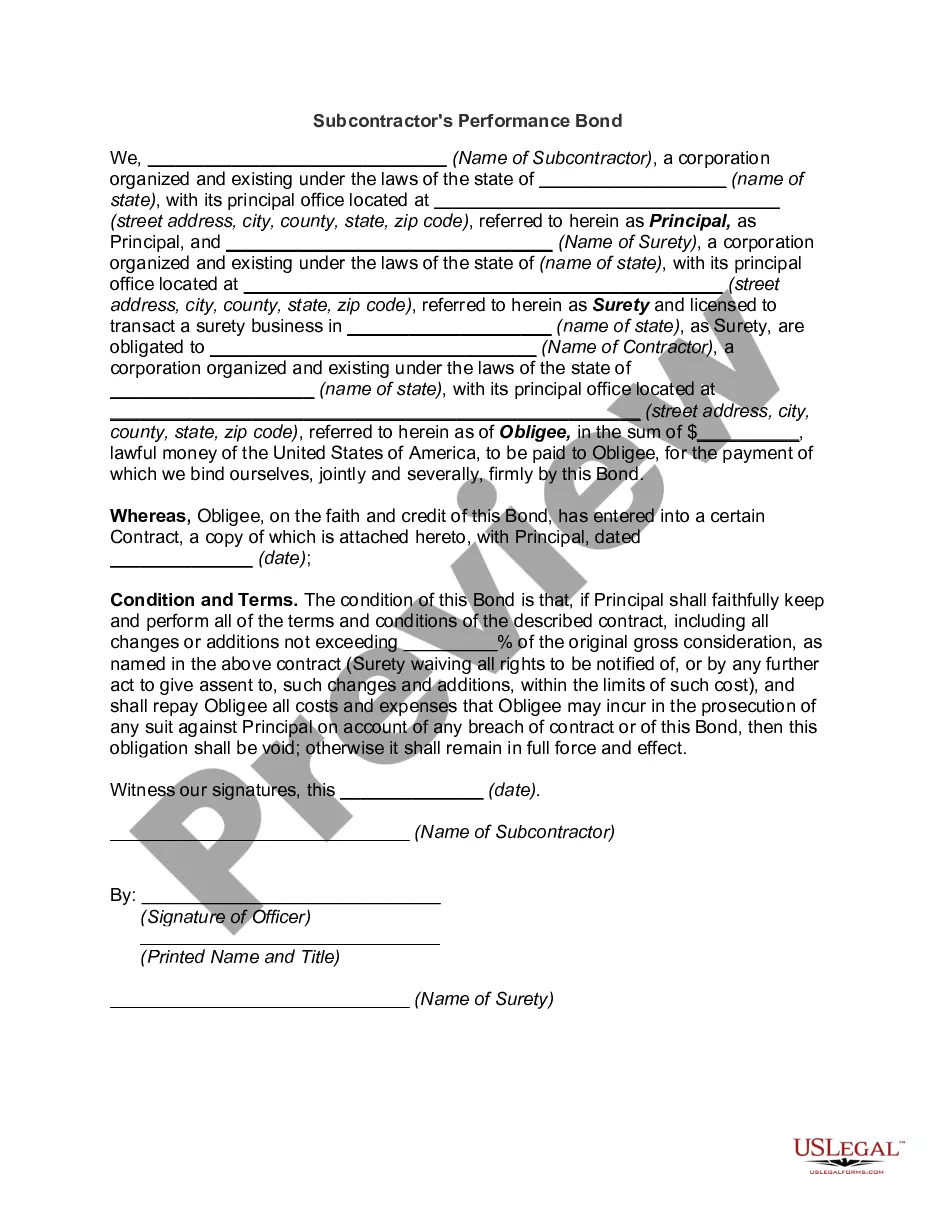

Los Angeles California Subcontractor's Performance Bond

Description

How to fill out Subcontractor's Performance Bond?

A document procedure consistently accompanies any legal action you undertake.

Establishing a company, applying for or accepting a job offer, transferring ownership, and numerous other life situations necessitate you to prepare formal documentation that differs across the nation.

That’s why having everything compiled in one location is incredibly beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal templates.

Utilize it as necessary: print it or complete it electronically, sign it, and send it where required. This is the simplest and most reliable method to acquire legal documents. All templates provided by our library are professionally crafted and verified for compliance with local laws and regulations. Organize your documentation and manage your legal matters effectively with US Legal Forms!

- On this platform, you can effortlessly find and download a document for any personal or commercial purpose relevant to your area, including the Los Angeles Subcontractor's Performance Bond.

- Finding forms on the site is exceptionally simple.

- If you already possess a subscription to our library, Log In to your account, search for the sample using the search bar, and click Download to save it on your device.

- After that, the Los Angeles Subcontractor's Performance Bond will be accessible for future use in the My documents section of your profile.

- If you are using US Legal Forms for the first time, follow this straightforward guideline to obtain the Los Angeles Subcontractor's Performance Bond.

- Confirm that you have accessed the correct page with your localized form.

- Utilize the Preview mode (if available) and review the template.

- Examine the description (if available) to ensure the form meets your requirements.

- Search for another document using the search feature if the sample does not suit you.

- Click Buy Now once you locate the desired template.

- Choose the appropriate subscription plan, and then Log In or create an account.

- Select the preferred payment option (credit card or PayPal) to continue.

- Select file format and download the Los Angeles Subcontractor's Performance Bond onto your device.

