For use in all states except AK,FL,ME,NY,PR,VT,VA,WV,WI

Travis Texas Multistate Promissory Note - Unsecured - Signature Loan

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

How long does it typically take you to create a legal document.

Since each state has its own laws and regulations for various aspects of life, locating a Travis Multistate Promissory Note - Unsecured - Signature Loan that meets all regional criteria can be exhausting, and hiring a professional lawyer is frequently expensive.

Many online platforms provide the most sought-after state-specific templates for download, but utilizing the US Legal Forms library is the most beneficial.

Regardless of how many times you need to utilize the acquired document, you can find all the samples you’ve ever downloaded in your account by accessing the My documents section. Give it a try!

- US Legal Forms is the largest online collection of templates, organized by states and usage areas.

- Besides the Travis Multistate Promissory Note - Unsecured - Signature Loan, you can access any particular document necessary to manage your business or personal affairs, adhering to your local specifications.

- Experts validate all samples for their legality, ensuring that you can prepare your documents accurately.

- Utilizing the service is incredibly straightforward.

- If you already possess an account on the platform and your subscription is current, you simply need to Log In, choose the required sample, and download it.

- You can store the file in your account at any time in the future.

- Alternatively, if you are new to the site, there will be a few additional steps to complete before acquiring your Travis Multistate Promissory Note - Unsecured - Signature Loan.

