Franklin Ohio Partial Assignment of Life Insurance Policy as Collateral

Description

How to fill out Partial Assignment Of Life Insurance Policy As Collateral?

An administrative procedure is always associated with any lawful action you undertake.

Establishing a business, submitting or accepting a job proposal, transferring assets, and numerous other life situations require you to prepare official documents that vary across the nation.

This is why having it all consolidated in one location is incredibly beneficial.

US Legal Forms represents the largest online compilation of current federal and state-specific legal documents.

Select the appropriate subscription plan, then Log In or create an account. Choose the preferred payment method (using credit card or PayPal) to continue. Pick the file format and download the Franklin Partial Assignment of Life Insurance Policy as Collateral to your device. Utilize it as necessary: print it or complete it electronically, sign it, and file where required. This is the simplest and most dependable method to acquire legal documents. All templates offered by our library are expertly drafted and verified for compliance with local laws and regulations. Prepare your documents and manage your legal matters effectively with the US Legal Forms!

- On this site, you can effortlessly locate and obtain a document for any personal or commercial purpose relevant to your area, including the Franklin Partial Assignment of Life Insurance Policy as Collateral.

- Finding templates on the site is exceptionally easy.

- If you already have a subscription to our service, Log In to your account, search for the sample using the search bar, and click Download to save it on your device.

- After that, the Franklin Partial Assignment of Life Insurance Policy as Collateral will be available for additional use in the My documents section of your profile.

- If you are encountering US Legal Forms for the first time, follow this straightforward guideline to acquire the Franklin Partial Assignment of Life Insurance Policy as Collateral.

- Ensure you have accessed the correct page with your localized form.

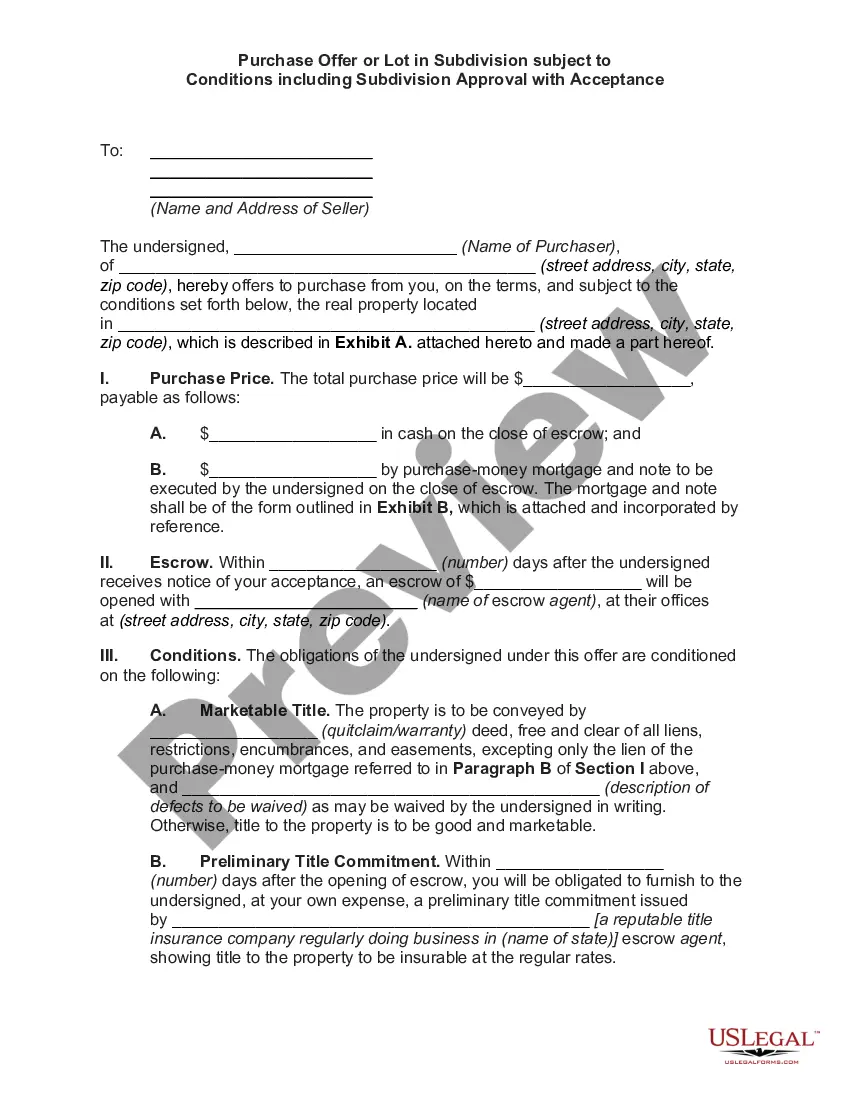

- Utilize the Preview mode (if accessible) and scroll through the sample.

- Examine the description (if provided) to confirm the template fits your requirements.

- Look for another document using the search tab if the sample does not satisfy you.

- Click Buy Now when you locate the required template.

Form popularity

FAQ

The two major classifications of insurance are property and casualty insurance, along with life and health insurance. Property and casualty cover risks related to assets, while life and health insurance protect individuals against health-related expenses and life valuation. Understanding these classifications can enhance your approach to insurance. With a Franklin Ohio Partial Assignment of Life Insurance Policy as Collateral, you can use insurance strategically for various financial engagements.

To make a collateral assignment, you need to fill out an assignment form, which typically includes the details of the life insurance policy and the lender's information. This process is part of a Franklin Ohio Partial Assignment of Life Insurance Policy as Collateral. Once the form is completed, you should submit it to your insurance company to officially establish the assignment and ensure all parties are informed of their rights and obligations.

To use a life insurance policy as collateral, you must first identify a lender willing to accept this type of security. Once you agree to the terms, you will complete a Franklin Ohio Partial Assignment of Life Insurance Policy as Collateral, which legally transfers the policy's benefits to the lender. You should always seek legal advice to ensure compliance with state laws and lender requirements.

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.

Privisions QuestionAnswerA provision in life insurance policy that pays the policy owner an amount that does not surpass the guaranteed cash value is calledPolicy Loan ProvisionThe consideration clause in a life insurance contract contains what pertinent information?Amount of premium payments and when they are due23 more rows

Which of these actions is taken when a policyowner uses a Life Insurance policy as collateral for a bank loan? Collateral assignment" A policyowner using the Life Insurance policy as collateral for a bank loan normally would make a collateral assignment.

Under a collateral assignment split dollar arrangement, the business loans a key employee money to pay the premium on a life insurance policy. The employee pledges the policy as collateral for the loan.

Any type of life insurance policy is acceptable for collateral assignment, provided the insurance company allows assignment for the policy. A permanent life insurance policy with a cash value allows the lender access to the cash value to use as loan payment if the borrower defaults.

Whole life insurance policy must be issued by one of the following approved insurance carriers to be eligible as collateral: Guardian Life, New York Life, MassMutual, Metropolitan Life, John Hancock, Northwestern Mutual, Brighthouse Financial, Penn Mutual Ohio National Life Insurance Company, and Pacific Life.

Collateral refers to the cash value in a life insurance policy whole life or universal life policies that build up cash value but it does not apply to term policies.