Houston Texas Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

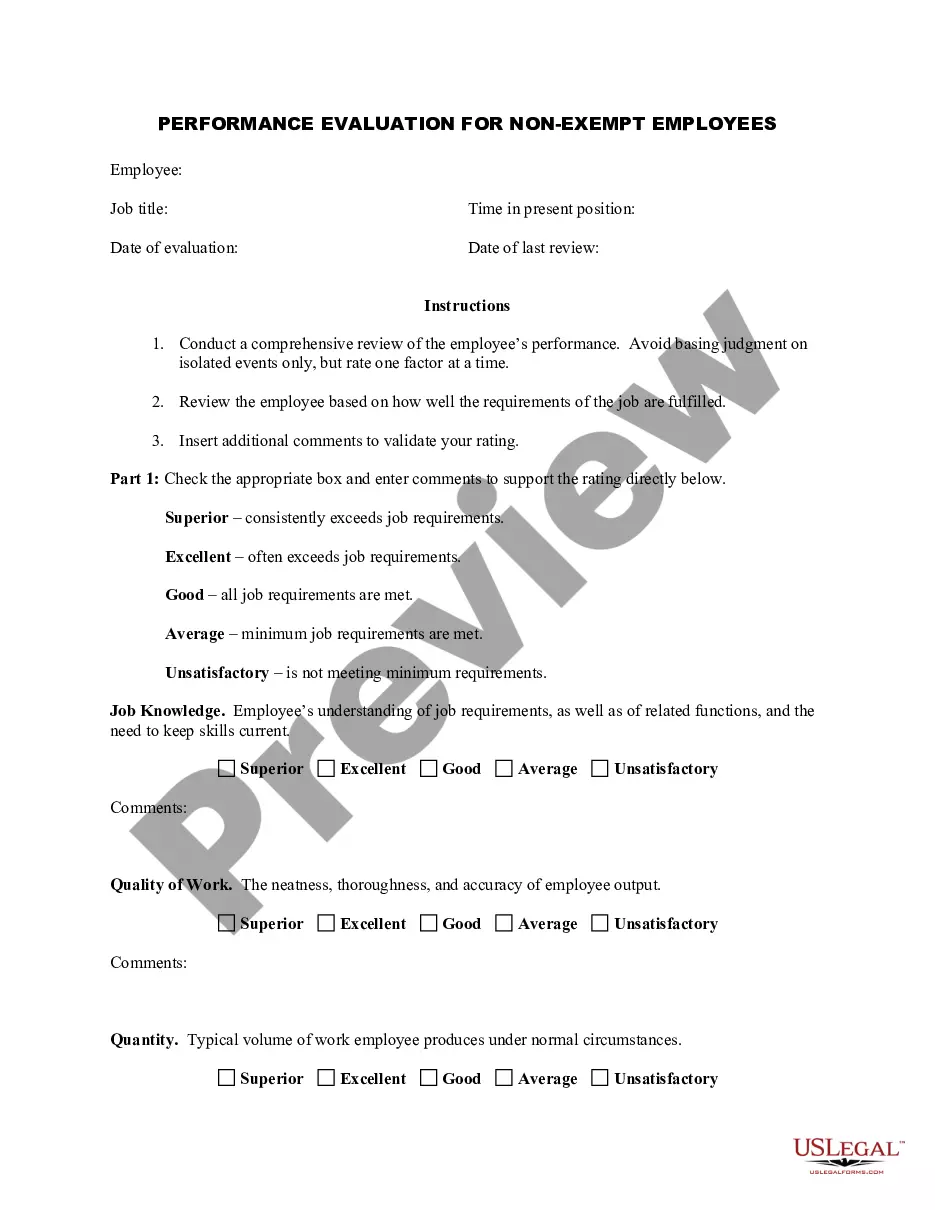

How to fill out Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

Drafting documents for business or individual requirements is consistently a significant duty.

