Wayne Michigan Receipt and Withdrawal from Partnership

Description

How to fill out Receipt And Withdrawal From Partnership?

A document procedure consistently accompanies any legal action you undertake.

Establishing a business, submitting or accepting a job proposal, transferring ownership, and numerous other life scenarios require you to prepare formal documentation that varies across the nation. That is why consolidating everything in one location is immensely beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal documents. On this platform, you can effortlessly locate and download a document for any personal or business need utilized in your area, including the Wayne Receipt and Withdrawal from Partnership.

Finding templates on the platform is incredibly straightforward. If you already have a membership to our service, Log In to your account, search for the sample using the search bar, and click Download to save it on your device. After that, the Wayne Receipt and Withdrawal from Partnership will be accessible for further use in the My documents section of your profile.

Utilize it as necessary: print it or fill it out digitally, sign it, and send it where required. This is the most straightforward and dependable method to obtain legal documents. All the samples available in our library are expertly drafted and verified for compliance with local laws and regulations. Prepare your documentation and manage your legal matters efficiently with US Legal Forms!

- Ensure you have accessed the correct page with your local form.

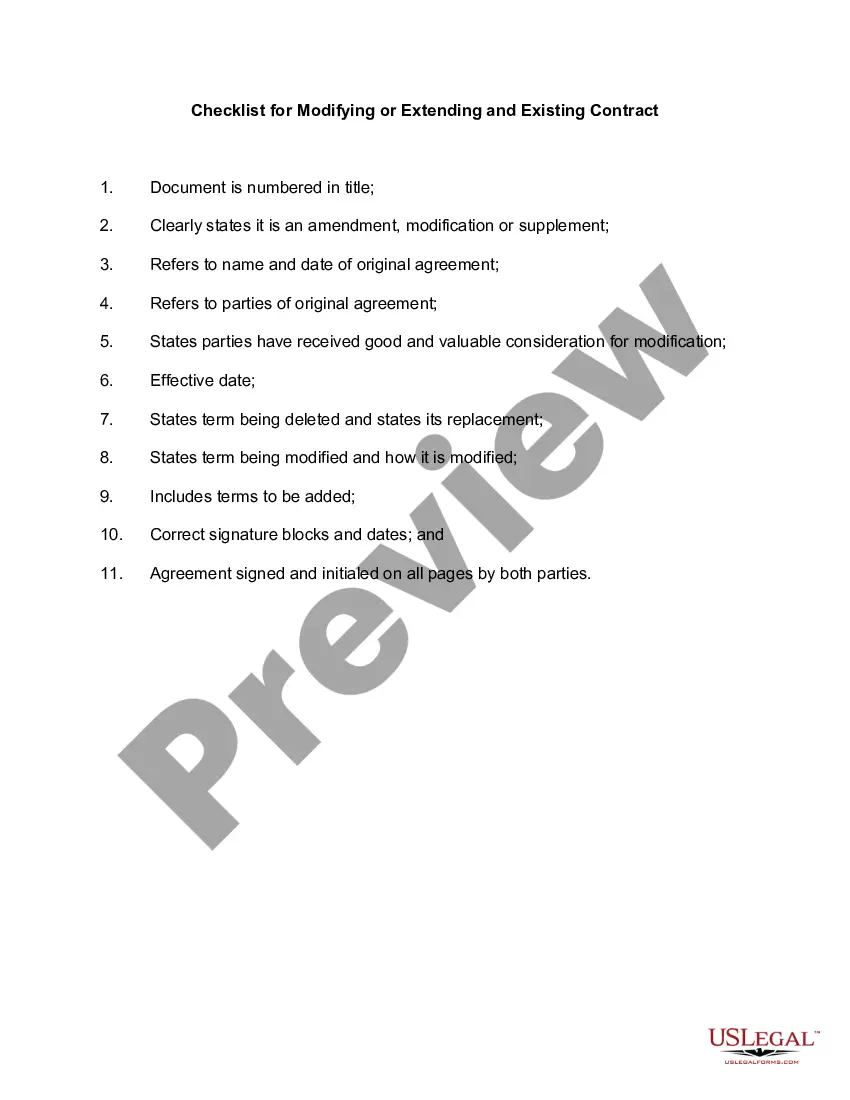

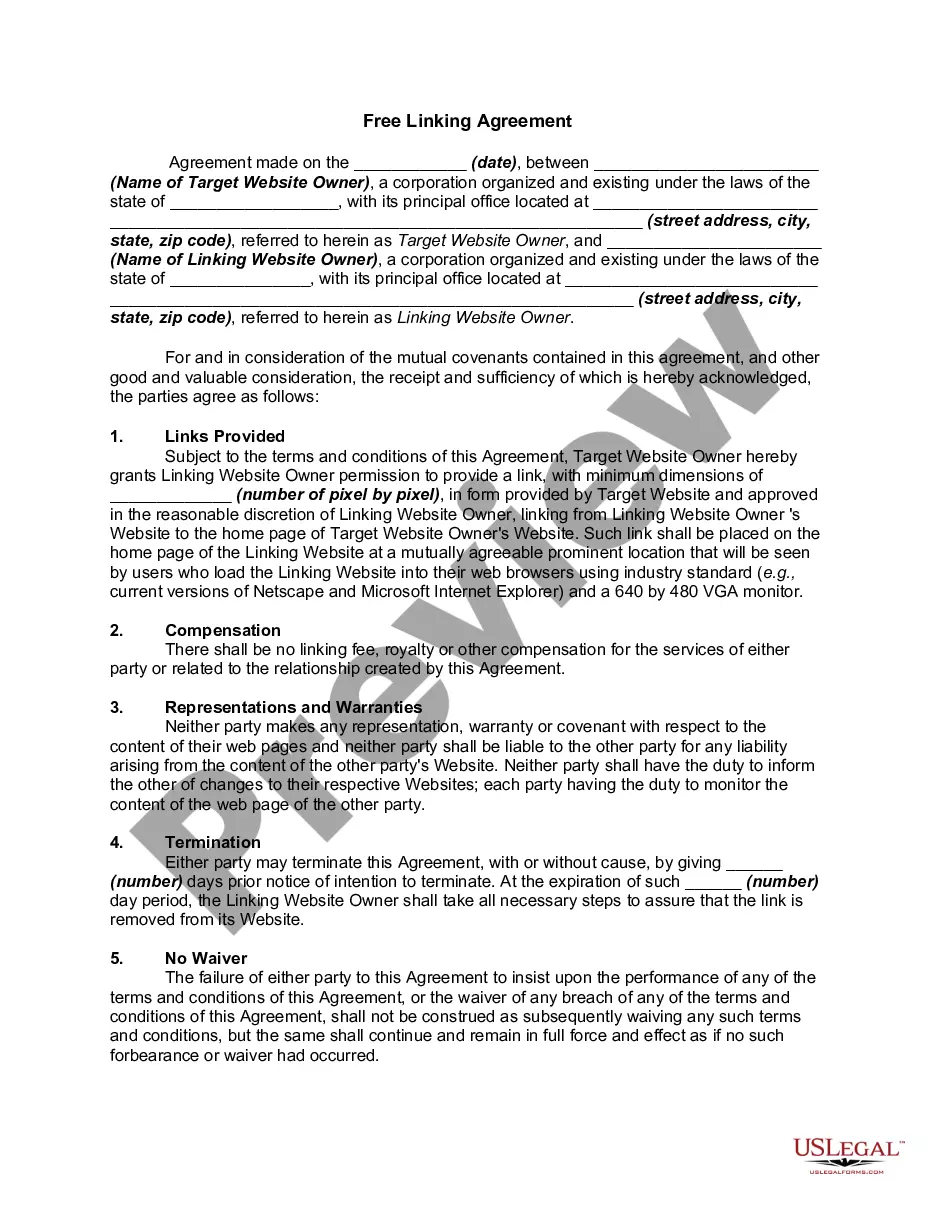

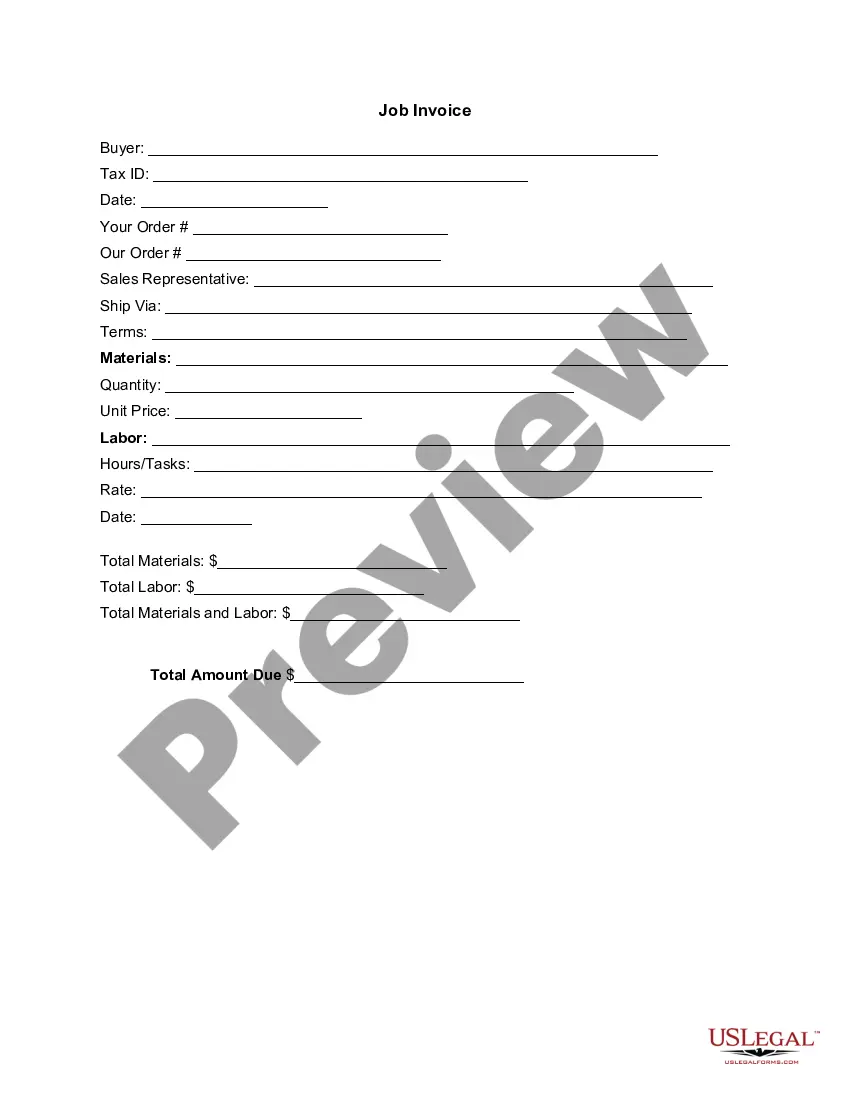

- Use the Preview mode (if available) and review the sample.

- Examine the description (if any) to confirm the form meets your needs.

- Search for an alternative document using the search tab if the sample does not suit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (via credit card or PayPal) to proceed.

- Select file format and save the Wayne Receipt and Withdrawal from Partnership on your device.

Form popularity

FAQ

In a normal partnership, when one partner withdraws, or leaves the company, the partnership dissolves.

A limited partner may withdraw from a limited partnership only at the time or upon the happening of events specified in the partnership agreement and in accordance with the partnership agreement.

Every state except for Louisiana has adopted either the UPA or the RUPA with approximately 37 states adopting the RUPA (or a variation of it). Under both the UPA and RUPA, a partner has the right to withdraw from the partnership at any time, provided proper notice (if required) is given.

General partners can withdraw at any time unless the partnership agreement restricts them. If you're a limited partner, you can only withdraw under the terms given in the agreement.

Limited partners may withdraw from a partnership in the manner allowed by the partnership agreement, or state law if there is no agreement. In states that follow the Revised Uniform Limited Partnership Act (RULPA), a limited partner has the right to withdraw after six months' notice to all the general partners.

Here are five clauses every partnership agreement should include: Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

Creating A Partnership To determine whether a partnership exists courts look at: (1) intention of the parties, (2) sharing of profits and losses (3) joint administration and control of business operation, (4) capital investment by each partner, and (5) common ownership of property.

Except as provided in this subchapter, upon withdrawal any withdrawing partner is entitled to receive any distribution to which such partner is entitled under a partnership agreement and, if not otherwise provided in a partnership agreement, such partner is entitled to receive, within a reasonable time after withdrawal

Entitlements of Partners: The default rule for partnerships is that each partner is entitled to an equal portion of profits and losses of the business. If the parties wish for an alternative allocation of ownership or entitlements, then the partnership agreement should address the allocation.

Withdrawal from a partnership is achieved by serving a written notice ending the involvement of a particular partner in the partnership for one reason or another. There are two kinds of withdrawals: Voluntary withdrawal is when a partner chooses to leave the partnership and is serving notice on the other partner(s).