The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Bronx New York Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor

Description

How to fill out Complaint Objecting To Discharge Of Debtor In Bankruptcy Due To False Oath Or Account Of Debtor?

Organizing documentation for professional or personal requirements is always a significant obligation.

When drafting an agreement, a civic service appeal, or a power of attorney, it's crucial to take into account all national and state laws of the particular area.

Nevertheless, minor counties and even municipalities have legislative processes that you must consider.

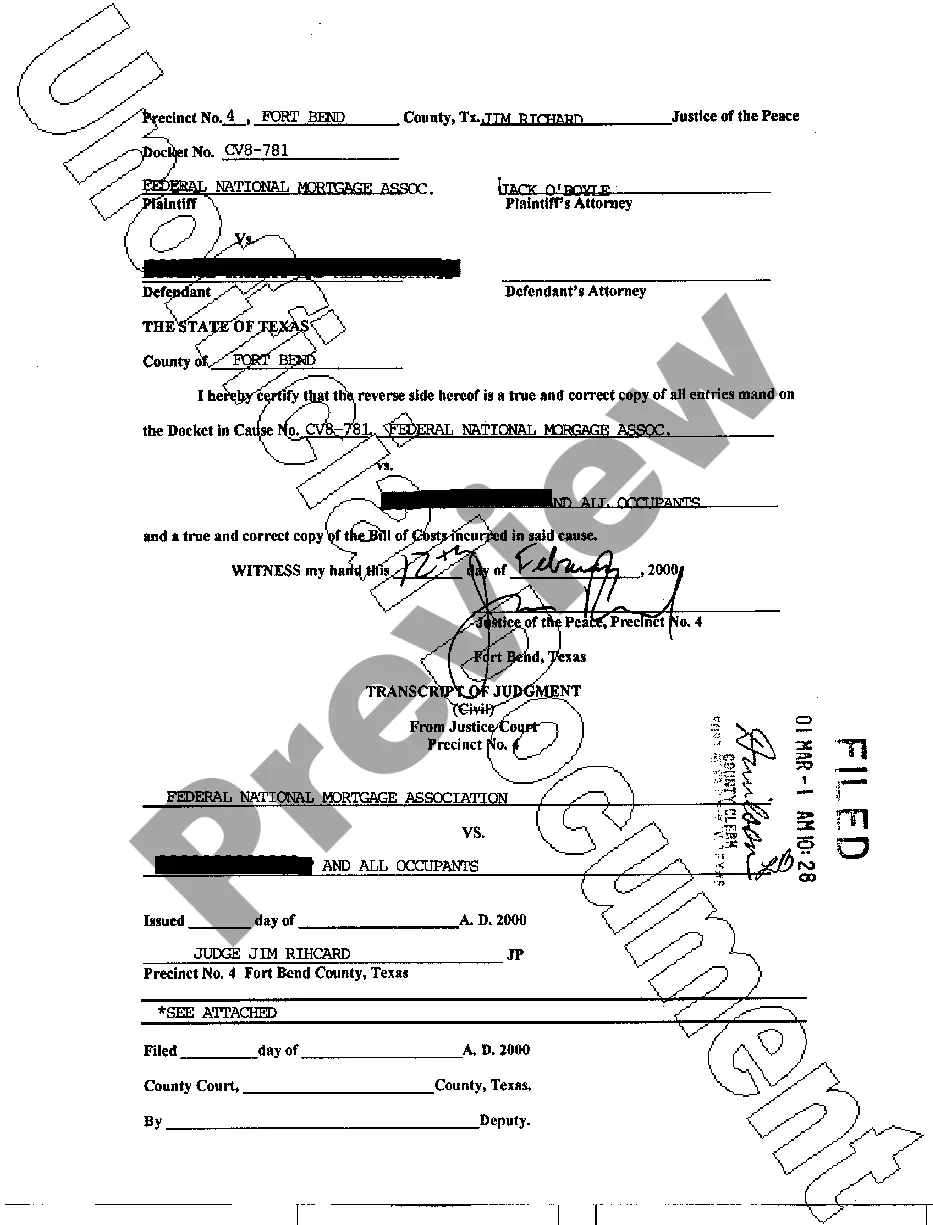

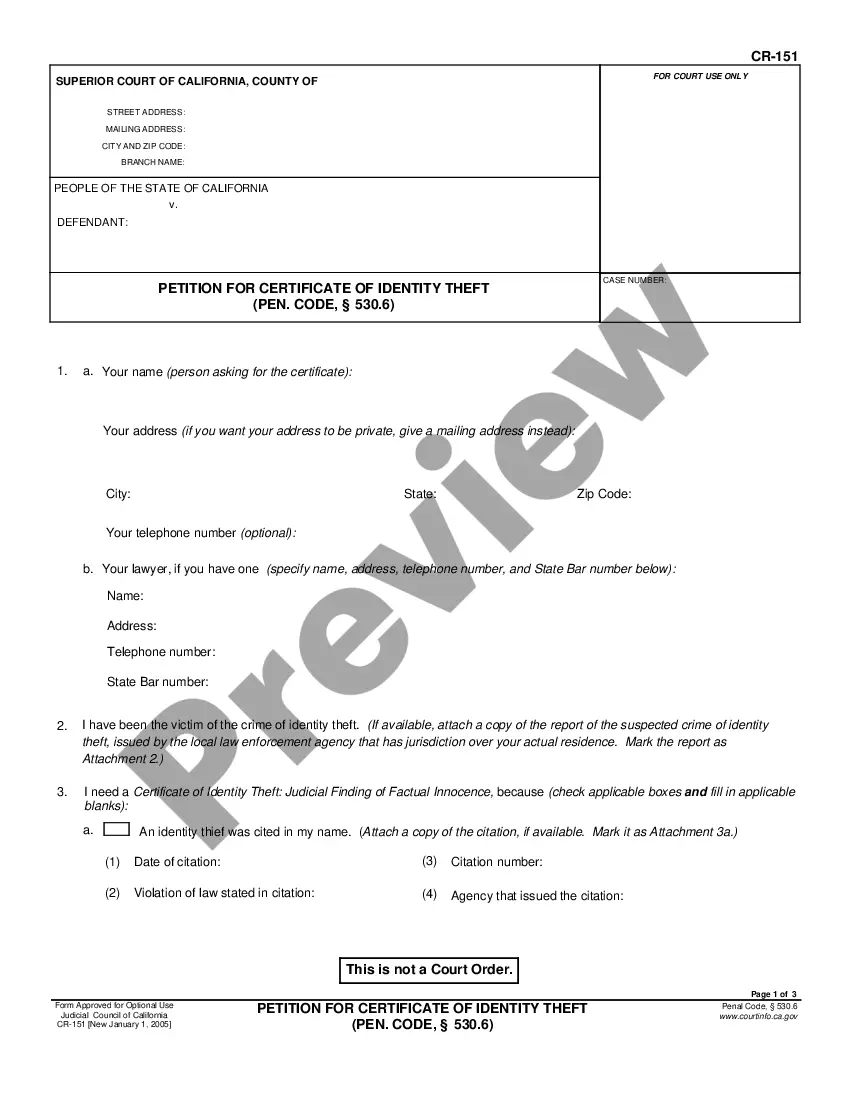

To accomplish this, utilize the form description and preview if those options are available.

- All these factors make it burdensome and time-consuming to produce Bronx Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor without specialised assistance.

- It's possible to avoid incurring expenses on lawyers drafting your documents and create a legally valid Bronx Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor by yourself, utilizing the US Legal Forms online archive.

- This is the largest online collection of state-specific legal templates that have been professionally validated, providing you assurance of their legitimacy when selecting a sample for your county.

- Formerly subscribed users just need to Log In to their accounts to retrieve the necessary document.

- If you haven't subscribed yet, follow the step-by-step guide below to acquire the Bronx Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor.

- Browse the page you've opened and verify if it contains the document you require.

Form popularity

FAQ

True. A bankruptcy court can indeed deny a discharge based on a debtor’s conduct, particularly if there's evidence of fraud or dishonesty. This includes situations related to the Bronx New York Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor. Ensure you fully understand your conduct and obligations to avoid potential denial.

