No definite rule exists for determining whether one is an independent contractor or an employee. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor. Finally, independent contractors are generally free to perform the same type of work for others.

Austin Texas Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause

Description

Form popularity

FAQ

The new federal rule focuses on the classification of workers as independent contractors versus employees and seeks to clarify the criteria used to make this determination. It aims to ensure that individuals are categorized correctly to protect their rights while maintaining favorable conditions for self-employed contractors. This classification is significant for those under the Austin Texas Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause, as it impacts the benefits and responsibilities you will have.

An independent contractor must earn at least $600 from a particular client within a calendar year to receive a 1099. This form is essential for tax reporting purposes and outlines what you earned. Be sure to review the terms in your Austin Texas Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause to align your expectations regarding income and reporting.

The $600 rule indicates that businesses must issue a 1099 form to independent contractors who earn $600 or more within a tax year. This requirement helps the IRS track earnings for self-employed individuals. For your Austin Texas Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause, understanding this rule can help you maintain accurate financial records.

You must file taxes even if you earned less than $5000 as a self-employed individual, especially if you have net earnings of $400 or more. It is crucial to consider how your income aligns with the requirements laid out in your Austin Texas Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause. Proper tax filing ensures compliance and protects you from potential issues with the IRS.

An independent contractor in the United States can make up to $600 within a fiscal year before a 1099 is issued. This amount refers to the total earnings from each client. Remember, even if you do not receive a 1099, you are still responsible for reporting this income on your taxes, especially in your Austin Texas Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause.

You can earn up to $600 in a calendar year as an independent contractor without receiving a 1099 form for your earnings. However, if you cross this threshold, the businesses you work for must report your income to the IRS. Thus, maintaining detailed records is essential in your Austin Texas Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause.

If you experience an injury as an independent contractor, your options may differ from those of traditional employees. Typically, independent contractors do not qualify for workers' compensation benefits, so it is vital to secure personal insurance coverage that addresses work-related injuries. Moreover, including provisions in your Austin Texas Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause can help outline the responsibilities of parties in the event of an injury. This foresight can offer additional peace of mind.

As an independent contractor, you have the right to negotiate your payment terms and working conditions within the framework of the Austin Texas Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause. You are also entitled to receive payment for completed work as agreed upon in your contract. Importantly, you have the right to terminate your contract under the stipulations outlined, ensuring you can exit a situation that no longer serves you. Understanding these rights empowers you to work confidently.

To safeguard yourself as an independent contractor, it is crucial to have a well-drafted Austin Texas Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause. This contract outlines your responsibilities and payment terms, reducing the chance of disputes. Additionally, consider obtaining liability insurance to cover potential risks associated with your work. Keeping thorough records of your transactions and communications also helps protect your interests.

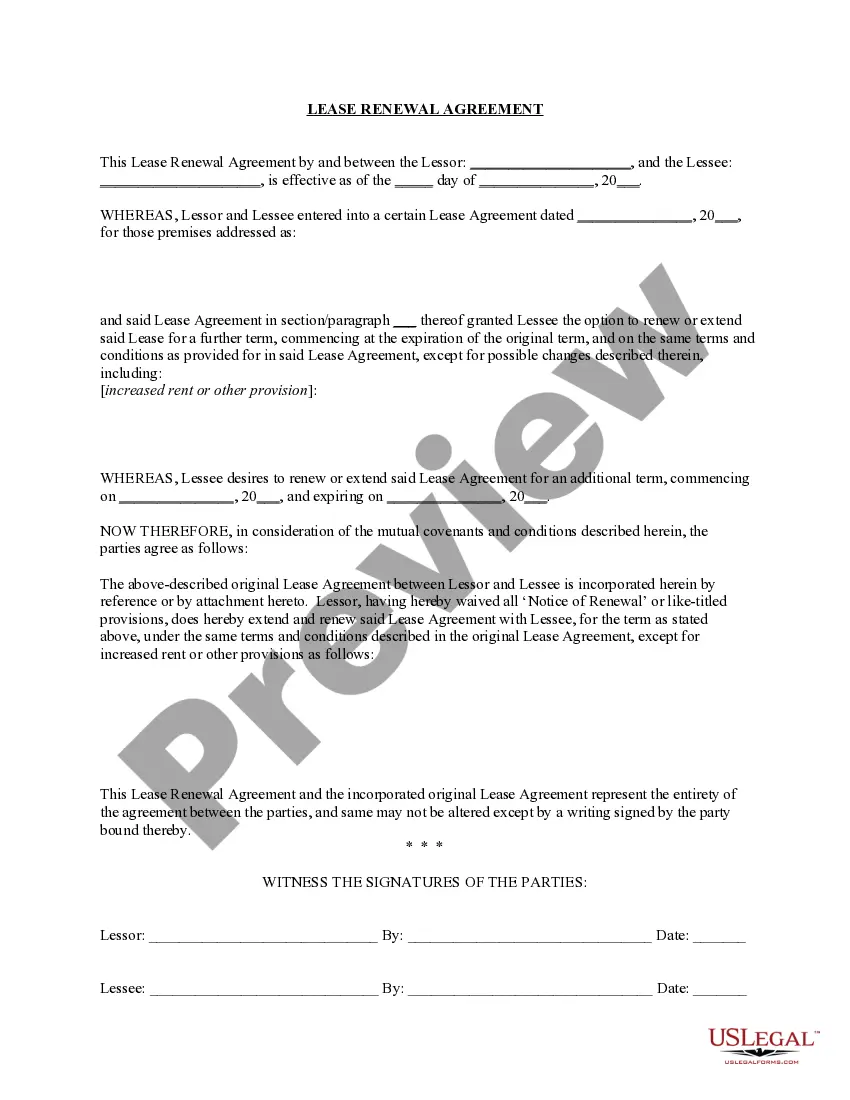

Writing an independent contractor agreement involves key components, such as defining the project's scope, payment terms, and legal responsibilities. When drafting an Austin Texas Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause, make sure to include clauses that protect both parties' interests. If you need assistance, consider using uslegalforms for reliable templates that fit your needs.