Detroit Michigan Cancellation of Back Order

Description

Form popularity

FAQ

Receiving a letter from the IRS can be concerning, but it often relates to your tax filings or refund status. It's important to read the letter carefully and address any issues promptly. If this situation affects your plans involving a Detroit Michigan Cancellation of Back Order, consider consulting with a tax professional for guidance.

The $550 check is available to eligible taxpayers in Michigan who meet specific income and filing criteria. This initiative is designed to support those who need it most. If you're navigating a Detroit Michigan Cancellation of Back Order, make sure to check your eligibility for this financial benefit.

The $550 refund in Michigan is part of the state's initiative to provide financial assistance to residents. This refund aims to alleviate the burden of rising costs for families. If you're dealing with a Detroit Michigan Cancellation of Back Order, knowing about this refund can offer some financial relief.

Eligibility for tax credits in Michigan often depends on your income level and family size. Residents should review the specific criteria set by the state to determine their qualification. Understanding these rules is crucial, especially if you are navigating a Detroit Michigan Cancellation of Back Order.

You can typically expect your Michigan tax refund within 14 days if you filed electronically and requested direct deposit. For paper returns, the wait may extend to several weeks. If your situation involves Detroit Michigan Cancellation of Back Order, planning for your refund timeline is essential.

The quickest way to secure your Michigan tax refund is to file electronically and opt for direct deposit. This method reduces processing time significantly. For those managing a Detroit Michigan Cancellation of Back Order, timely refunds can assist in balancing your finances.

Generally, taxpayers in Detroit can expect their refunds within a few weeks if they file electronically. Paper returns may take longer to process. If you are dealing with a Detroit Michigan Cancellation of Back Order, staying informed about your tax status can expedite your financial planning.

Yes, Michigan has introduced inflation relief checks to assist residents during challenging economic times. These checks aim to provide financial support to families facing rising costs. If you're curious about how this relates to the Detroit Michigan Cancellation of Back Order, understanding your tax situation can help you maximize your benefits.

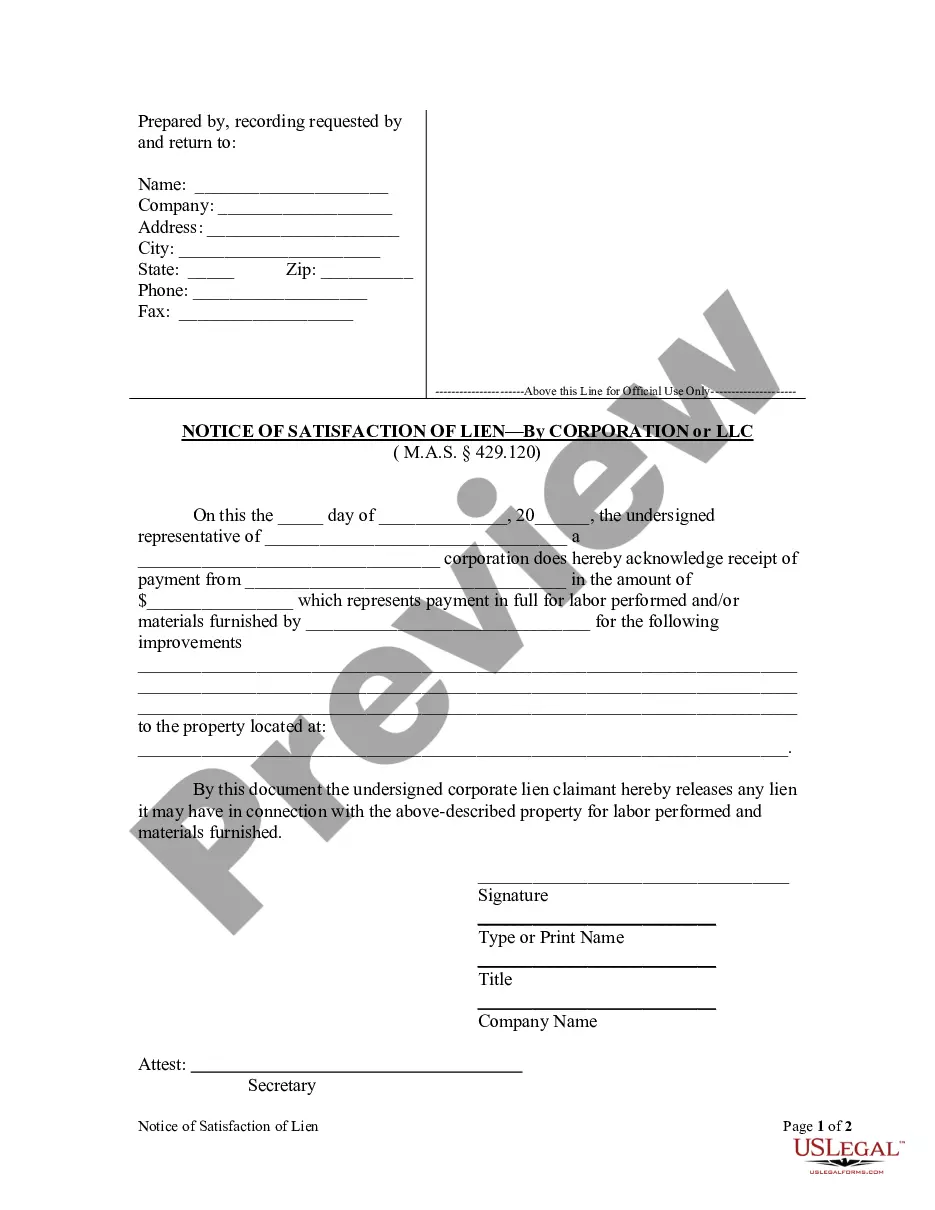

The cool off period in Michigan refers to the time frame allowed for consumers to reconsider their purchases and potentially cancel agreements. This period is particularly relevant for door-to-door sales and certain service agreements, giving you a chance to think things over. If you are dealing with a back order in Detroit, Michigan, understanding this cool off period can empower you to make informed decisions. For seamless management of cancellations and back orders, consider using uslegalforms to navigate your rights effectively.

The 3-day cancellation law in Michigan allows consumers to cancel certain types of contracts within three days of signing. This law specifically applies to transactions that occur outside of a regular business location, such as at home or in a hotel. If you find yourself needing to cancel a back order in Detroit, Michigan, this law provides a clear pathway to exercise that right. Always be aware of the terms of your contract to ensure you utilize this cancellation opportunity effectively.