For use in all states except AK,FL,ME,NY,PR,VT,VA,WV,WI

Tarrant Texas Multistate Promissory Note - Unsecured - Signature Loan

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

A paperwork routine consistently accompanies any legal undertaking you initiate.

Launching a company, applying for or accepting a job proposal, changing ownership, and many other life situations require you to prepare formal documents that vary from jurisdiction to jurisdiction.

This is why having everything gathered in one location is extremely advantageous.

US Legal Forms is the largest online collection of current federal and state-specific legal forms.

This is the simplest and most trustworthy method to acquire legal documents. All the samples offered by our library are professionally prepared and confirmed for compliance with local laws and regulations. Prepare your documentation and manage your legal matters efficiently with US Legal Forms!

- On this site, you can effortlessly find and download a document for any personal or commercial purpose used in your area, including the Tarrant Multistate Promissory Note - Unsecured - Signature Loan.

- Finding samples on the site is exceptionally uncomplicated.

- If you already possess a subscription to our library, Log In to your account, search for the sample using the search bar, and click Download to save it on your device.

- Subsequently, the Tarrant Multistate Promissory Note - Unsecured - Signature Loan will be accessible for further use in the My documents section of your profile.

- If you're using US Legal Forms for the first time, follow this brief guide to obtain the Tarrant Multistate Promissory Note - Unsecured - Signature Loan.

- Make sure you open the correct page with your localized form.

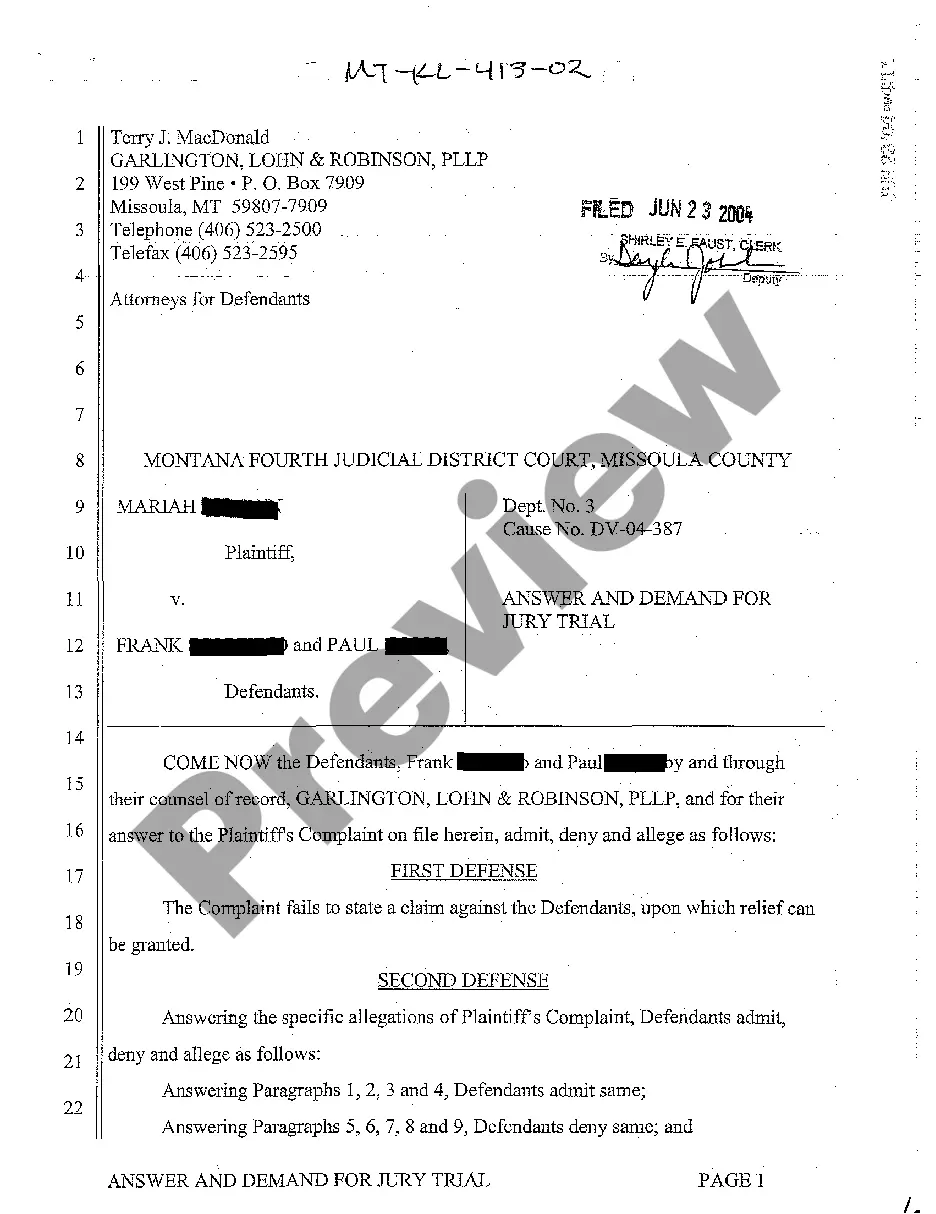

- Utilize the Preview mode (if available) and browse through the sample.

- Review the description (if any) to confirm that the form satisfies your needs.

- Look for an alternative document using the search option if the sample does not suit you.

- Click Buy Now when you find the necessary template.

- Choose the appropriate subscription plan, then Log In or create an account.

- Select the chosen payment method (via credit card or PayPal) to proceed.

- Pick the file format and save the Tarrant Multistate Promissory Note - Unsecured - Signature Loan on your device.

- Utilize it as needed: print it or complete it electronically, sign it, and send it where necessary.

Form popularity

FAQ

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Unsecured Promissory NotesAn unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

Collecting on an unsecured promissory note through the courts is a two-step process. First, you need to go through the court process to obtain a judgment against the borrower. Then you need to try to attach the borrower's wages, bank accounts, or other assets in order actually get paid.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).