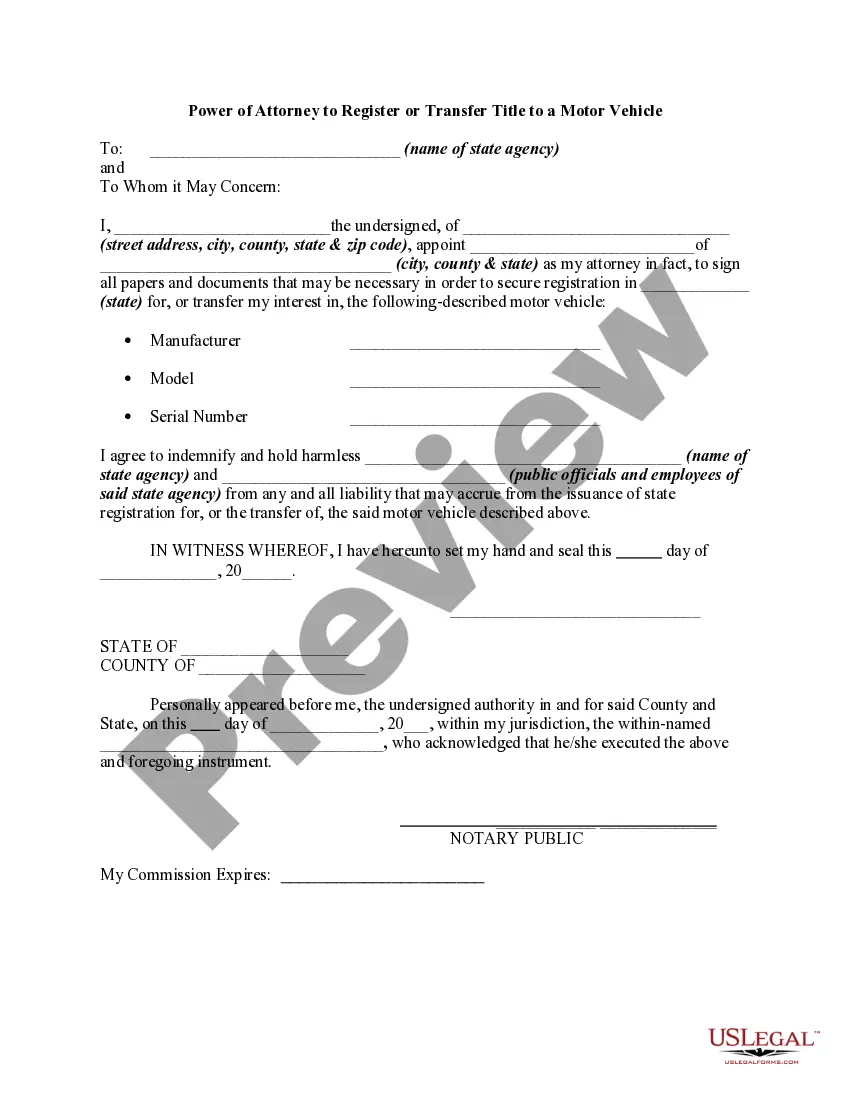

When formulating a contract, a public service application, or a power of attorney, it's vital to take into account all federal and state statutes relevant to the area in question.

Nonetheless, small counties and even municipalities also possess legislative rules that you need to take into consideration.

Utilize the search tab in the page header to find the one that meets your requirements.

- All these elements render it cumbersome and time-intensive to formulate a Houston Sample Letter for Request for IRS not to Off Set against Tax Refund without professional assistance.

- It is feasible to sidestep unnecessary expenses on attorneys crafting your documentation and generate a legally sound Houston Sample Letter for Request for IRS not to Off Set against Tax Refund independently, utilizing the US Legal Forms web library.

- It is the largest online repository of state-specific legal documents that are professionally verified, allowing you to have confidence in their legality when choosing a template for your county.

- Previously registered users simply need to Log In to their accounts to retrieve the required form.

- If you do not yet have a subscription, follow the step-by-step instructions below to acquire the Houston Sample Letter for Request for IRS not to Off Set against Tax Refund.

- Review the page you have accessed and confirm if it contains the sample you require.

- To accomplish this, utilize the form description and preview if these features are available.

Form popularity

FAQ

To write an IRS abatement letter, start by gathering pertinent information such as your tax identification number and the details surrounding your tax situation. Clearly state your request for the IRS not to offset against your tax refund, using the Houston Texas Sample Letter for Request for IRS not to Offset against Tax Refund as a guideline. Make sure to include any documentation that supports your reason for the abatement request. You may find that resources like uslegalforms offer helpful templates and guidance to ensure you craft an effective letter.

When writing a disagreement letter to the IRS, start by stating your full name, address, and taxpayer identification number at the top. Clearly outline the issue you disagree with and provide evidence to support your case. Using a Houston Texas Sample Letter for Request for IRS not to Off Set against Tax Refund can help structure your arguments effectively. Closing the letter with a polite request for reconsideration can also be helpful.

To write a reasonable cause letter to the IRS, clearly explain the circumstances that led to your noncompliance. Include specific details and any relevant documents that support your claim, such as medical records or employment loss notifications. It is beneficial to reference a Houston Texas Sample Letter for Request for IRS not to Off Set against Tax Refund for format and language. This approach increases the likelihood of a favorable response.

Writing a formal letter to the IRS requires clarity and structure. Begin with your contact information, followed by the IRS address. Clearly state your purpose, and provide any reference numbers, such as your Social Security number or tax identification number. Utilize a Houston Texas Sample Letter for Request for IRS not to Off Set against Tax Refund as a guide to help outline your thoughts effectively.

If you disagree with the IRS, first, review your notice thoroughly to understand the specific issue. Next, gather any documentation that supports your case, including records and receipts. You may consider drafting a Houston Texas Sample Letter for Request for IRS not to Off Set against Tax Refund to formally communicate your disagreement and provide evidence. Finally, stay in contact with the IRS to ensure they are aware of your stance.

Stopping tax refund garnishment involves requesting a review of your situation with the IRS. Utilizing a Houston Texas Sample Letter for Request for IRS not to Offset against Tax Refund can streamline this process. In your letter, clearly state your reasons for the request, and include any necessary documentation. Timely action is critical, so don’t hesitate to reach out for assistance.

To stop IRS garnishment, you should contact the IRS and explain your situation. You can submit a Houston Texas Sample Letter for Request for IRS not to Offset against Tax Refund as part of your request. In your letter, provide clear reasons why you believe the garnishment should cease, and offer any documentation that supports your claim. Acting promptly increases your chances of success.

If the IRS has taken your refund for child support, you may have options to stop the offset. You can file a request with the IRS using a Houston Texas Sample Letter for Request for IRS not to Offset against Tax Refund. Include relevant details such as your account information and the reason you believe the offset is unjust. Keep records of all correspondence to support your case.

To stop your refund from being offset, you need to first understand the reason behind the offset. Typically, the IRS offsets refunds for debts owed, such as taxes or child support. You can use a Houston Texas Sample Letter for Request for IRS not to Offset against Tax Refund to formally request the IRS reconsider the offset. It's essential to provide any supporting documentation along with your request.

Yes, it is possible to stop your tax refund from being garnished by submitting a formal request to the IRS. You must provide a compelling reason along with supporting documents. Using the Houston Texas Sample Letter for Request for IRS not to Off Set against Tax Refund can assist you in crafting a clear and organized request that effectively communicates your situation.