Philadelphia Pennsylvania Adjustable Rate Rider - Variable Rate Note

Description

How to fill out Philadelphia Pennsylvania Adjustable Rate Rider - Variable Rate Note?

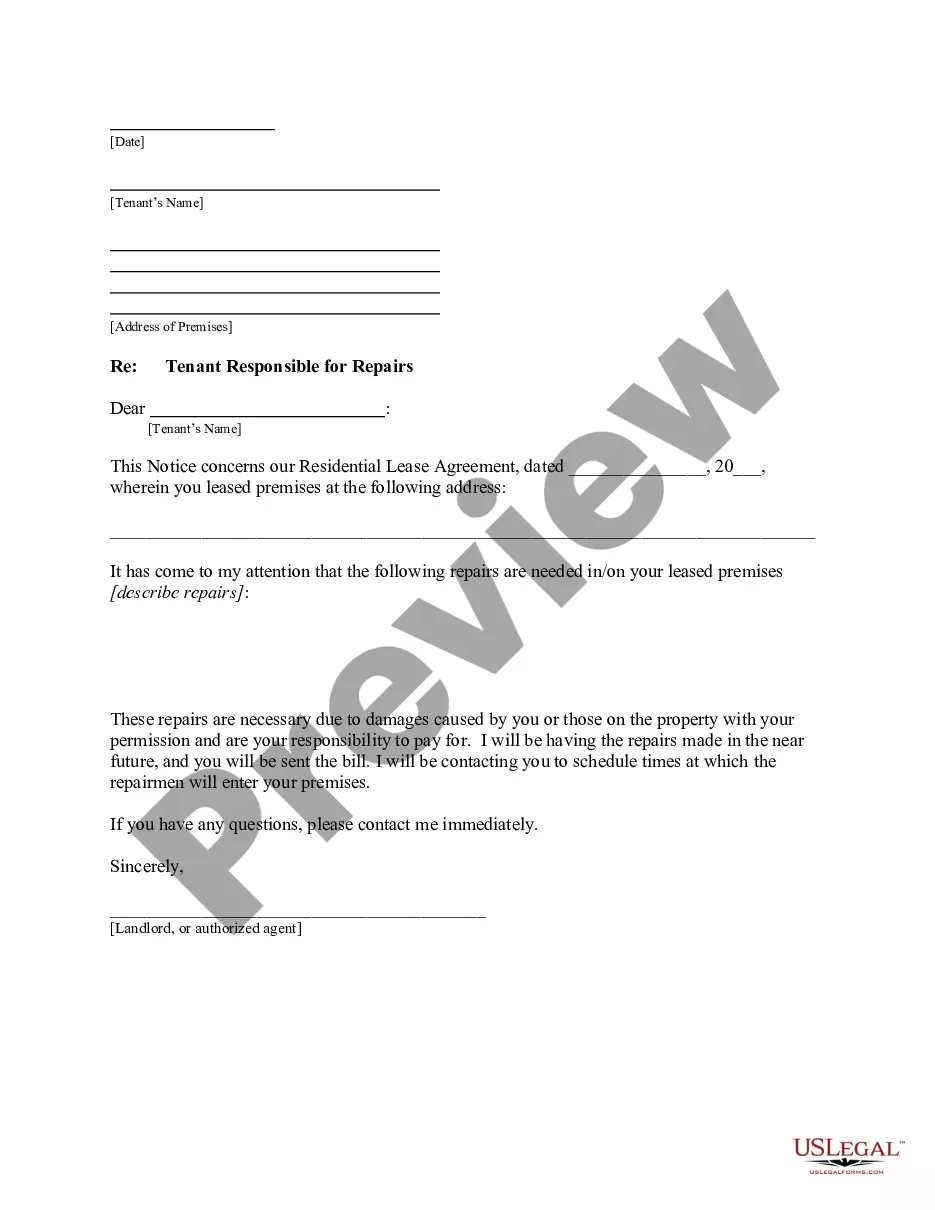

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Philadelphia Adjustable Rate Rider - Variable Rate Note, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you obtain a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Philadelphia Adjustable Rate Rider - Variable Rate Note from the My Forms tab.

