This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Gilbert Arizona Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness

Description

Form popularity

FAQ

The assignment of interest in an estate involves transferring a beneficiary's rights to receive assets or income from an estate to another party. This action is often necessary in the Gilbert Arizona Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness to help resolve outstanding debts of the estate. By assigning these interests, the original beneficiary can reduce their financial burden while ensuring that the estate's obligations are met. Utilizing resources from uslegalforms can simplify this process and provide clarity.

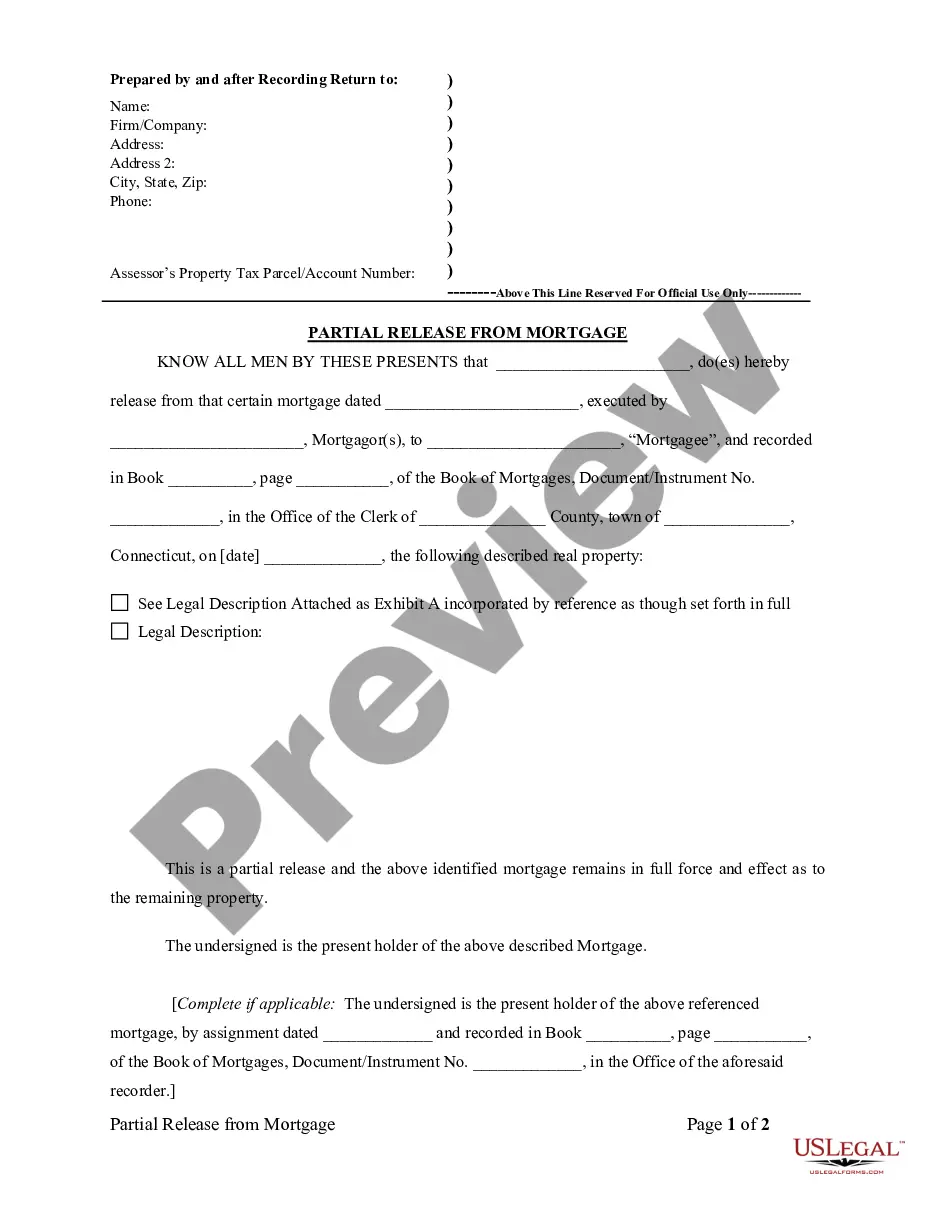

The assignment of interest in the estate form is a legal document used to formalize the transfer of one's expected interests in an estate. This form is essential when utilizing the Gilbert Arizona Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, as it outlines the specific terms of the assignment. Completing this form accurately ensures that the assigned interests are recognized legally. You can find user-friendly templates for this form on platforms like uslegalforms.

