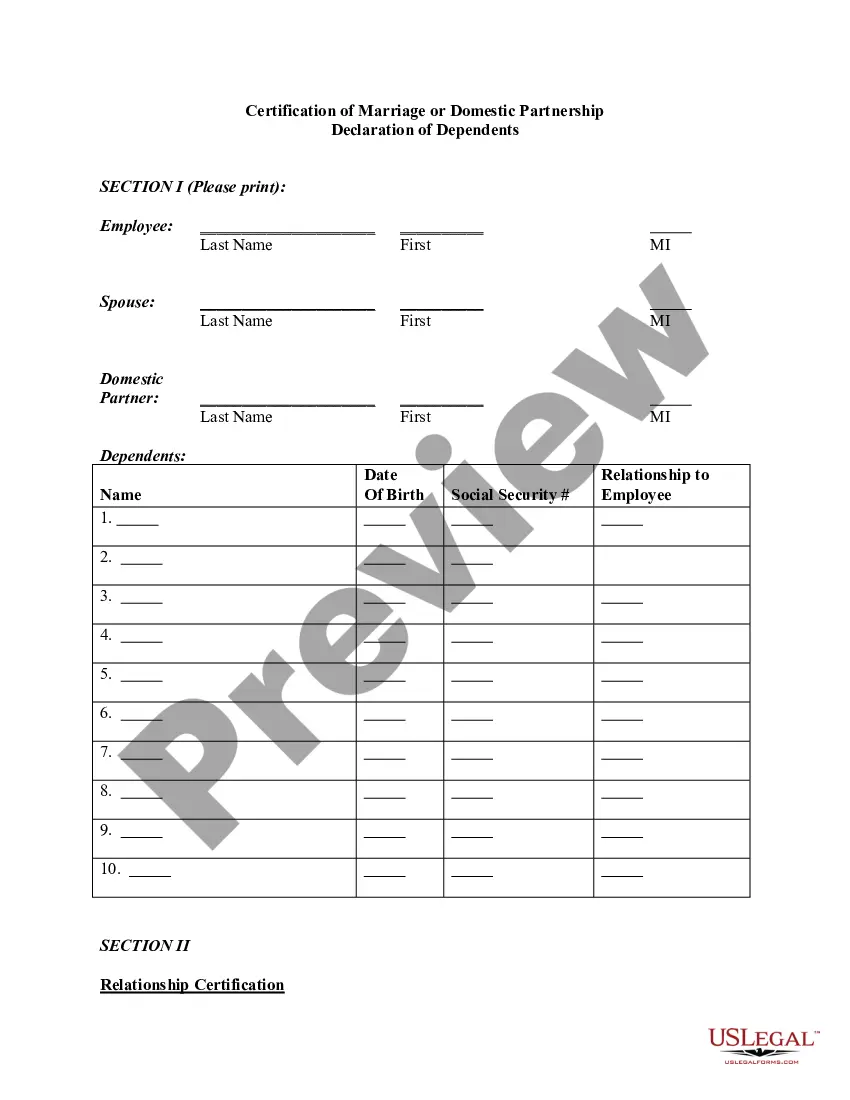

"Declaration of Domestic Partnership." A "Declaration of Domestic Partnership" is a statement signed under penalty of perjury. By signing it, the two people swear that they meet the requirements of the definition of domestic partnership when they sign the statement. Each must provide a mailing address.

Acceptable forms of identification for the Domestic Partnership application are: IDNYC. Valid driver license or non-driver identification card issued by the Department of Motor Vehicles (from the United States or any of its territories) Original Birth Certificate. Passport. Official School Record.

No. Like other provisions of the federal tax law that apply only to married taxpayers, section 66 and section 469(i)(5) do not apply to registered domestic partners because registered domestic partners are not married for federal tax purposes.

Domestic partnerships were initially created to provide basic legal and economic protections to same-sex couples. While marriage is now legal across the United States for everyone, individuals from all walks of life may still choose to enter into a domestic partnership as opposed to marriage for a variety of reasons.

The IRS doesn't allow you to claim a domestic partner as your only dependent and file as a Head of Household. The only way to claim a domestic partner as a dependent and also file under the Head of Household filing status is also to have another qualifying dependent on your return.

You can claim a boyfriend or girlfriend as a dependent on your federal income taxes if that person meets the IRS definition of a "qualifying relative."

Each state defines the partnerships differently. In most states that continue to offer it, a domestic partnership involves committed, unmarried couples, same or opposite sex, in a relationship that is like a marriage.

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.

For example, if you will be including your spouse in your medical coverage and designating him or her as a recipient of your life insurance, then your spouse is both a dependent and a beneficiary.

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.