Travis Texas Affidavit Regarding the Identity of a Grantor and Grantee of Real Property

Description

How to fill out Affidavit Regarding The Identity Of A Grantor And Grantee Of Real Property?

Laws and statutes in every region differ across the nation.

If you're not an attorney, it's simple to feel overwhelmed by numerous standards when it comes to drafting legal paperwork.

To prevent costly legal fees when preparing the Travis Affidavit Concerning the Identity of a Grantor and Grantee of Real Property, you require a verified template suitable for your area.

Choose your preferred method to pay for your subscription (via credit card or PayPal). Select the format you wish to save the file in and click Download. Fill out and sign the template in writing after printing it, or complete everything electronically. This is the simplest and most cost-effective approach to obtain current templates for any legal needs. Find them all in clicks and keep your documents organized with US Legal Forms!

- This is where the US Legal Forms platform proves to be so beneficial.

- US Legal Forms is a reliable collection utilized by millions, featuring over 85,000 state-specific legal documents.

- It serves as an outstanding solution for both professionals and individuals seeking do-it-yourself templates for a variety of life and business situations.

- All the forms can be utilized multiple times: once you acquire a sample, it remains accessible in your profile for future usage.

- Therefore, if you possess an account with a valid subscription, you can simply Log In and re-download the Travis Affidavit Concerning the Identity of a Grantor and Grantee of Real Property from the My documents section.

- For new users, several additional steps are needed to obtain the Travis Affidavit Concerning the Identity of a Grantor and Grantee of Real Property.

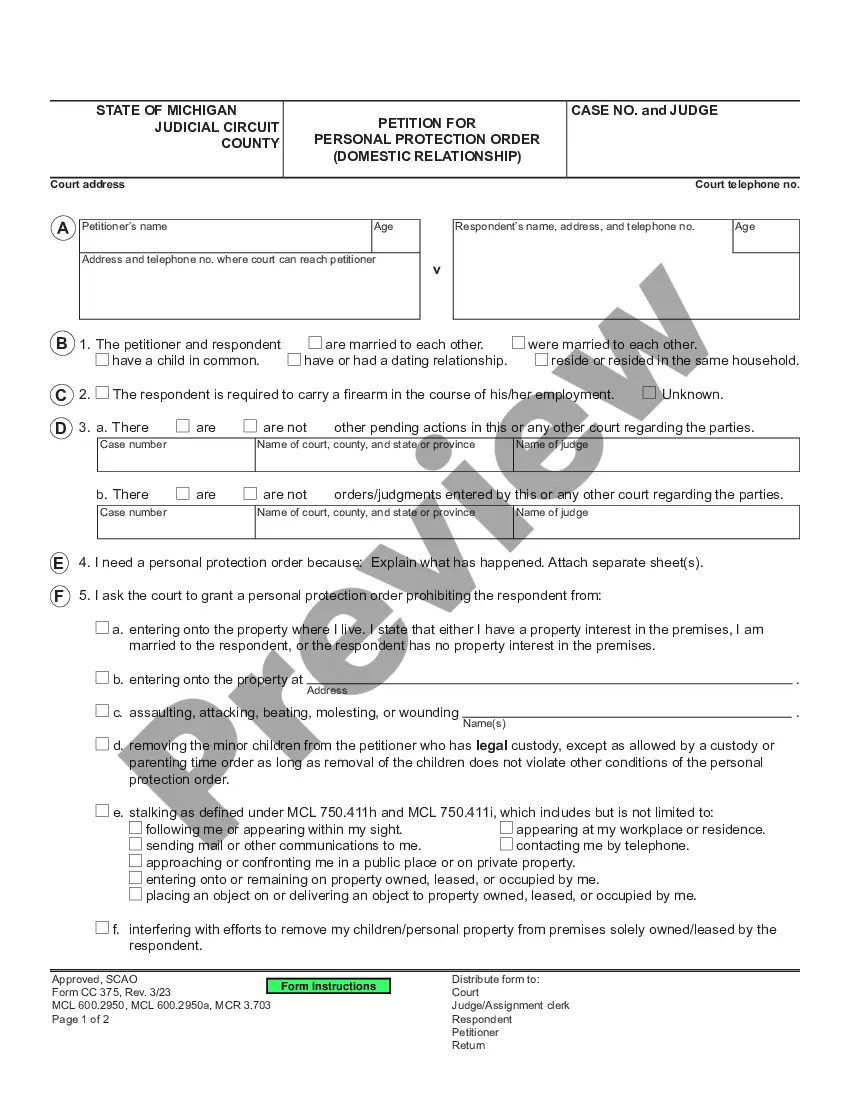

- Review the page content to ensure you've located the appropriate template.

- Utilize the Preview feature or examine the form description if offered.

- Search for an alternative document if there are discrepancies with any of your requirements.

- Press the Buy Now button to acquire the template when you've identified the correct one.

- Select one of the subscription plans and log in or create a new account.

Form popularity

FAQ

Gifting property to family members with deed of giftThe owner should be of sound mind and acting of their own free will.Independent legal advice should be sought before commencing with a deed of gift.The property in question should have no outstanding debts secured against it.More items...

Before you can transfer property ownership to someone else, you'll need to complete the following.Identify the donee or recipient.Discuss terms and conditions with that person.Complete a change of ownership form.Change the title on the deed.Hire a real estate attorney to prepare the deed.Notarize and file the deed.

Transferring Texas real estate usually involves four steps:Find the most recent deed to the property.Create a new deed.Sign and notarize the deed.File the documents in the county land records.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

You can't add your spouse's name to an existing deed in Texas, but you can create a new deed by transferring the property from yourself to yourself and your spouse jointly, using either a deed without warranty or a quitclaim deed.

5 Ways to Transfer Property in IndiaSale Deed. The most common way of property transfer is through a sale deed.Gift Deed. Another popular way of transferring property ownership is by 'gifting' the property using a gift deed.Relinquishment Deed.Will.Partition Deed.

In Texas, you can't add your spouse's name to an existing deed, but you can create a new deed by transferring the property from yourself to you and your spouse jointly. You can do this by using either a deed without warranty or a quit claim deed.

All property deeds $195 Any Property Deed needed to transfer real estate in Texas. Prepared by an attorney licensed in the state of Texas.

When properly executed, delivered and accepted, a deed transfers title to real property from one person (the grantor) to another person (the grantee). Transfer may be voluntary, or involuntary by act of law, such as a foreclosure sale. There are several different essentials to a valid deed: 1. It must be in writing; 2.

Before you can transfer property ownership to someone else, you'll need to complete the following.Identify the donee or recipient.Discuss terms and conditions with that person.Complete a change of ownership form.Change the title on the deed.Hire a real estate attorney to prepare the deed.Notarize and file the deed.