Franklin Ohio Accounts Receivable Write-Off Approval Form

Description

How to fill out Accounts Receivable Write-Off Approval Form?

Crafting documents for business or personal demands is consistently a significant responsibility.

When formulating a contract, a public service application, or a power of attorney, it’s vital to take into account all federal and state laws along with regulations specific to the area in question.

However, small counties and even municipalities also have legislative processes that must be taken into account.

The fantastic aspect of the US Legal Forms library is that all the documents you have ever purchased are never lost - you can access them in your profile under the My documents tab at any time. Enroll in the platform and effortlessly obtain verified legal templates for any purpose with just a few clicks!

- These elements contribute to the difficulty and time-consuming nature of producing the Franklin Accounts Receivable Write-Off Approval Form without expert help.

- You can bypass unnecessary legal fees for drafting your documents and create a legally binding Franklin Accounts Receivable Write-Off Approval Form independently using the US Legal Forms online library.

- This is the largest virtual collection of state-specific legal papers that are professionally verified, ensuring their legitimacy when selecting a template for your county.

- Previously subscribed users simply need to Log In to their accounts to access the required document.

- If you have not yet subscribed, follow the step-by-step instructions below to acquire the Franklin Accounts Receivable Write-Off Approval Form.

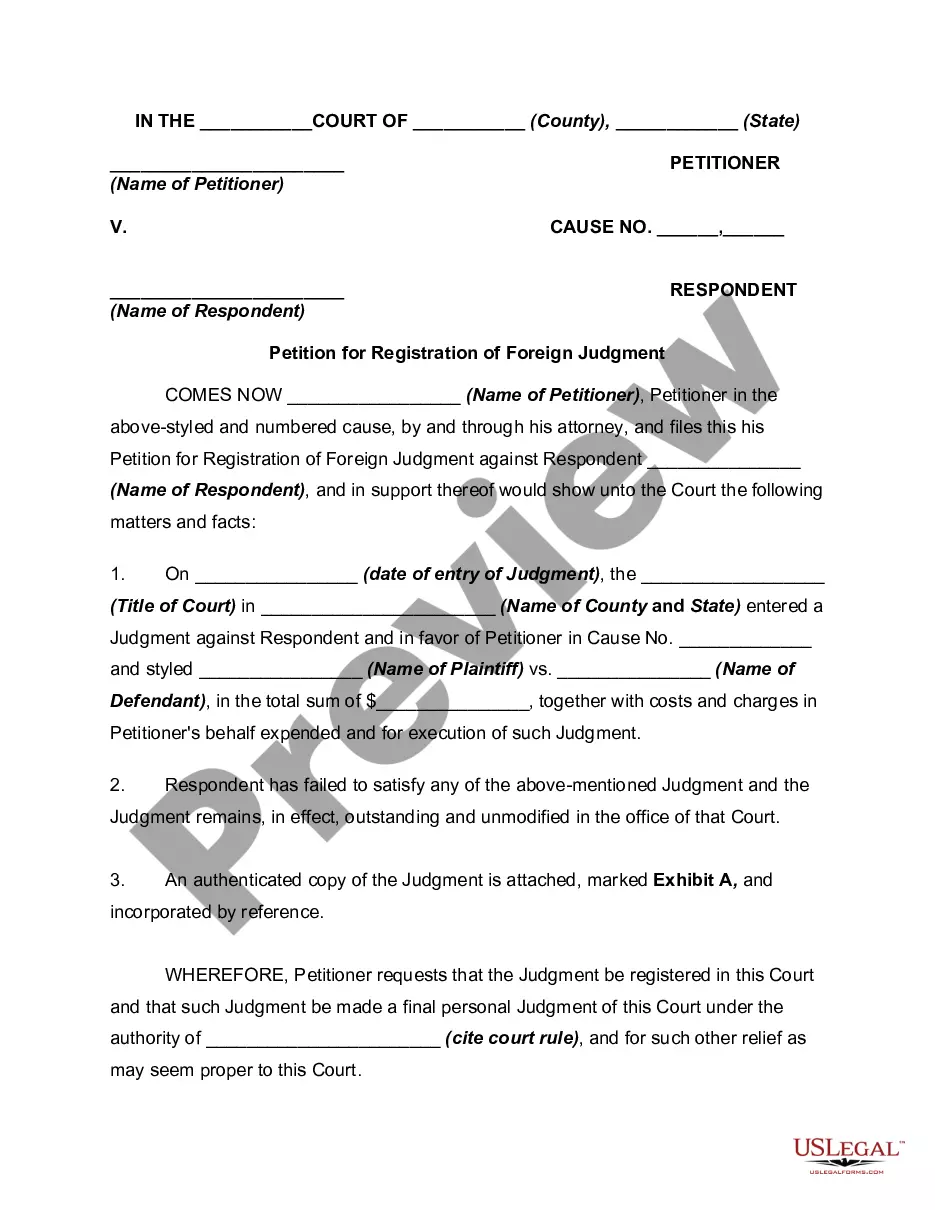

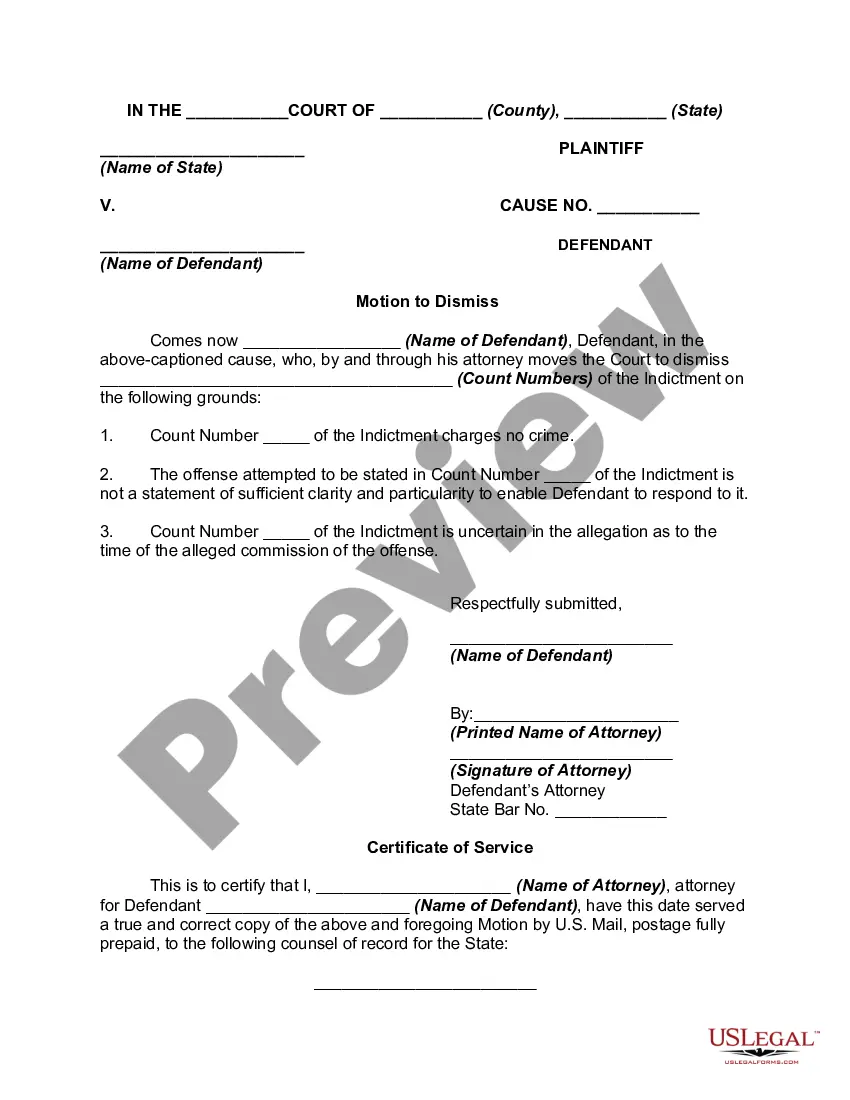

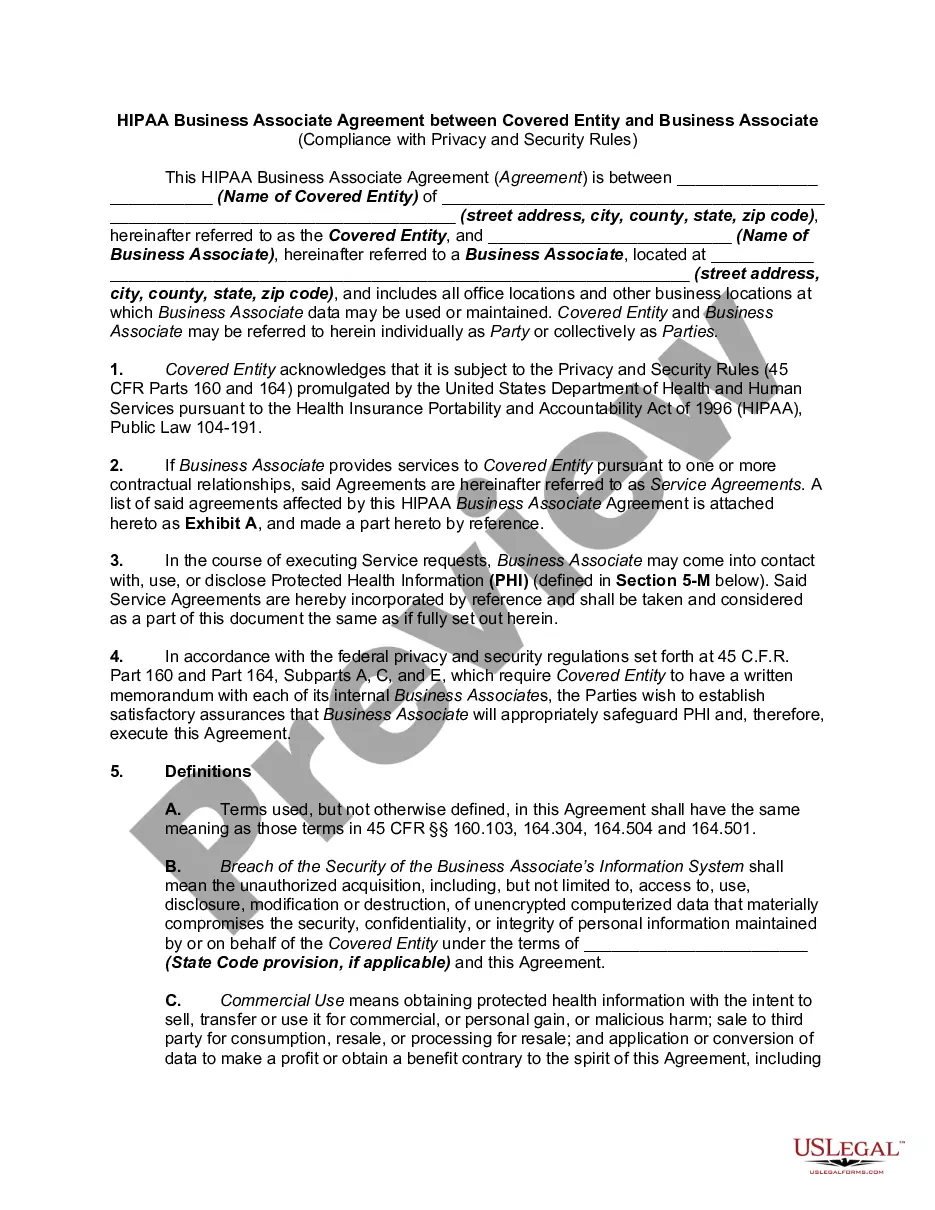

- Browse the page you’ve opened and confirm whether it contains the sample you need.

- To do this, utilize the form description and preview if these features are available.

Form popularity

FAQ

Write off the debt (sole name) Use this letter when asking your creditor if they would consider writing off your debt. You can choose to send a letter in your own name or in joint names. You may have a debt in joint names, or want to write to your creditors together because you have worked out a joint budget.

When a specific customer's account is identified as uncollectible, the journal entry to write off the account is: A credit to Accounts Receivable (to remove the amount that will not be collected) A debit to Allowance for Doubtful Accounts (to reduce the Allowance balance that was previously established)

Worthy Creditors Companies can reduce uncollectible accounts by offering credit only to credit-worthy organizations. This is accomplished by running a credit check on the organization or by contacting businesses that have had previous experience with the organization.

If you want to write off your uncollectable notes receivable, you must use the accrual accounting method. Per IRS regulations, the income from the transaction must be recognized before you can write off any uncollectable amount.

off is an elimination of an uncollectible accounts receivable recorded on the general ledger. An accounts receivable balance represents an amount due to Cornell University. If the individual is unable to fulfill the obligation, the outstanding balance must be written off after collection attempts have occurred.

The entry to write off the bad account under the direct write-off method is: Debit Bad Debts Expense (to report the amount of the loss on the company's income statement) Credit Accounts Receivable (to remove the amount that will not be collected)

Under the direct write off method, when a small business determines an invoice is uncollectible they can debit the Bad Debts Expense account and credit Accounts Receivable immediately. This eliminates the revenue recorded as well as the outstanding balance owed to the business in the books.

Authorization for Sponsored Write-Offs Less than $5,000 may be approved by the senior director of sponsored financial services. Greater than or equal to $5,000 or more will require the endorsement of the senior director of sponsored financial services and the approval of the university controller.

If you want to write off your uncollectable notes receivable, you must use the accrual accounting method. Per IRS regulations, the income from the transaction must be recognized before you can write off any uncollectable amount.