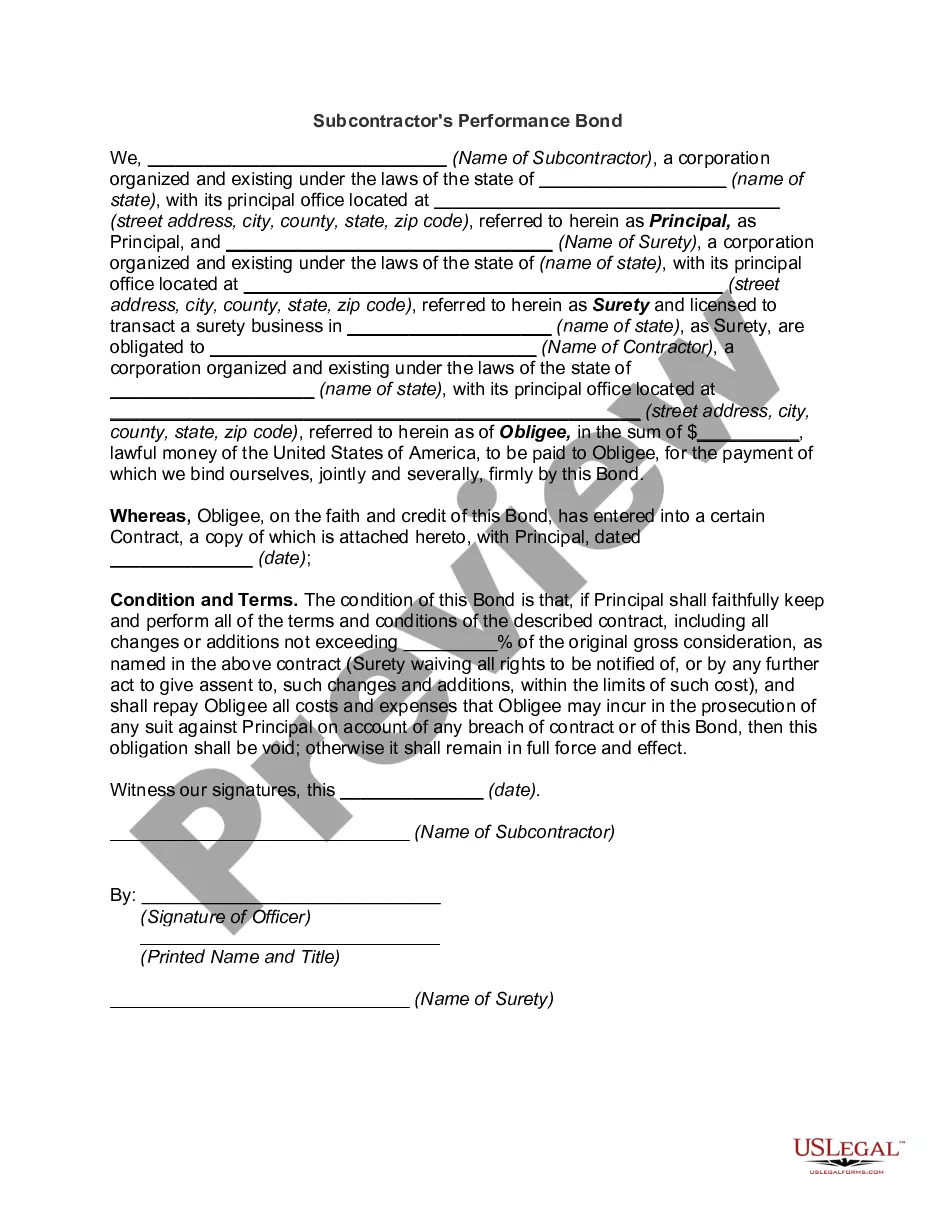

Dallas Texas Performance Bond

Description

How to fill out Performance Bond?

Preparing documentation for commercial or individual requirements is consistently a significant obligation.

When formulating a contract, a public service inquiry, or a power of attorney, it is vital to reflect on all federal and state regulations of the specific area.

However, small jurisdictions and even municipalities also possess legislative protocols that you must take into account.

To locate the one that satisfies your requirements, utilize the search tab at the top of the page.

- All these aspects make it anxiety-inducing and time-intensive to devise a Dallas Performance Bond without professional assistance.

- It's simple to forgo expenses on attorneys for preparing your documents and create a legally acceptable Dallas Performance Bond independently, utilizing the US Legal Forms online library.

- This is the largest digital repository of state-specific legal forms that are expertly validated, so you can be assured of their legitimacy when selecting a template for your county.

- Previously registered users just need to Log In to their accounts to download the necessary document.

- Should you still lack a subscription, adhere to the step-by-step instructions below to acquire the Dallas Performance Bond.

- Browse the page you've accessed and confirm if it contains the sample you need.

- To achieve this, utilize the form description and preview if these features are available.

Form popularity

FAQ

Payment bonds ensure that contractors pay their material suppliers and subcontractors according to their contracts. Performance bonds provide a financial guarantee to project owners that their contractor will perform according to contract terms.

A construction performance bond is required on federal government construction projects exceeding $100,000 as a result of the Miller Act of 1934.

The cost of a performance bond may go up by 1.5% to 2% on riskier contracts. The financial strength and credit worthiness of the principal are major considerations in the cost of the bond. For our small contractor bonds (those that are <$400,000) three percent (3%) is a pretty good rule to follow.

The most obvious benefit of a performance bond for the owner is the assurance of a project's completion. The surety protects the owner in the event the contractor defaults on the contract. Contractors are taken through a meticulous pre-qualification process.

It is calculated by dividing the interest rate by the purchase price. The current yield does not account for the amount you will receive if you hold bond to maturity.

The Performance Bond secures the contractor's promise to perform the contract in accordance with its terms and conditions, at the agreed upon price, and within the time allowed. The Payment Bond protects certain laborers, material suppliers and subcontractors against nonpayment.

How much does a performance bond cost? Performance bonds are typically for 10% of the contract value. Rates are normally around 12 per cent for a 12-month period for a secure company, however this can increase for bonds over longer periods.

A performance bond is intended for the protection of the owner (or of the contractor, if dealing with a performance bond provided by a subcontractor). A performance bond is different from a payment bond in that a performance bond is not intended to protect unpaid subcontractors or suppliers.

A performance bond is issued by one party to contract to the other party as a guarantee against the issuing party's failure to meet their obligations under the contract, or to delivery on the level of performance specified in the agreement.

A performance bond is an agreement between the contractor and the owner of a project. The contractor agrees to provide a certain level of work in exchange for payment, while the owner agrees to pay if the work is not completed satisfactorily.