Supervised visitation may be ordered by a court where the non-custodial parent:

" has a drug or alcohol abuse problem;

" has had trouble controlling anger;

" may have been involved in inappropriate sexual behavior with the child;

" engaged in child abuse, neglect or abandonment;

" engaged in domestic violence;

" has a mental illness;

" has a substance abuse problem; and/or

" as a criminal history.

The above list is not exhaustive, but gives examples of situations where a court might order supervised visitation.

Supervised visitation often takes place in a neutral location under the supervision of paid staff. An adult other than the custodial parent must be present at all times during the visit. The adult may be known or unknown to the child, and may be someone agreed upon by the parents or appointed by the court. In any case, the adult must be approved by the court ordering the supervised visitation.

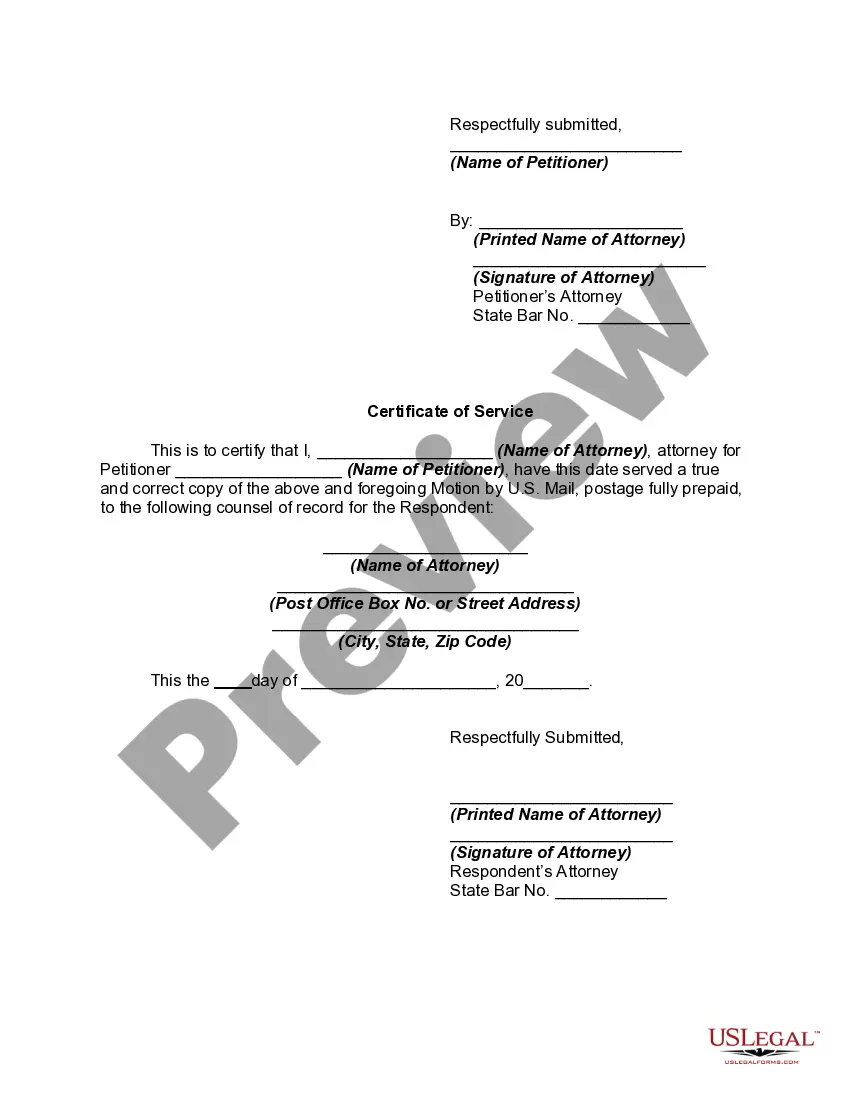

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.