Atlanta Georgia Request for Refund of Duplicate Payment

Description

Form popularity

FAQ

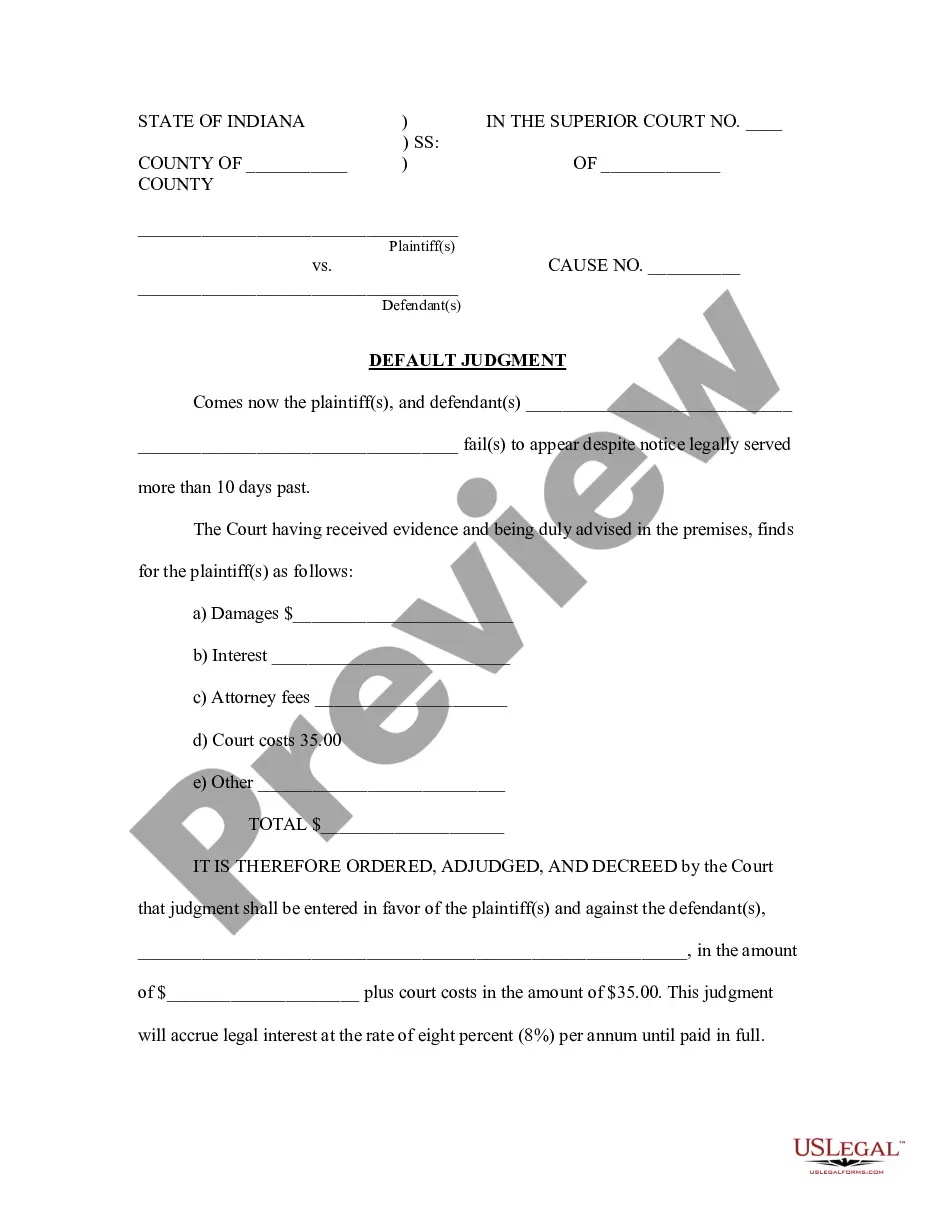

The form for the Atlanta Georgia Request for Refund of Duplicate Payment is a specific document that you need to fill out to initiate your request. This form allows you to detail the duplicate payment situation and provides the necessary information for processing your refund. By using the right form, you can ensure a smoother and faster refund process. You can easily access this form through the US Legal Forms platform, which offers a user-friendly way to obtain and submit your request.

When writing an email regarding a twice payment, begin with a clear subject line, such as 'Request for Refund of Duplicate Payment.' In the body, explain the situation, including the payment details and the total amount overpaid. Mention the Atlanta Georgia Request for Refund of Duplicate Payment, and conclude with a request for prompt assistance and your contact information for any follow-up.

A good sentence for a refund might be, 'I kindly request a refund due to an overpayment made on date for the amount of amount.' This sentence clearly communicates your request while emphasizing the context of the Atlanta Georgia Request for Refund of Duplicate Payment. It’s essential to be direct yet polite, ensuring your request is taken seriously.

To write a letter of refund payment, start by addressing the appropriate recipient. Clearly state that you are requesting a refund, and provide all necessary details such as the payment amount and date. Refer to the Atlanta Georgia Request for Refund of Duplicate Payment, and make it easy for them to process your request. End with a polite closing and your contact information.