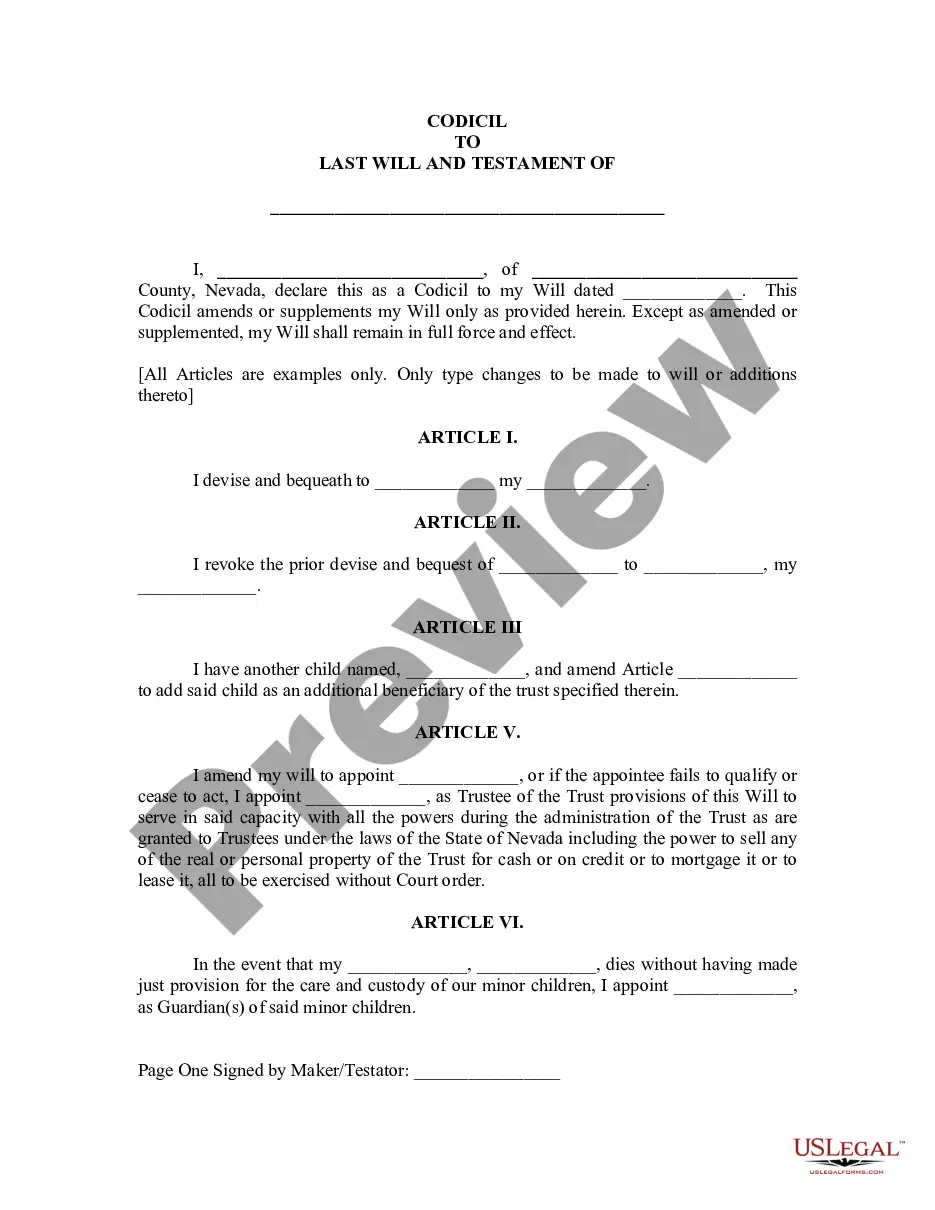

The assignment of interest refers to the process where a person transfers their rights to a portion of their estate to another party. In the context of the Gilbert Arizona Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, this means that the individual assigns their expected interests to settle debts. This can be crucial for clearing financial obligations while managing estate assets. Understanding this process can help you navigate estate planning more effectively.

In Arizona, an executor typically has up to one year to settle an estate. This timeline can vary based on the complexity of the estate and any disputes that may arise. During the process of managing a Gilbert Arizona Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, the executor must address all debts and distribute the remaining assets in accordance with the will or state law. Utilizing platforms like uslegalforms can simplify this process by providing necessary legal documents and guidance.

In Arizona, creditors can begin to collect debts from the estate as soon as they are notified of the death. However, they must adhere to the four-month notice period for filing claims. This process is particularly relevant when dealing with the Gilbert Arizona Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. To ensure proper handling of creditor claims, using USLegalForms can simplify the necessary legal steps and documentation.

The three-year rule refers to the period in which a deceased person's estate must be settled and claims resolved. In Arizona, if an estate remains open beyond this period, it could complicate matters for creditors and beneficiaries alike, particularly concerning the Gilbert Arizona Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. To avoid such issues, it’s important to initiate timely estate administration. USLegalForms can provide the necessary resources to help manage these timelines effectively.

Creditors in Arizona typically have four months from the date of the notice regarding the estate to file their claims. This timeframe is crucial for creditors seeking repayment, especially in cases involving the Gilbert Arizona Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. Understanding these timelines can help beneficiaries navigate their financial responsibilities effectively. Consider using USLegalForms to manage creditor claims efficiently.

Yes, in Arizona, the executor is required to provide an accounting to the beneficiaries. This accounting must detail all financial transactions related to the estate, ensuring transparency. By doing so, the executor demonstrates their responsibilities in managing the estate, including the Gilbert Arizona Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. Utilizing platforms like USLegalForms can help streamline this process and ensure compliance.

In Arizona, the statute of limitations for debt collection after a person's death generally lasts for the same duration as it would if the debtor were alive, which is typically three to six years, depending on the type of debt. However, if you are dealing with an estate, it's important to understand that the estate must settle all debts before any assets can be distributed. The Gilbert Arizona Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness can provide a structured approach to ensuring that all debts are accounted for and settled appropriately.

Creditors typically have a four-month period to present their claims against an estate in Arizona. This period begins once the notice to creditors is published by the personal representative. If a creditor fails to file a claim within this timeframe, they may lose their right to collect the debt. Utilizing the Gilbert Arizona Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness can assist in addressing these claims timely and efficiently.