Cuyahoga Ohio Sample Letter for Evaluation Report

Description

How to fill out Sample Letter For Evaluation Report?

Developing legal documents is essential in the modern era. However, it is not always necessary to seek professional help to create some of these from scratch, including Cuyahoga Sample Letter for Evaluation Report, by utilizing a service like US Legal Forms.

US Legal Forms offers over 85,000 templates to choose from across various categories such as living wills, real estate documents, and divorce paperwork. All forms are categorized according to their applicable state, simplifying the search process.

Furthermore, you can access comprehensive resources and guides on the site to facilitate any tasks related to completing documents with ease.

If you are a current subscriber of US Legal Forms, you can find the necessary Cuyahoga Sample Letter for Evaluation Report, Log In to your account, and download it. Of course, our platform cannot fully substitute a lawyer. If you face a particularly complex scenario, we recommend using the assistance of an attorney to review your form before signing and submitting it.

With more than 25 years in the industry, US Legal Forms has become a trusted source for numerous legal documents for millions of clients. Join today and effortlessly purchase the documents specific to your state!

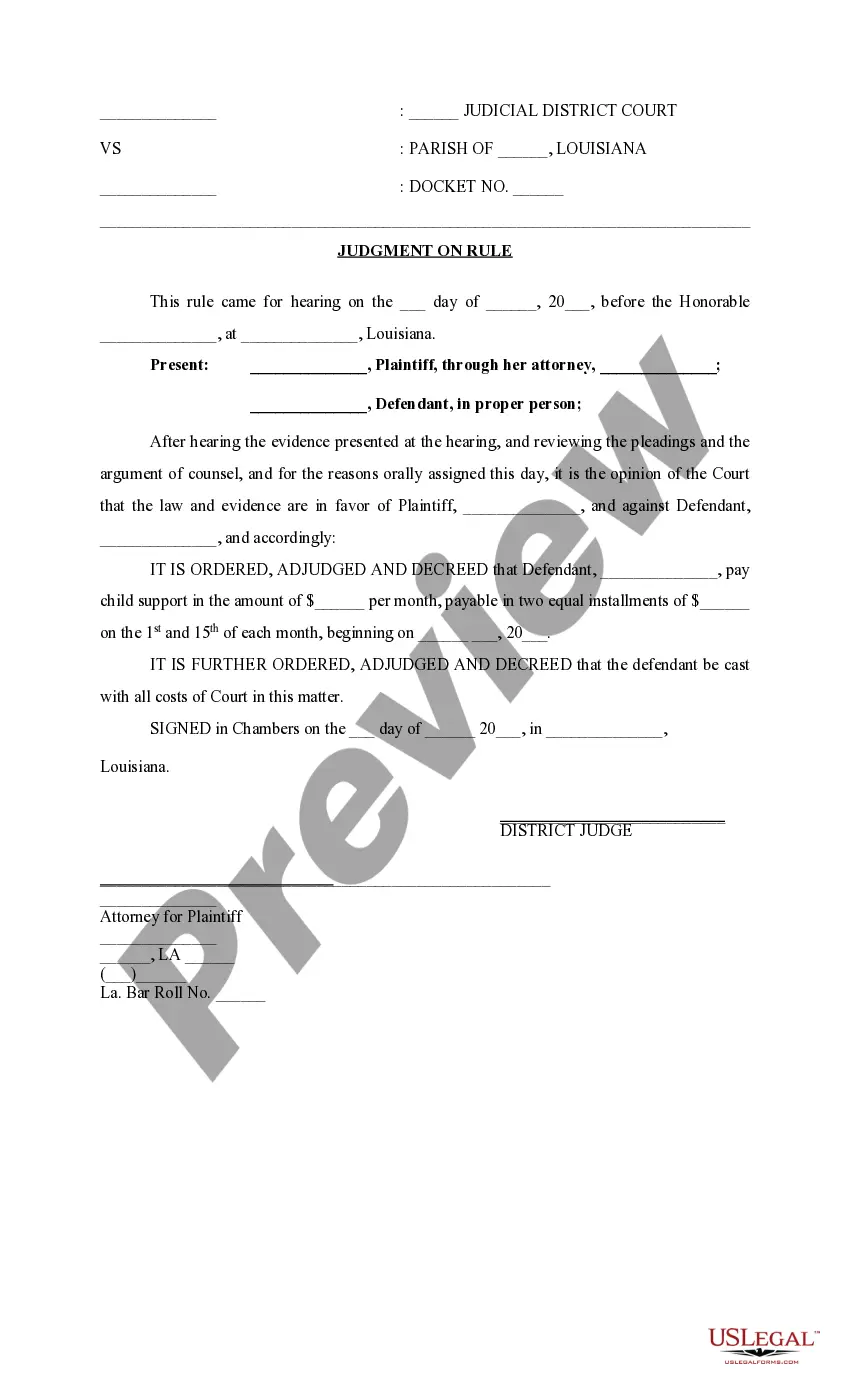

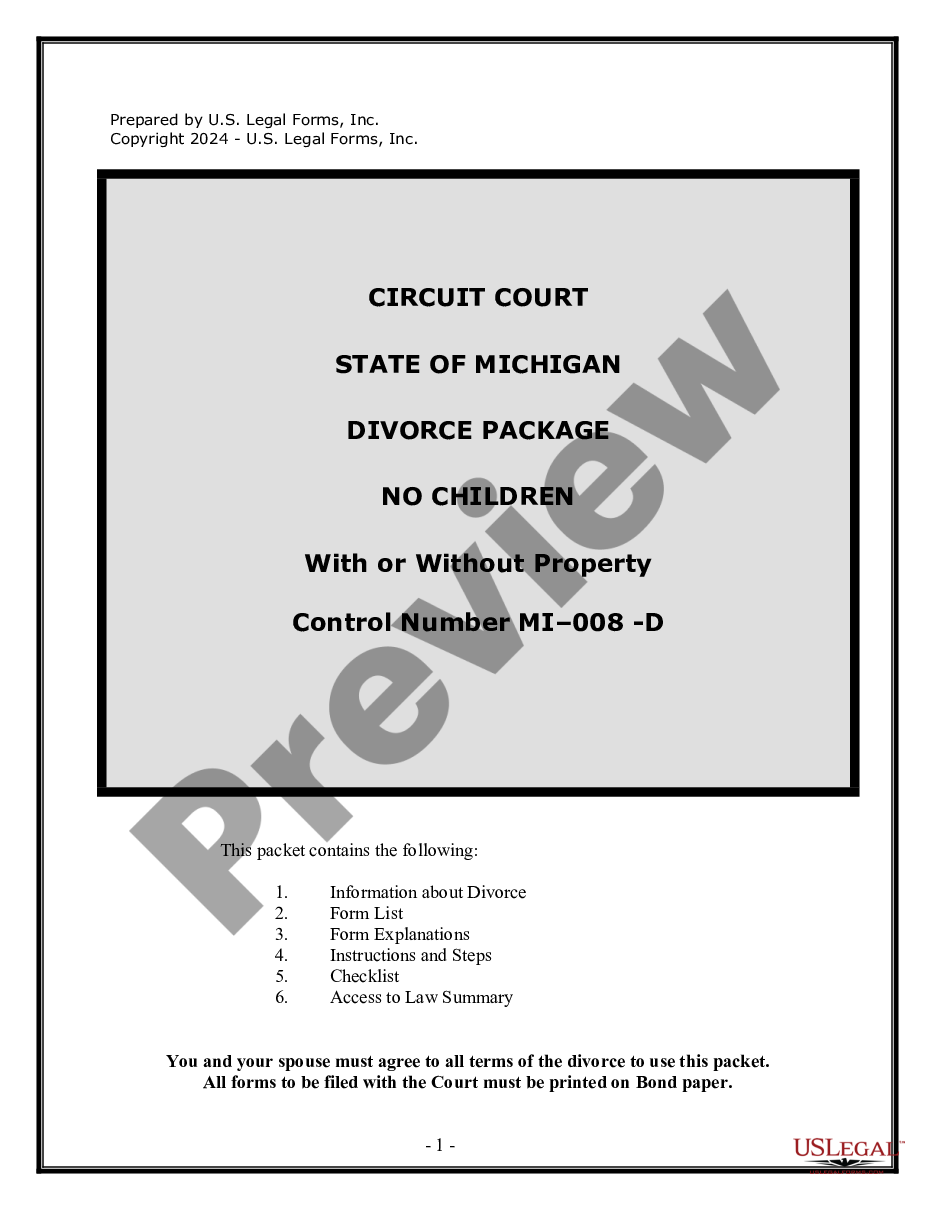

- Review the document's preview and outline (if available) to gain a basic understanding of what you will receive after purchasing the document.

- Verify that the document you select is relevant to your state/county/region, as state laws can affect the legality of certain forms.

- Examine similar document templates or restart your search to find the correct file.

- Click Buy now and create an account. If you have an account already, choose to Log In.

- Choose the preferred option, then a suitable payment method, and purchase Cuyahoga Sample Letter for Evaluation Report.

- Decide to save the form template in any of the available file formats.

- Go to the My documents section to re-download the document.

Form popularity

FAQ

