Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information. If such a request is made and is received within 60 days after the consumer learned of the adverse action, the user, within a reasonable period of time, must disclose to the consumer the nature of the information.

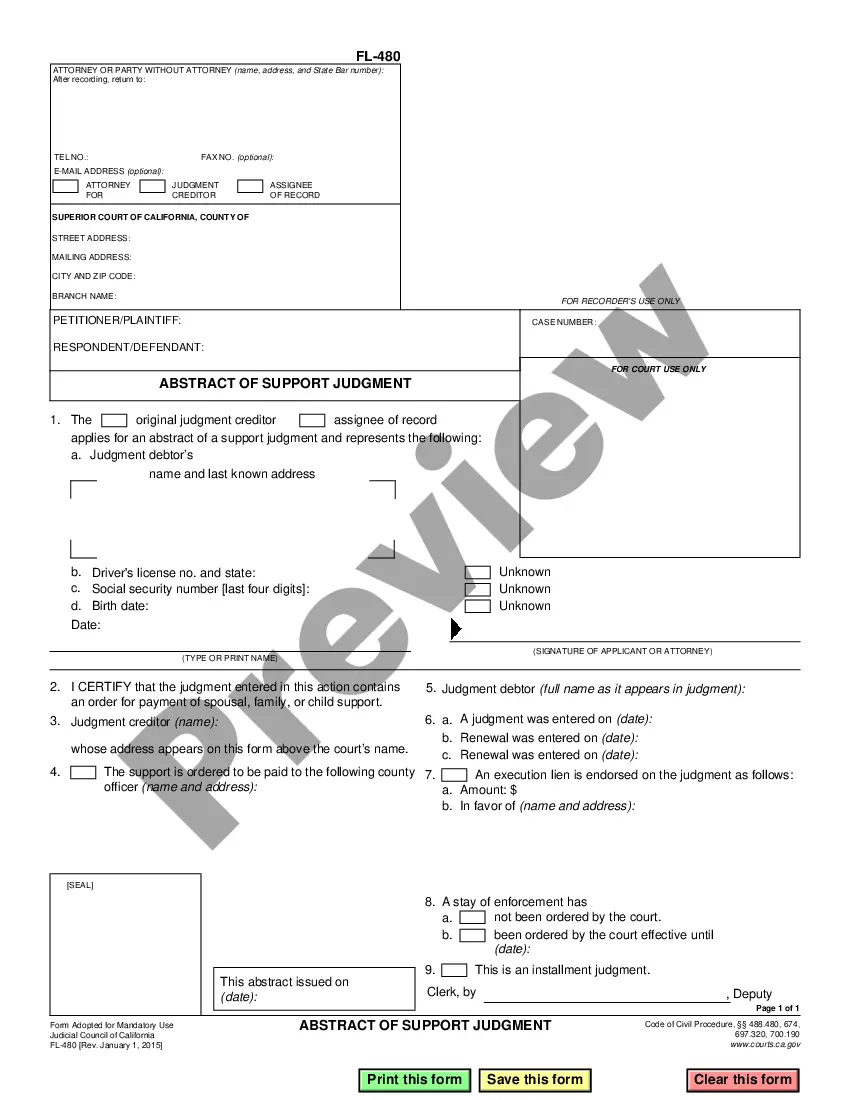

Orlando Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency

Description

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) requires credit reporting agencies to provide accurate and complete information in credit reports. Agencies must also ensure that consumers are notified of any negative information that impacts their credit score. Adhering to these standards not only helps consumers understand their credit dynamics but also relates to the Orlando Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency.

A credit agency can release someone's credit information in Florida when there is a clear, lawful purpose for doing so, which includes obtaining consumer consent, as seen in various financial transactions. This regulatory measure protects consumer interests while complementing systems like the Orlando Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency, ensuring transparency.

Yes, credit reporting agencies do share information, but they often do so with certain restrictions. They can share information with lenders and other parties with a legitimate and lawful purpose, such as determining creditworthiness. However, consumer consent is generally required, especially if the information is related to an Orlando Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency.

In Florida, a credit agency can release someone's credit information to an employer only if the consumer authorizes it, typically through a written consent form. This authorization must be provided before the employer can access the credit report. The process ensures that consumers are aware of who accesses their credit information, which is especially important related to Orlando Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency.

A person's credit report typically includes their personal details, such as name, address, and Social Security number. It also contains information about credit accounts, including payment history, credit limits, and outstanding balances. Additionally, public records like bankruptcies may be included. For anyone dealing with an Orlando Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency, understanding this information is crucial.

A negligent violation of the Fair Credit Reporting Act occurs when a credit reporting agency fails to exercise reasonable care in preparing a consumer's credit report. For example, if an agency does not update the credit file after receiving valid evidence of an error, this could serve as negligence. Such oversights can negatively impact a consumer's creditworthiness and financial opportunities. Staying updated on the Orlando Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency can help you protect your rights.

An example of a violation of the Fair Credit Reporting Act occurs when a credit reporting agency provides incorrect information to a lender without verifying accuracy. For instance, if a consumer's account is wrongly reported as delinquent, this constitutes a breach of their rights. Additionally, failing to remove outdated or inaccurate information from a consumer's report also represents a violation. Staying informed about laws like the Orlando Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency can help you address such issues.

To respond to a possible violation of the Fair Credit Reporting Act, first gather all relevant documentation related to the dispute. Next, reach out to the credit reporting agency and provide clear details about the violation. If necessary, you may also want to contact the creditor directly. Knowing your rights regarding the Orlando Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency can empower your response.

When your credit report states that account information disputed by the consumer meets the Fair Credit Reporting Act (FCRA) requirements, it typically means the credit report has noted your dispute. This notation indicates that the dispute has been recorded, and the information is still being verified. Furthermore, the reporting agency must correct or remove any inaccurate information once the dispute is settled. Understanding this can clarify your position, especially regarding the Orlando Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency.

The Consumer Financial Protection Bureau (CFPB) provides several model forms for notices of action taken. These forms help ensure compliance with credit laws and help consumers understand their rights. They typically include formats for notifying consumers about adverse actions such as increases in charges or denials based on credit information. Utilizing these forms can be beneficial when dealing with scenarios involving the Orlando Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency.