Franklin Ohio Sample Letter for Notice to Debtor of Assignment of Debt

Description

How to fill out Sample Letter For Notice To Debtor Of Assignment Of Debt?

Whether you aim to launch your enterprise, enter into a contract, request your identification update, or settle family-related legal matters, you must prepare specific paperwork that complies with your regional laws and regulations.

Locating the appropriate documents may take considerable time and effort unless you utilize the US Legal Forms library.

The platform offers users over 85,000 professionally drafted and validated legal documents for any personal or business occasion. All documents are categorized by state and purpose, making it quick and easy to select a copy like the Franklin Sample Letter for Notice to Debtor of Assignment of Debt.

Print the copy or complete it and sign it electronically via an online editor to conserve time. Forms offered on our website are reusable. With an active subscription, you can access all previously acquired documents anytime in the My documents section of your account. Stop squandering time on incessantly searching for current official documentation. Become a member of the US Legal Forms platform and keep your paperwork organized with the most extensive online collection of forms!

- Log in to your account on the US Legal Forms website and click the Download button next to the template you need.

- If you are a newcomer to the service, you’ll need to follow additional steps to get the Franklin Sample Letter for Notice to Debtor of Assignment of Debt. Please adhere to the instructions below.

- Ensure the template meets your specific requirements and adheres to state regulations.

