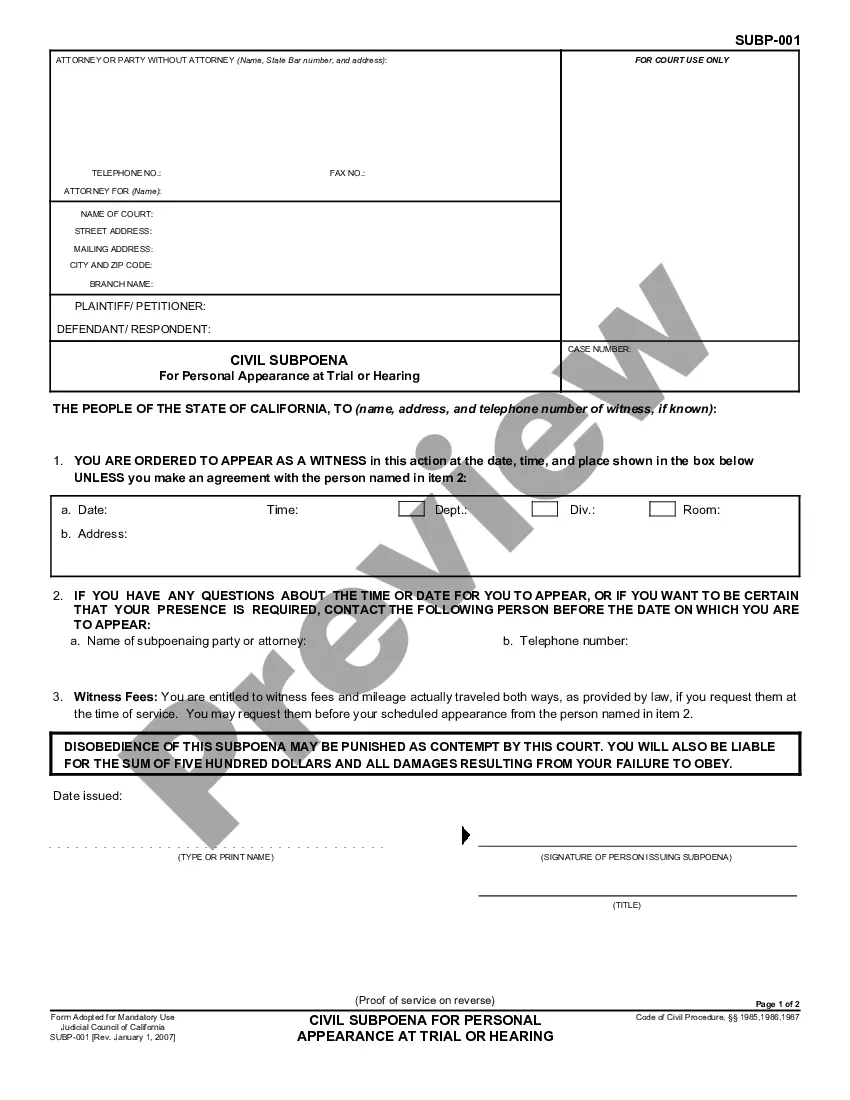

A Legacy is a gift of property or money under the terms of the will of a person who has died. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Chandler Arizona Assignment of Legacy in Order to Pay Indebtedness

Description

Form popularity

FAQ

Creditors have up to 4 months to file claims against an estate in Arizona after the personal representative has filed for probate. If you're dealing with a Chandler Arizona Assignment of Legacy in Order to Pay Indebtedness, understanding this timeframe is vital for managing your estate's obligations. Promptly addressing claims can prevent complications. For assistance, consider platforms like uslegalforms to navigate legal documents and procedures efficiently.

In Arizona, the statute of limitations on debt after death typically lasts for 6 months from the date of the decedent's passing. If you are managing a Chandler Arizona Assignment of Legacy in Order to Pay Indebtedness, it's crucial to address any outstanding debts promptly. Creditors may file claims against the estate within this period. Staying informed about these timelines can help you navigate estate responsibilities effectively.

In Arizona, you can inherit any amount without paying state inheritance taxes, as there are none. This is beneficial when dealing with a Chandler Arizona Assignment of Legacy in Order to Pay Indebtedness. However, federal estate taxes may apply if the estate exceeds a certain threshold. It's wise to consult with a financial advisor to understand your specific situation.

You can pay your Chandler court bill through several methods, including online payments, mail, or in-person at the courthouse. If your bill is related to a Chandler Arizona Assignment of Legacy in Order to Pay Indebtedness, ensure you have the correct case number and details handy. Online payments often provide a quick and convenient option. Check the official Chandler court website for specific instructions and payment methods.

In Arizona, there is no inheritance tax, so you do not need to file an inheritance tax waiver form. However, if you are involved in a Chandler Arizona Assignment of Legacy in Order to Pay Indebtedness, it’s essential to understand how these processes work. It's advisable to consult a legal expert to ensure compliance with any estate-related requirements. Always keep informed about state laws, as they can change.

Arizona does not have a filial responsibility law that requires adult children to pay their parents' debts. However, specific situations might lead to obligations under certain circumstances. The Chandler Arizona Assignment of Legacy in Order to Pay Indebtedness can assist in understanding these nuances. For comprehensive legal guidance, you can rely on platforms like USLegalForms to navigate these matters efficiently.

In Arizona, individuals can inherit debt, but typically only if they were jointly responsible for the debt. Debts incurred solely by the deceased party do not transfer to heirs. To protect yourself and understand your options, consider the Chandler Arizona Assignment of Legacy in Order to Pay Indebtedness. This may help clarify any inherited financial responsibilities.

In Arizona, children do not inherit their parents' debt unless they are co-signers or have a shared account. The state does not hold children accountable for debts in most circumstances. Understanding the Chandler Arizona Assignment of Legacy in Order to Pay Indebtedness can be beneficial for families dealing with financial obligations after a parent's passing. Utilizing resources like USLegalForms can guide you through these complexities.

In general, children are not personally liable for their parents' debts. However, certain circumstances, such as co-signing loans or joint accounts, can create liability. If you are navigating issues related to debt and inheritance, consider exploring the Chandler Arizona Assignment of Legacy in Order to Pay Indebtedness. This can help clarify your responsibilities and protect your financial interests.

A Rule 83 motion in Arizona refers to a request for the court to modify or enforce a local rule or procedure. This motion can arise in various legal contexts, including cases involving debts. If you are considering a Chandler Arizona Assignment of Legacy in Order to Pay Indebtedness, understanding these motions can be crucial in managing your legal obligations. US Legal Forms offers useful tools to help you navigate these legal complexities.