Orange California Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump-sum Payment?

Managing legal documents is essential in the contemporary era.

Nonetheless, it's not always necessary to seek professional help to create certain documents from scratch, such as the Orange Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment, through a service like US Legal Forms.

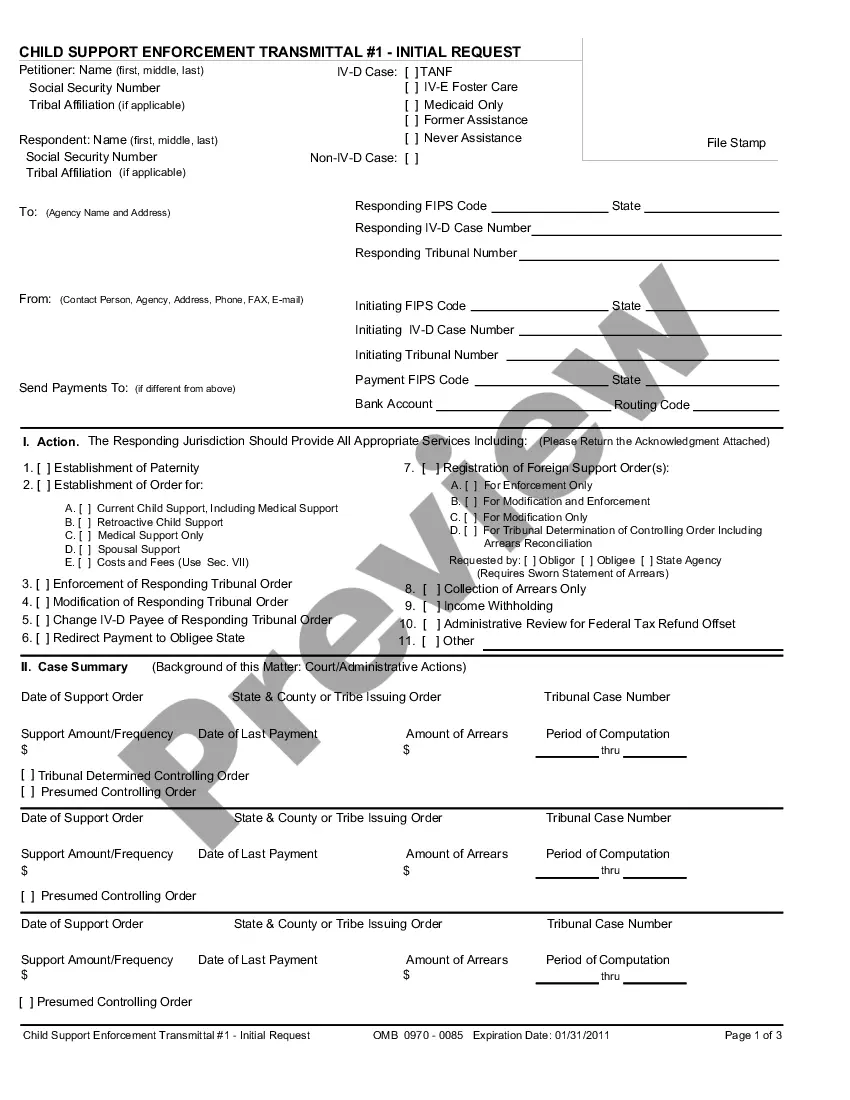

US Legal Forms offers over 85,000 templates to choose from across numerous categories, including living wills, real estate documents, and divorce papers. All forms are categorized according to their applicable state, simplifying the search process.

If you are already a member of US Legal Forms, you can locate the necessary Orange Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment, Log In to your account, and download it.

It goes without saying that our platform cannot entirely replace an attorney. If you are confronted with an especially complex situation, we recommend utilizing a lawyer's services to review your document before signing and submitting it.

