Wake North Carolina Sample Letter for Order Approving Third and Final Accounting

Description

How to fill out Sample Letter For Order Approving Third And Final Accounting?

Laws and guidelines in all areas differ from jurisdiction to jurisdiction.

If you're not a lawyer, it's simple to become confused by the multitude of rules when it comes to composing legal documents.

To prevent expensive legal fees when readying the Wake Sample Letter for Order Approving Third and Final Accounting, you require a verified template valid for your region.

That's the simplest and most cost-effective method to acquire up-to-date templates for any legal situations. Find them all in moments and keep your documentation organized with US Legal Forms!

- This is where utilizing the US Legal Forms platform proves advantageous.

- US Legal Forms is a reliable web directory trusted by millions, offering over 85,000 state-specific legal documents.

- It's an excellent option for professionals and individuals looking for DIY templates for various personal and business situations.

- All documents can be used multiple times: once you acquire a sample, it remains accessible in your account for future use.

- Thus, if you have an account with a valid subscription, you can simply Log In and re-download the Wake Sample Letter for Order Approving Third and Final Accounting from the My documents section.

- For new users, it's essential to follow several additional steps to secure the Wake Sample Letter for Order Approving Third and Final Accounting.

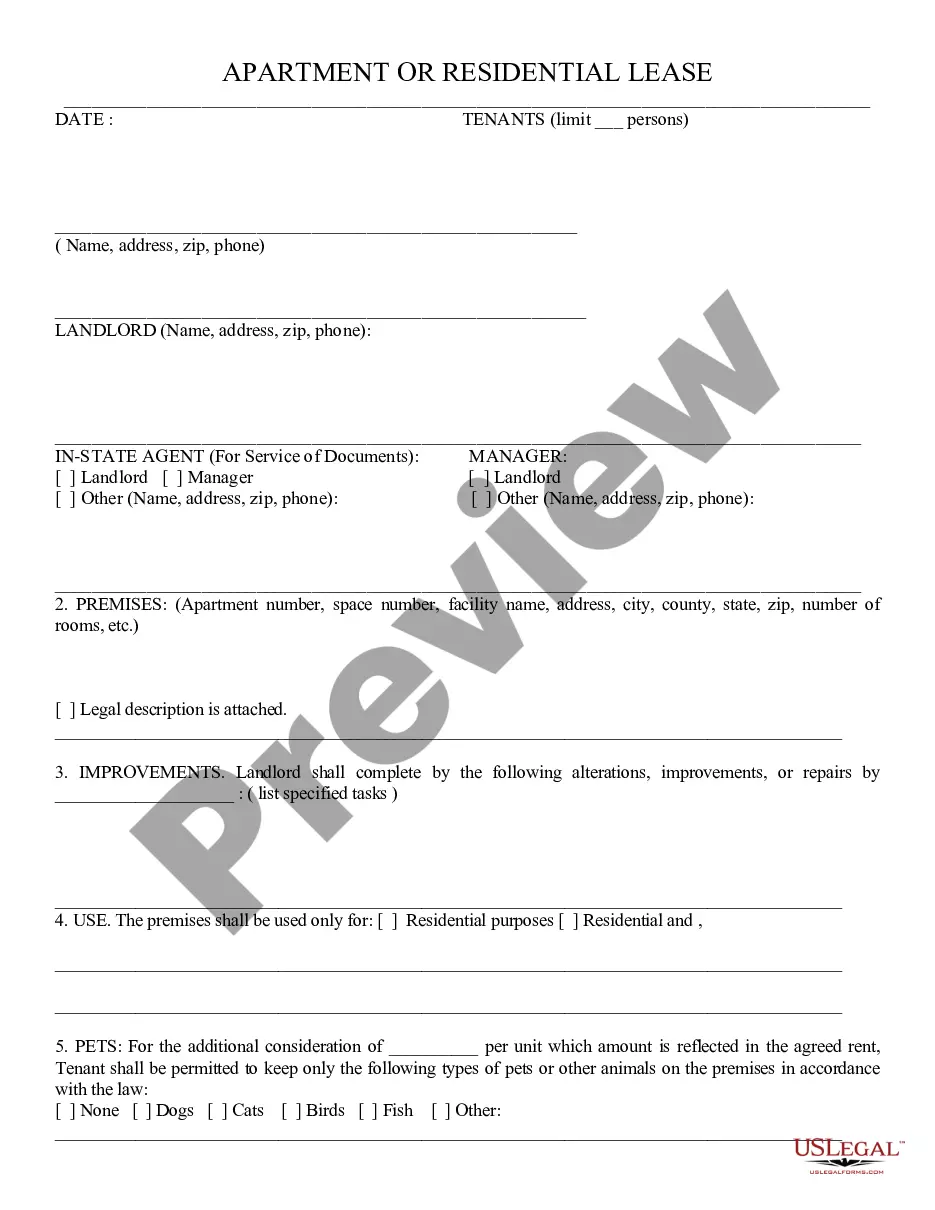

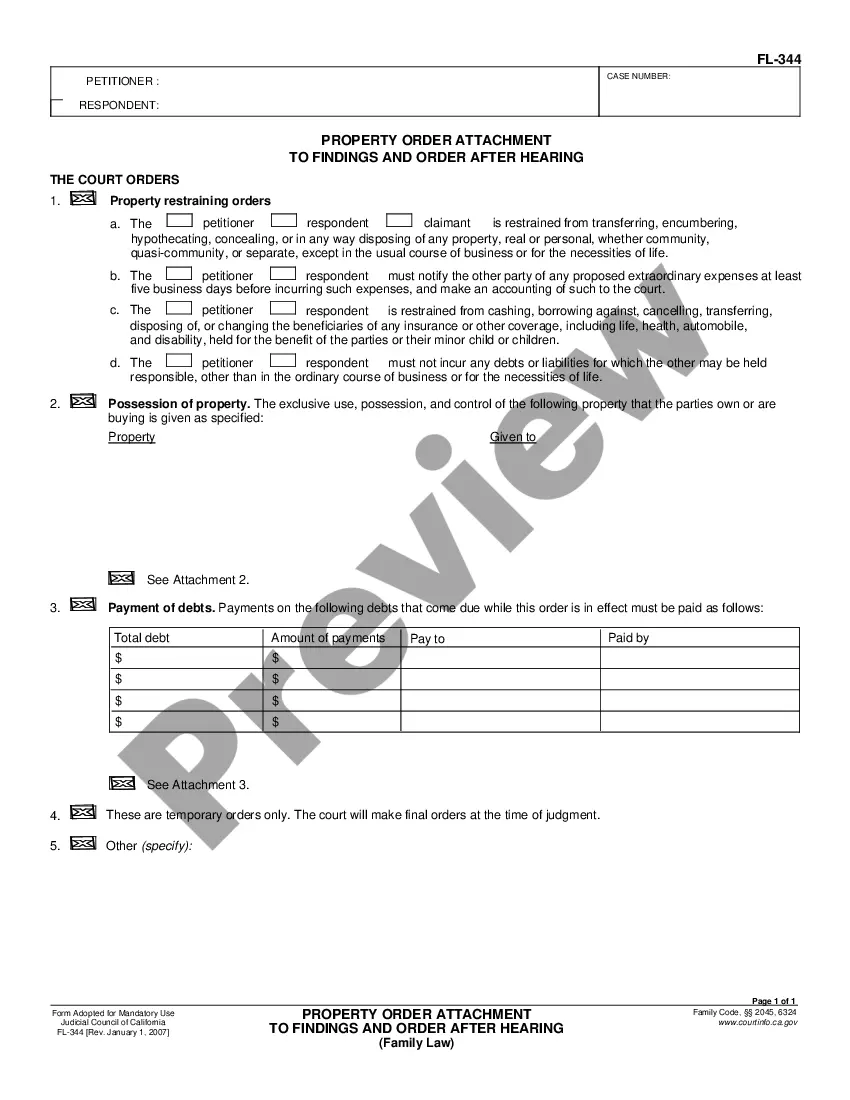

- Review the page content to ensure you have found the correct sample.

- Utilize the Preview feature or read the form description if available.

Form popularity

FAQ

Give the letter a personal touch and address each of your heirs and beneficiaries personally. Tell them any last wishes you may have or any hopes you have for their future. Write as clearly as possible. Use specific details and avoid using shorthand.

