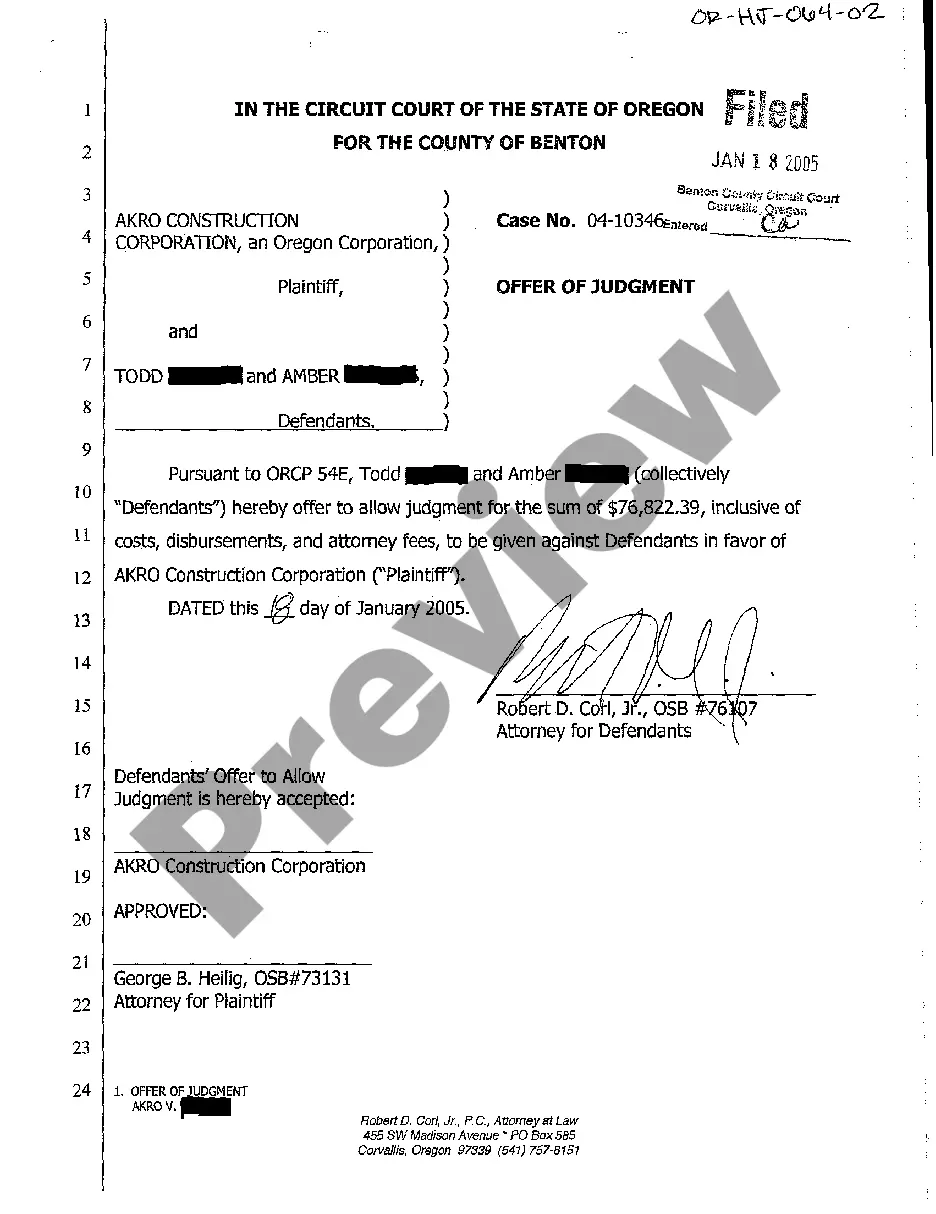

Most states have adopted charitable solicitation laws designed to protect donors, the general public, and charities themselves from fraud. Generally, these laws require charities and their fundraisers to register with the state, describe their fundraising activities, file financial documents, and pay a fee that covers the administrative expenses of monitoring charities. The Federal Trade Commission authorizes the filing of complaints when it has reason to believe that the law has been or is being violated, and it appears to the Commission that a proceeding is in the public interest.