When writing a letter to request a refund for overpayment, organize your information clearly. Begin with a polite salutation, then explain the reason for your request, specifically mentioning the overpayment and its details. Use a straightforward approach to ask for the Atlanta Georgia Request for Refund of Duplicate Payment, and conclude with a courteous closing and your signature.

To write a letter requesting a refund for overpayment, start by clearly stating your intention. Include your name, address, and contact details at the top. Then, mention the payment details, including the amount and date of the overpayment, and request the Atlanta Georgia Request for Refund of Duplicate Payment. Finally, express your appreciation and provide your contact information for any follow-up.

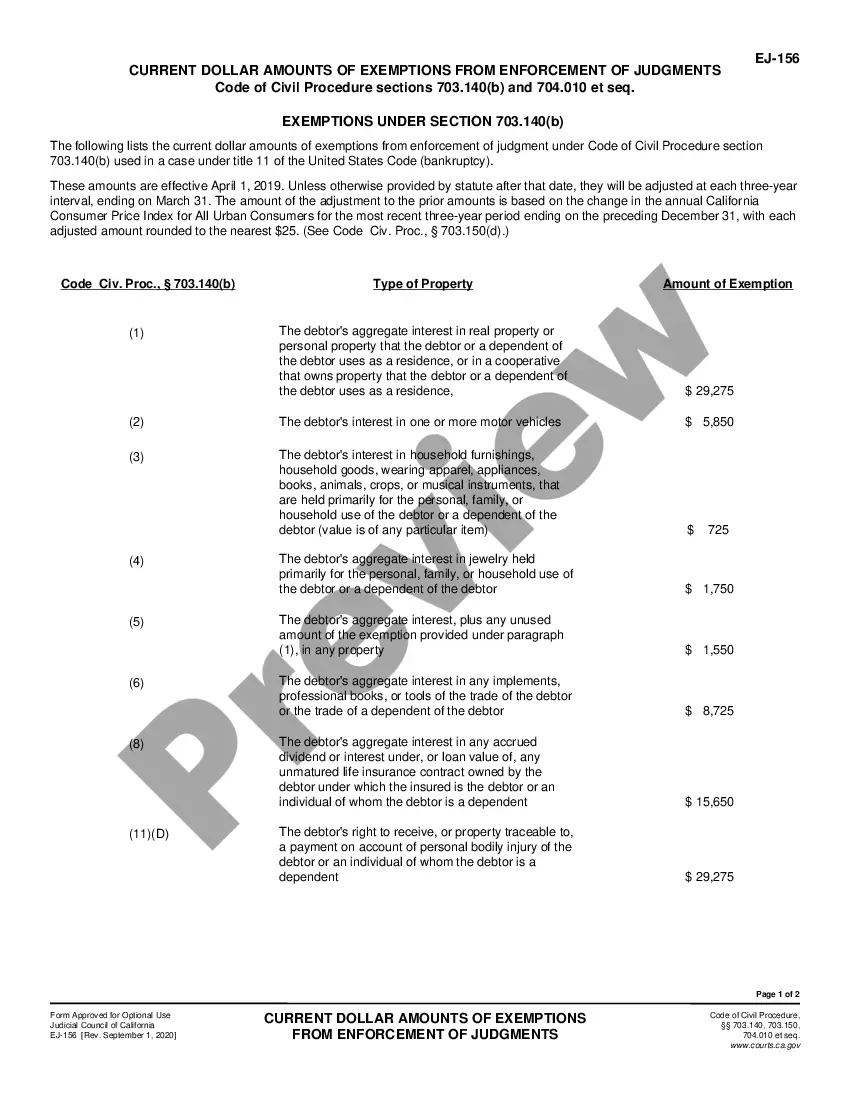

A check from the Georgia Department of Revenue usually indicates a refund or adjustment related to your tax filings. This could stem from an overpayment or a correction made on your account. To ensure you comprehend the reason behind the check, consider using the Atlanta Georgia Request for Refund of Duplicate Payment to find the necessary information and understand your financial standing.

Receiving an unexpected tax refund check may be due to various reasons, such as overpayment or adjustments made by the state. It’s important to review your tax filings to understand why this occurred. If you need further clarification, the Atlanta Georgia Request for Refund of Duplicate Payment can assist you in navigating any discrepancies.

The $500 check in Georgia is typically issued to eligible taxpayers who filed their state tax returns. This payment is part of the state's effort to provide financial relief to residents. If you believe you qualify, consider using the Atlanta Georgia Request for Refund of Duplicate Payment to help clarify your eligibility and facilitate your request.

To request your tax refund, you need to file a tax return with the Georgia Department of Revenue. Be sure to include all necessary documentation to support your claim. Utilizing the Atlanta Georgia Request for Refund of Duplicate Payment can simplify this process, as it guides you through the steps needed to ensure your refund is processed efficiently.