As an executor, you will have a duty to ensure that you are selling the property for the best possible price, for the benefit of the estate. For example, you must not sell the property at an undervalue to yourself, a member of your family, or indeed to one of the beneficiaries in the will.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

What to Include In Your Letter An introduction.An explanation about why certain gifts were made.An explanation about disparities in gifts.Suggestions for shared gifts.Positive or negative sentiments.A statement in support of your same-sex relationship.An explanation about your pet.

Spouse, partner, children, parents, brothers and sisters, business partner, key employee, trust and charitable organization.

Getting Permission to Sell Real Property There are multiple ways in which estate executors can be given permission to sell real property. One of the common ways to be given permission is if the decedent had a will that directed the executor to sell the property without court involvement.

For small estates, North Carolina has a simplified process which allows you to wrap up the estate without formal probate. This process applies to estates with personal property valued at $20,000, or $30,000 if the surviving spouse inherits everything under state law.

When dealing with estates and estate contracts, the best practice is to have all parties sign all agreements. The heirs will need to sign because, more than likely, they will hold title to the property subject to the debts of the estate.

It isn't legally possible for one of the co-executors to act without the knowledge or approval of the others. Co-executors will need to work together to deal with the estate of the person who has died. If one of the executors wishes to act alone, they must first get the consent of the other executors.

A beneficiary should be addressed in a letter in the same manner as any other professional person. The letter should be addressed to the beneficiary, using her title and full name. Begin the salutation with the word ?dear? and then state all relevant issues in a concise and clear manner.