Stockton California Fundraising Agreement

Description

Form popularity

FAQ

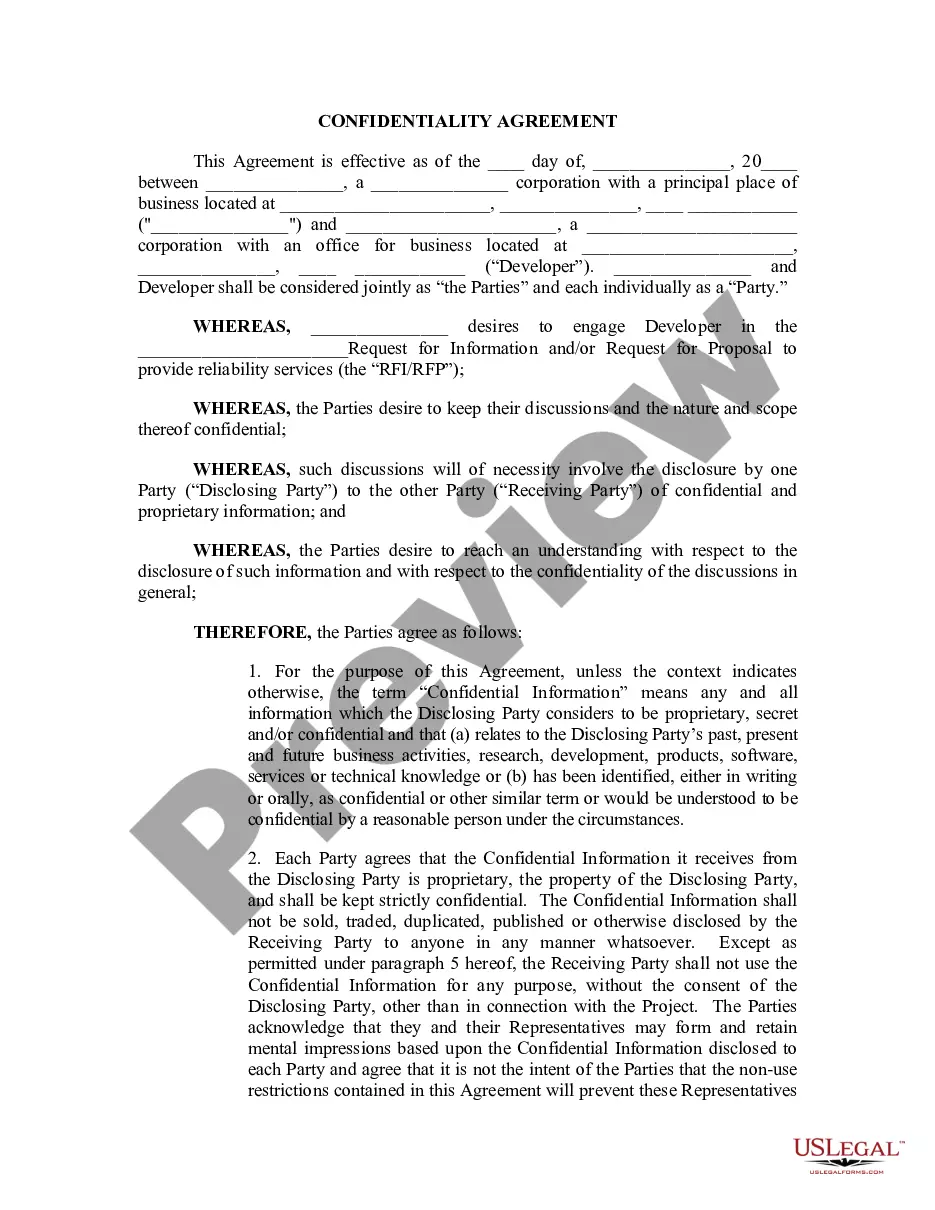

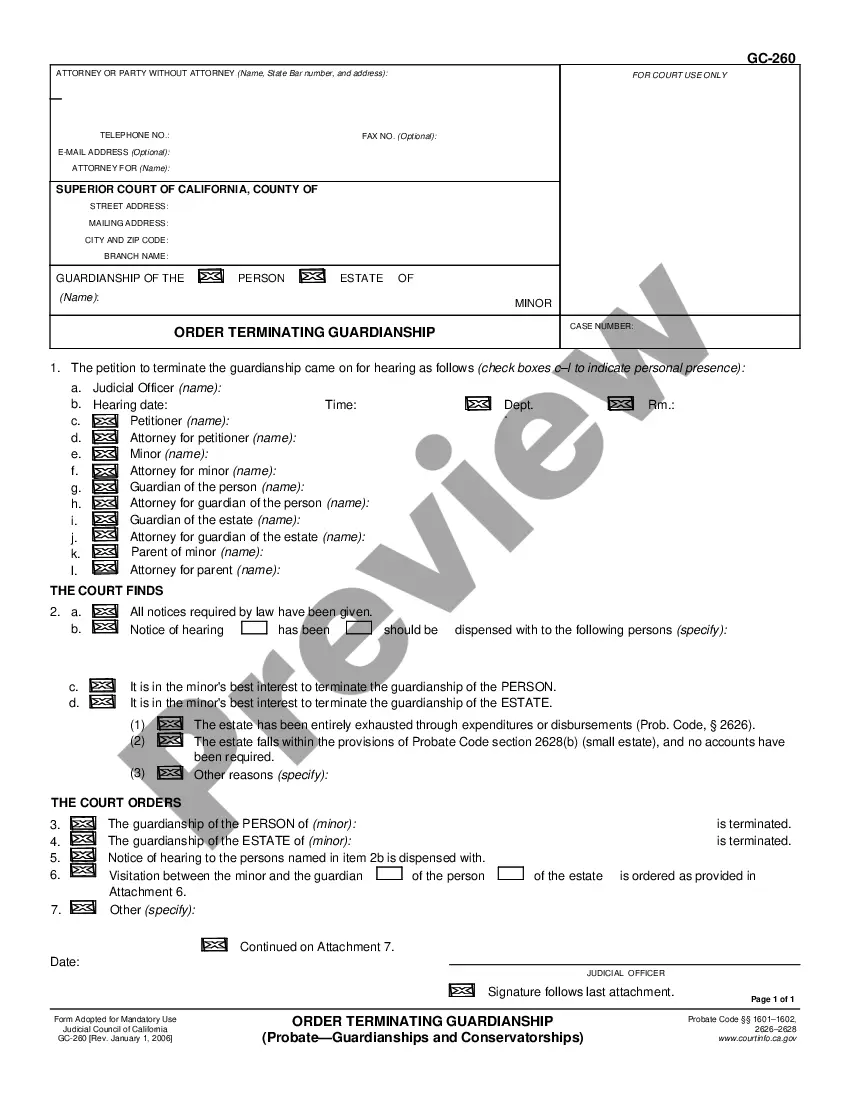

The charitable solicitation law in California governs how charities and fundraisers can solicit donations from the public. This law aims to protect donors by requiring transparency and ethical practices in fundraising. To navigate these regulations effectively, creating a Stockton California Fundraising Agreement is key. By outlining compliance with these laws, you can ensure that your fundraising activities are lawful and trustworthy.

