Allegheny Pennsylvania License of Vending Machines

Description

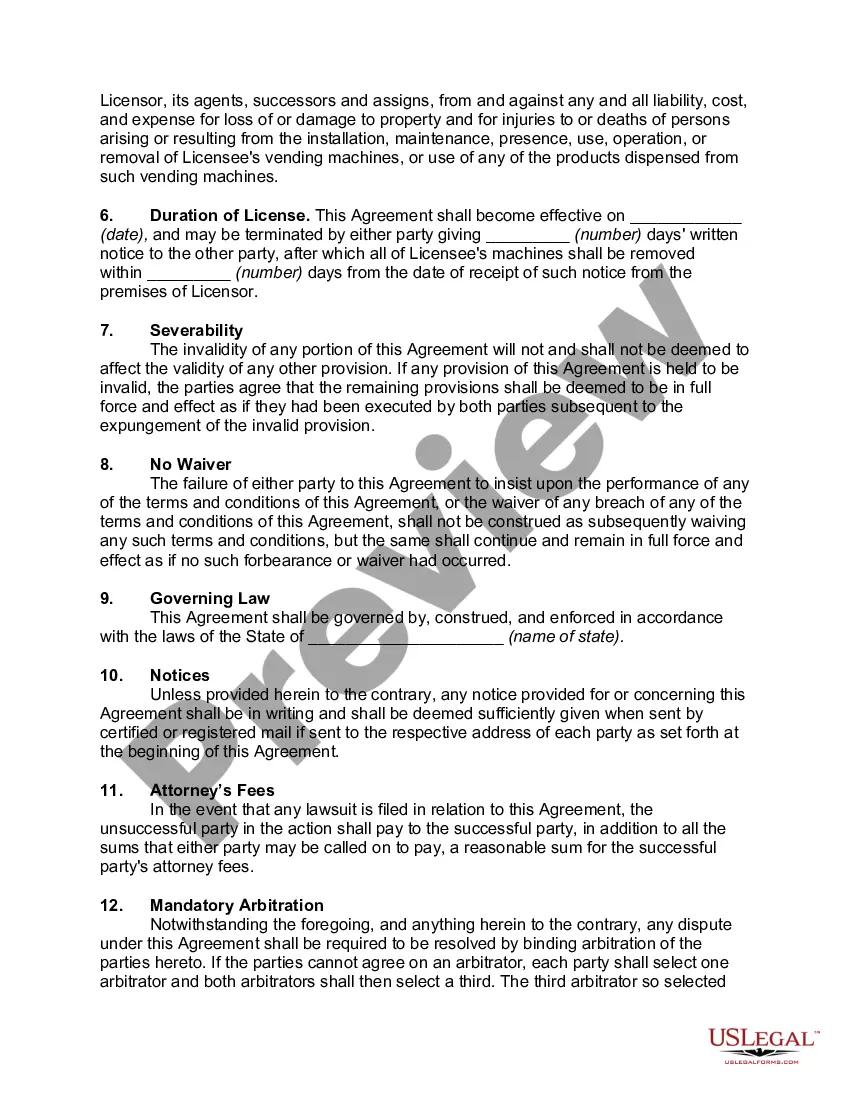

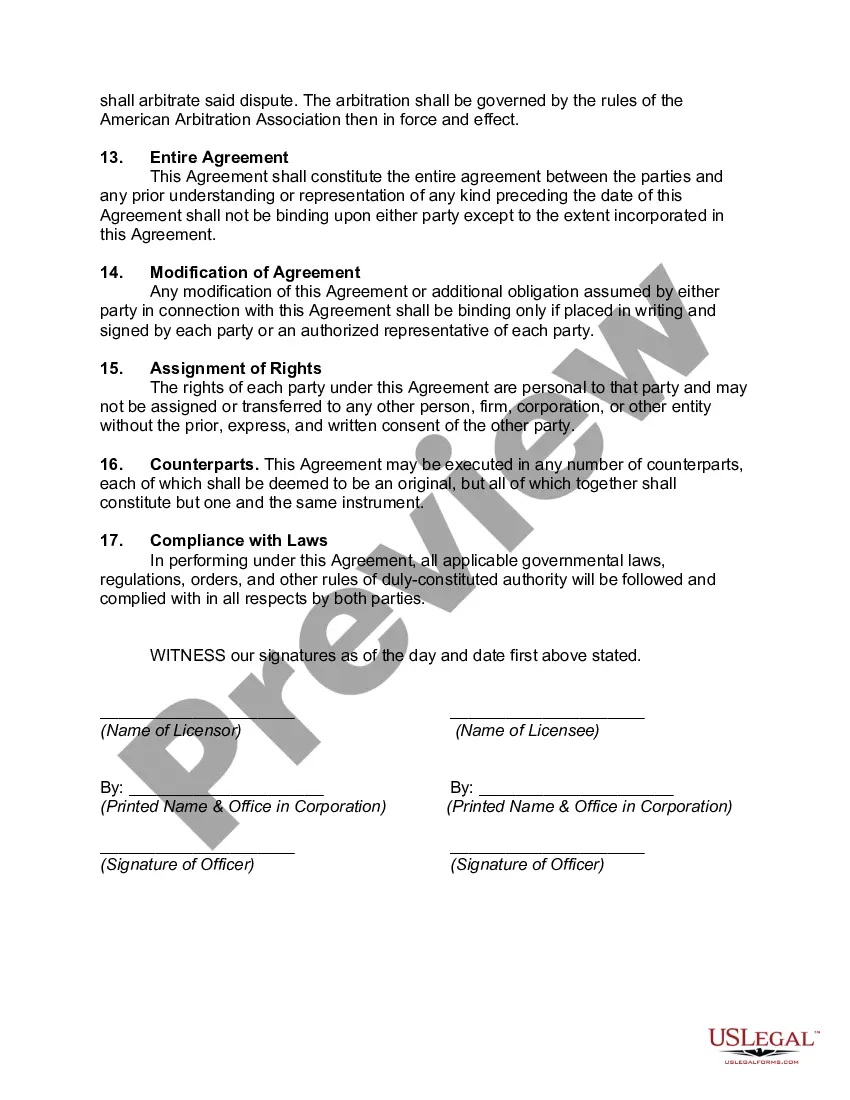

How to fill out License Of Vending Machines?

Are you seeking to swiftly generate a legally-binding Allegheny License of Vending Machines or perhaps any other documentation to manage your personal or business concerns? You have two choices: reach out to an expert to compose a legal document for you or produce it entirely by yourself. The positive news is there’s another option - US Legal Forms. It will assist you in obtaining professionally crafted legal documents without incurring exorbitant costs for legal services.

US Legal Forms provides a vast assortment of over 85,000 compliant document templates tailored to various states, including the Allegheny License of Vending Machines and various form packages. We supply templates for numerous life situations: from separation documents to property agreements. We have been operating for more than 25 years and have built an impeccable reputation among our clients. Here’s how you can join them and acquire the necessary template without unnecessary hassle.

If you’ve previously set up an account, you can merely Log In to it, find the Allegheny License of Vending Machines template, and download it. To re-download the document, simply go to the My documents tab.

It’s straightforward to locate and download legal documents if you utilize our catalog. Furthermore, the templates we offer are evaluated by industry professionals, which provides you with greater assurance when handling legal matters. Experience US Legal Forms now and witness the benefits for yourself!

- First and foremost, thoroughly check if the Allegheny License of Vending Machines is formatted according to your state's or county's laws.

- If the form includes a description, ensure to review what it’s meant for.

- Initiate the search anew if the document isn’t quite what you were anticipating by using the search bar at the top.

- Select the plan that is most suitable for your requirements and proceed to the payment.

- Choose the file format you wish to receive the form in and download it.

- Print it out, complete it, and sign where indicated.

Form popularity

FAQ

How to Nominate a New Vending Site: Applicant submits a vending nomination form to the Department of Permits, Licenses and Inspections (PLI). The nominated site will be reviewed by the vending site committee which meets twice per year. If approved, the application will be forwarded to City Council for approval.

