Middlesex Massachusetts Sample Letter for Tax Exemption - Review of Applications

Description

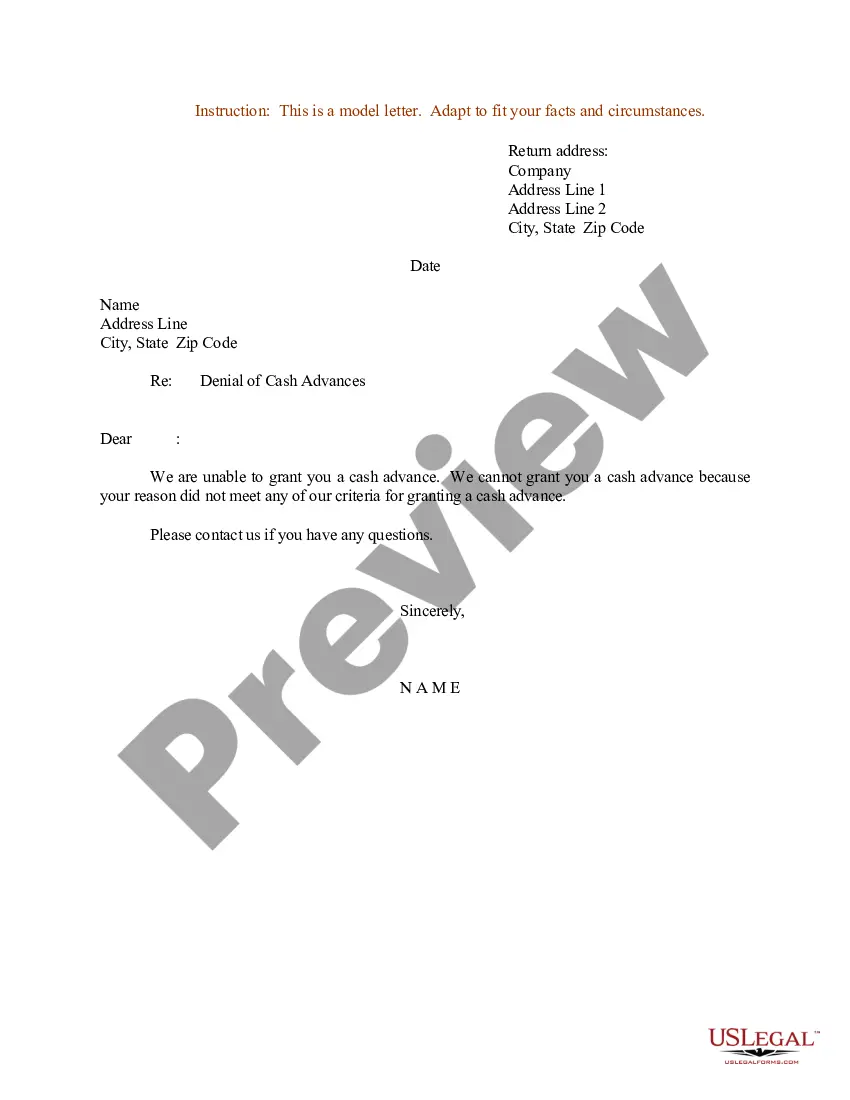

How to fill out Sample Letter For Tax Exemption - Review Of Applications?

Creating documents for personal or business requirements is consistently a significant obligation.

When formulating a contract, a public service demand, or a letter of authority, it is crucial to consider all federal and state legislation of the particular area.

Nevertheless, smaller counties and municipalities also have legislative guidelines that must be contemplated.

Ensure the template adheres to legal standards and click Buy Now. Select the subscription plan, then Log In or create an account with US Legal Forms. Use your credit card or PayPal account to pay for your subscription. Download the selected document in your chosen format, print it, or complete it online. The best part about the US Legal Forms library is that all the documents you have ever obtained remain accessible—you can retrieve them in your profile under the My documents section at any time. Join the platform and effortlessly access verified legal forms for any situation in just a few clicks!

- All these specifics render the process stressful and time-intensive to produce Middlesex Sample Letter for Tax Exemption - Review of Applications without professional aid.

- You can bypass unnecessary legal fees for drafting your paperwork and independently prepare a legally acceptable Middlesex Sample Letter for Tax Exemption - Review of Applications by utilizing the US Legal Forms online repository.

- It is the largest digital collection of legally recognized state-specific templates that have been professionally verified, assuring you of their legitimacy when selecting a sample for your jurisdiction.

- Returning subscribed users only need to Log In to their profiles to retrieve the necessary document.

- If you lack a subscription currently, follow the detailed steps below to acquire the Middlesex Sample Letter for Tax Exemption - Review of Applications.

- Review the webpage you have opened and verify if it contains the template you seek.

- To do this, utilize the form description and preview if these features are accessible.

Form popularity

FAQ

Taxpayers can access their federal tax information through a secure login at IRS.gov/account. After logging in, the user can view: The amount they owe. Their payment history.

Us. an official document that gives someone special permission not to do or pay something: a medical/tax exemption certificate.

LETTER OF EXEMPTION. This Letter of Exemption certifies that federal credit unions are exempt from all taxes imposed by the United States or by any state, territorial, or local taxing authority, except for local real or personal property tax. Section 122 of the Federal Credit Union Act (12 U.S.C.

Exemption is defined as freedom from an obligation, duty or consequence. When everyone else is required to attend a meeting and you don't have to attend, this is an example of a situation where you have an exemption.

On behalf of (Foundation/Organization name), I request you to please issue the Tax Exemption Certificate for (Foundation/Organization name). (Cordially Describe your requirements). I will be at your complete disposal of any information/reports/ that you may require to process our request.

To exempt a person or thing from a particular rule, duty, or obligation means to state officially that they are not bound or affected by it. exemption (026agzemp02830259n )Word forms: plural exemptions variable noun. See full entry.

According to the Internal Revenue Service, you can download a copy of your determination letter using the Tax Exempt Organization Search (TEOS) tool at the IRS.gov website. If you don't care to search for your letter online, you can also submit IRS Form 4506-A via fax or email to the IRS.

The IRS determination letter notifies a nonprofit organization that its application for federal tax exemption under Section 501(c)(3) has been approved. This is an exciting day for an emerging nonprofit!

You can download copies of original determination letters (issued January 1, 2014 and later) using our on-line search tool Tax Exempt Organization Search (TEOS). It may take 60 days or longer to process your request. You may also request an affirmation letter using Form 4506-B.

Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.