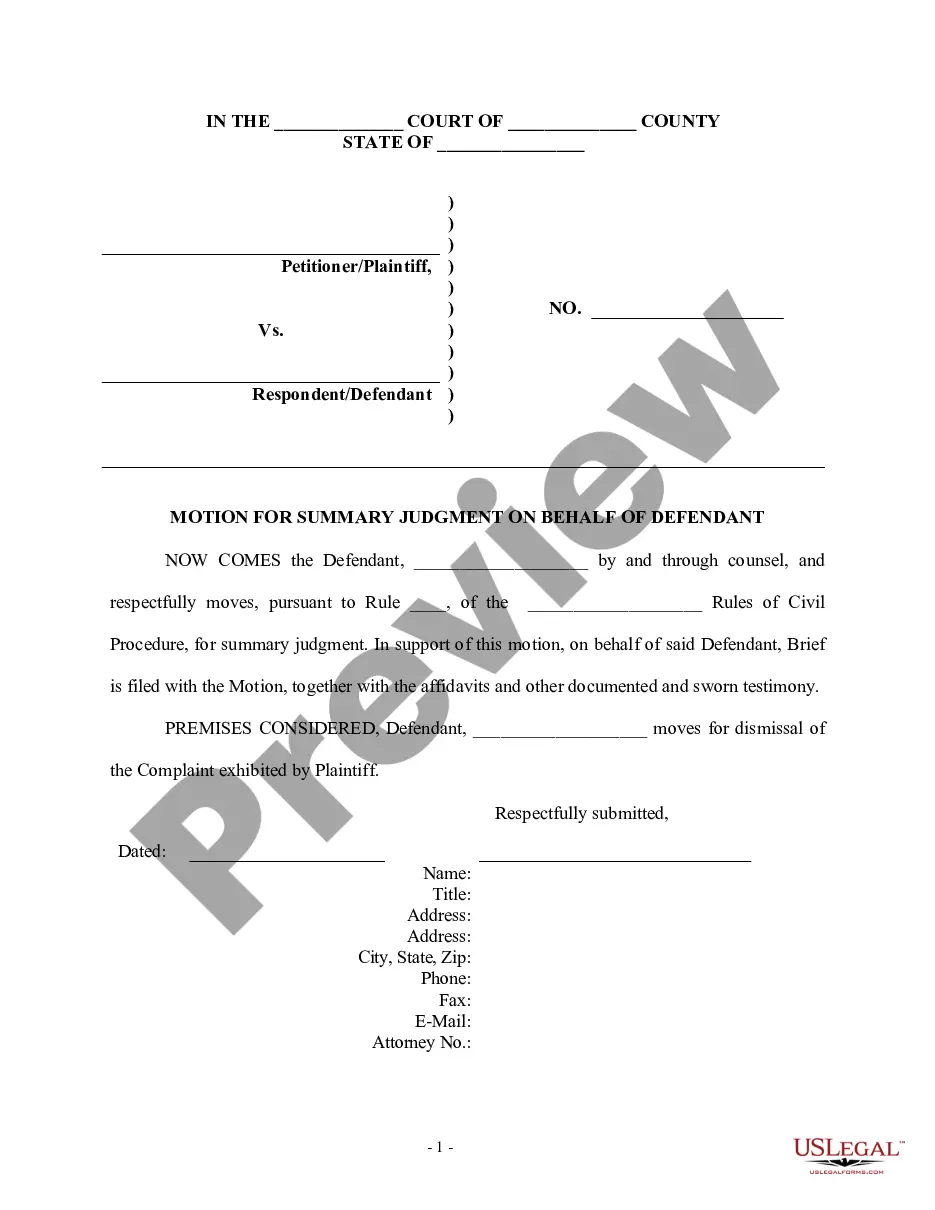

Motions are formal requests for the court to take some sort of action. A motion for summary judgment is appropriate in situations where there are no important facts in dispute and the only dispute is how the law should be applied to the facts. If there is no dispute over the important facts of the case, there is nothing for the fact finder (e.g., a jury) to determine at a trial where the facts would be presented. The judge will therefore apply the law to the facts and render a judgment. That will be the end of the case unless there is an appeal. Generally, a motion for summary judgment is not made unless all discovery has been completed.

This form is a generic motion for summary judgment. The motion adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another.