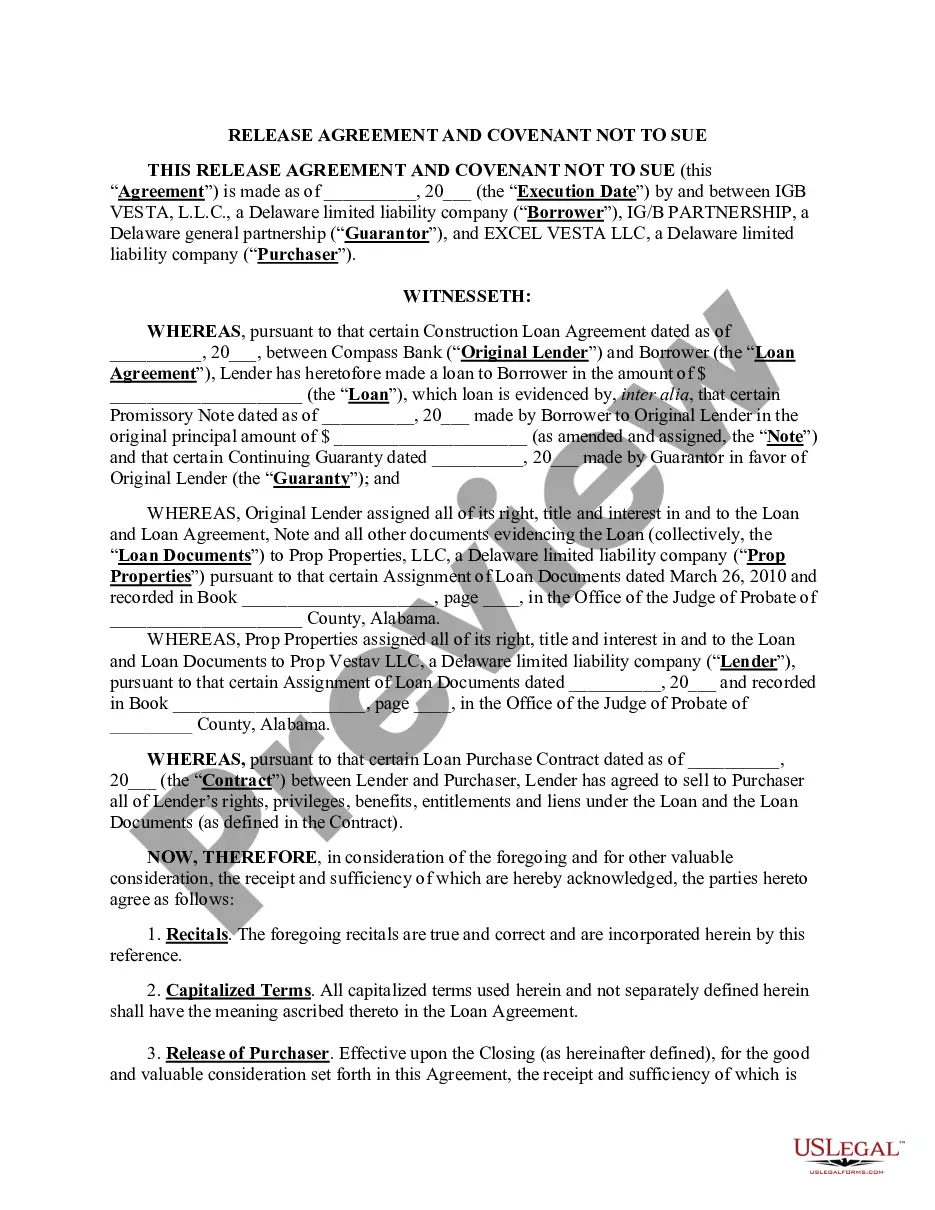

Santa Clara California Covenant Not to Sue by Widow of Deceased Stockholder

Description

How to fill out Covenant Not To Sue By Widow Of Deceased Stockholder?

Whether you intend to launch your enterprise, engage in a contract, request your identification modification, or address family-related legal issues, you must assemble particular paperwork in accordance with your regional laws and regulations.

Locating the appropriate documents may require significant time and exertion unless you utilize the US Legal Forms library.

The service offers users over 85,000 expertly drafted and verified legal templates for any personal or business matter.

Log in to your account and process the payment through a credit card or PayPal. Download the Santa Clara Covenant Not to Sue by Widow of Deceased Stockholder in your preferred file format. Print the document or complete it and sign it electronically using an online editor to save time. The forms offered by our library are reusable. With an active subscription, you can access all your previously purchased documents anytime from the My documents section of your profile. Stop wasting time in a perpetual search for current official documents. Register for the US Legal Forms platform and maintain your paperwork in order with the most comprehensive online form collection!

- All documents are categorized by state and purpose, making it quick and straightforward to select a copy like the Santa Clara Covenant Not to Sue by Widow of Deceased Stockholder.

- Users of the US Legal Forms library merely need to Log In to their account and click the Download button adjacent to the desired template.

- If you are new to the service, it will involve several additional steps to acquire the Santa Clara Covenant Not to Sue by Widow of Deceased Stockholder.

- Ensure the sample meets your unique requirements and adheres to state law stipulations.

- Examine the form description and inspect the Preview if available on the page.

- Utilize the search bar above to locate another template relevant to your state.

- Click Buy Now to purchase the file when you identify the correct one.

- Choose the subscription plan that best fits your needs to proceed.

Form popularity

FAQ

Follow these steps: Obtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident.Include attachments.Obtain other signatures.Get the documents notarized.Transfer the property.

To file, you bring a petition under section 17200, which gives the court the power to issue orders regarding the internal affairs of the Trust. Section 17200 provides a long list of actions that the court can take to help you fix problems with a bad Trustee.

The person left the house in the will must go to the office to have the deed reissued in their name. If no will was left, the estate must be probated and the New Jersey probate court will issue papers regarding ownership of the property. These papers would then be taken to the clerk's office to have a deed issued.

California Spousal Property Petition Form DE-221 - YouTube YouTube Start of suggested clip End of suggested clip I find the link for California Judicial Council. And once we're on that site you can go up to formsMoreI find the link for California Judicial Council. And once we're on that site you can go up to forms and rules you can browse the forms.

California Notice of Petition for Probate--Form DE-121 - YouTube YouTube Start of suggested clip End of suggested clip Number four the petition requests that decedent's wills and codicils of if any be admitted toMoreNumber four the petition requests that decedent's wills and codicils of if any be admitted to probate.

Without opening probate, any assets titled in the decedent's name, including real estate and vehicles, will remain in the decedent's name for an indefinite period of time. This prevents you from selling them to pay off debts, distributing them to the beneficiaries, or keeping registration current.

Probate is generally required in California. However, there are two different types of probate for estates. Simplified procedures may be used if the value of the estate is less than $166,250. Probate may not be necessary if assets are attached to a beneficiary or surviving owner.

California Spousal Property Petition Form DE-221 - YouTube YouTube Start of suggested clip End of suggested clip Now you're going to fill in the date of the hearing. The time the Department and the room number andMoreNow you're going to fill in the date of the hearing. The time the Department and the room number and so all of that will be filled out after the hearing either by you or it.

How long does probate take? California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

In order to close a probate estate in California, the appointed personal representative must file a petition with the probate court which reports everything he/she has done in regards to the estate. The personal representative must file a Petition for Final Distribution within one year after Letters are issued.