Stockton California Registration Statement

Description

Form popularity

FAQ

In California, the Secretary of State (SOS) number is a unique identifier assigned to each business entity. The format consists typically of a series of digits, often starting with a letter followed by seven numerical digits. This SOS number is crucial for your Stockton California Registration Statement, as it helps maintain accurate records and identify your business within the state's system.

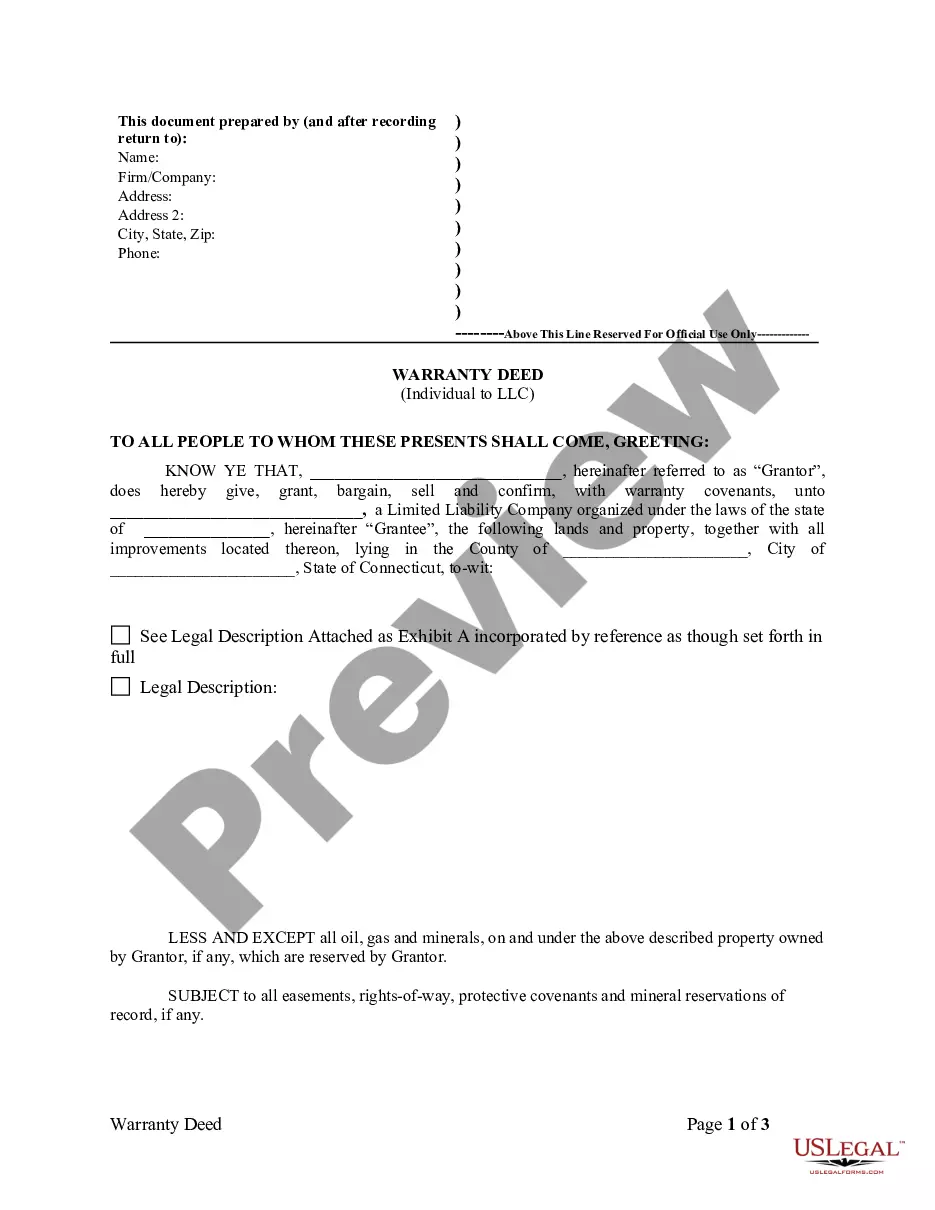

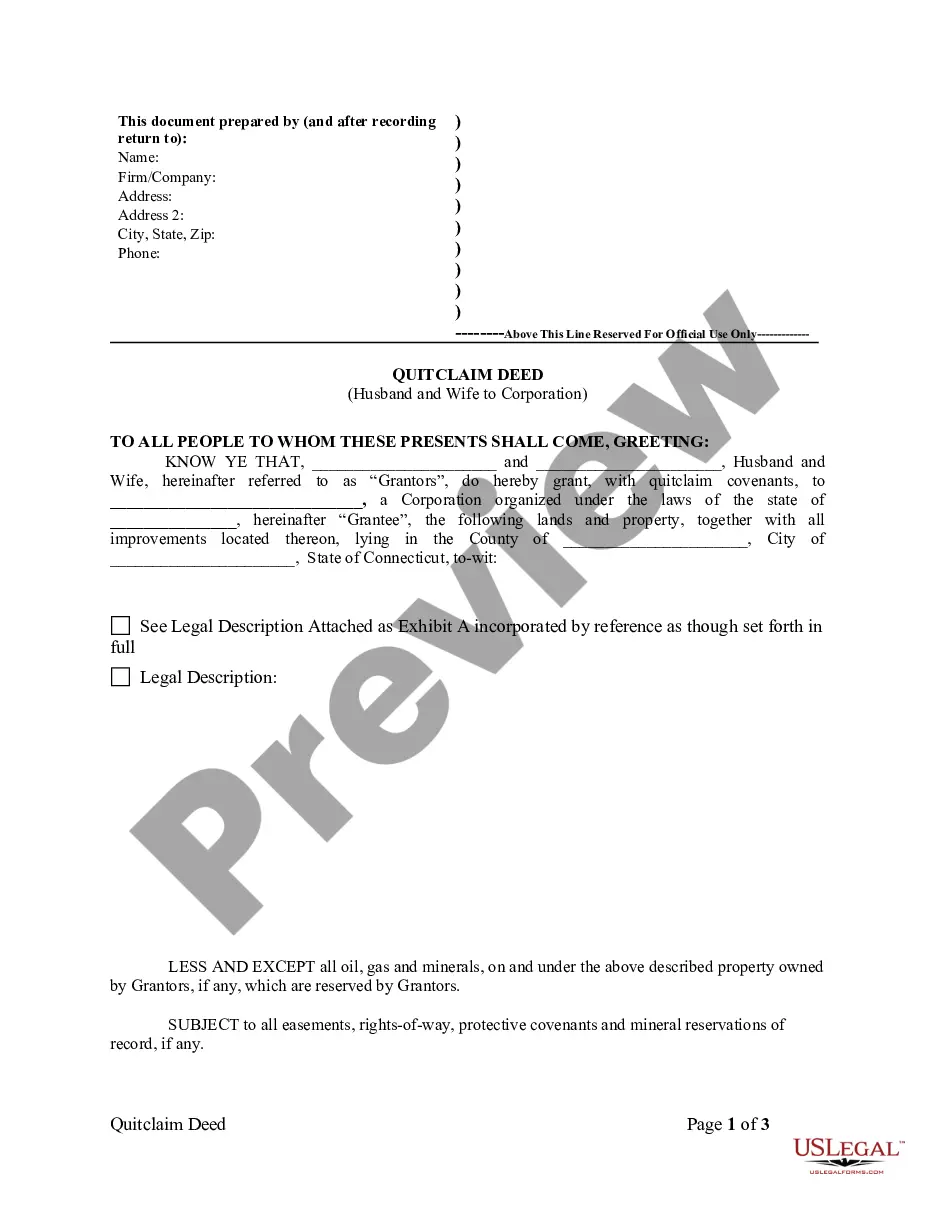

Filling out the Statement of Information in California involves providing accurate details about your business. You’ll need to complete the form with essential information about your entity and file it with the Secretary of State's office. Platforms like USLegalForms can simplify this process, offering guidance and templates specifically designed for your Stockton California Registration Statement needs.

A Statement of Information typically includes vital details about your business, such as the entity's name, address, and the names of its officers or members. In California, the document may also request information about the business's registered agent and principal office location. Ensuring that your Stockton California Registration Statement is complete and accurate helps establish transparency in your business operations.

In California, any business entity, including corporations and limited liability companies, must file a Statement of Information with the Secretary of State. This requirement is essential for maintaining good standing and ensuring compliance with state laws. If you operate in Stockton, California, you should be aware of the specific guidelines for the Stockton California Registration Statement process.

Filing corporate dissolution in California requires submitting specific forms to the Secretary of State. First, obtain the Certificate of Dissolution and complete all required sections. Additionally, ensure that your Stockton California Registration Statement is up to date, as this process involves closing out corporate records properly. You can use uslegalforms as a helpful resource to navigate the paperwork and achieve a smooth dissolution process.