Form popularity

FAQ

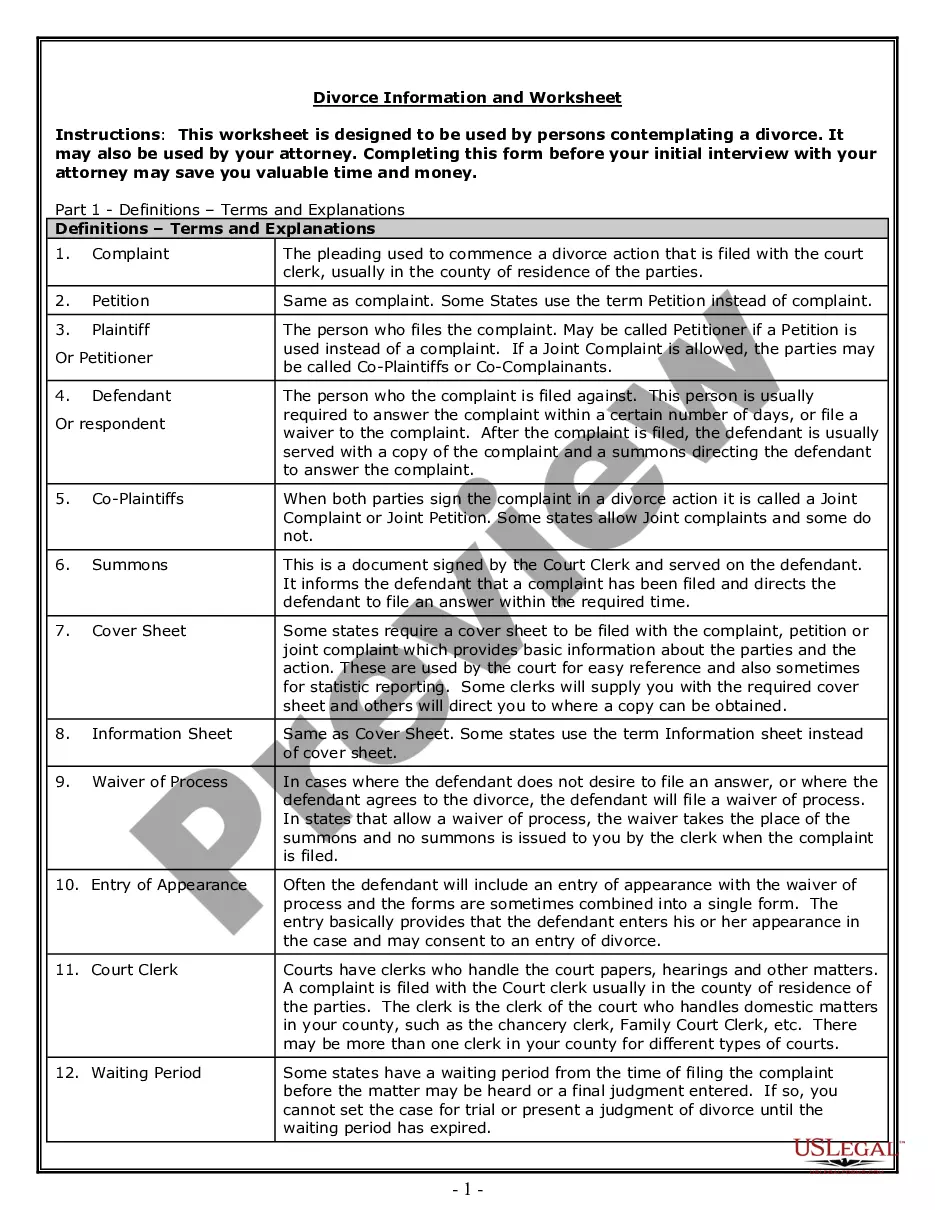

The 3 most common types of construction bonds are Bid Bonds, Performance Bonds, and Payment Bonds. Other construction bonds that are often required include Maintenance Bonds, Supply Bonds, Subdivision Bonds, and Site Improvement Bonds.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet the obligations of the contract. A performance bond is usually issued by a bank or an insurance company.

While a performance bond usually entitles the creditor to payment upon the simple presentation of a demand, a guarantee depends upon the liability of the primary debtor, and payment under the guarantee may be delayed until the existence of the liability is established in Court.

A construction surety bond is a contractual agreement between three parties: a contractor or construction company, someone who wants to hire them, and a surety bond company. The bond serves as a kind of guarantee that a contractor will complete the construction project within the parameters of the contract.

How much is the performance bond? 15% bond covering Contractor's obligations arising from the Contract to its workers, subcontractors and suppliers.

What is the cost of performance bonds in construction? Construction performance bonds are typically for 10% of the contract value. Rates are around 12 per cent for a 12-month period for a secure company.

On average, the cost for a surety bond falls somewhere between 1% and 15% of the bond amount. That means you may be charged between $100 and $1,500 to buy a $10,000 bond policy. Most premium amounts are based on your application and credit health, but there are some bond policies that are written freely.

When a contractor fails to abide by any of the conditions of the contract, the surety and contractor are both held liable. The three main types of construction bonds are bid, performance, and payment.

A payment bond guarantees a party pays all entities, such as subcontractors, suppliers, and laborers, involved in a particular project when the project is completed. A performance bond ensures the completion of a project.

A subcontractor performance bond is a project specific contractual agreement between a subcontractor and a surety by which the surety guarantees to arrange for the completion of a subcontract if the subcontractor runs into trouble and fails to complete its scope of work on the project.