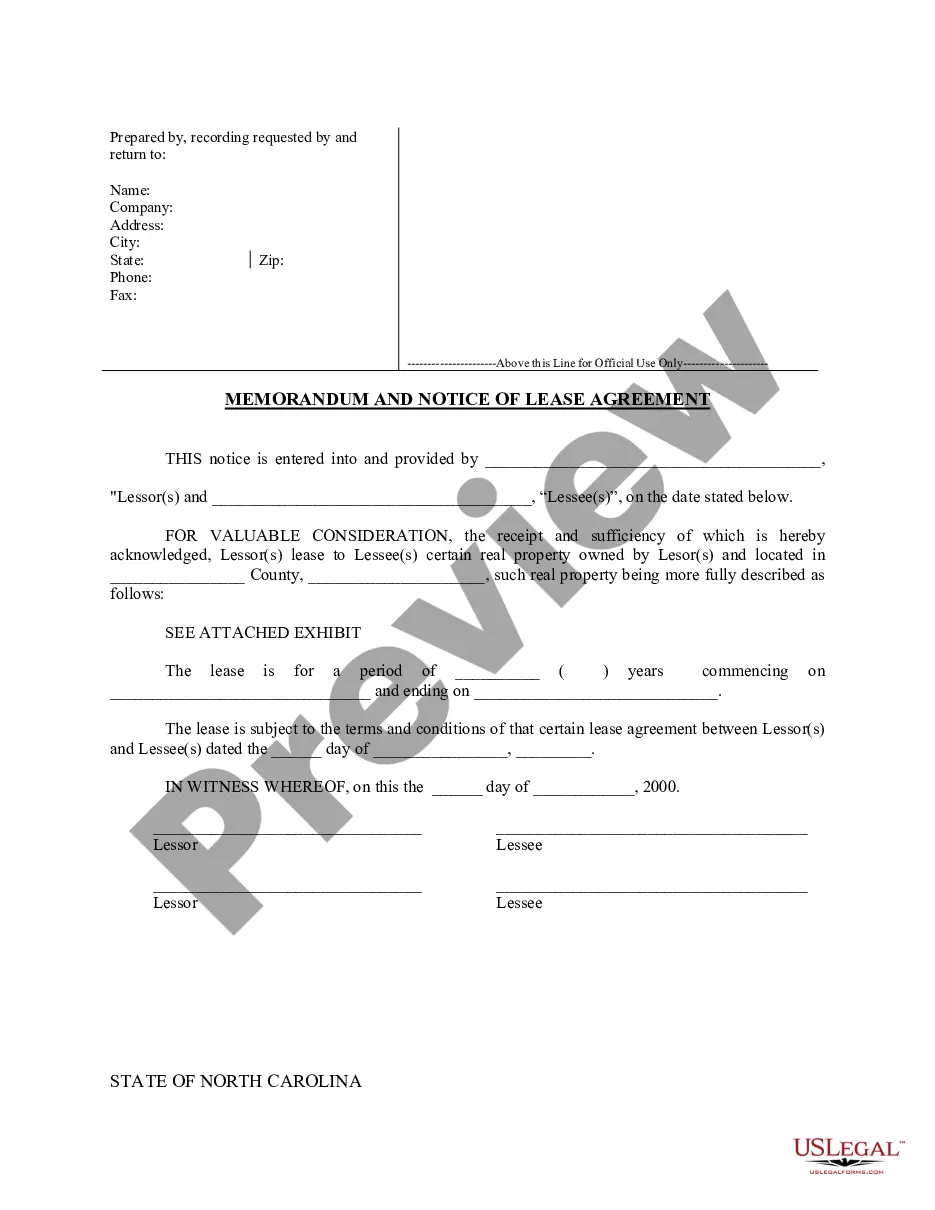

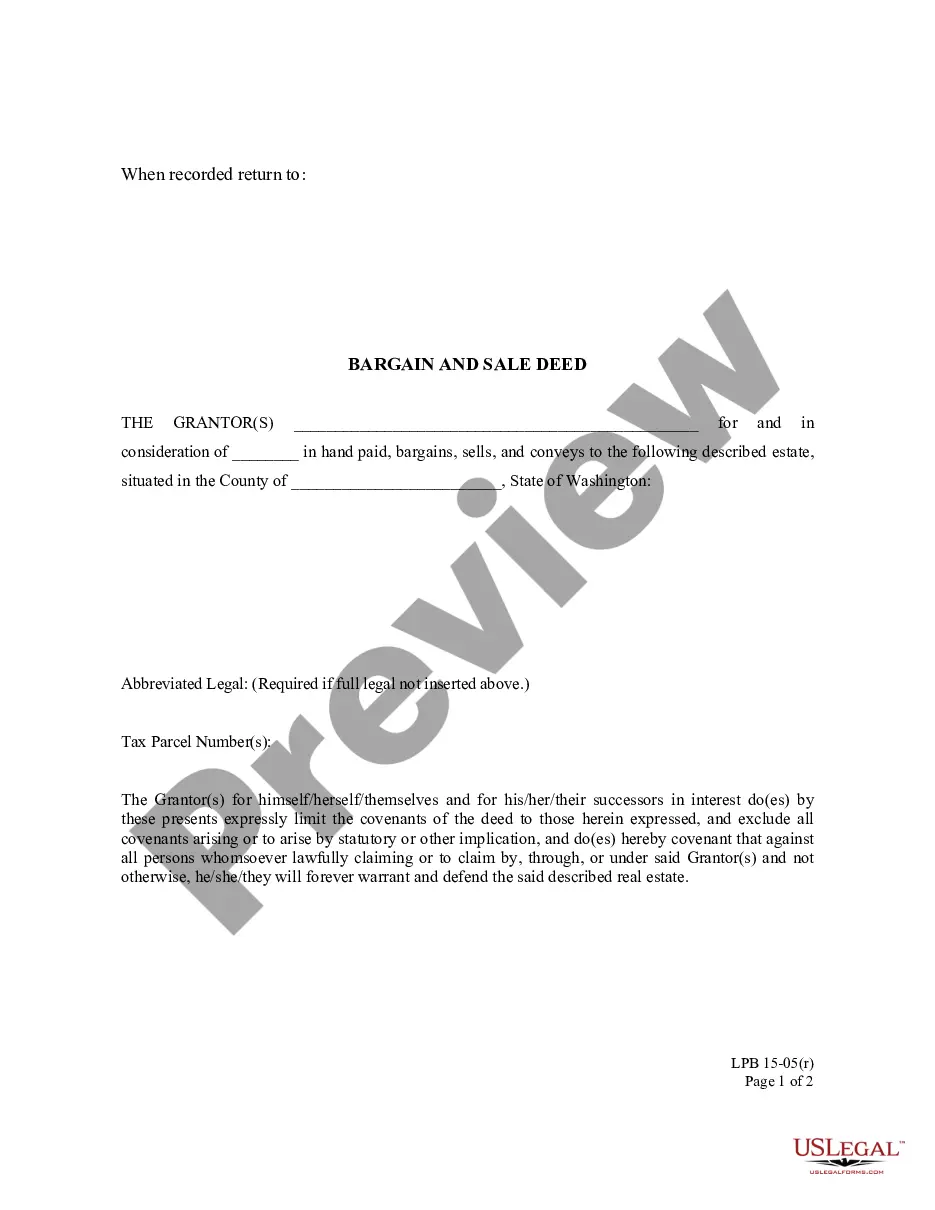

- Review the document's preview and description (if available) to obtain basic details about what you’ll receive after acquiring the form.

- Confirm that the template you select is relevant to your state/county/region, as state regulations can affect the legitimacy of certain documents.

- Investigate the related forms or restart the search to locate the appropriate document.

- Click Buy now and create your account. If you already possess one, opt to Log In.

- Select the pricing plan, followed by an appropriate payment method, and purchase the Orange Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment.

- Choose to save the form template in any available format.

- Navigate to the My documents tab to re-download the document.

Form popularity

FAQ

How are accounts settled. Losses of the firm will be paid out of the profits, next out of the capital of the partners, and even then if losses aren't paid off, losses will be divided among the partners in profit sharing ratios. Third party debts will be paid first.

In a General Partnership, all partners are financially obligated to any debts incurred by the partnership. When a partner leaves, the partnership dissolves and the partners equally split debts and assets.

To close their business account, partnerships need to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.

The firm shall apply its assets including any contribution to make up the deficiency firstly, for paying the third party debts, secondly for paying any loan or advance by any partner and lastly for paying back their capitals. Any surplus left after all the above payments is shared by partners in profit sharing ratio.

Just keep in mind these five key steps when dissolving a partnership: Review your partnership agreement.Discuss with other partners.File dissolution papers.Notify others.Settle and close out all accounts.

How to Dissolve a Partnership Review and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Payment of the debts of the firm to the third parties. Payment of advances and loans given by the partners. Payment of capital contributed by the partners. The surplus, if any, will be divided among the partners in their profit-sharing ratio.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

File a Dissolution Form. You'll need to file a dissolution of partnership form with the state your business is based in to formally announce the end of the partnership. Doing so makes it clear that you are no longer in a partnership or liable for its debts; it's a good protective measure to take.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.