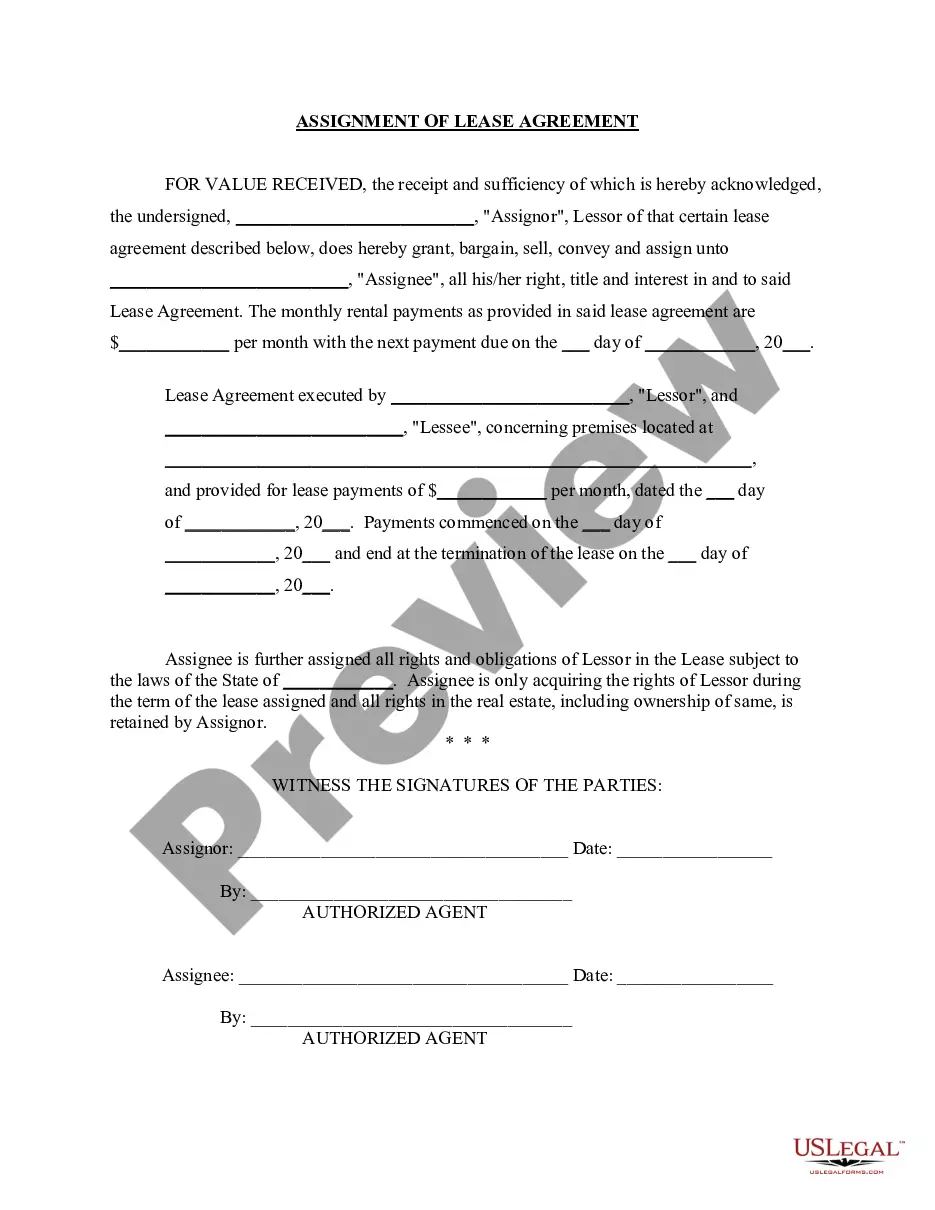

A fundraising agreement is a legal document that outlines the terms and conditions between a charity and a fundraiser. This agreement specifies roles, responsibilities, and compensation, ensuring both parties understand their obligations. For anyone involved in fundraising, a Stockton California Fundraising Agreement is essential for clear communication and legal protection. Utilizing platforms like uslegalforms can simplify the process of creating a comprehensive agreement tailored to your needs.

Basic rules on fundraising in California require compliance with state laws, including registration and disclosure requirements. Fundraisers must provide clear information about the charity's mission and how funds will be used. A well-structured Stockton California Fundraising Agreement can help ensure adherence to these rules, protecting both the charity and the fundraiser. By outlining key responsibilities and financial details, the agreement fosters transparency and trust.

A commercial fundraiser for charitable purposes in California is an individual or organization that solicits donations on behalf of a charity. This type of fundraiser typically receives compensation for their services, which can include organizing events and managing donation campaigns. Understanding the role of commercial fundraisers is crucial, especially when drafting a Stockton California Fundraising Agreement. Such an agreement ensures that both the charity and the fundraiser are clear on expectations, responsibilities, and financial arrangements.

To report illegal fireworks in Stockton, California, you can contact local law enforcement or the city’s non-emergency line. Make sure to include specific details about the location and time of the incident. Being proactive about community safety is vital, especially if you're planning an event under a Stockton California Fundraising Agreement, as safety regulations must be prioritized.

The average salary in Stockton, California, is approximately $50,000 to $60,000 per year. This figure reflects various industries, including healthcare, education, and retail. Understanding the local average salary can be essential when drafting a Stockton California Fundraising Agreement, especially if your initiative aims to support local residents.

If you need to file a complaint with the city of Stockton, you can do so through the official city website or by visiting local government offices. It's important to provide detailed information about your issue to ensure a prompt response. Engaging with local governance can be beneficial, especially if you're organizing a community event under a Stockton California Fundraising Agreement, as it may require city permits or approvals.

A good salary in Stockton, California, varies depending on your profession and lifestyle. Generally, earning around $60,000 to $80,000 annually can provide a comfortable living while allowing for savings and leisure activities. When you consider the costs associated with local fundraising events, understanding these salary ranges can help you plan effectively, especially if you're involved in a Stockton California Fundraising Agreement.