Los Angeles California Assignment of Property in Attached Schedule

Description

How to fill out Assignment Of Property In Attached Schedule?

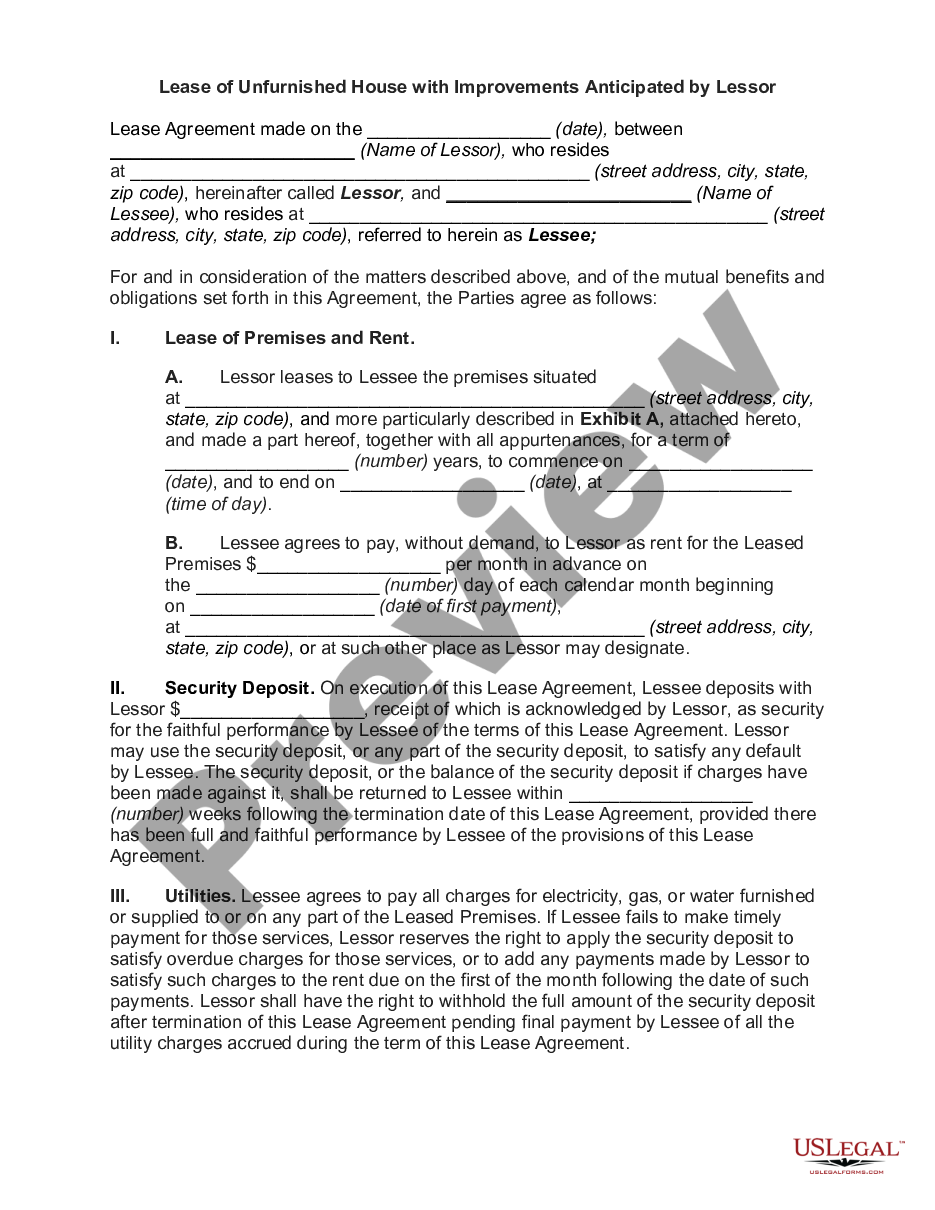

Do you require to swiftly create a legally-binding Los Angeles Assignment of Property in Attached Schedule or perhaps another document to manage your personal or business matters.

You can choose between two alternatives: reach out to a professional to draft a legitimate document for you or produce it entirely by yourself.

