This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Clark Nevada Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty

Description

How to fill out Clark Nevada Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease With Mortgage Securing Guaranty?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Clark Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Clark Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty from the My Forms tab.

For new users, it's necessary to make several more steps to get the Clark Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty:

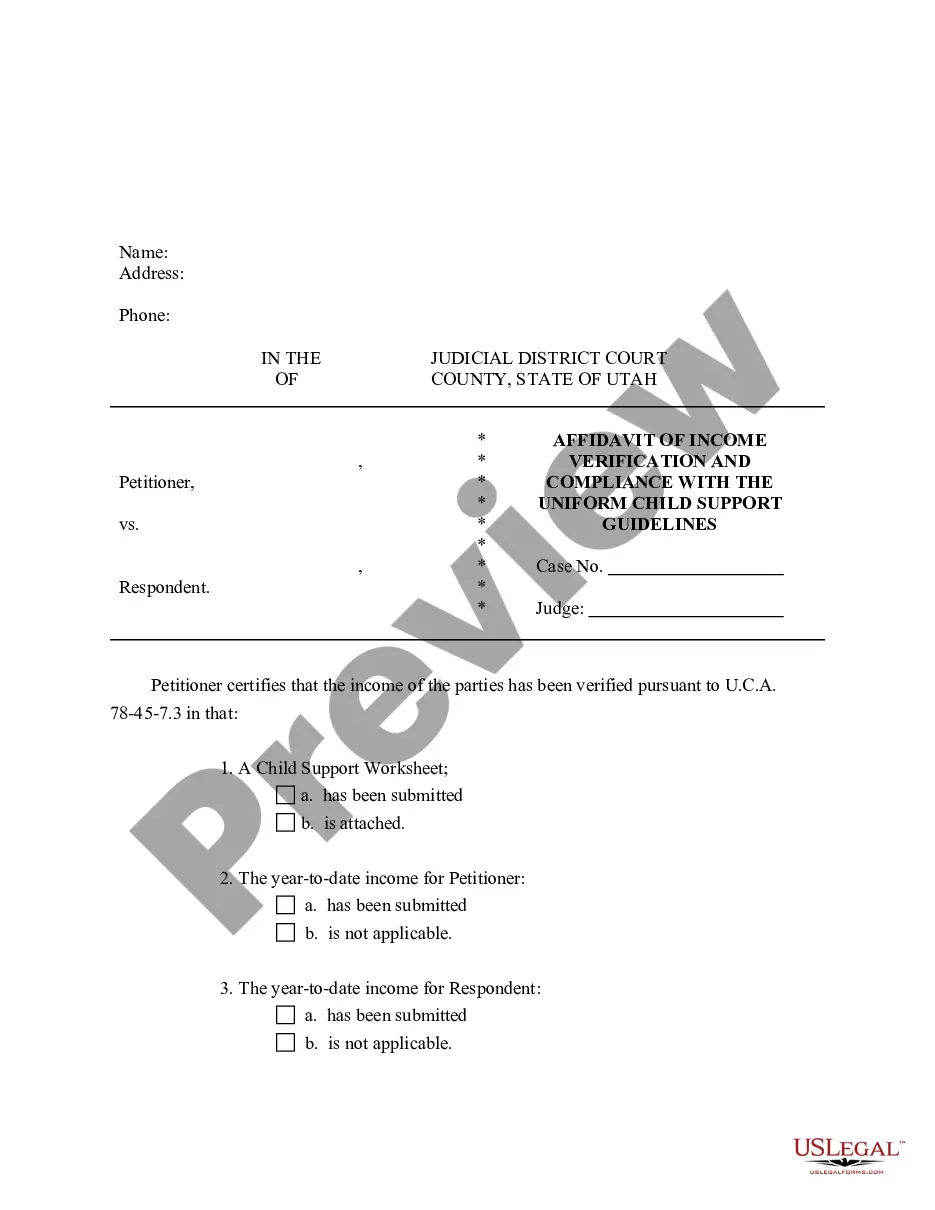

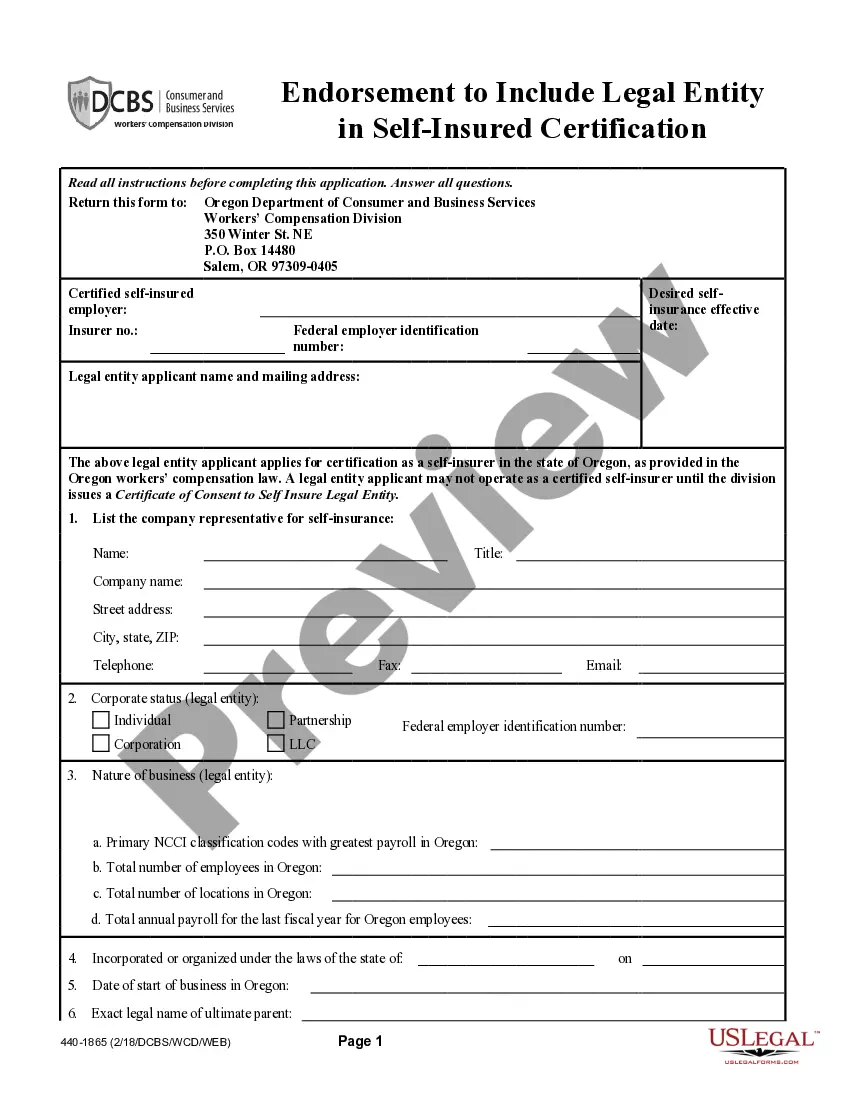

- Examine the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Guarantee of collection means a loan guarantee under which the authority agrees to pay according to the terms of the guarantee agreement if the instrument is not paid when due and the participating lender has pursued all reasonable efforts relative to collection. Sample 1.

Put another way, a guaranty of collection requires that the debtor must exhaust certain remedies against the debtor before proceeding against the guarantor, while a guaranty of payment means that the lender can proceed directly against the guarantor even if the debtor is solvent and otherwise able to pay.

A deed guaranteeing the performance of a party's payment obligations under a commercial agreement. For drafting purposes, one party agrees to guarantee to the other party the payment obligations of a third party under a commercial agreement.

A typical mortgage loan requires the borrower and/or its principals to execute a bad boy guaranty (a/k/a recourse carve out guaranty), which provides for personal liability against the borrower and principals of borrower upon the occurrence of certain enumerated bad acts committed by the borrower or its principals.

A continuing guarantee is defined under section 129 of the Indian Contract Act,1872. A continuing guarantee is a type of guarantee which applies to a series of transactions. It applies to all the transactions entered into by the principal debtor until it is revoked by the surety.

Specific Guarantee: A specific guarantee is for a single debt or any specified transaction. It comes to an end when such debt has been paid. Continuing Guarantee: A continuing guarantee is a type of guarantee which applies to a series of transactions.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

Properly drafted, this guaranty permits the lender to force one or more of the guarantors to make every payment that would have been due from the borrower. In other words, whatever the borrower's obligations to the lender may be (at least in terms of payment), the guarantor has the same obligations.

Continuing guarantee: Meaning In the former event which is a simple guarantee, the suretyfffds liability come to an end as soon as payment is made by principal debtor for the goods sold. While in the continuing guarantee, the surety remains liable for future transactions to the extent of his guarantee.