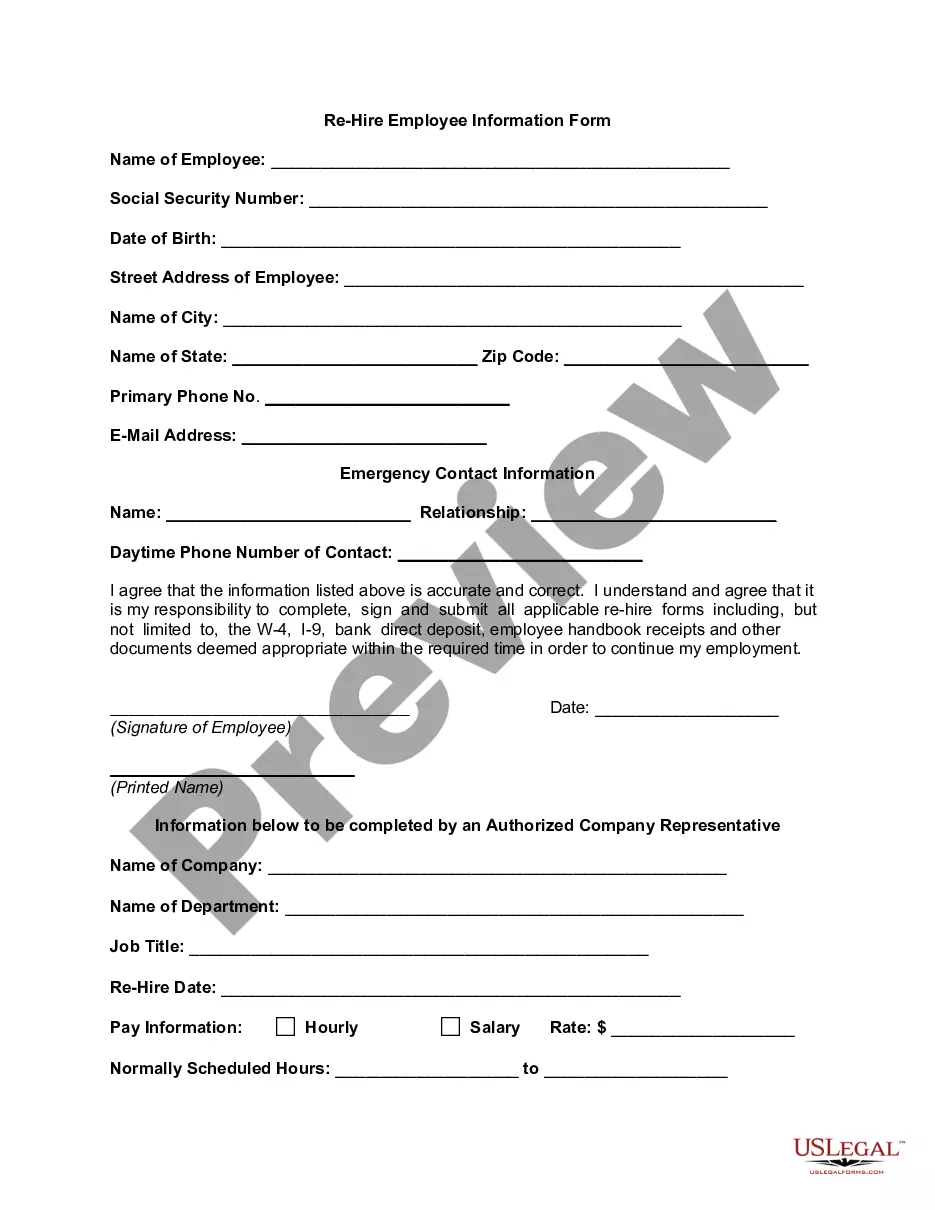

- Review the content of the page you are on.

