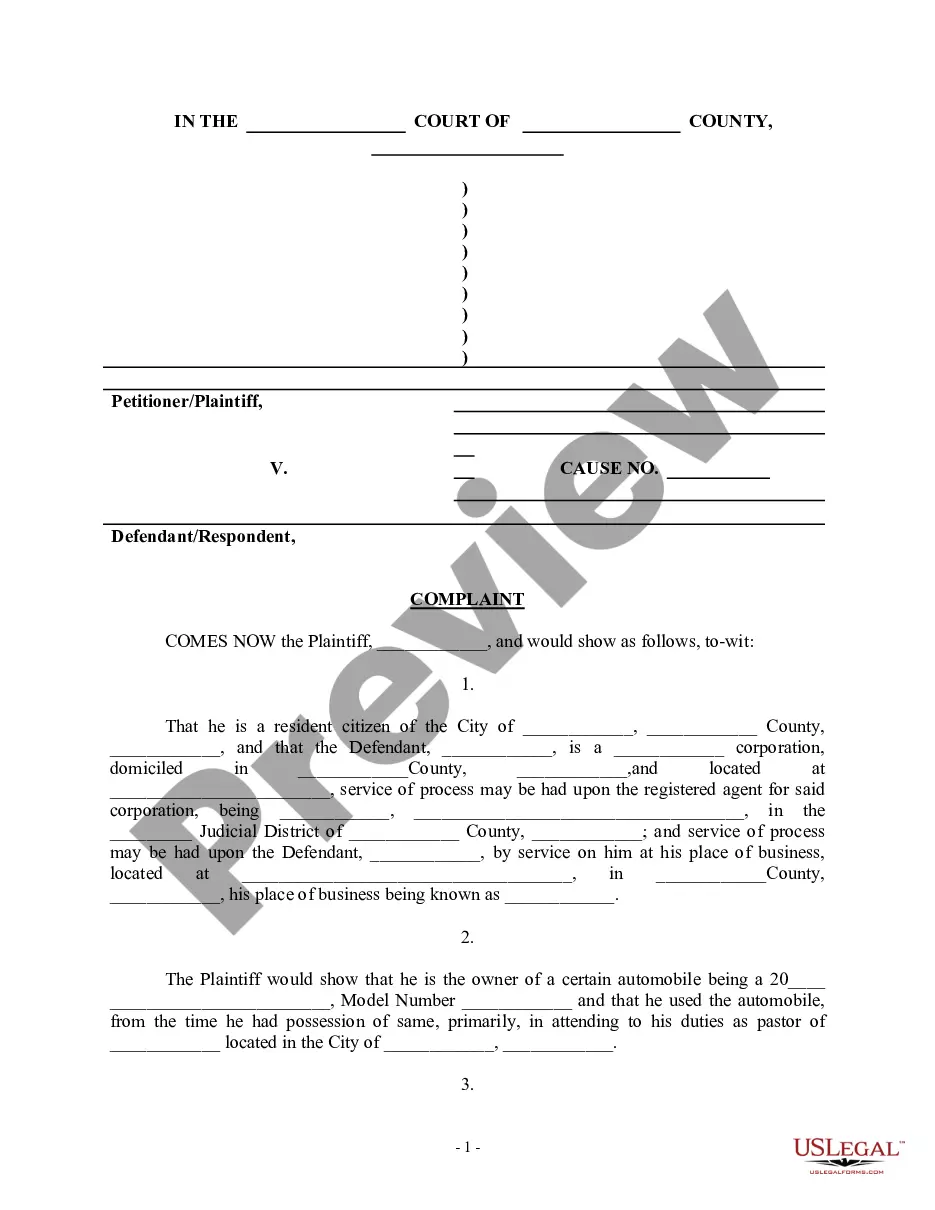

An action for partition usually arises when there is a dispute as to how to divide property, or in a dispute as to whether property should be sold. One co-owner of real property can file to get a court order requiring the sale of the property and division of the profits.

Columbus Ohio Complaint for Conversion of Personal Property by Co-Owner and Request for Partition

Description

Form popularity

FAQ

Ing to Ohio Instructions for Form IT 1040, ?Every Ohio resident and part year resident is subject to the Ohio Income tax.? Every full-year resident, part year resident and full year nonresident must file an Ohio tax return if they have income from Ohio sources.

Local income tax is usually based on where a taxpayer lives, but in some cases, taxpayers also owe local income tax based on where they perform work (for example, if they commute). You may have withholding obligations based on where your company does business or based on where your employees perform work.

Columbus residents pay a total of 2.5% in taxes on all income earned, regardless of whether it was earned in Columbus or another city.

In Ohio, you have an income tax obligation to both your employment city and your resident city. Your employer is required by law to withhold your work place city tax and if you have "fully withheld", you have no filing requirement with your work place city.

Municipalities may generally impose tax on on wages, salaries, and other compensation earned by residents and by nonresidents who work in the municipality. The tax also applies to the net profits of business attributable to activities in the municipality, and to the net profits from rental activities.

1. WHO SHOULD FILE THIS RETURN: a) All Ohio City residents 18 years of age and over, (except high school students) are required to regis- ter and report income with the Ohio City Tax Office. b) High School Students 18 years of age and under, working part time, do not have to register with the Ohio City Tax Office.

Cities that administer their own taxes on their own form: City of Akron. City of Canton. City of Carlisle. City of Cincinnati. City of Columbus. City of Dayton. City of Middletown. City of St. Marys.

Free to File. Easy to Use. Faster Refund.