For new users, it's necessary to make several more steps to get the Philadelphia Adjustable Rate Rider - Variable Rate Note:

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

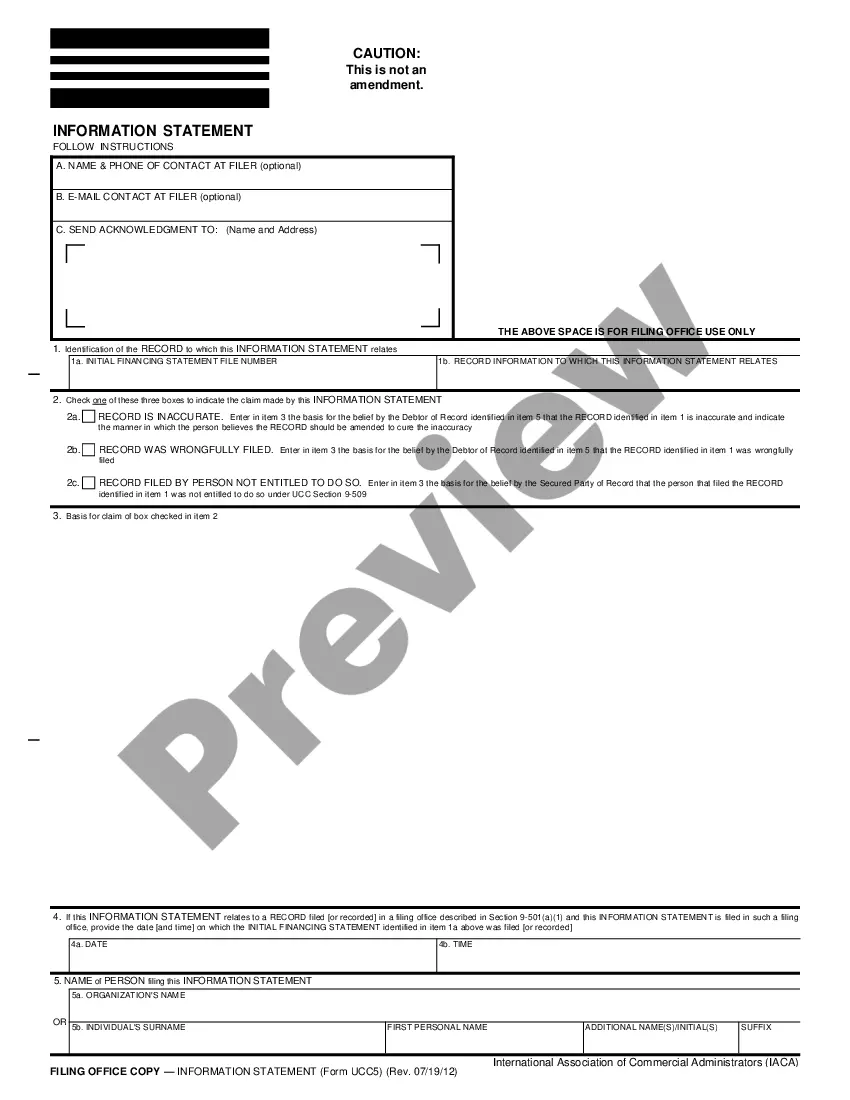

THE NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN THE INTEREST RATE AND THE MONTHLY PAYMENT. THE NOTE LIMITS THE AMOUNT THE BORROWER'S ADJUSTABLE INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MINIMUM AND MAXIMUM RATES THE BORROWER MUST PAY.

An adjustable-rate mortgage (ARM) is a home loan with a variable interest rate. With an ARM, the initial interest rate is fixed for a period of time. After that, the interest rate applied on the outstanding balance resets periodically, at yearly or even monthly intervals.

Why do I have mortgage rider? The mortgage rider includes special terms, conditions, and situations that affect the loan but are not present in the primary mortgage document. A mortgage rider is necessary when there are additional loan terms that are too complex to include into the primary mortgage papers.

Cons of Adjustable-Rate Mortgages You could be left with a much higher payment. You might buy more house than you can afford. Budget and financial planning is more difficult. You might end up owing more than your house is worth.

What is an Adjustable Rate Note? An adjustable rate note is a debt instrument with an interest rate that can fluctuate over time. Lenders typically use adjustable rates to compensate for risk and inflation, allowing borrowers to save money on their loan's interest payments.

An adjustable-rate mortgage, or ARM, is a home loan with an interest rate that can change periodically. This means that the monthly payments can go up or down. Generally, the initial interest rate is lower than that of a comparable fixed-rate mortgage.

Pros of an adjustable-rate mortgage It has lower rates and payments early in the loan term. Because lenders can consider the lower payment when qualifying borrowers, people can buy more expensive homes than they otherwise could. It allows borrowers to take advantage of falling rates without refinancing.

Adjustable-Rate Mortgage Benefits The bank (usually) rewards you with a lower initial rate because you're taking the risk that interest rates could rise in the future. 2feff Contrast the situation with a fixed-rate mortgage, where the bank takes that risk.

Adjustable-rate mortgage riders explain that the interest rate on the loan will change on a set date. Condominium riders specify the special terms of condominium ownership, such as the percentage of interest the borrower legally owns in the shared areas, or common elements.

A variable rate mortgage is one where the interest rates change with the market but the monthly payments are always the same. An adjustable rate mortgage is one where the monthly payments can change when the interest rate changes.