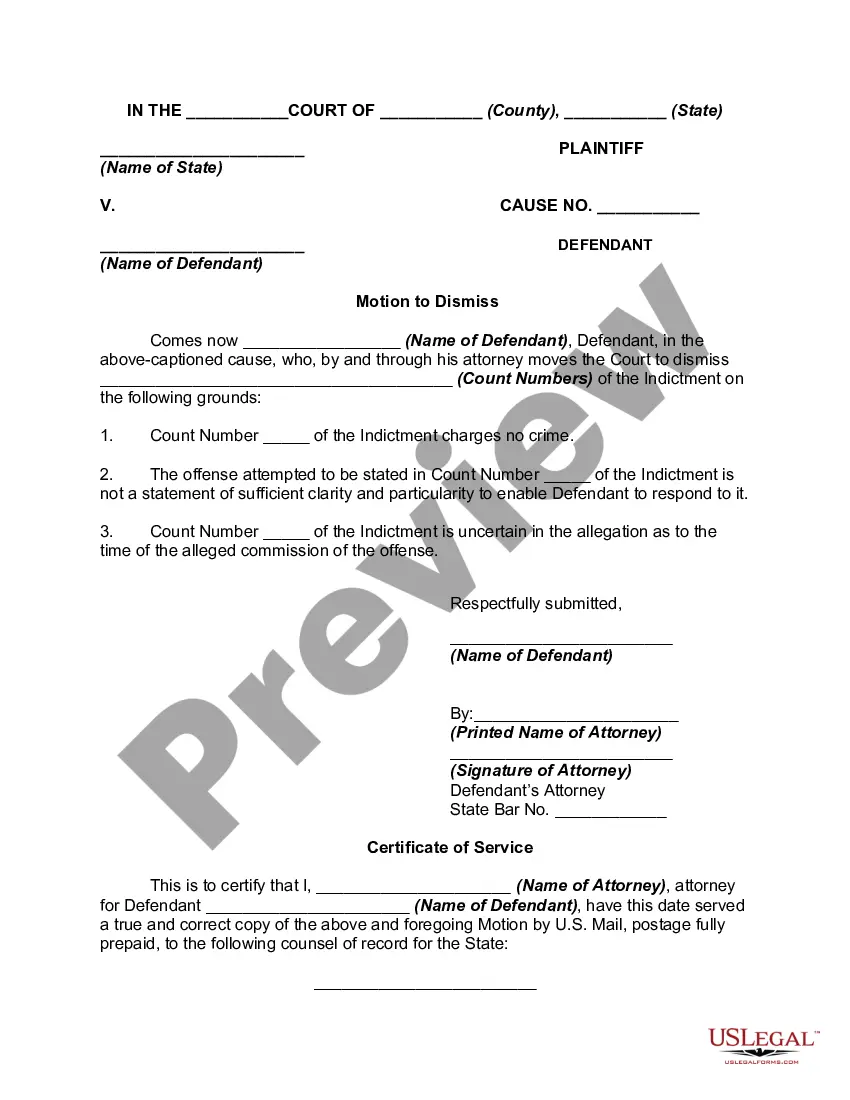

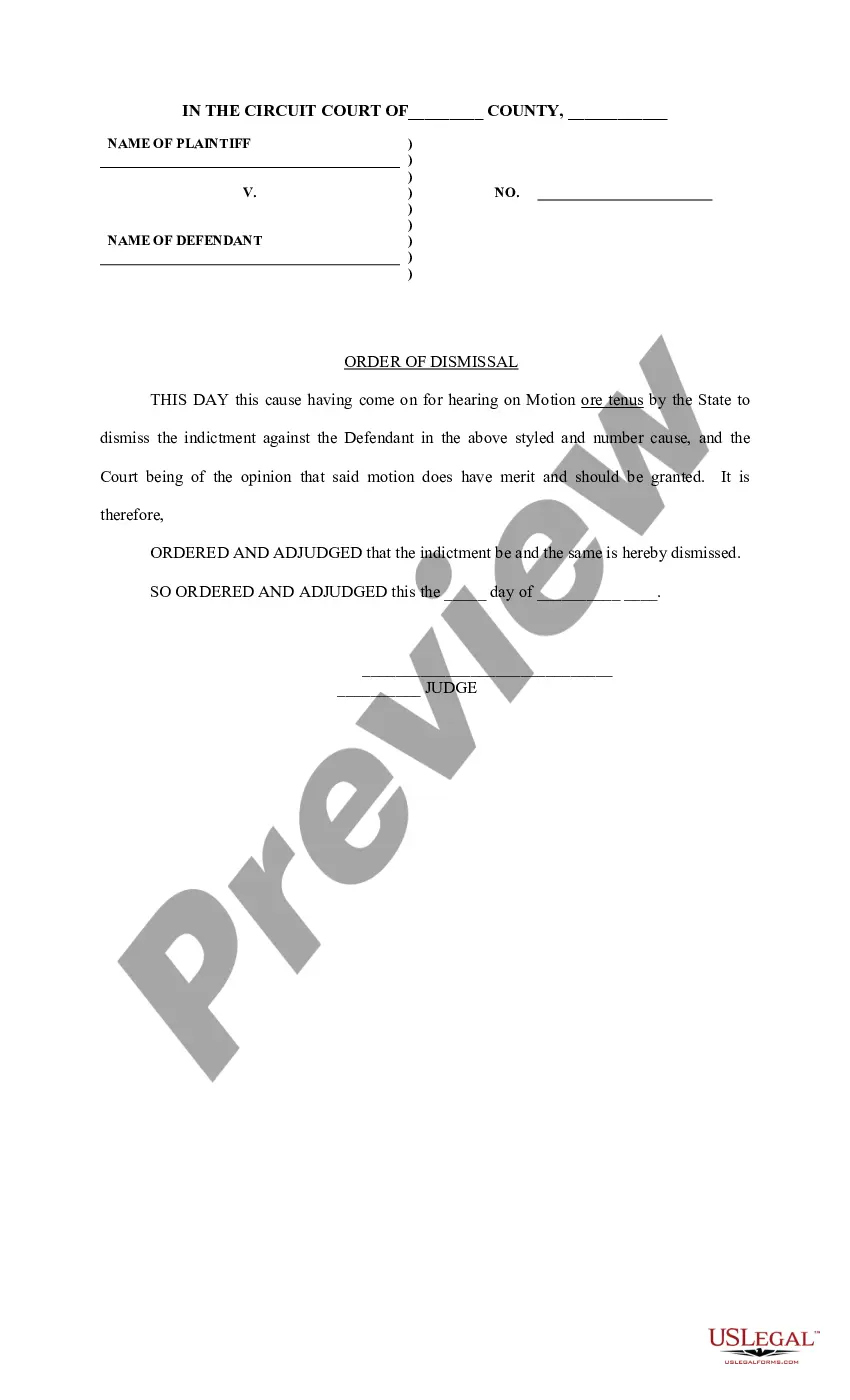

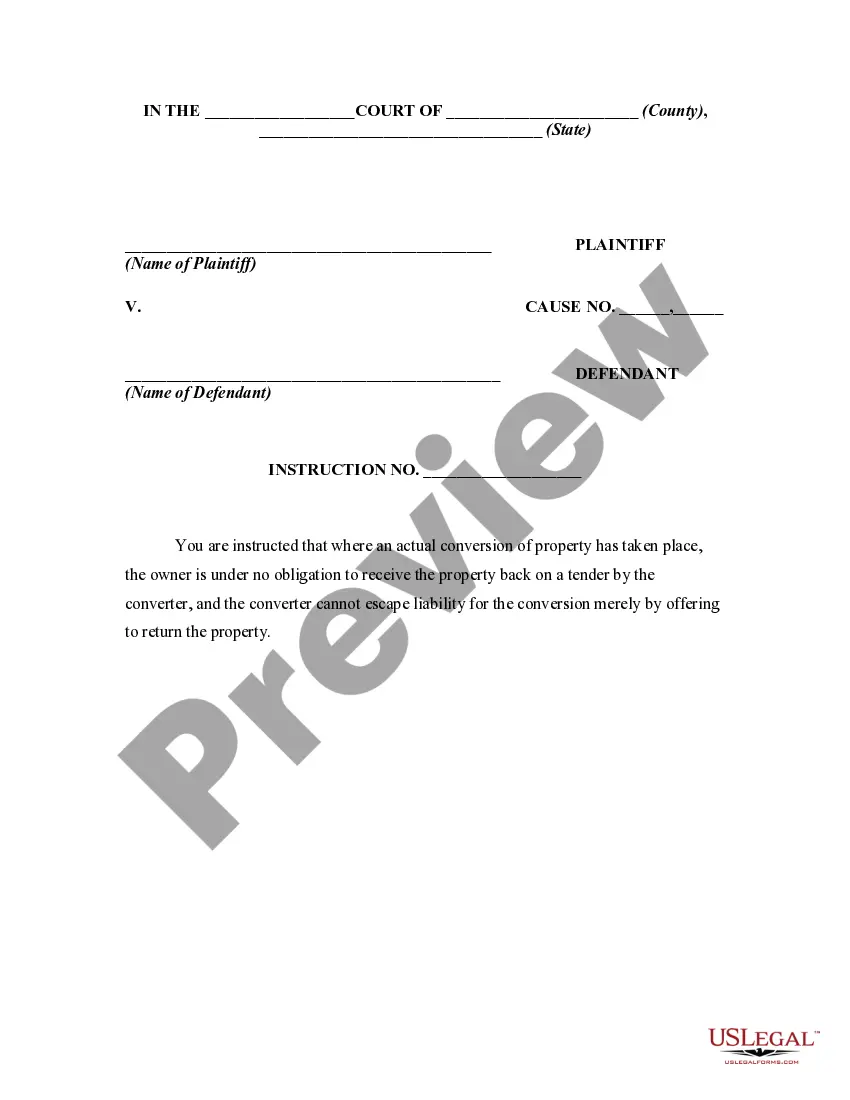

Upon motion of a defendant the court may dismiss an indictment in any of the following circumstances:

" When the names of the witnesses are not inserted at the foot of the indictment or information or endorsed thereon;

" When more than one offense is charged in a single count;

" When it does not describe a public offense;

" When it contains matter which, if true, would constitute a legal justification or excuse of the offense charged, or other bar to the prosecution;

" When the grand jury which filed the indictment had no legal authority to inquire into the offense charged because it was not within the jurisdiction of the grand jury or because the court was without jurisdiction of the offense charged; and

" When an improper person was permitted to be present during the session of the grand jury while the charge embraced in the indictment was under consideration.

The above is not an exhaustive list.