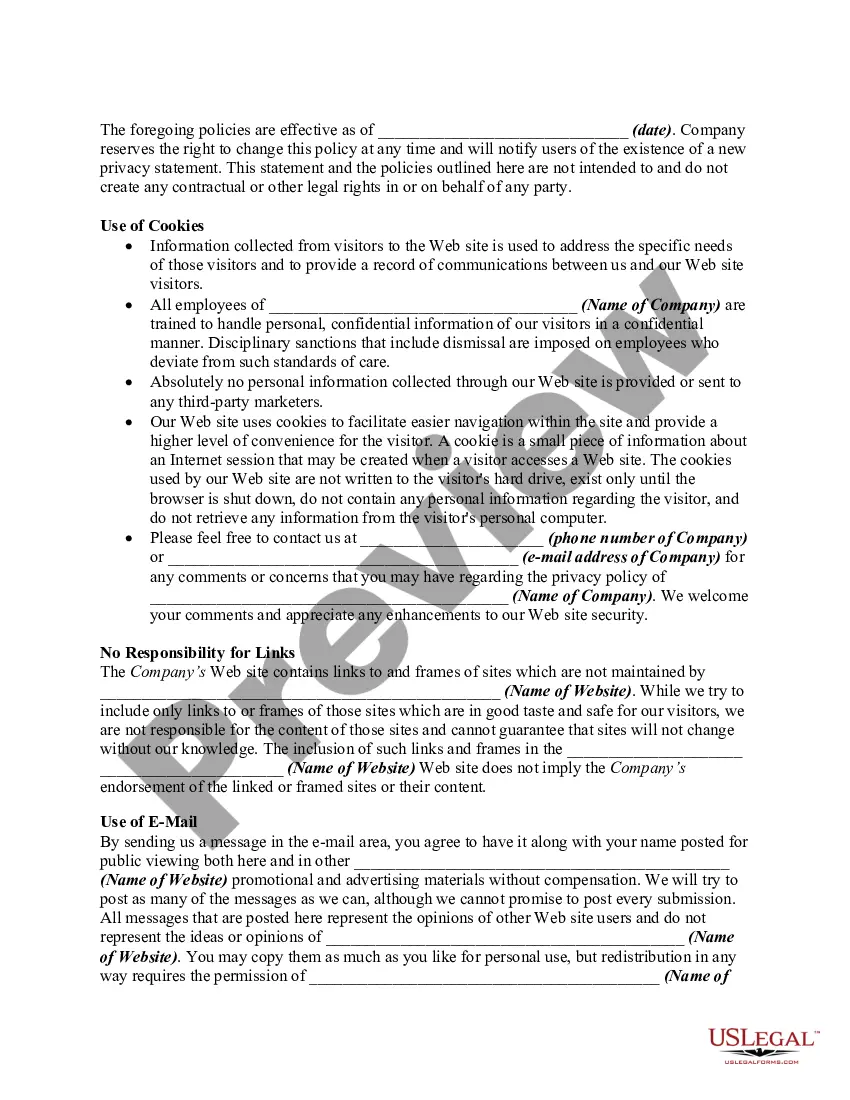

This policy is different than the end user agreement, but should not contradict it. Many Internet users are concerned that personal identifying information will be sold to entities that market their products through the Internet. A privacy statement gives assurance that information gathered will not be distributed. Privacy statements and disclosures also allow those who visit a Website to assess how private information will be collected and used. Accordingly, the visitor can make an informed decision on whether or not to interface with the Website. The following form is a sample of such a privacy statement.

Columbus Ohio Privacy Policy for Website that Conducts OnLine Auctions

Description

Form popularity

FAQ

To put a privacy policy on your website, start by drafting a clear and comprehensive document that outlines how you collect, use, and protect user data. Ensure that your privacy policy complies with the Columbus Ohio Privacy Policy for Website that Conducts OnLine Auctions regulations. You can use platforms like USLegalForms to create a customized privacy policy template, making the process straightforward. Once you have your policy ready, add it to your website's footer for easy access, and consider linking to it from registration or checkout pages.

Yes, if you conduct online auctions in Ohio, you typically need an auctioneer license. This requirement helps regulate the auction process and protect consumers. To ensure that you meet all legal requirements, including those related to a Columbus Ohio Privacy Policy for Website that Conducts OnLine Auctions, consider consulting legal resources or platforms like US Legal Forms.

Yes, if your website collects personal data from users, you are legally required to have a privacy policy. This requirement is particularly important for websites that conduct online auctions, as they handle sensitive information. By implementing a Columbus Ohio Privacy Policy for Website that Conducts OnLine Auctions, you not only comply with legal obligations but also build trust with your users.

You can easily find a privacy policy for your website through platforms like US Legal Forms. They offer a range of templates specifically designed for various types of businesses, including those conducting online auctions. By using their Columbus Ohio Privacy Policy for Website that Conducts OnLine Auctions, you ensure compliance with legal standards while maintaining transparency with your users.

To obtain a privacy policy for your website, especially one that conducts online auctions, you can use online legal services like US Legal Forms. They provide customizable templates tailored to meet the requirements of a Columbus Ohio Privacy Policy for Website that Conducts OnLine Auctions. This ensures that your policy aligns with local laws while protecting your users' data effectively.

Ing to Ohio Instructions for Form IT 1040, ?Every Ohio resident and part year resident is subject to the Ohio Income tax.? Every full-year resident, part year resident and full year nonresident must file an Ohio tax return if they have income from Ohio sources.

Local income tax is usually based on where a taxpayer lives, but in some cases, taxpayers also owe local income tax based on where they perform work (for example, if they commute). You may have withholding obligations based on where your company does business or based on where your employees perform work.

Columbus residents pay a total of 2.5% in taxes on all income earned, regardless of whether it was earned in Columbus or another city.

In Ohio, you have an income tax obligation to both your employment city and your resident city. Your employer is required by law to withhold your work place city tax and if you have "fully withheld", you have no filing requirement with your work place city.

Municipalities may generally impose tax on on wages, salaries, and other compensation earned by residents and by nonresidents who work in the municipality. The tax also applies to the net profits of business attributable to activities in the municipality, and to the net profits from rental activities.