Your annual property tax bill is determined by the taxable value of your property multiplied by the tax rate levied by Cuyahoga County, your city, your school district and your library district. Your taxable value is 35% of market value for real property.

You can pay using a debit or credit card online by visiting ACI Payments, Inc. or calling 1-800-272-9829. You may also use the Online Services portal to pay using a credit\debit card. You will be redirected to the ACI Payments, Inc.

By phone at 1-877-738-1212. By drop box located on the side of the Cuyahoga County Administrative building at 2079 E. 9th St. At any Key Bank branch in the county, though the last day for this service will be July 7.

By mail, with parcel number written on the check, to: Cuyahoga County Treasurer, P.O. Box 94547, Cleveland, OH 44101-4547. By phone at 1-877-738-1212. By drop box located on the side of the Cuyahoga County Administrative building at 2079 E. 9th St.

CUYAHOGA COUNTY, Ohio ? 200,000 Cuyahoga County residents will head to their mailboxes to find a bill from the county. Property tax bills were sent out to residents with a Thursday, July 14, 2022 deadline to pay. Need to know how to pay your property taxes?

When are Cuyahoga County property taxes due? Your Cuyahoga County property tax bill is due in two installments, typically in January and July. Cuyahoga County property tax due dates in 2022 are February 10 and July 14.

Cuyahoga County Tax Payments Cuyahoga County real estate taxes due date: February 10, 2022 (first half 2021 tax bill, extended from January 27) July 14, 2022 (second half 2021 tax bill)

General Information. The Homestead Exemption is a property tax reduction available by application to seniors (age 65 or older) and the disabled (permanent/total). In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners.

This is a collaborative effort between Cuyahoga County Treasurer's Office and US Bank. You do NOT need to have an account with US Bank in order to make an online payment. STEP 1: HOW MUCH DO YOU WANT TO PAY? The First Half 20 Tax Collection closing date is Saturday, December 30, 1899 at midnight.

Q: How do I obtain a copy of my Marriage License? A: Contact Cuyahoga County Probate Court at (216) 443-8764.