The provision excepts from discharge a debt owed to a spouse, former spouse or child of the debtor, in connection with a separation agreement, divorce decree, or property settlement agreement, for alimony to, maintenance for, or support of such spouse or child but not to the extent that the debt is assigned to another

In a Chapter 7 bankruptcy, a creditor or trustee can either object to the discharge of a particular debt or they can object to the discharge of all of your debts. If a creditor objects to a specific debt, it will not affect any of the other debts in your case.

Normally the only way for a court to deny you a discharge is if you are either dishonest or you fail to follow court rules and requirements.... Attempt to Defraud.Concealing or Destroying Information.Lying.Loss of assets.Refusal to comply with court order.Failure to take instructional course.

If you hide assets, lie on your bankruptcy papers, file for bankruptcy solely to delay creditors, or otherwise abuse the bankruptcy system, the bankruptcy trustee can ask the court to deny you a discharge for all your debts.

All creditors are also entitled to challenge the debtor's right to a discharge. Not all creditors are treated equally in a bankruptcy case. All creditors are entitled to share in payment from the bankruptcy estate, but only according to the priority of their claims.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors;

5 Reasons Your Bankruptcy Case Could Be Denied The debtor failed to attend credit counseling. Their income, expenses, and debt would allow for a Chapter 13 filing. The debtor attempted to defraud creditors or the bankruptcy court. A previous debt was discharged within the past eight years under Chapter 7.

Subdivision (a) is amended to clarify that, in a chapter 7 case, the deadline for filing a complaint objecting to discharge under §727(a) is 60 days after the first date set for the meeting of creditors, whether or not the meeting is held on that date.

If the court grants a creditor or trustee's objection to a debt discharge, you'll remain responsible for paying the debt. Usually, when you file for Chapter 7 bankruptcy and make it through your meeting of creditors, you have nothing but smooth sailing ahead.