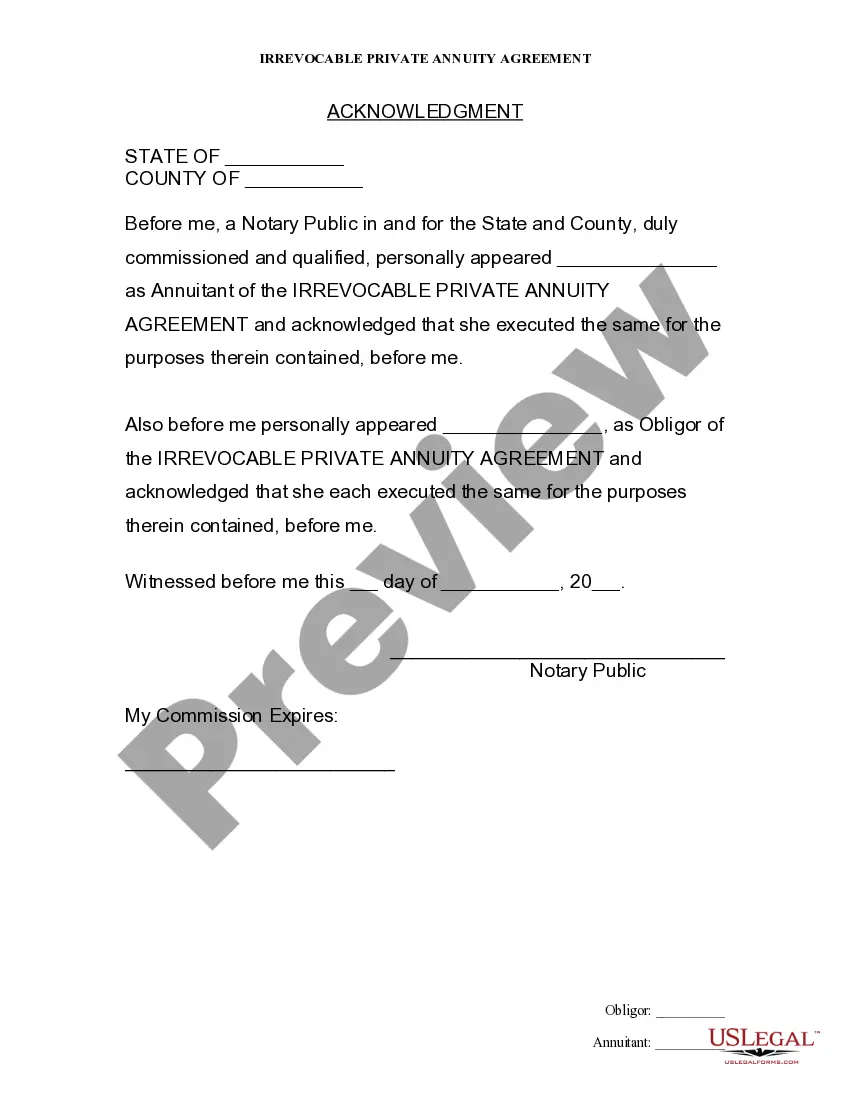

Mesa Arizona Private Annuity Agreement

Description

Form popularity

FAQ

A 70-year-old might find that buying an annuity provides a steady income stream during retirement. A Mesa Arizona Private Annuity Agreement can help secure financial stability and peace of mind, especially if other income sources are limited. However, it is essential to evaluate personal financial plans and perhaps consult a financial advisor before making a decision. Each individual’s situation is unique and deserves thoughtful consideration.

The downside of a Single Premium Immediate Annuity (SPIA) is its lack of flexibility once purchased. Upon purchasing a Mesa Arizona Private Annuity Agreement, you typically cannot access the lump sum amount. Furthermore, while it provides guaranteed income, it does not allow for inflation adjustments, which can erode purchasing power over time. Therefore, careful consideration is essential before committing.

The monthly income from a $100,000 annuity will depend on various factors, including the type of annuity and current interest rates. Generally, you might expect between $500 to $600 per month from a Mesa Arizona Private Annuity Agreement. It's crucial to discuss options with a financial advisor to find the best product for your situation. Adequate planning ensures your income meets your retirement needs.

Suze Orman frequently recommends fixed indexed annuities for their balance of security and growth potential. These products can provide stability while still allowing some opportunity for higher returns. A Mesa Arizona Private Annuity Agreement can fit within this category and cater to your specific retirement needs. It's essential to evaluate your financial situation to find the best fit.

The best age to buy an annuity generally falls between 50 and 70, as individuals start planning for retirement during this time. Investing in a Mesa Arizona Private Annuity Agreement early can be advantageous, providing more years for the investment to grow. It allows more strategic financial planning. However, the right age can vary based on personal financial situations.

The age 75 rule pertains to the tax treatment of annuity distributions. Essentially, it states that if you're over age 75, certain annuity withdrawals may be subject to different tax rules. If you're considering the implications of this rule in light of a Mesa Arizona Private Annuity Agreement, consulting a professional could be beneficial. U.S. Legal Forms can assist you in gaining clarity on these important financial matters.

Retirees in Arizona face various taxes, including income tax on pensions and annuities. While social security benefits are not taxed, other forms of income can be. Understanding this can help you better plan your retirement finances, especially if you're considering a Mesa Arizona Private Annuity Agreement. U.S. Legal Forms offers detailed information to help retirees navigate these tax considerations.

Yes, your retirement annuity could be subject to taxes based on your total income. This taxation often includes both federal and state levels, which is an important consideration when planning for retirement. Engaging in a Mesa Arizona Private Annuity Agreement may help create a more favorable tax situation for your annuity income. For personalized advice, U.S. Legal Forms offers a range of resources to assist you.

Arizona does impose taxation on retirement annuities. The law treats such income similarly to other forms of income, which can mean you may owe state taxes on the payments you receive. It’s wise to explore a Mesa Arizona Private Annuity Agreement, which can potentially offer tax advantages. Utilizing U.S. Legal Forms can provide you with the necessary documents for better management of your retirement income.

In Arizona, annuity income is generally subject to state income tax. However, the specific tax treatment can depend on various factors, including your total income and filing status. A Mesa Arizona Private Annuity Agreement may help you manage your tax liability in retirement. If you have further questions, consider consulting a tax professional or using resources from U.S. Legal Forms.