An operator who sells taxable tangible personal property or selected food and beverage items through a vending machine is required to obtain a Sales, Use and Hotel Occupancy Tax License for the purpose of collecting and remitting tax to the Department.

To sell acidified or fermented foods, producers must provide the Pennsylvania Department of Agriculture with written recipes, pay for testing in a commercial food laboratory, and receive approval from a food inspector. The application fee is $35 and takes three to five weeks to process.

"Currently in Pennsylvania, this is not allowed -- volunteer groups cannot sell homemade goods along with foods that are made on-site in that organization's inspected kitchen." Even if Pennsylvania laws change, some institutions and organizations may still have stricter guidelines that prohibit bake sales of any type.

If you're selling goods or services in Pennsylvania, you probably need a sales tax license. Pennsylvania also applies a sales and use tax on digital goods, so even if you're only selling online, you likely need a Pennsylvania sales and use tax license, sometimes also called a seller's permit.

An operator who sells taxable tangible personal property or selected food and beverage items through a vending machine is required to obtain a Sales, Use and Hotel Occupancy Tax License for the purpose of collecting and remitting tax to the Department.

Get ready to organize a start-up/operating budget; fill out a commissary application, a mobile food vending application, a fee assessment and a preliminary sanitation worksheet; find quality business/liability/fire/auto insurance; take a food safety course for certification; get your truck inspected; apply for a

To sell acidified or fermented foods, producers must provide the Pennsylvania Department of Agriculture with written recipes, pay for testing in a commercial food laboratory, and receive approval from a food inspector. The application fee is $35 and takes three to five weeks to process.

The Commonwealth of Pennsylvania does not offer a specific license for commercial caterers. Any business operating within the state needs to obtain state and local business licenses. In addition, as a caterer you will need to license your production facility as a retail food establishment.