To file a California corporate disclosure statement, gather the necessary information about your corporation's structure and operations. You can choose between online filing through the California Secretary of State's portal or submitting a paper form by mail. Completing your Stockton California Registration Statement accurately is vital for compliance and transparency in your business operations.

Yes, you can file a California statement of information online for your corporation. This convenient option saves time and allows you to submit your Stockton California Registration Statement anytime from anywhere. Simply navigate to the California Secretary of State's website and follow the step-by-step instructions for online filing.

Yes, corporations are required to file a statement of information in California. This statement provides essential details about your corporation, such as the addresses and names of directors and officers. Filing your Stockton California Registration Statement on time is crucial, as it helps maintain your corporation's good standing with the state.

To file a California corporate disclosure statement online, start by visiting the California Secretary of State's website. You will need to create an account and select the appropriate forms for your corporation. Once you have entered all required information, be sure to review your Stockton California Registration Statement before submitting it. This online process ensures your filing is quick and secure.

The tax rate in Stockton, CA, includes both the state sales tax and additional local taxes, totaling approximately 8.25%. Understanding this tax structure is vital for both residents and business owners to manage financial obligations wisely. The Stockton California Registration Statement serves as an important resource in understanding these rates and complying with local laws. Staying informed about your tax rate will help you avoid unexpected costs.