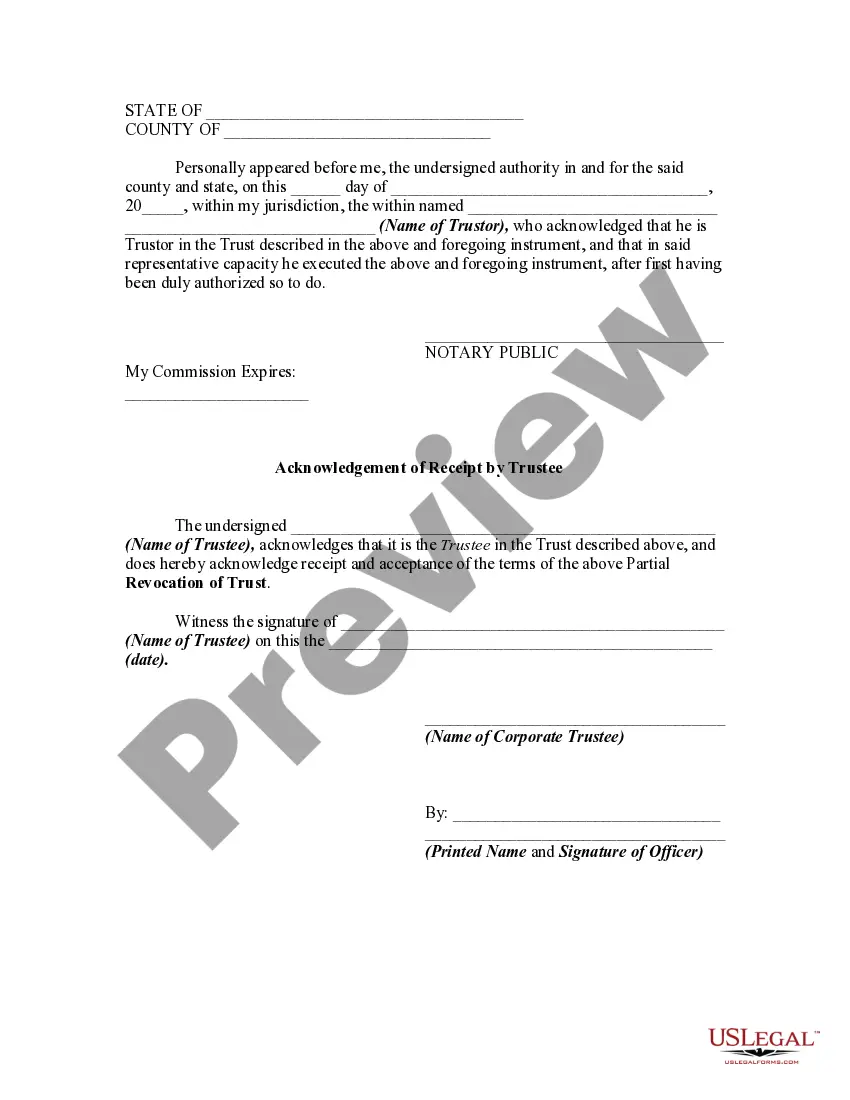

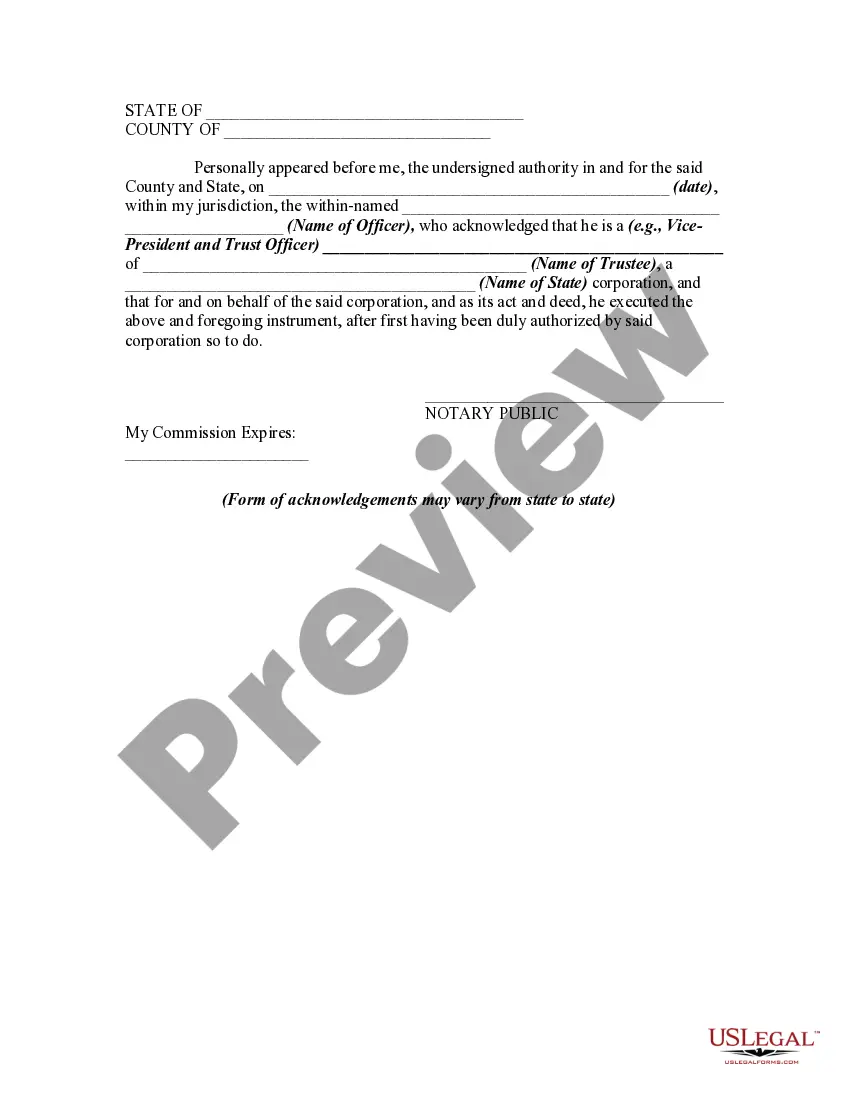

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Harris Texas Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee Introduction: In Harris County, Texas, the concept of partial revocation of a trust holds significant importance. When certain circumstances necessitate altering the terms or provisions of an existing trust, Harris Texas Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee come into play. This article delves into the various types of partial trust revocations available in Harris County, Texas and sheds light on the role of the trustee in acknowledging the receipt of notice regarding these changes. Types of Harris Texas Partial Revocation of Trust: 1. Partial Revocation by Addition: This type of revocation allows for new provisions or terms to be incorporated into an existing trust, providing an opportunity for beneficiaries to receive updated benefits or assets. 2. Partial Revocation by Removal: In some cases, a trust or may wish to remove specific provisions or beneficiaries from the trust. Partial revocation by removal enables the trust or to eliminate certain aspects while keeping the rest of the trust intact. 3. Partial Revocation by Amendment: An alternative to the aforementioned types, partial revocation by amendment permits the modification of existing provisions within a trust. This allows the trust or to alter specific terms or conditions while upholding the general framework of the original trust. Acknowledgment of Receipt of Notice of Partial Revocation by Trustee: In Harris County, it is crucial for the trustee to acknowledge the receipt of notice regarding partial revocations. This step ensures transparency and effective communication between the trust or and the trustee, safeguarding the interests of all parties involved. The acknowledgment should include specific details such as the date of receipt, the nature of the partial revocation, and any subsequent actions to be taken by the trustee. Keywords: — Harris Texas Partial Revocation of Trust — Trust Revocatioadditionio— - Trust Revocation by Removal — Trust Revocatioamendmenten— - Acknowledgment of Receipt — Notice of Partial Revocation by Trustee Trust oror - Trustee - Beneficiaries - Harris County, Texas. Conclusion: Harris Texas Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee play a significant role in Harris County, Texas, when amendments or modifications are required within an existing trust. Understanding the different types of partial trust revocations and the importance of trustee acknowledgment fosters clear communication and ensures a seamless transition to revised provisions. If you find the need to enact changes in a trust, consulting a legal professional experienced in Texas trust laws is recommended.