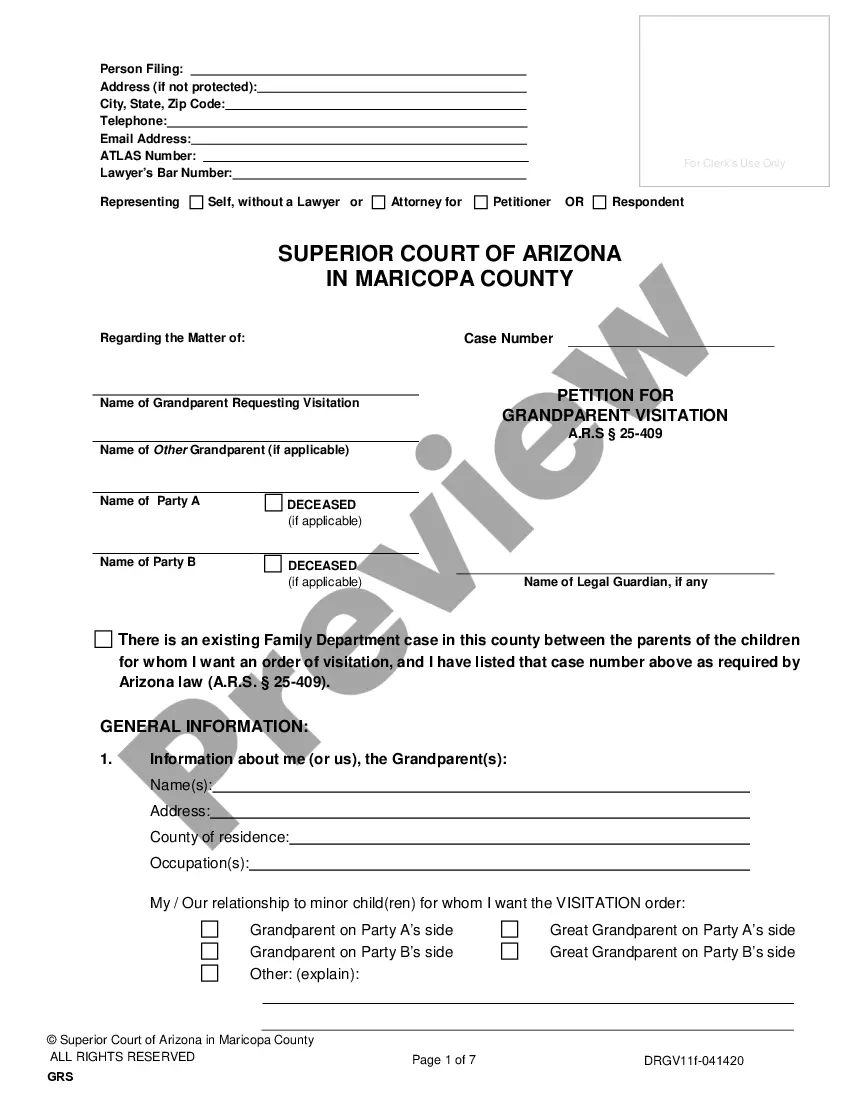

Maricopa Arizona Worksheet - Contingent Worker

Description

How to fill out Worksheet - Contingent Worker?

Whether you plan to start your enterprise, engage in a contract, request your identification update, or address family-related legal matters, you must assemble specific documents in accordance with your local statutes and regulations.

Finding the appropriate paperwork may consume considerable time and effort unless you take advantage of the US Legal Forms library.

The platform offers users over 85,000 professionally composed and validated legal documents for any personal or business situation. All files are categorized by state and usage area, making it easy to select a document such as the Maricopa Worksheet - Contingent Worker.

Documents provided by our site are reusable. With an active subscription, you can access all your previously acquired documents at any time in the My documents section of your profile. Stop wasting time on an endless pursuit for current official documents. Register for the US Legal Forms platform and maintain your paperwork organized with the most extensive online form library!

- Ensure the template meets your individual requirements and state law guidelines.

- Review the form description and examine the Preview if available on the page.

- Use the search feature specifying your state above to locate another template.

- Click Buy Now to acquire the document when you identify the correct one.

- Choose the subscription plan that best fits your needs to proceed.

- Log in to your account and pay the service using a credit card or PayPal.

- Download the Maricopa Worksheet - Contingent Worker in the file format you need.

- Print the document or complete it and sign it electronically via an online editor to save time.

Form popularity

FAQ

Like all contingent workers, consultants are non-employees who aren't on your payroll. Unlike temporary workers, however, consultants typically work with a high level of independence and, while they offer guidance on strategy, they usually don't execute the work required to carry it out.

Contingent labor is a group of workers who provided services to an organization on a non-permanent basis. These workers are often known as independent professionals, temporary contract workers, labor hires, freelancers, contractors, or consultants. These type of workers are commonly known as contingent workers.

A contingent worker is an individual who works in a company on a temporary basis. These workers are hired on an ad-hoc basis and do not have a specific contract defining long-term employment status with a company.

If your client wants to hire a contingent worker, they generally do not need to handle employment taxes. Contingent workers who are independent contractors are responsible for paying their own taxes because they are self employed. Contract workers are on the Employer of Record's payroll, not your client's.

Contingent workers are individuals hired by a company to do role- or project-based work on its behalf, but not as traditional employees. They could include independent contractors, consultants, freelancers, temps, or other outsourced labor such as gig workers.

A contingent worker is someone who works for an organization without being hired as their employee. Contingent workers may provide their services under a contract, temporarily, or on an as-needed basis.

Contingent workers are not employees. A person cannot be an active contingent worker and an active employee at the same time. Contingent workers can never be paid in Workday, can never be benefits eligible, and cannot hold more than one job in Workday.

Contingent workers include independent contractors, freelancers, consultants, advisors or other outsourced workers hired on a per-job and non-permanent basis.