An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Collin Texas Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

Legislation and policies across various sectors differ throughout the nation.

If you're not an attorney, it can be challenging to navigate the diverse rules regarding the preparation of legal documents.

To steer clear of expensive legal fees when drafting the Collin Petition to Demand Accounting from Estate Trustee, you require a verified template applicable in your area.

This is the simplest and most cost-effective way to obtain updated templates for any legal conditions. Find them quickly and maintain your documents organized with the US Legal Forms!

- That's where the US Legal Forms platform proves to be advantageous.

- US Legal Forms is a resource trusted by millions, featuring over 85,000 state-specific legal templates.

- It serves as an ideal solution for professionals and individuals seeking DIY templates for various personal and business situations.

- All documents can be utilized multiple times: once you acquire a template, it will remain accessible in your profile for future use.

- Therefore, when you possess an account with a valid subscription, you can simply Log In and re-download the Collin Petition to Demand Accounting from Estate Trustee from the My documents section.

- For first-time users, it is important to follow a few additional steps to secure the Collin Petition to Demand Accounting from Estate Trustee.

- Review the page content to confirm you have located the correct sample.

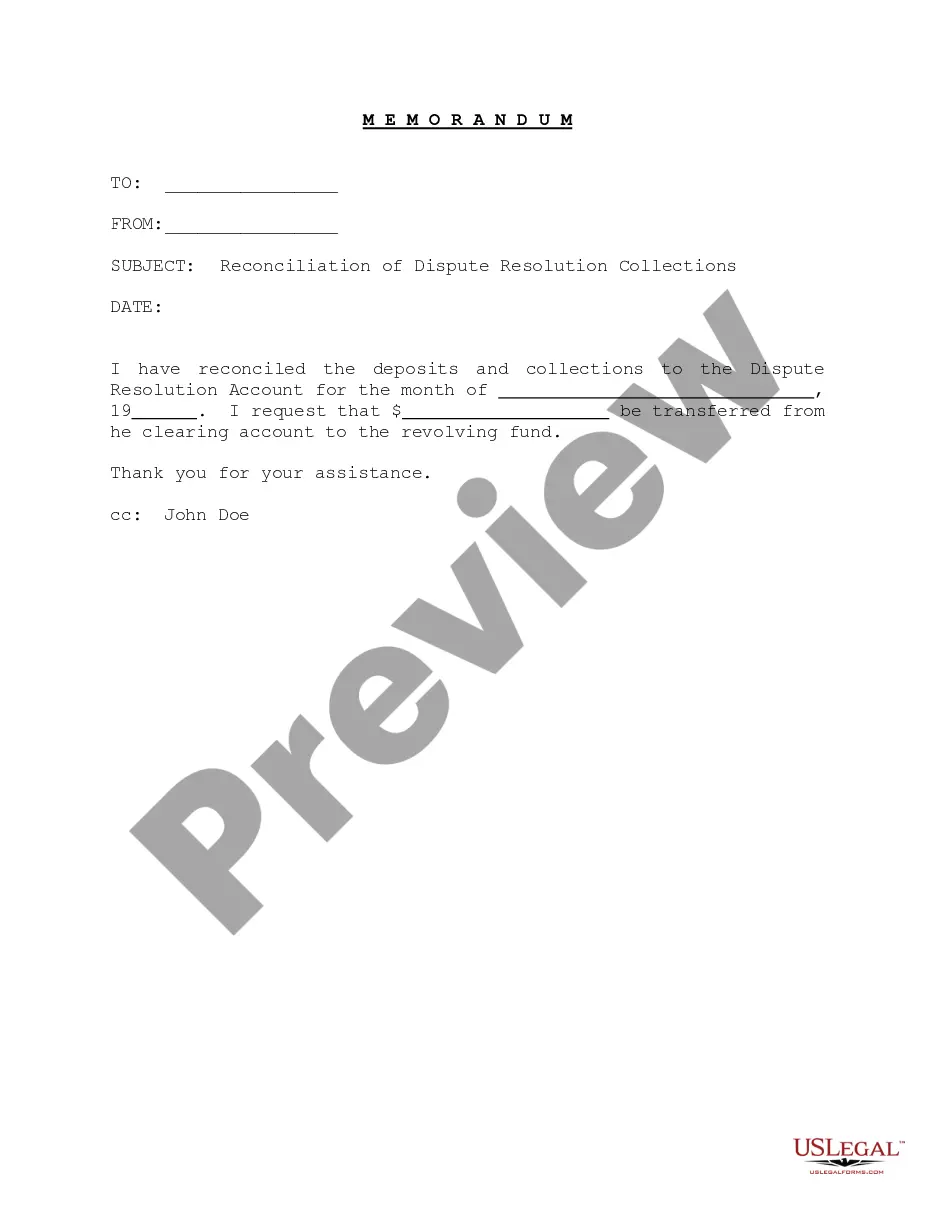

- Utilize the Preview feature or examine the form description if provided.

- Look for an alternative document if discrepancies arise with any of your specifications.

- Click the Buy Now button to purchase the template once you identify the right one.

- Select one of the subscription plans and log in or set up a new account.

- Decide how you wish to pay for your subscription (via credit card or PayPal).

- Choose the format in which you want to save the document and click Download.

- Fill out and sign the template in writing after printing it or complete it electronically.

Form popularity

FAQ

An estate accounting is a document that provides specific details about what property was in the estate at the time of the decedent's death, what additional property came into the estate since the decedent's death, how the estate funds were spent, what property remains in the estate at the time that the accounting is

To file, you bring a petition under section 17200, which gives the court the power to issue orders regarding the internal affairs of the Trust. Section 17200 provides a long list of actions that the court can take to help you fix problems with a bad Trustee.

An executor must account to the residuary beneficiaries named in the Will (and sometimes to others) for all the assets of the estate, including all receipts and disbursements occurring over the course of administration.

Before any interested person can file a court petition to compel an accounting, they must make a 60 day written demand to the trustee. If the 60 day demand is not met, then they can file a petition to compel accounting with the court.

The two primary reasons to compel an account are: 1) to check the status of trust assets; and 2) to determine if the trustee is acting within his or her discretion or has breached a duty.

If beneficiaries suspect a trustee of theft or mismanagement, they can request that the trustee provide a detailed list of all dealings with the estate. Called an accounting proceeding, this acts as an audit for a trust or estate administrator's actions and can ultimately lead to legal action against the trustee.

A petition, asking the court to approve the accounting (if filed), approve the distribution of the estate assets, plus any additional matters that require court approval (such as allowing fees to the representative or the attorney).

The general rule in Texas is that the executor has four years from the date of death of the testator (person who drafted the will) to file for probate.