Collin Texas Domestic Partnership Dependent Certification Form

Description

How to fill out Domestic Partnership Dependent Certification Form?

Laws and statutes in every domain differ across the nation.

If you're not a legal expert, it can be challenging to navigate through different standards when it comes to composing legal documents.

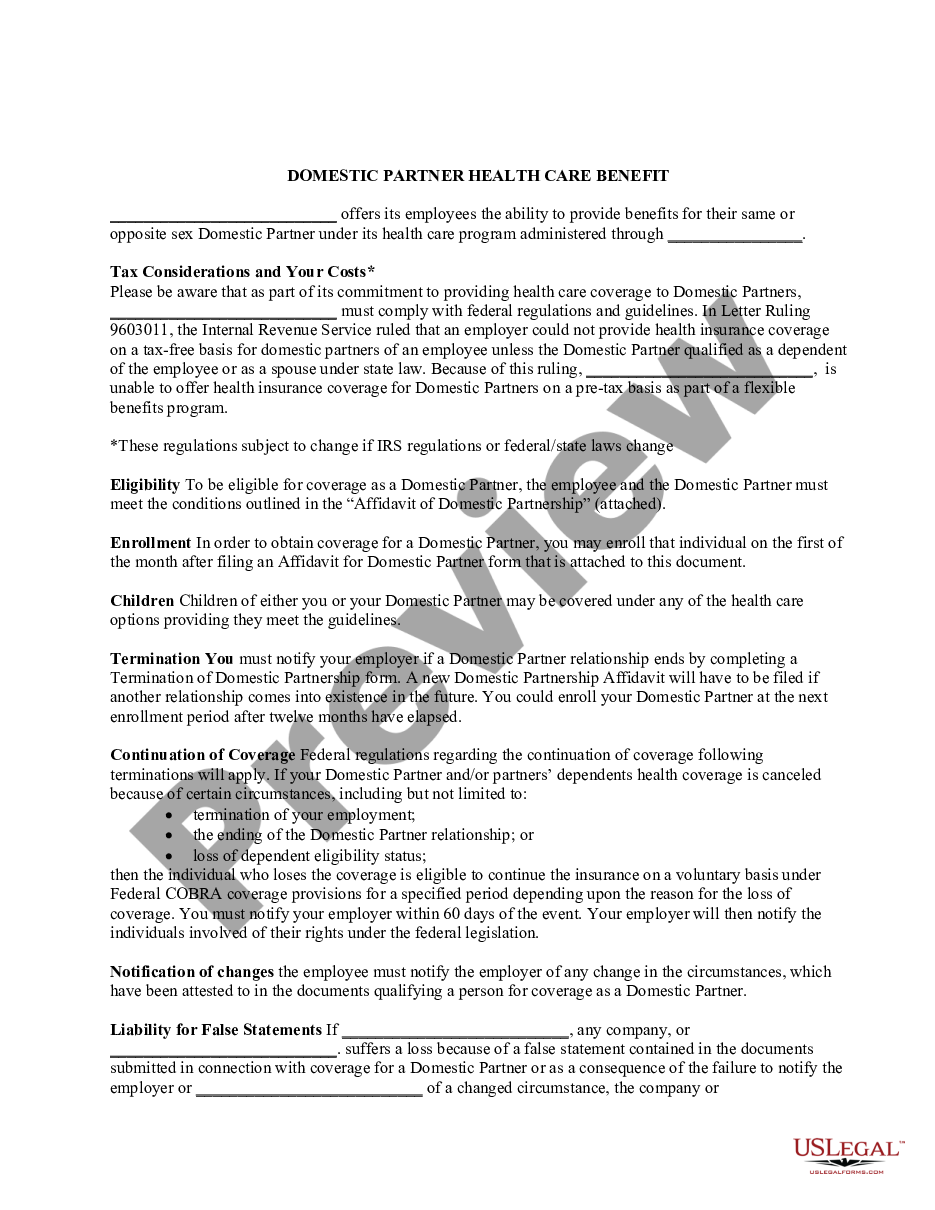

To steer clear of expensive legal help when filling out the Collin Domestic Partnership Dependent Certification Form, you require a verified template valid for your area.

That's the simplest and most economical way to obtain up-to-date templates for any legal needs. Discover them all with just a few clicks and maintain your documents organized with US Legal Forms!

- That's when utilizing the US Legal Forms platform becomes particularly beneficial.

- US Legal Forms is an esteemed online repository trusted by millions containing over 85,000 state-specific legal templates.

- It’s a fantastic option for professionals and individuals looking for DIY templates for various life and business situations.

- All documents can be reused: once you purchase a sample, it stays available in your account for future use.

- Therefore, if you hold an account with an active subscription, you can simply Log In and re-download the Collin Domestic Partnership Dependent Certification Form from the My documents section.

- For newcomers, there are a few additional steps to acquire the Collin Domestic Partnership Dependent Certification Form.