First and foremost, thoroughly check whether the Los Angeles Assignment of Property in Attached Schedule complies with your state's or county's regulations.

If the form includes a description, ensure you confirm what it is intended for. Initiate the search again if the form isn't what you were hoping to locate by utilizing the search bar in the header. Choose the plan that best suits your requirements and continue to the payment. Pick the format in which you would like to receive your document and download it. Print it, fill it out, and sign in the designated area. If you have already created an account, you can simply Log In to it, find the Los Angeles Assignment of Property in Attached Schedule template, and download it. To re-download the document, just navigate to the My documents tab.

- Fortunately, there is another option - US Legal Forms.

- It will assist you in obtaining well-crafted legal documents without needing to spend exorbitant fees for legal assistance.

- US Legal Forms provides an extensive array of more than 85,000 state-compliant form templates, including the Los Angeles Assignment of Property in Attached Schedule and various form packages.

- We supply documents for a wide range of purposes: from divorce records to real estate form templates.

- We've been in operation for over 25 years and have established a strong reputation among our clients.

- Here's how you can join them and acquire the required template without unnecessary difficulties.

Form popularity

FAQ

The homeowners property tax exemption in Los Angeles County can reduce the assessed value of your primary residence, resulting in lower property taxes. This exemption is available for homeowners who meet specific criteria, providing financial relief. If you are navigating the Los Angeles California Assignment of Property in Attached Schedule, knowing about this exemption is crucial for your budgeting. Our platform, uslegalforms, offers comprehensive guidance to help you secure these benefits.

A Prop 58 claim is filed when parents want to transfer property to their children without it being reassessed. This claim needs to be completed with specific details regarding the properties involved. Using the Los Angeles California Assignment of Property in Attached Schedule can simplify the documentation needed for this claim. Engaging with uslegalforms can provide the necessary resources to effectively handle your claim.

In Los Angeles County, Proposition 58 enables parents to transfer their primary residence or other properties to their children without reassessment. This is particularly beneficial in preserving wealth within families as it protects them from potential tax increases. If you are considering the Los Angeles California Assignment of Property in Attached Schedule, Prop 58 can significantly affect your financial planning. Knowing the local regulations ensures you maximize the benefits of property transfer.

Proposition 58 allows parents to transfer property to their children without the property being reassessed for tax purposes. This means families can keep their inherited properties in the family without facing increased property taxes. It supports families by facilitating the Los Angeles California Assignment of Property in Attached Schedule, allowing smooth transitions of property ownership. Understanding this can help you make informed decisions regarding property transfers.

Eligibility for property tax relief in California typically includes seniors, individuals with disabilities, and those who have experienced financial hardships. Programs may provide exemptions or reductions based on specific criteria. By understanding your eligibility, you can easily navigate options like the Los Angeles California Assignment of Property in Attached Schedule to alleviate some of your financial burdens.

To qualify as a primary residence under Prop 19, the property must be the homeowner's principal place of abode for at least two years before a transfer. Additionally, the new property must be within California. This qualification is particularly important in the context of the Los Angeles California Assignment of Property in Attached Schedule, as it affects tax liabilities and exemptions for homeowners.

Proposition 58 allows for the transfer of property between parents and children without triggering a property tax increase in California. This is particularly relevant for residents involved in the Los Angeles California Assignment of Property in Attached Schedule, as it enables families to maintain favorable tax positions while transferring property ownership. Knowledge of Prop 58 can help families make informed decisions when planning estate issues.

In California, a property tax reassessment can occur due to changes in ownership or new construction. Events such as selling a property or completing significant renovations often trigger a reassessment. Understanding these factors is essential when dealing with the Los Angeles California Assignment of Property in Attached Schedule, as they directly impact your property tax liabilities.

On Form 571L, you should report your property and any associated exemptions related to property taxes in California. This includes detailing any information pertinent to the Los Angeles California Assignment of Property in Attached Schedule. Completing this form accurately ensures you receive the appropriate property tax assessments and benefits.

Proposition 19 allows homeowners in California to transfer their property tax base to a new home, benefiting seniors and people with disabilities. It simplifies the process and addresses situations like the Los Angeles California Assignment of Property in Attached Schedule. By understanding Proposition 19, you can take advantage of tax relief options when relocating within California.