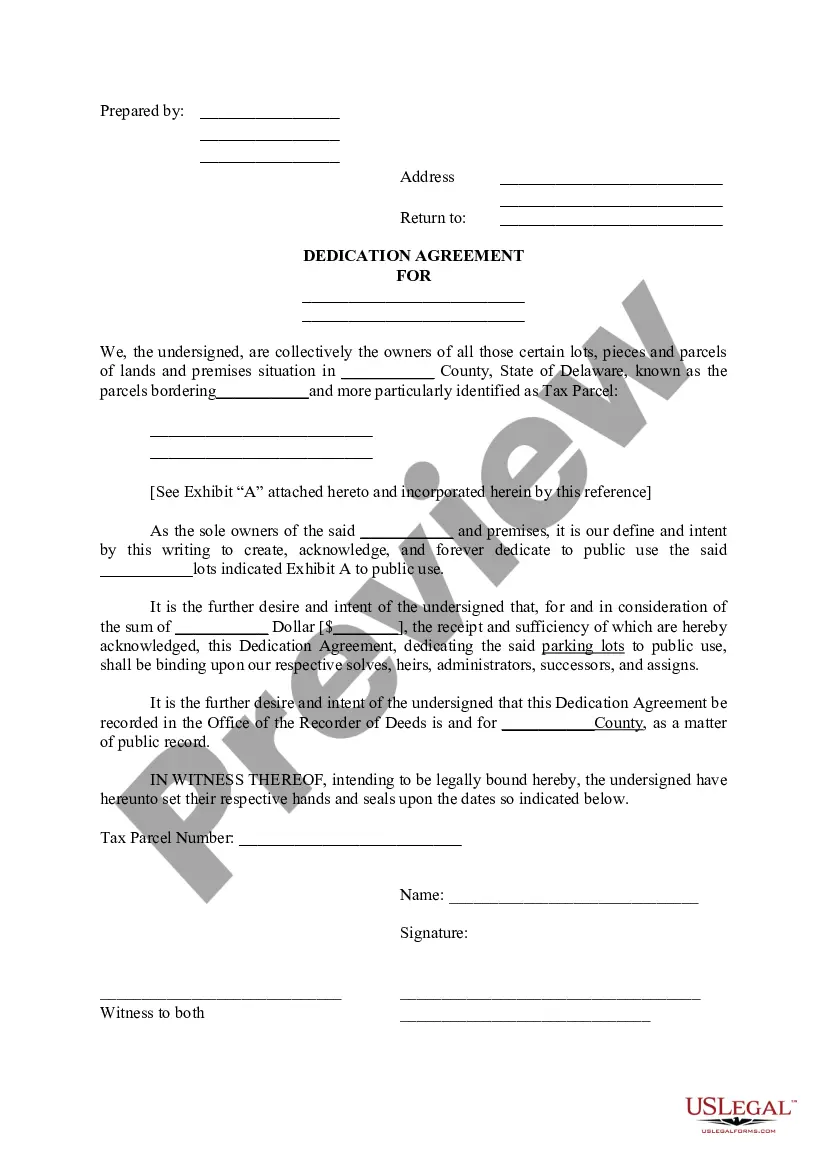

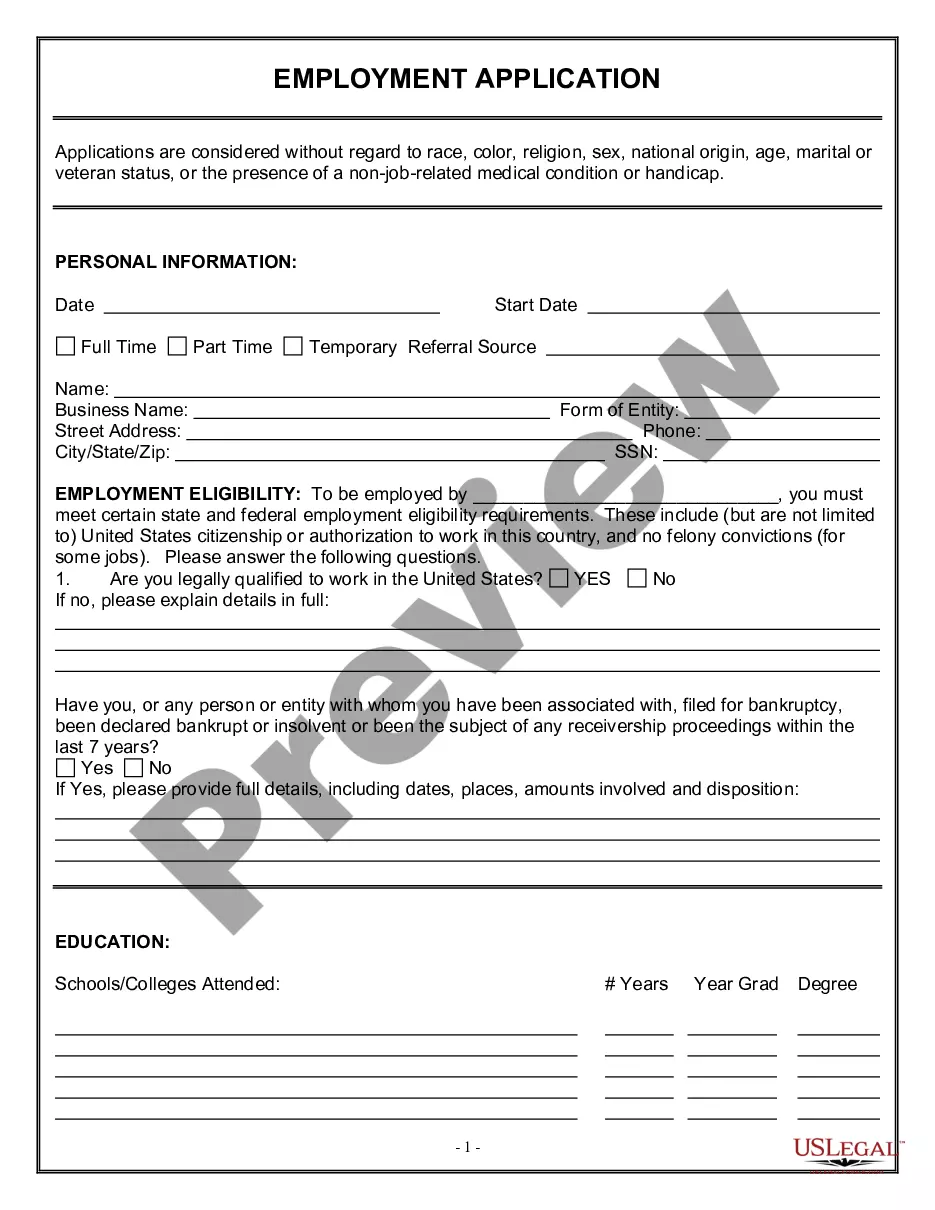

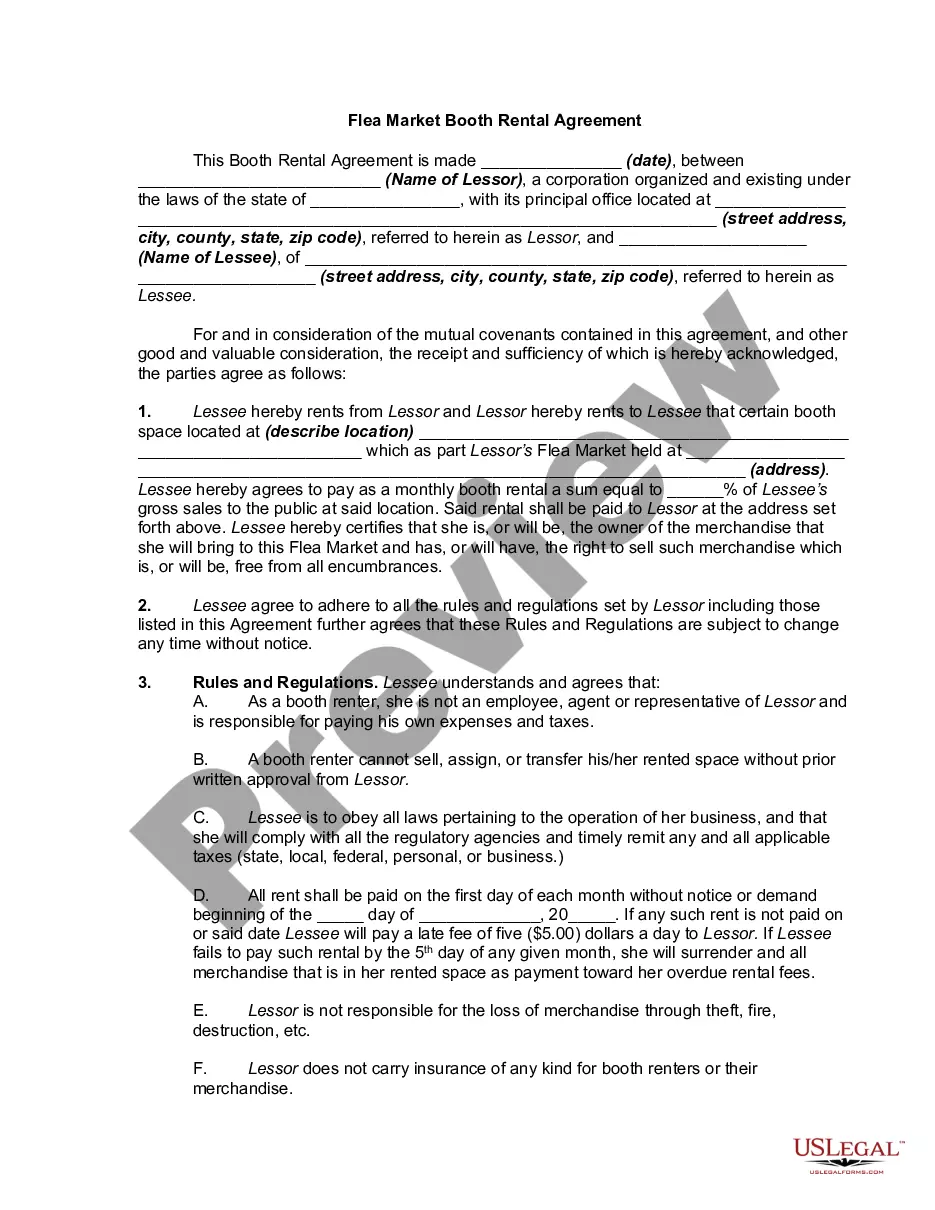

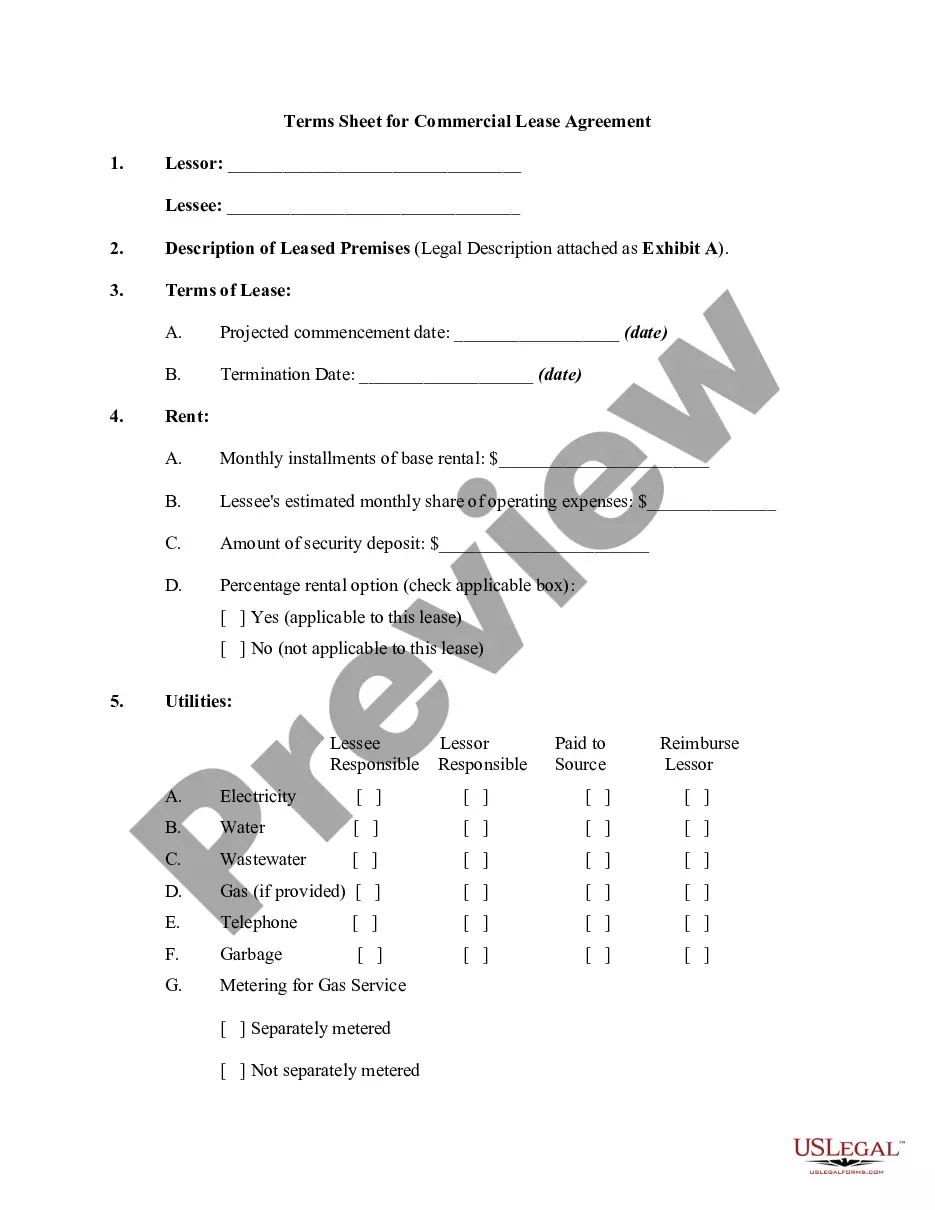

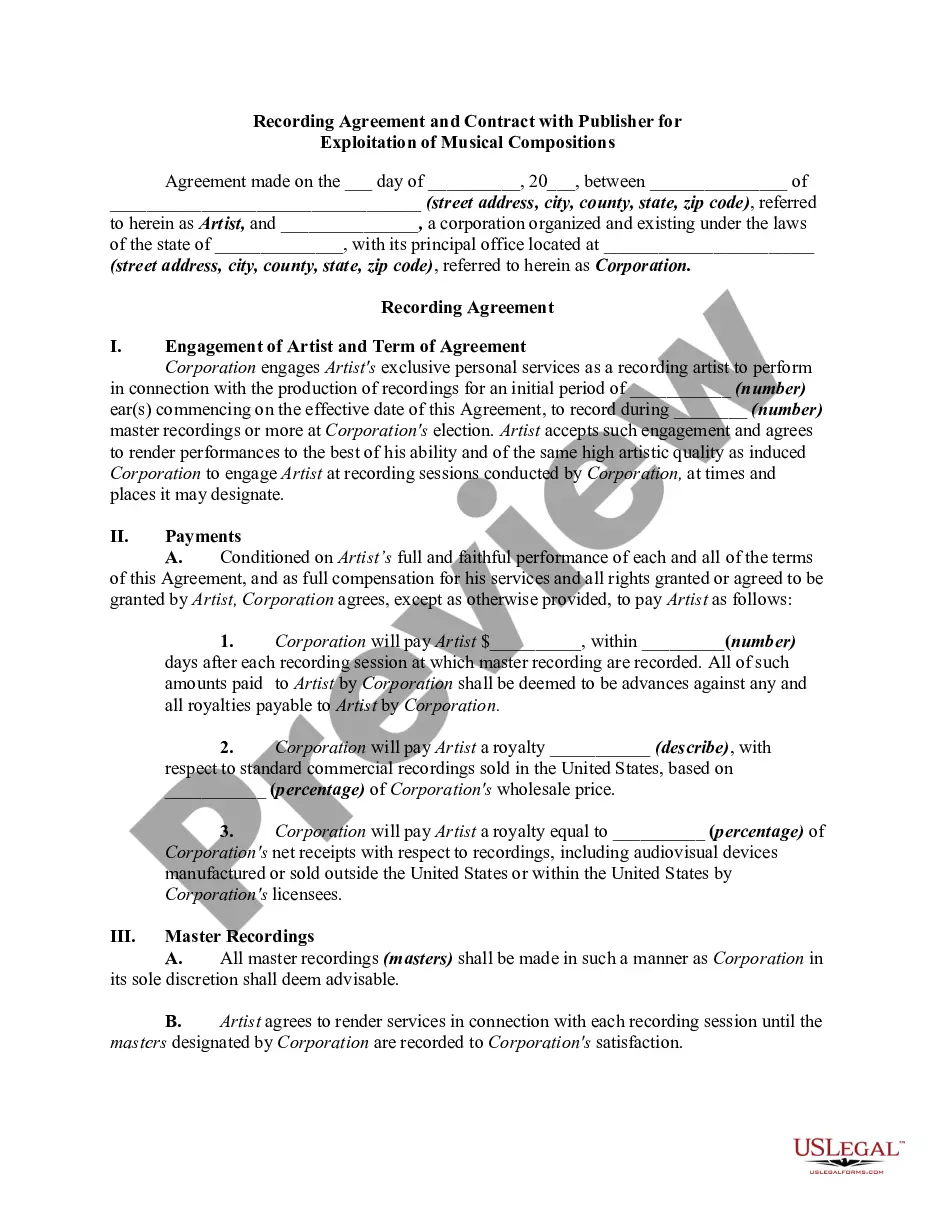

- Examine the description of the sample or Preview it (if available).

- Look for another document using the appropriate option in the header.

- Press Buy Now when you are confident in the chosen file.

- Choose the subscription plan that fits you best.

- Establish an account on the platform or Log In to proceed to payment methods.

- Complete the transaction via PayPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Travis Multistate Promissory Note - Unsecured - Signature Loan.

- Print the document or use any chosen online editor to complete it electronically.

Form popularity

FAQ

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

Collecting on an unsecured promissory note through the courts is a two-step process. First, you need to go through the court process to obtain a judgment against the borrower. Then you need to try to attach the borrower's wages, bank accounts, or other assets in order actually get paid.

A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

In order for a promissory note to be legally binding, it must include the signature of the borrower. You generally are not required by law to have the signatures witnessed or notarized. However, these two steps can add a layer of protection particularly if the two parties do not know and trust each other.

Unsecured Promissory NotesAn unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

BORROWER'S PROMISE TO PAY.INTEREST.PAYMENTS.BORROWER'S RIGHT TO PREPAY.LOAN CHARGES.BORROWER'S FAILURE TO PAY AS REQUIRED.GIVING OF NOTICES.OBLIGATIONS OF PERSONS UNDER THIS NOTE.More items...

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.