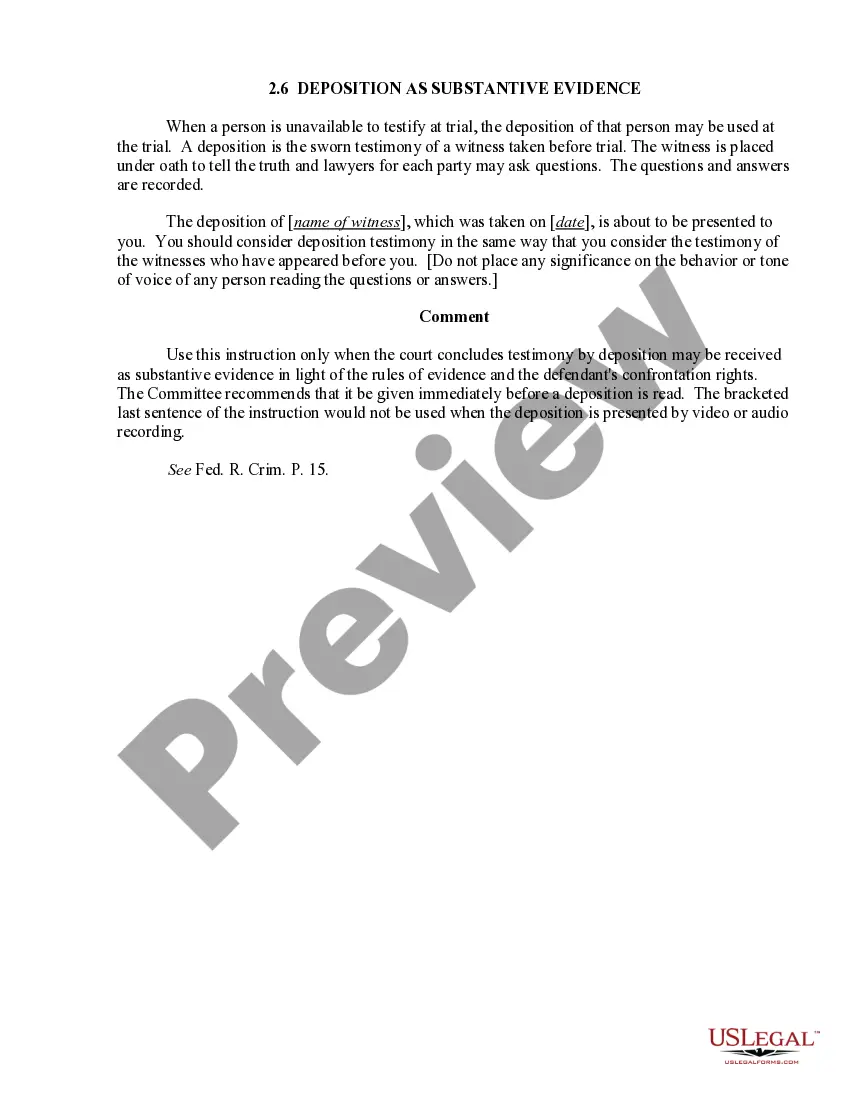

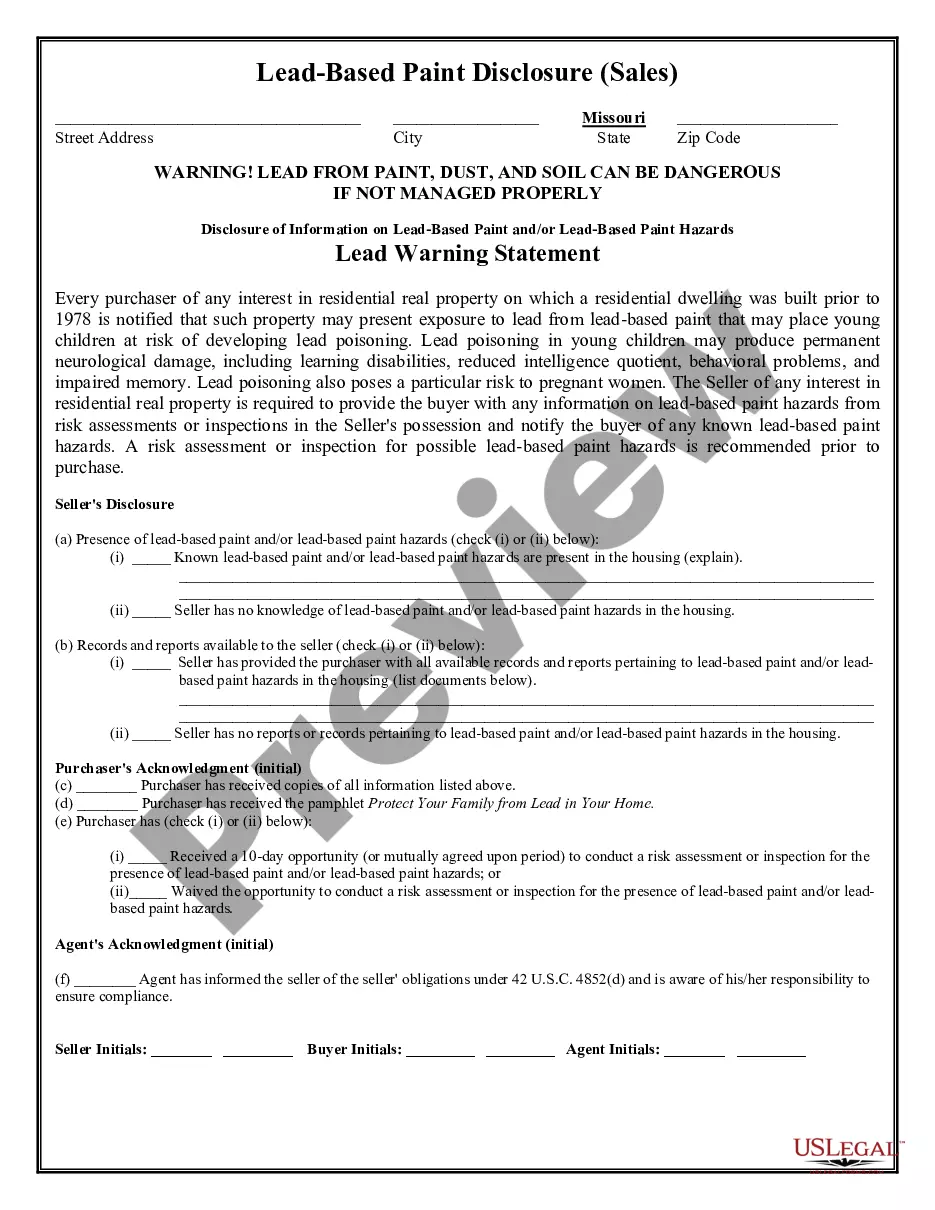

- Review the form description and examine the Preview if available on the page.

- Use the search field provided above for your state to locate another template.

- Click Buy Now to purchase the sample when you find the correct one.

- Choose the subscription plan that best fits your needs for continued access.

- Log in to your account and process the payment using a credit card or PayPal.

- Download the Franklin Sample Letter for Notice to Debtor of Assignment of Debt in your needed file format.

Form popularity

FAQ

The sample is as follows: Dear XX (name of debtor), We regret to inform you that due to your unpaid debt amount of XX (full debt amount, additional charges and interest cost) to XX (creditor's name and company), from today, XX (date) we have passed your case to court.

While there's no sure fire method of debt collection, use these strategies to improve your ability to get your money: Know your customer's credit history.Ask for payment right away.Offer easy payment options.Communicate with your customer.Use a collection agency.

I would be very grateful if you would consider writing off the outstanding debt owing. I have always taken my financial responsibilities very seriously but unfortunately, my circumstances are so bad that I cannot realistically maintain payments of any kind.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

What Is a Notice of Debt Recovery? A notice of debt recovery is a letter that requests payment from an outstanding debt in your name. The notice may ask for full payment and possibly administration fees or late fines.

It should be short, concise, to the point and very clear as to what you want. It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date.

A debt collection letter reminds a debtor that they owe you money. You can use a debt collection letter to set up a repayment plan or warn of impending legal proceedings. A debt collection letter should include the total debt owed, the initial due date, and any necessary warnings of impending legal action.

I am requesting that you accept payments of $paid on the. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible. I regret that I have to ask for this consideration and hope that you will understand.

Tips for Writing a Hardship Letter Keep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.