A Collin Texas Simple Assignment of Promissory Note is a legal document that outlines the transfer of rights and obligations for a promissory note from one party, known as the assignor, to another party, referred to as the assignee. This simple assignment process involves the transfer of the promissory note from one party to another without any accompanying changes or modifications to the terms and conditions of the note itself. In Collin County, Texas, there are various types of Simple Assignment of Promissory Note, each serving different purposes and scenarios. Some common types of assignments include: 1. Absolute Assignment: This is the most basic form of assignment wherein the assignor transfers all of their rights and interests in the promissory note to the assignee without any conditions or restrictions. 2. Collateral Assignment: In this type of assignment, the promissory note is used as collateral for a loan or as security for another debt. The assignor pledges the promissory note to the assignee as a form of protection. 3. Partial Assignment: In a partial assignment, the assignor transfers only a portion of their rights and obligations under the promissory note to the assignee. This arrangement may occur when the assignor wants to share the benefits or risks associated with the note with another party. 4. Specific Assignment: A specific assignment involves the transfer of a particular promissory note, clearly identified with its specific terms and conditions, from the assignor to the assignee. This type of assignment provides clarity and avoids any confusion over which promissory note is being transferred. 5. Conditional Assignment: In certain cases, an assignment may be made conditional, meaning that the transfer of the promissory note will only occur upon the occurrence of a specific event or fulfillment of predetermined conditions. This type of assignment offers flexibility and protection to both parties involved. It is crucial to consult with a legal professional experienced in Collin County, Texas, to ensure compliance with local laws and regulations when executing a Simple Assignment of Promissory Note. Proper documentation and understanding of the specific terms of the assignment are essential to protect the interests of both the assignor and assignee.

Collin Texas Simple Assignment of Promissory Note

Description

How to fill out Collin Texas Simple Assignment Of Promissory Note?

Drafting paperwork for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Collin Simple Assignment of Promissory Note without professional assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Collin Simple Assignment of Promissory Note by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Collin Simple Assignment of Promissory Note:

- Examine the page you've opened and verify if it has the document you require.

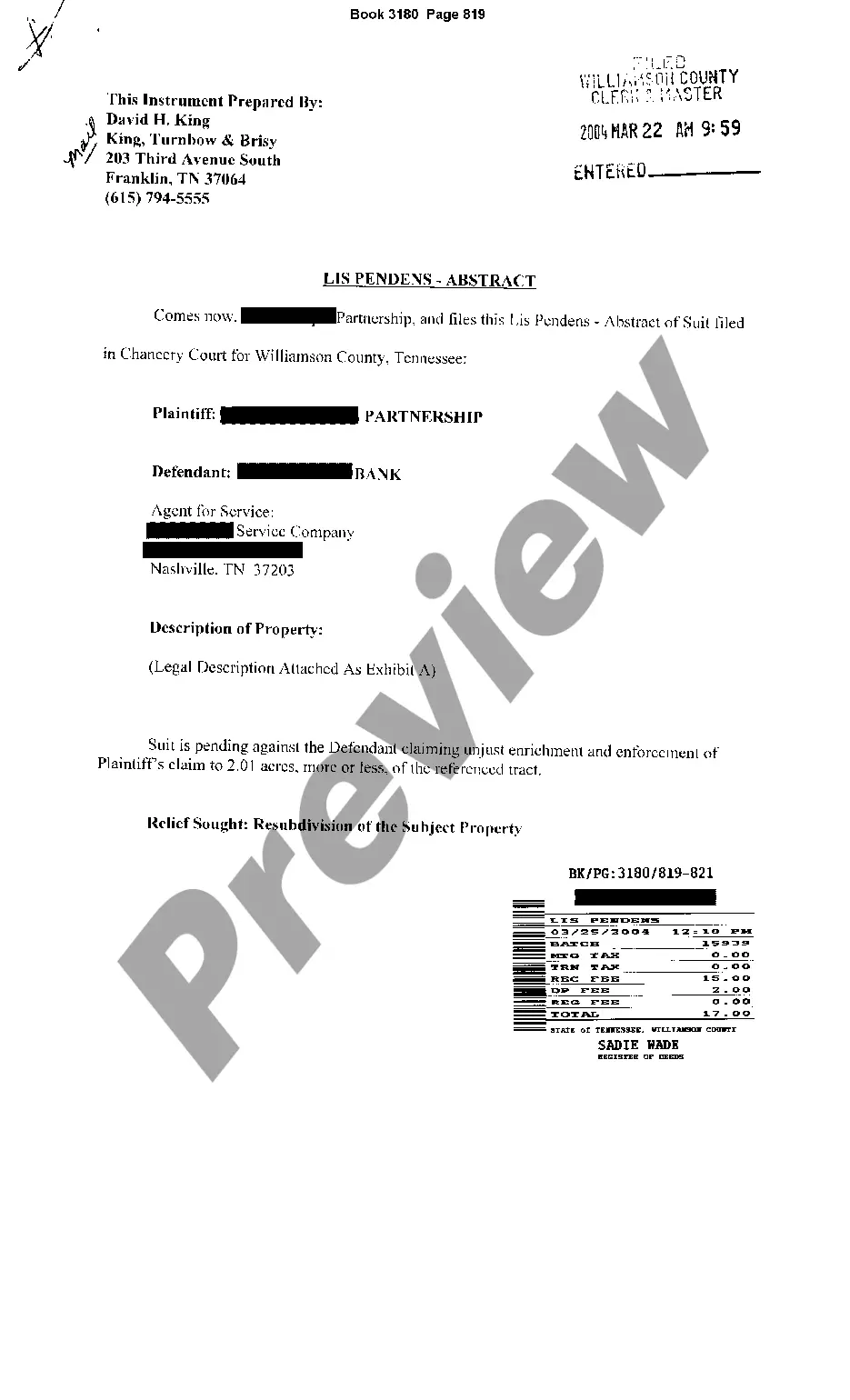

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Promissory Notes. A promissory note can be transferred to a revocable living trust by assignment. An assignment is accomplished by the payee signing over the note to the trustee or trustees of the revocable living trust. The assignment should be in writing and a copy of the promissory note should be attached.

Promissory notes are a common type of financial instrument in loan transactions. As the payer of such a note, it's important to know that, unless a note expressly stipulates that it is not negotiable, promissory notes are negotiable instruments that can be transferred or assigned by the original payee to a third party.

If you're signing a promissory note, make sure it includes these details: Date. The promissory note should include the date it was created at the top of the page. Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

How To Write a Promissory Note Step 1 Full names of parties (borrower and lender)Step 2 Repayment amount (principal and interest)Step 3 Payment plan.Step 4 Consequences of non-payment (default and collection)Step 5 Notarization (if necessary)Step 6 Other common details.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

Definition of promissory note : a written promise to pay at a fixed or determinable future time a sum of money to a specified individual or to bearer.

More info

Enter the loan amount, your name and address, and other key information. Enter your signature before you go to the next section. Use the links under the video to navigate to the corresponding form. Sign, and then click on the form for your loan. Results will auto-populate. You know everything you need to know from this document. This is the key to making a successful lawsuit (or settlement) that can bring relief to all parties. There is no need for you to know who you or your loved ones owe money, how your debts have changed or who is or is not owed anything in this process. The form automatically calculates (and reports) the amount that has changed in the corresponding account, as well as the borrower and Lender names. This method is much quicker, and often times simpler than the process that is described above. Be very wary, however, of lawyers who use such a system.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.