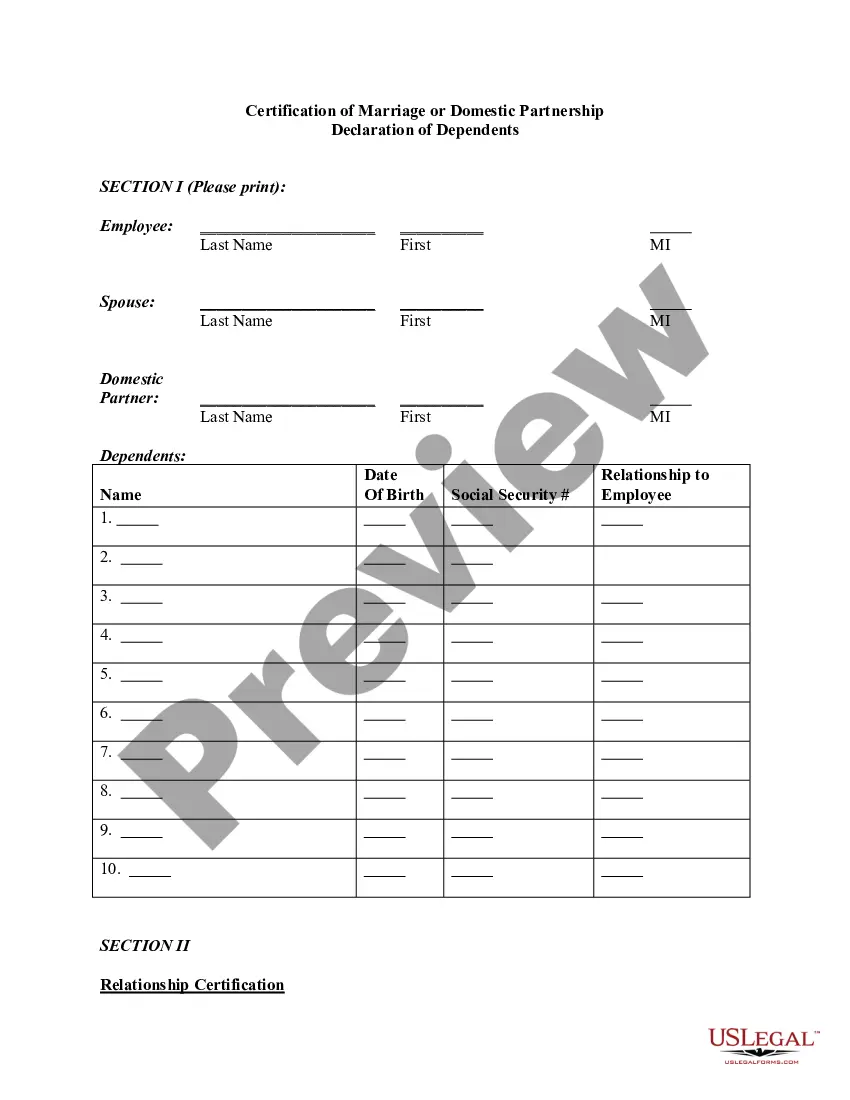

- Check the page content to confirm that you have located the correct sample.

- Utilize the Preview feature or read the form description if it’s provided.

Form popularity

FAQ

A domestic partner can be broadly defined as an unrelated and unmarried person who shares common living quarters with an employee and lives in a committed, intimate relationship that is not legally defined as marriage by the state in which the partners reside.

To claim your domestic partner as a dependent on your taxes, your partner must meet the requirements of a qualifying dependent. Your partner must have lived with you the entire year and you must have paid at least half of your partner's support.

"Declaration of Domestic Partnership." A "Declaration of Domestic Partnership" is a statement signed under penalty of perjury. By signing it, the two people swear that they meet the requirements of the definition of domestic partnership when they sign the statement. Each must provide a mailing address.

A domestic partnership agreement is a legal agreement but it is not a marriage, a common-law marriage, or a civil union. Texas does not currently recognize any of these unions.

The IRS doesn't allow you to claim a domestic partner as your only dependent and file as a Head of Household. The only way to claim a domestic partner as a dependent and also file under the Head of Household filing status is also to have another qualifying dependent on your return.

No. Registered domestic partners may not file a federal return using a married filing separately or jointly filing status. Registered domestic partners are not married under state law.

Steps for Filing a Domestic Partnership Agreement Make an appointment with the county clerk's office: 5501 Airport Blvd, Austin, TX 78751. Bring proof of identity and age. Acceptable identification includes:

For example, if you will be including your spouse in your medical coverage and designating him or her as a recipient of your life insurance, then your spouse is both a dependent and a beneficiary.

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.

The state Constitution prohibits government entities from recognizing domestic partnerships and offering insurance benefits to those couples, Texas Attorney General Greg Abbott wrote in an opinion on Monday.