Allegheny Pennsylvania Sample Letter for Letter Requesting Extension to File Business Tax Forms

Description

How to fill out Sample Letter For Letter Requesting Extension To File Business Tax Forms?

How long does it usually take you to draft a legal document.

Since every state has its own laws and regulations governing various aspects of life, locating an Allegheny Sample Letter for Letter Requesting Extension to File Business Tax Forms that meets all local requirements can be exhausting, and hiring a professional lawyer is frequently costly.

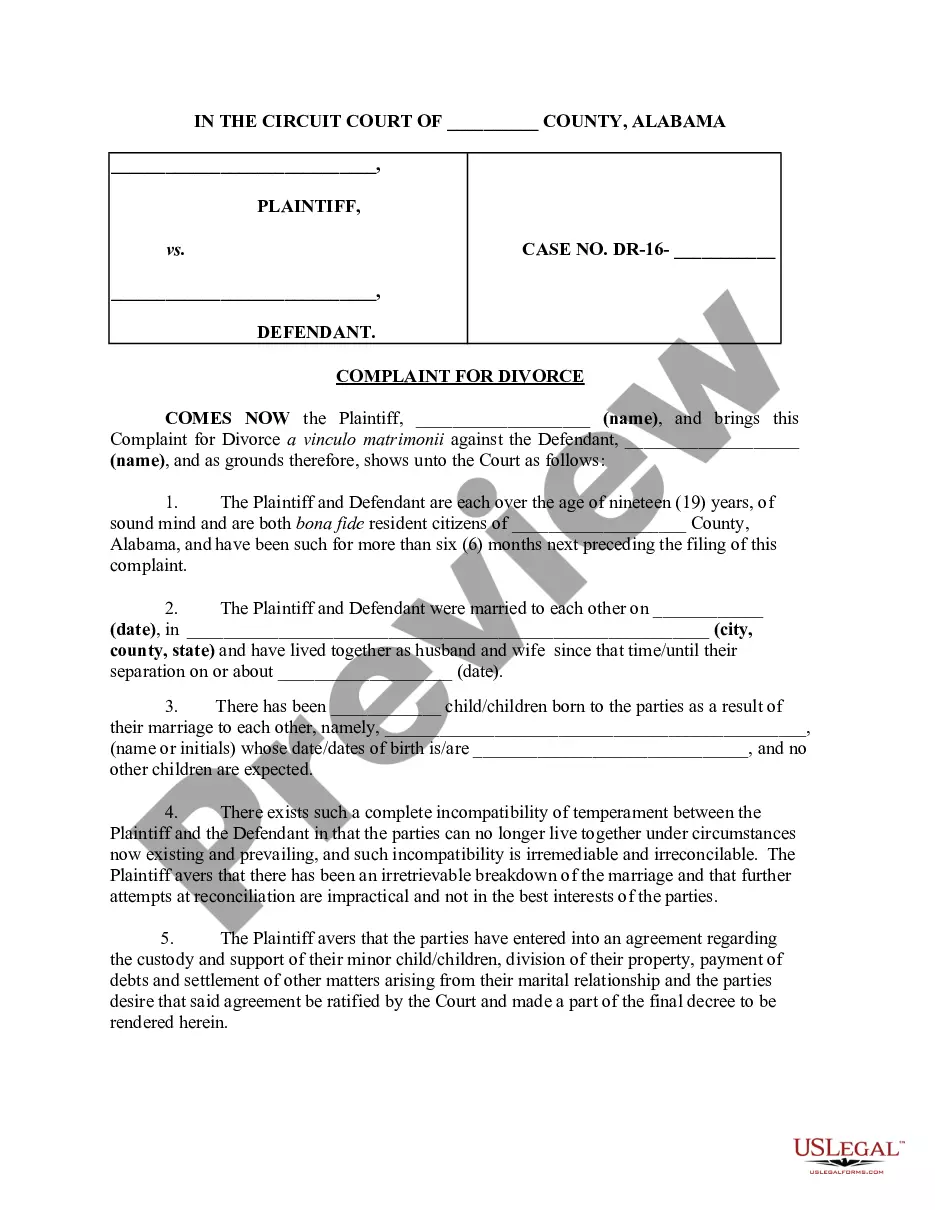

Numerous online services provide the most common state-specific templates for download, but utilizing the US Legal Forms library is the most advantageous.

Choose the subscription plan that best fits your needs. Create an account on the platform or Log In to move forward to payment options. Pay via PayPal or with your credit card. Adjust the file format if needed. Click Download to save the Allegheny Sample Letter for Letter Requesting Extension to File Business Tax Forms. Print the document or use any preferred online editor to fill it out electronically. Regardless of how many times you need to use the purchased document, you can find all the files you’ve ever stored in your profile by accessing the My documents tab. Give it a try!

- US Legal Forms is the most extensive online collection of templates, categorized by states and areas of application.

- In addition to the Allegheny Sample Letter for Letter Requesting Extension to File Business Tax Forms, you can access any specific document needed for your business or personal tasks, adhering to your county requirements.

- Professionals verify all samples for their relevance, ensuring you can prepare your documentation accurately.

- Using the service is incredibly straightforward.

- If you already have an account on the platform and your subscription is active, you simply need to Log In, choose the necessary sample, and download it.

- You can keep the file in your profile for future access.

- If you are new to the site, there are some additional steps to complete before obtaining your Allegheny Sample Letter for Letter Requesting Extension to File Business Tax Forms.

- Review the content of the page you’re currently on.

- Examine the description of the template or Preview it (if applicable).

- Look for another document using the related option in the header.

- Click Buy Now when you are confident in your selected file.

Form popularity

FAQ

I am emailing you to ask if it might be possible to be granted additional time for the name of assignment due on due date of assignment. Unfortunately, I am behind with this assignment because give reason why you will not complete your assignment on time and attach supporting documentation, if any.

How do you ask for an extension deadline? Determine if an extension is possible.Don't put in a request at the last moment.Ask in person or by phone or email.Give a credible reason.Furnish proof of work done.Set a new deadline and stick to it.Thank the supervisor or manager.Make sure it doesn't happen again.

Individual tax filers, regardless of income, can use IRS Free File to electronically request an automatic tax-filing extension. The fastest and easiest way to get an extension is through IRS Free File on IRS.gov. Taxpayers can electronically request an extension on Form 4868PDF.

Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension. Filing this form gives you until October 15 to file a return.

Emergencies involving dependents; Job or internship interview at short notice that requires significant time, e.g. due to travel; Victim of a crime which is likely to have significant emotional impact; Military conflict, natural disaster, or extreme weather conditions.

Tips for Requesting an Extension Read the syllabus or assignment. Ask your instructor as early as possible. Reach out via email with a specific request. Ask for a shorter extension if possible. Demonstrate your commitment to the class.

To file for an LLC extension, file Form 7004: Application for Automatic Extension of Time to File Certain Business Income Tax Information, and Other Returns. When you request partnership extension, your LLC will get an automatic five-month extension to file Form 1065.

I am emailing you to ask for an extension on assignment, which is due original due date. I would really appreciate an extension because I have a very busy week, and I would like more time to devote towards my assignment.

Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension. Filing this form gives you until October 15 to file a return.To get the extension, you must estimate your tax liability on this form and should also pay any amount due.

Use Form 7004 to request an automatic 6-month extension of time to file certain business income tax, information, and other returns.